⬇️ My Thoughts ⬇️

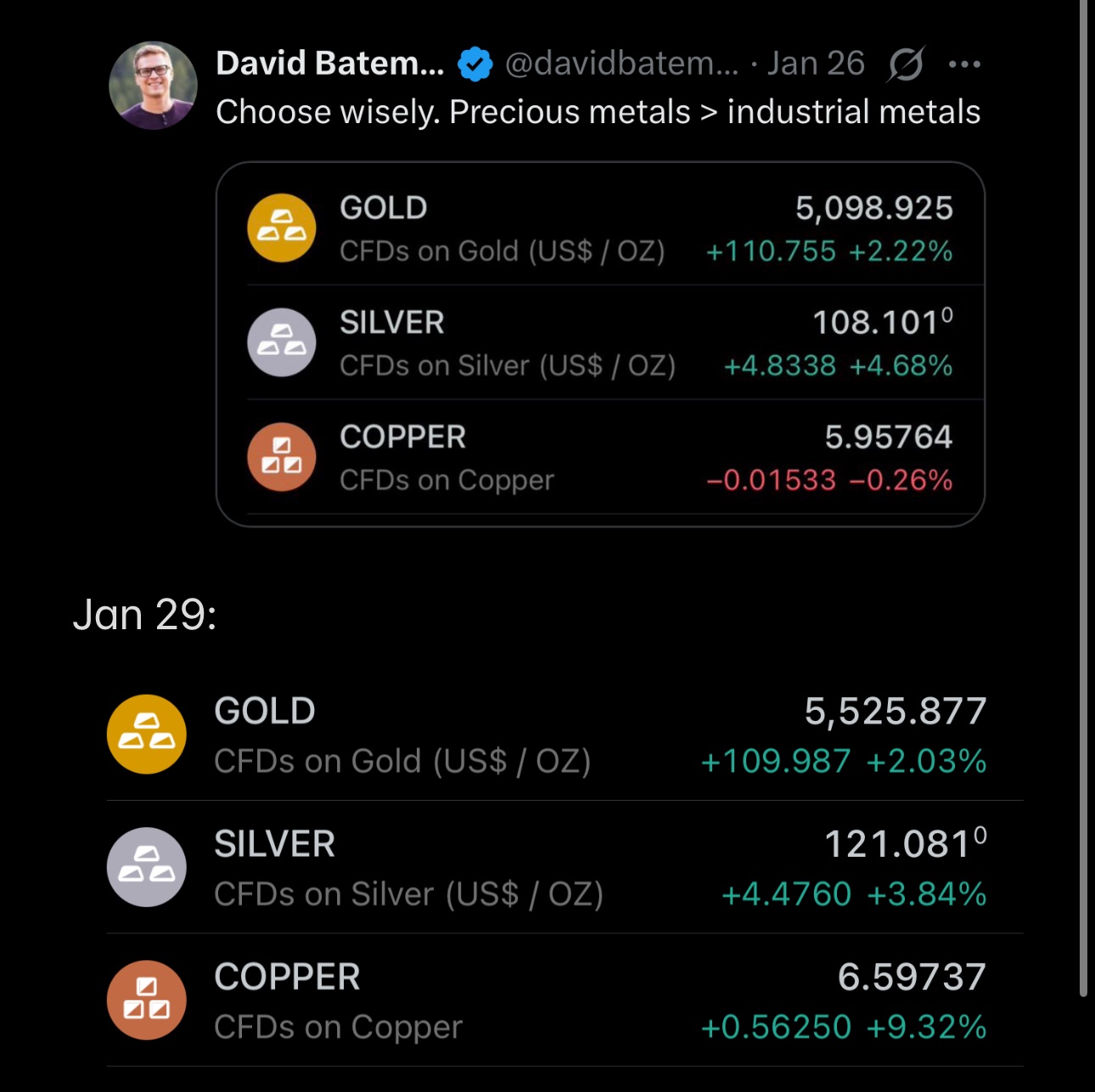

Copper extends its gains to ≈9% on the day, and its appreciating more than gold and silver

A week ago I wrote an article explaining why this upwards move in copper (and copper miners!) was imminent, from both fundamental and technical standpoints.

And don't be alarmed by near-term volatility. Keep the macro picture in mind under the lens of liquidity inflow into the commodity sector. I've explained this extensively in my articles. You can read them all on my website for free (there is also an RSS feed you can subscribe to).

