Illya Gerasymchuk

Entrepreneur / Engineer

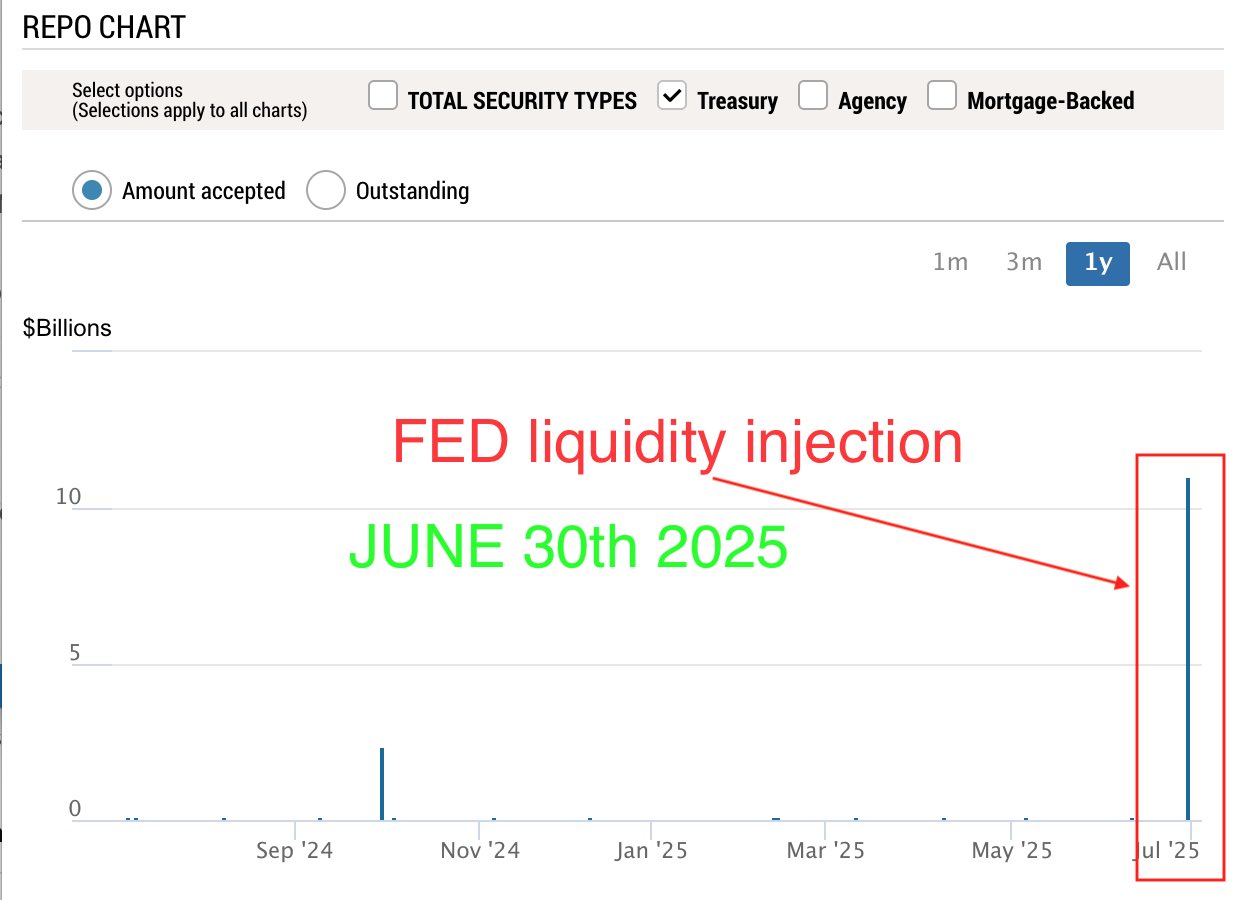

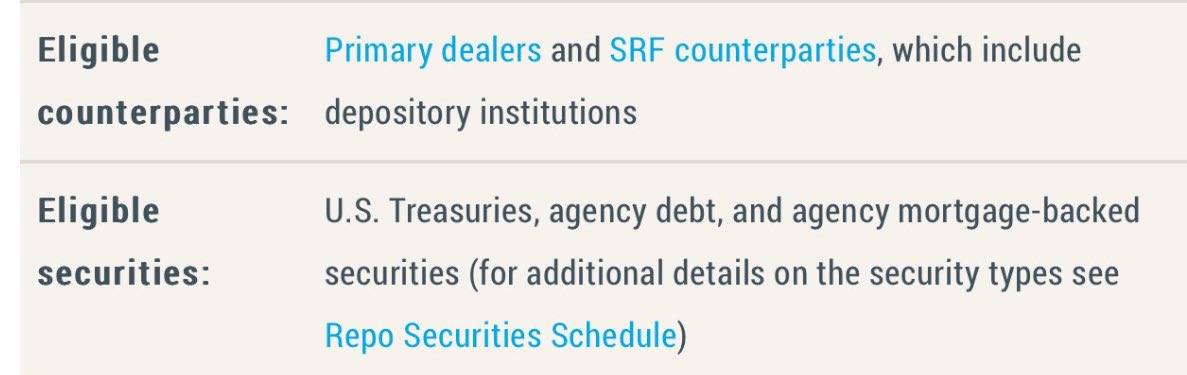

