Illya Gerasymchuk

Entrepreneur / Engineer

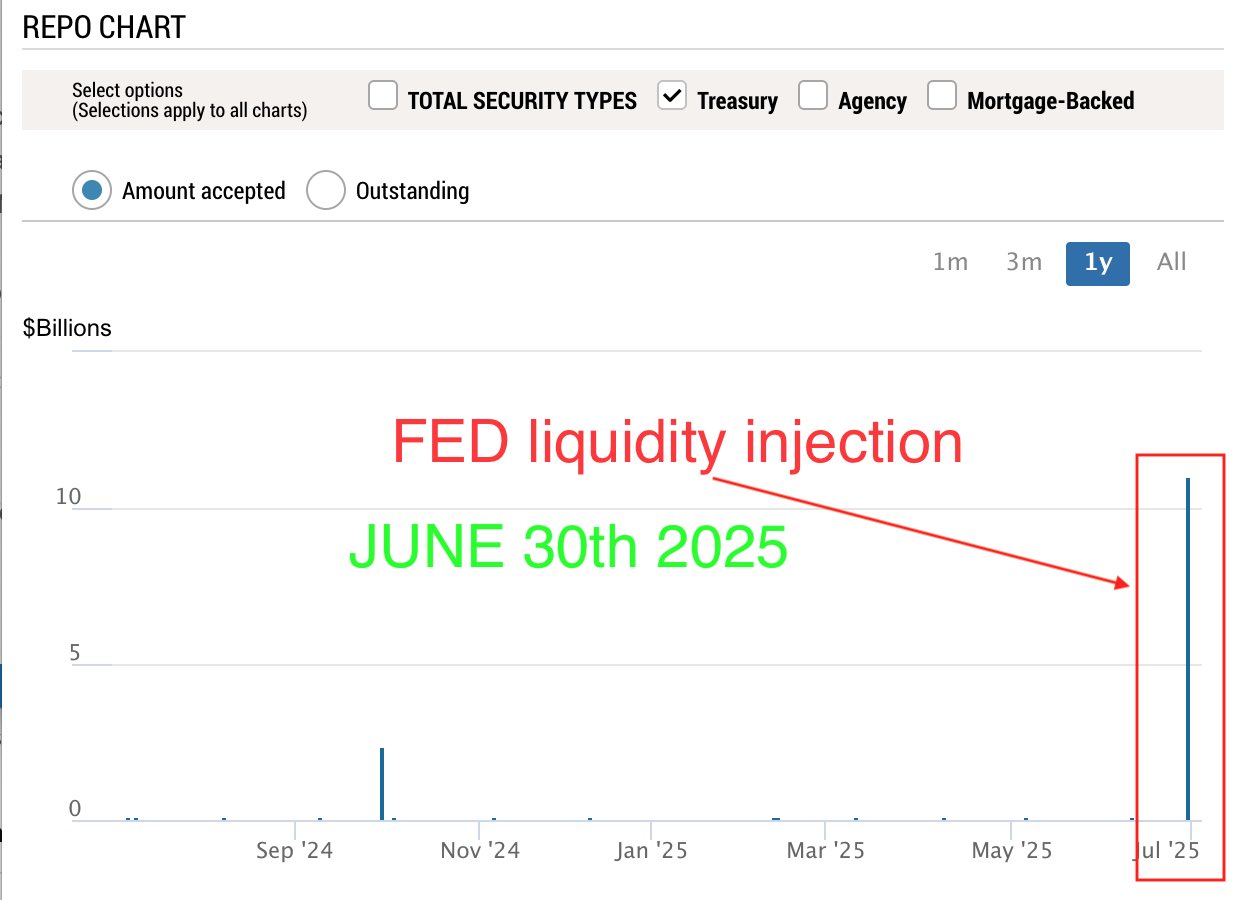

SRF provides daily $500B liquidity limit for overnight repo operations a rate is published daily & dealers lend borrow against US bonds dealers/market makers use SRF when the rate in the open repo market gets too high SRF = Standing Repo Facility