Copper just hit a new all time high, and it's not stopping here

The white rectangle on the chart represents copper's support area for 2026. Copper will have a lot of buying pressure waiting inside that box.

This is a monthly chart, with the support area being formed over the last ≈5 years, since 2021.

A week ago I wrote an article explaining why copper is a great investment in 2026

Today, copper is up ≈5%, hitting a new all time high

The article covers copper's technicals and fundamentals. You can read it here:

https://illya.sh/threads/copper-is-a-great-investment-in-2026-technicals-fundamentals

Today's Commodity Miners Sell-Off Is A Buying Opportunity

I've made numerous such calls in the past, and they were correct 100% of the time. Today, I'm making one of such calls again.

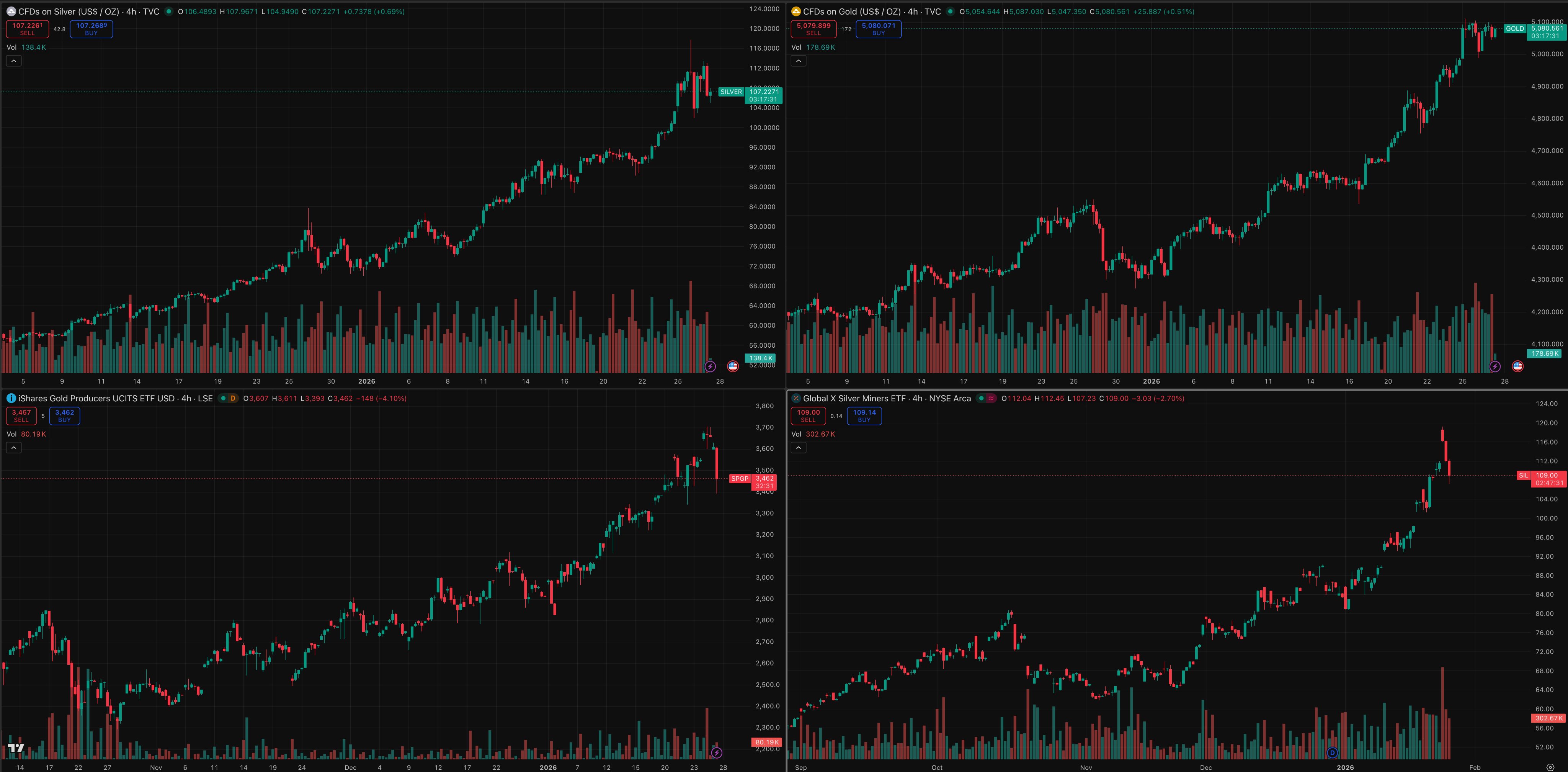

Gold, silver and copper miners are down today, with indices and individual large caps falling by as much as ≈8%, despite the underlying metals remaining in the green. This is exactly the situation where you can leverage the increased volatility in the mining sector to increase your exposure to the underlying metals during an uptrend.