🚨FED just injected $11B of liquidity #1

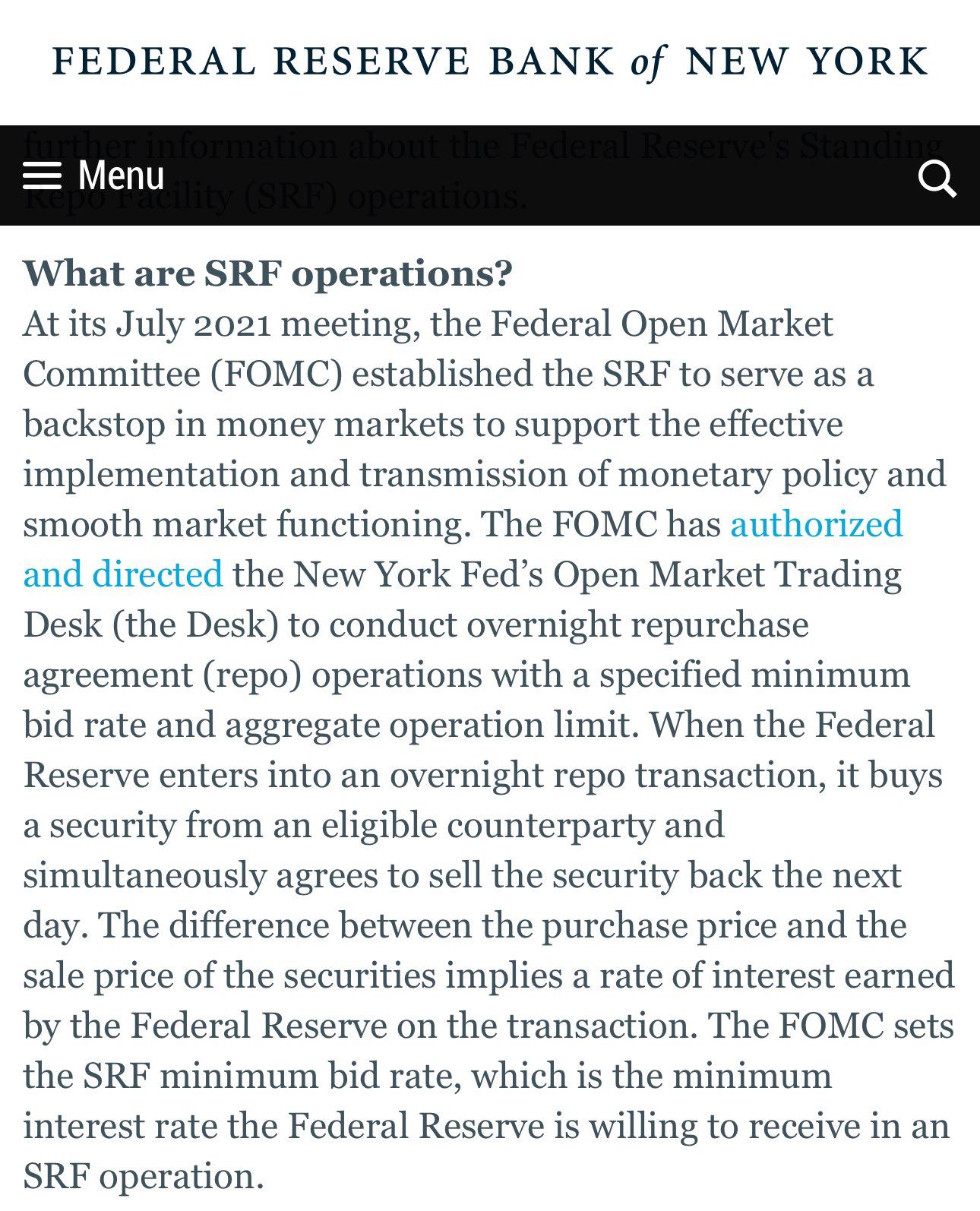

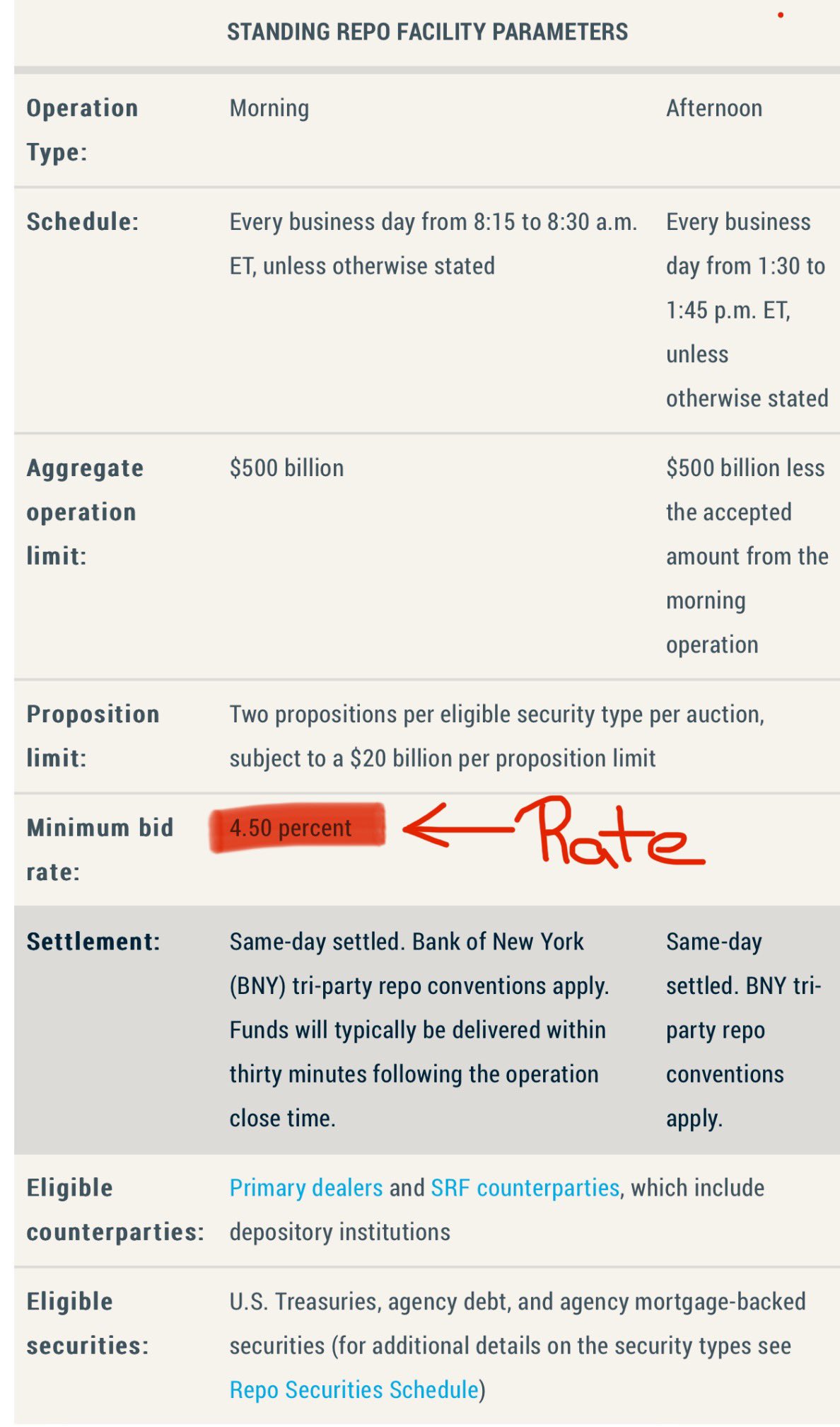