I expect the prices of gold and silver miners indices to increase by ≈30% from current levels within roughly 10 trading weeks from now. It may happen sooner than though - pay close attention to the price action.

It's also possible for the price to dip lower than the current levels before the upwards move described above materializes. This mainly depends on the price action of the precious and industrial metals in the next few weeks, but I don't believe that either one of them has topped for the cycle, thus uptrend resumption is imminent.

I've written several articles explaining why commodities and commodity miners are a great investment for 2026. I suggest you to read them if you haven't done so yet.

Natural Gas Prices Are Very Volatile

It's normal for natural gas prices to increase or decrease sharply. Among others, the demand for it is dependent on weather and subject to seasonality. This is very intuitive: if it's colder, there is an increased demand for heat (fuels), and natural gas is that fuel.

The spike in natural gas prices in January 2026 can be explained by the severe cold/snow storms and their effects on supply, demand and storage across the United States and Europe.

But you don't need to know any of that. All you have to do is open a historical price chart for natural gas.

From 2020 to 2022, natural gas prices increased almost ≈x6.5 in price. Then, from 2022 to 2024, the prices fell by ≈84%, bottoming just ≈6% above the 2020 lows.

Thus, any sources proclaiming that "it is not normal" for NATGas to increase 70% in roughly two weeks, implying that it's a signal of a major distress in the system, are unlikely to be a reliable source on this topic.

"Random forest" is currently my favorite term from financial ML

... TREES MAKE FINANCIAL DECISIONS NOW?? 🌳😄

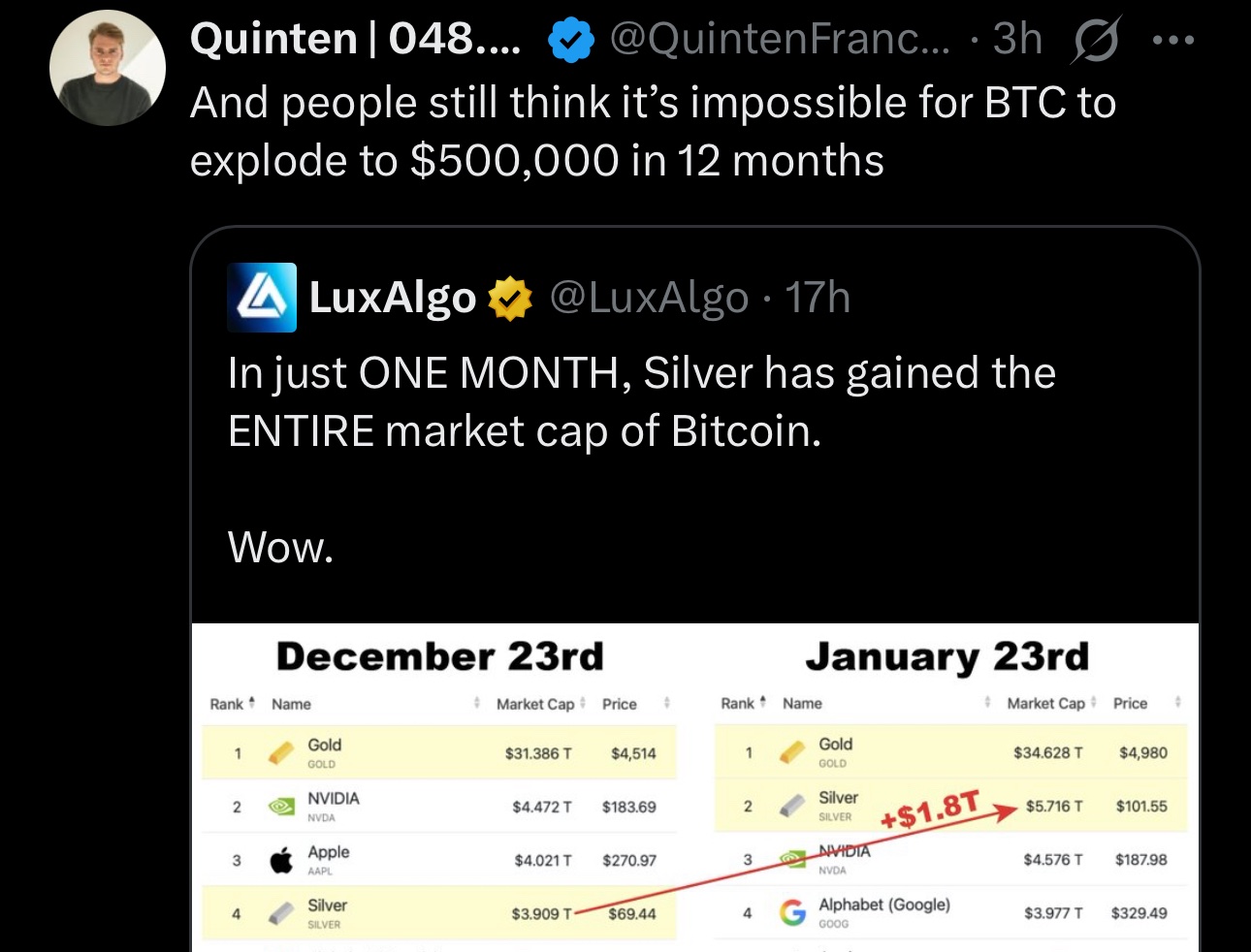

And people still think that silver and Bitcoin are within the same category of assets

(hint: they're not)

Silver Miners Are Up ≈12% Since My Recommendation From 4 Days Ago

On January 18th 2026 I wrote an article explaining why silver mining stocks are undervalued, and how you should expect a price increase/breakout in the sector soon. 4 days after I published the article, the silver miners index is up more than 10%, and some individual large-cap names like Hecla Mining (whom I use for my longer-term silver miners proxy) are up more than 20%.

You can read the article on silver miners outlook for 2026 here: https://illya.sh/threads/silver-mining-stocks-are-undervalued-in-2026

Don't Overthink Commodity Miners Investments

I'm now coming across several large finance accounts on X, which are sharing the results of their miner equity picks from 2025 made available to groups/newsletters/communities with paid access. The results from their buy calls from just a few months ago look impressive - price more than doubling isn't uncommon. The keywords here are *isn't uncommon*. A 2x gain in the mining sector since November 2025 isn't impressive. When evaluating the quality of the calls, it's important that you establish the correct baseline.

One examples of such buy calls was shared by Peter Schiff, who posted his investment suggestion from November 2025 on Nexa Resources S.A. (NYSE: NEXA), which is a miner/producer of zinc, copper, silver and some gold. Since November 2025, its stock price has more than doubled. This was shared as a part of a paid newsletter, whose November 2025 issue was made available to the public. While a >100% price increase may seem impressive, you could've been better off by just investing in a larger, well established miners like Hecla, which are subjects to a smaller set of risks.

Speaking numbers, you could've achieved a similar x2 gain since November 2025 by acquiring Hecla Mining Company stock (NYSE: HL) instead. Hecla is a well-established gold, silver, zinc and other metals miner with more than 60 years of price action dating back to 1964. In contrast, Nexa's price action dates back only by less than a decade - to 2017. As such, you can achieve the result at the cost of a smaller risk. I've shared Hecla Mining several times in my lists on my website throughout 2025 at no cost. I probably also shared others, but Hecla is the one that first comes to mind.

Here's what's important to understand:

There's a global liquidity inflow into the commodities sector, which includes miners, producers & Co equities. The alpha comes from identifying outperformers relative to the index, conditional to risk. Well-established, long running companies generally come with a lower risk profiles, compared to less well established or juniors.

The question isn't whether you can get more upside gain with smaller cap miners/juniors, the question is whether that extra potential gain justifies the extra risk and cost. Frequently the most obvious choices are the best ones. Investing into several miner/producer indexes, alongside a few individual well established, large-cap picks may be all that you need.

Copper Is A Great Investment In 2026 - Technicals & Fundamentals Explained

*A big part of this analysis also applies to copper miners, but I prefer to cover that in a separate article

From a technical standpoint, copper is currently flipping a ≈20 year old resistance for support. On a monthly chart, copper is in a multi-year upwards channel, and it’s now close to the upper trend line of that channel. Copper is also at record lows when priced in terms of gold and silver.