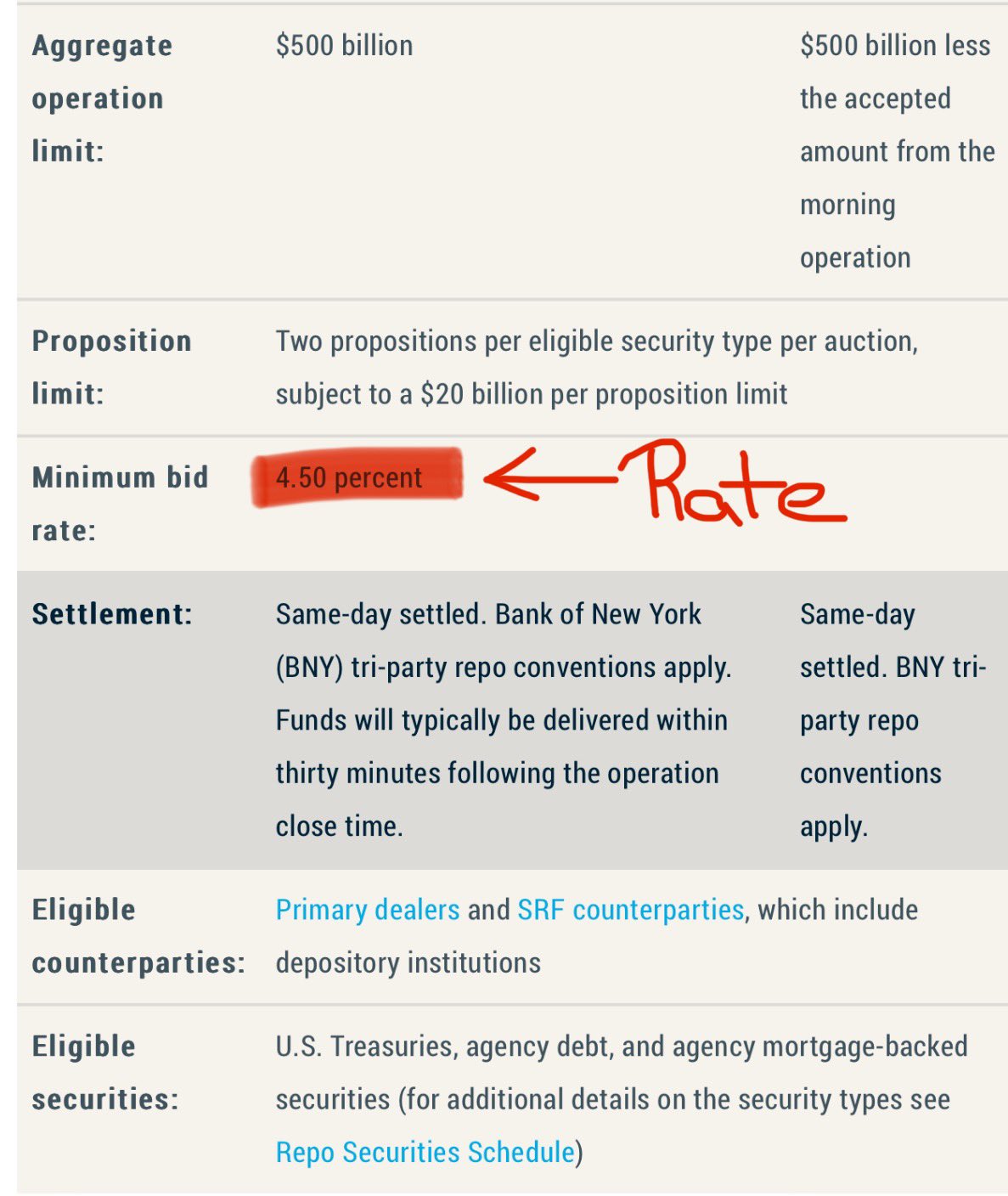

with SRF the FED sets an upper limit on repo market rates most of the collateral is US Treasury bonds this exerts downward pressure on bond yields - by preventing sell-offs