From a fundamental, supply/demand perspective, copper is required for electrification, data centers, new buildings, electric vehicles, and electric appliances in general.

International Copper Study Group (ICSG) expects refined copper’s demand to surpass the available supply/production in 2026. Given that new copper mines are slow to build, increasing the supply of copper requires great investments of capital and time, and in case of continued increase of global copper demand, it may take decades for the production to meet that demand fully.

This creates a setup for a significant upwards price pressure on copper from current levels.

It's also important to be aware of the metal's general price action. Copper is not gold - copper is significantly more volatile, but post 2021, the volatility has been more compressed to the upwards channel structure described above and shown in the chart.

Regarding the maximum drawdown from the current price levels (≈$5.90/lb), I don’t believe that copper will correct more than ≈15%, as there it will find a strong support area, and soon after the bottom support trend line from the monthly upwards channel, both of which will exert strong buying pressure. Within 6 months from now, I expect copper’s price to be above the current levels. This a risk-adjusted timeframe in which you should frame the current thesis - so it means that, for the same amount of capital, your investments in copper from today will be yield significantly more than they would in at the prevailing rate in money market funds. Realistically, I think it will happen much sooner than 6 months.

In addition to everything above there is also monetary debasement, debt refinancing walls and negative pressures on USD dominance as a reserve currency. These 3, alongside the geopolitical tensions present an additional source of positive price pressure on the whole commodity sector. My copper price thesis is positioned within this liquidity flow into commodities. I’ve covered these points in detail in my previous posts.

Copper is another great buy for 2026 at current prices

I'll write an article explaining why in more detail soon, so stay tuned!

Silver miners are up another ≈4% today, and more than 10% in the last 5 days 😄

But this is unsurprising to you if you read my articles from a few days ago on miner/producer equity prices and why they present a great investing opportunity for this year

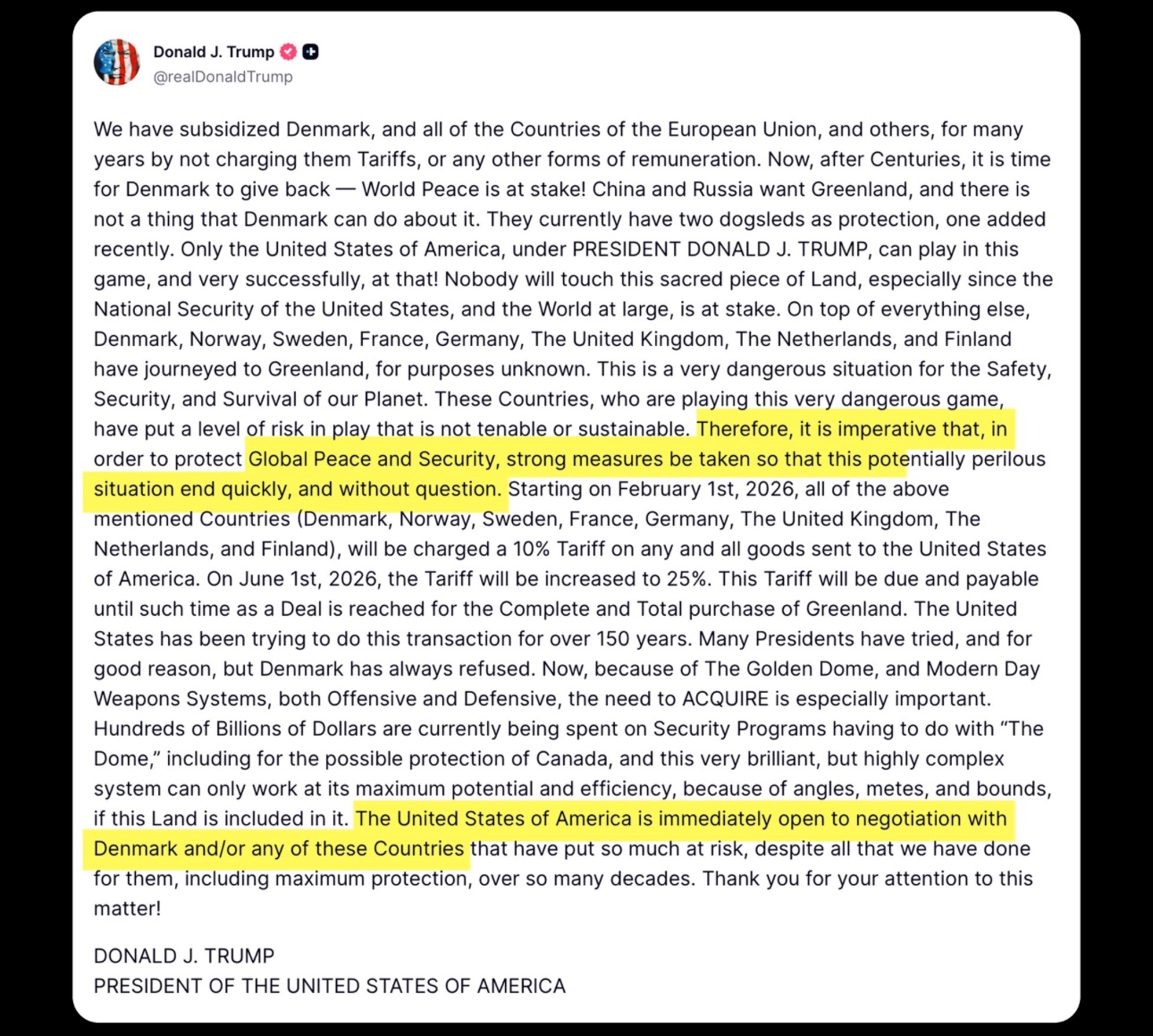

Yesterday I wrote an article explaining why US tariffs on Europe mean more expensive gold and cheaper US dollar

Today, gold hit a new all time high & you should expect this trend to continue

If you haven't read the article yet, you can do it here: https://illya.sh/threads/good-for-gold-bad-for-usd-us-tariffs-on-europe

8 months later, Japan's 30 year bond yield is now ≈32% higher

The yields on the 30Y Japanese bonds is approaching 4%. The yields are up across the whole tenor curve.

Soon, BoJ will have little options left but to resume QE and lower interest rates, and thus expand the Yen monetary base in an effort to reduce government refinancing costs (A.K.A. government bond yields).

I first wrote about this almost a year ago. The thesis for 2026 and onwards remains the same.

First European pension fund - the Danish pension fund AkademikerPension, started selling US Treasuries. Eurozone countries may start doing the same soon. I've been writing for a long time about how swapping USD-denominated reserves for gold would've been the best response to the tariffs.

Maybe, just maybe the EU will start swapping their USD-denominated reserves for gold and (at least eventually) renminbi 😉

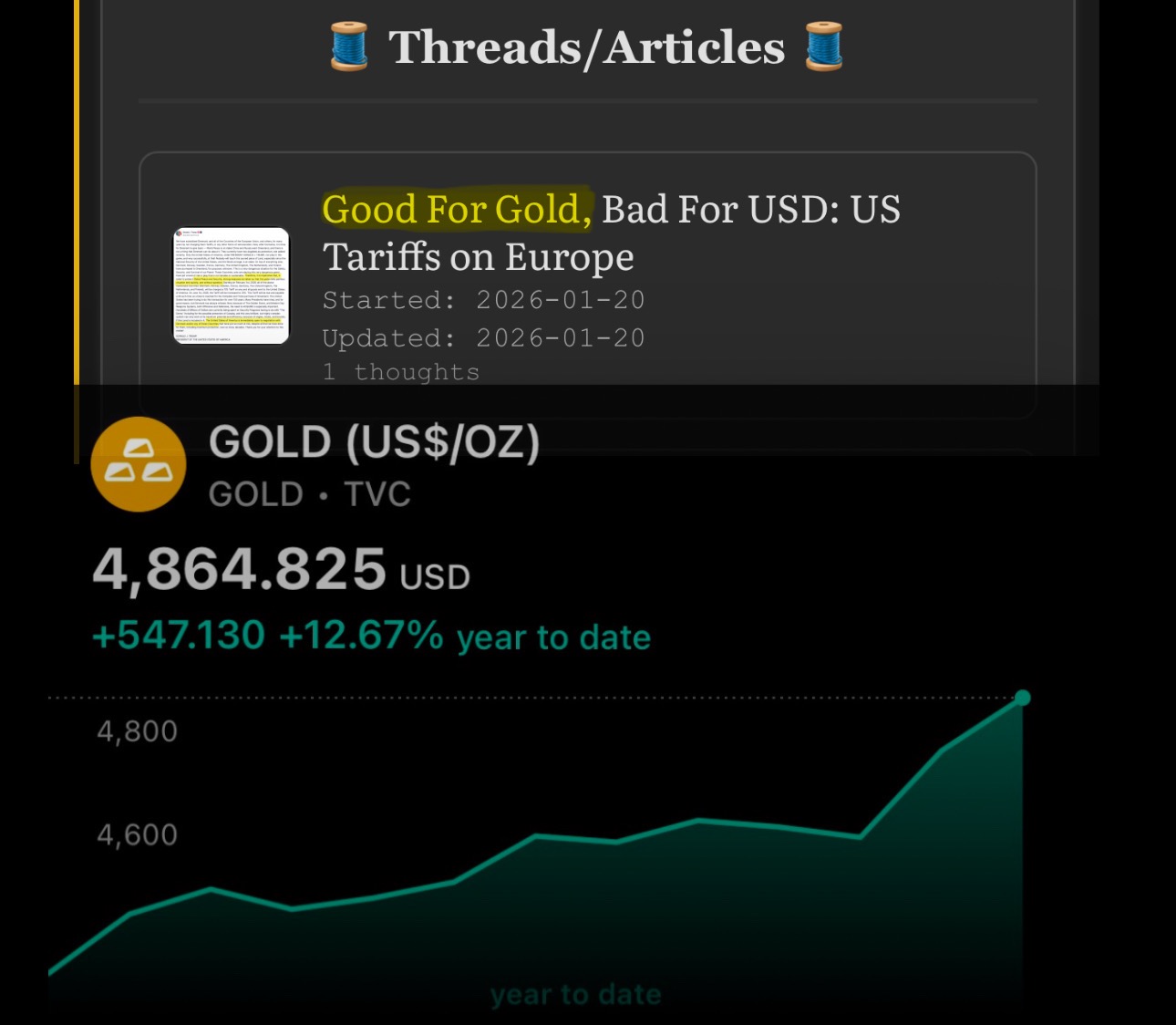

Good For Gold, Bad For USD: US Tariffs on Europe

The tariffs imposed by the U.S. on the European countries are detrimental to USD's position as a reserve currency. A capital outflow out of the U.S. dollar creates positive price pressure on gold via increased demand.

This is true regardless of the U.S. Supreme Court's decision on whether President Trump can lawfully impose unilateral broad tariffs via executive order using the the International Emergency Economic Powers Act (IEEAP).

At the high level, there's two moves for gold here:

➖ If the tariffs are deemed illegal and the collected tariff revenue must to refunded - which would lead to an increase of USD supply accessible to the wider economy. The refund would come either from existing reserves, thus directly increasing broad money or from newly issued debt, which may reduce broad money in the short-term, but the newly issued bonds will eventually be rehypothecated, thus effectively increasing USD credit/effective supply. This is positive price pressure on gold, at the very least due to the increase in liquidity. This is negative price pressure on USD, due to increased supply & public debt of the issuer.

➖If the tariffs are deemed legal, and/or do not need to be refunded, the geopolitical and liquidity risk remains, which materializes in a lower incencitve to own USD. After all, why would you want to hold a currency, whose purchasing power/liqudity may be reduced every other week after the markets close on a Friday? Gold is the natural outflow path from USD, especially at sovereign/central bank level.

If the Eurozone wants to reduce their USD exposure in the next 5 years, what can they do? The European countries may not want to start significantly increasing the share of renminbi in their FX reserves just yet. Additionally, EU could position Euro as an alternative to USD for settlements, as EUR is already the second most used currency for international trade & FX turnover, second only to USD. Gold presents itself as an attractive alternative to USD, even if the focus on increasing its tonnage in the reserves is transitory. At the very least, increasing the share of gold relative to the balance sheet size in the Eurozone, would increase foreign exchange rate value of Euro and/or would provide basis for monetary expansion in the future.

Many forget that the "gold and foreign exchange reserves" are a single asset-side item in central banks balance sheets. "Gold" is explicitly discriminated among all other assets/commodities, while all currencies and their derivatives (e.g. sovereign bonds) are clustered under the generic "FX reserves" name. Across all currencies, renminbi is best positioned to increase its share in reserve assets and international settlement. Unlike renminbi, gold is nobody's liability and has no counterparty risk (assuming no jurisdiction risk, which can be greatly mitigated by storing the gold bullion domestically).

Given this, I expect the European countries to increase their gold holdings, via a combination of swaps from USD-denominated assets for gold and other FX currencies like the Chinese Yen.

Every day it becomes more obvious how US tariffs, unilateral sanctions & multi-faceted geopolitical aggression including towards its allies and major trade partners is a strategic mistake

Expect this trend to continue throughout 2026

Yesterday, I explained why silver mining stocks are undervalued in 2026

Today, silver miners are up almost 6% across major FX currencies 😄

Of course, it's to early to tell whether my thesis is correct, but I'll throw in another prediction: this upward price movement in miners to continue.

Even As Central Banks Bought Gold, The Market Analysts Remained Bearish

* This goes to the list of "things that are obvious in hindsight"

In 2014 Forbes published an opinion saying that increased gold buying by Central Bank of Russia (CBR) isn't an indicator of positive price pressures for gold.

Gold's price has more than quadrupled since then, going from ≈$1600/oz in November 2014 to ≈$4600/oz as of January 19th 2026.

The article frames the purchase as "forced", when commenting the fact that CBR decided to increase the share of gold in the "gold and foreign exchange reserve assets" item in their balance sheet. It is not by chance that this central bank accounting item explicitly includes "gold" in its name.

The Forbes article also seems to assume that miner profit margins don't spread cross-border.

Another thing that the article omits is that a central bank can buy gold without expanding the base monetary base (i.e. "printing" new currency), for example by swapping FX reserves for gold via a single or multi-leg sale.

Silver Mining Stocks Are Undervalued In 2026

*Below is my 5-minute analysis on silver miners equity prices for 2026

The price ratio of silver miners to silver is at some of its lowest levels in history, roughly at the same values as it was in the 2000’s. The ratio is currently sitting on a support from 2014-2015 inside of a multi-year upward price channel. Alongside the macroeconomic and geopolitical fundamentals, this setup’s potential upside gain justifies the limited downside risk. Unless silver experiences a large medium-to-longterm pullback, silver mining equity prices are set to increase against the price of silver. For this to happen, there are 3 high-level scenarios:

1️⃣ Silver price remains above ≈$88: silver miners appreciate more than silver

2️⃣ Silver price remains above ≈$83: silver falls in price, miners fall less or increase

3️⃣ Silver price remains above ≈$70: silver falls in price, miners fall less (more likely) or increase

Given the increasing demand for physical silver combined with currency debasement driven by refinancing needs, I don’t believe silver’s spot price will experience a pullback to lower than the ≈$70 level in 2026. Pullbacks below ≈$70 are more likely to trigger a larger sell-off in silver miners, potentially even pushing the ratio further down, meaning that silver mining stocks fall in price more than silver.

Silver producers/miners, royalty and streamers can be a great source of diversification and even "hedging" of your silver investments without ever leaving the commodities sector. You can further diversify your exposure to other metals by acquiring fund units and/or equities in producers, royalty and streamers that focus on more than two metals (e.g. there are companies mining gold, silver and copper).

A few days ago, I wrote a post about how gold miner prices are set to breakout. But silver is not gold. Silver miners will be more volatile than gold miners, but given a positive correlation between gold and silver prices, they will tend to follow the gold miner’s direction. After all, most gold mining companies mine silver and vice-versa (silver is often mined as a byproduct of other metals like gold, copper, lead and zinc). The attached chart shows the ratio between the price of Hecla Mining and Pan American Silver, so it doesn’t include all silver miners, but you’ll find a similar structure in silver equity-based indices against the spot/futures price of the metal.

In the longer timespan (e.g. 3+ years), miners may underperform the underlying metal. This analysis is written with a focus on the current price levels with a timeframe of 1 year from now. Given that this article was written in January 2026, you can consider this as a guide for the remainder of 2026. Physical silver is not the same as silver miners. The mining sector is exposed to an array of risks distinct from the metal, with the highest one currently being the geopolitical risk in the form of armed conflict (destruction, supply chain disruption) and legal changes (sanctions, tariffs, export/import limits). Thus, even if the price of the physical metal goes up, miners price can collapse. The same risks can put upwards pressure on the metal and downward pressure on the miners simultaneously. I don't believe these risks will materialize sufficiently for miners by the end of 2026, and given the upside price pressure on commodities, miners will also ride that price wave up.

Why wouldn't markets be able to react to Trump's new tariffs on Europe until Monday night?

Markets may be closed in the U.S. on Monday, but they're open in Europe and Asia.

The market isn't going to wait for the U.S. to react 😂