Illya Gerasymchuk

Entrepreneur / Engineer

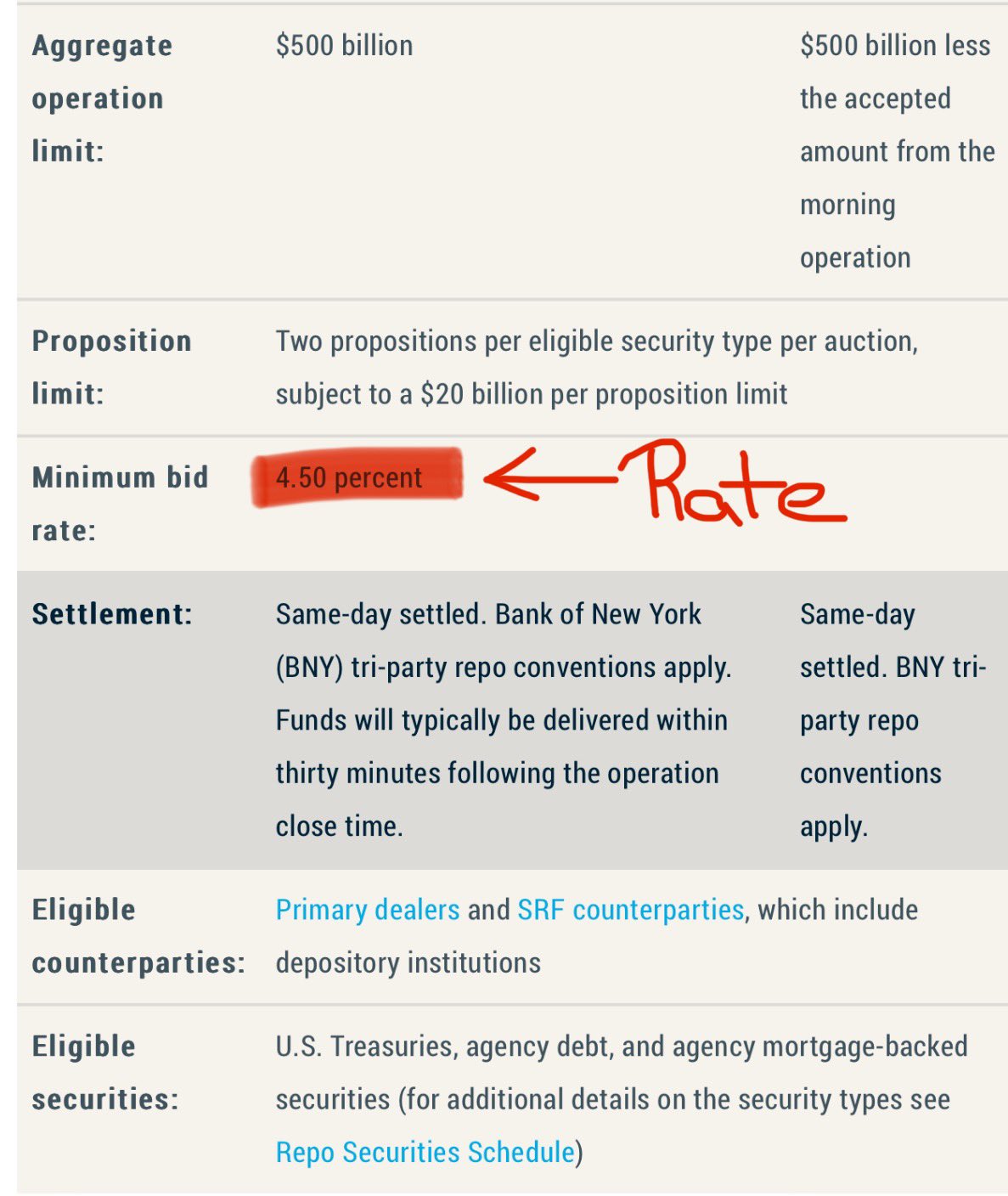

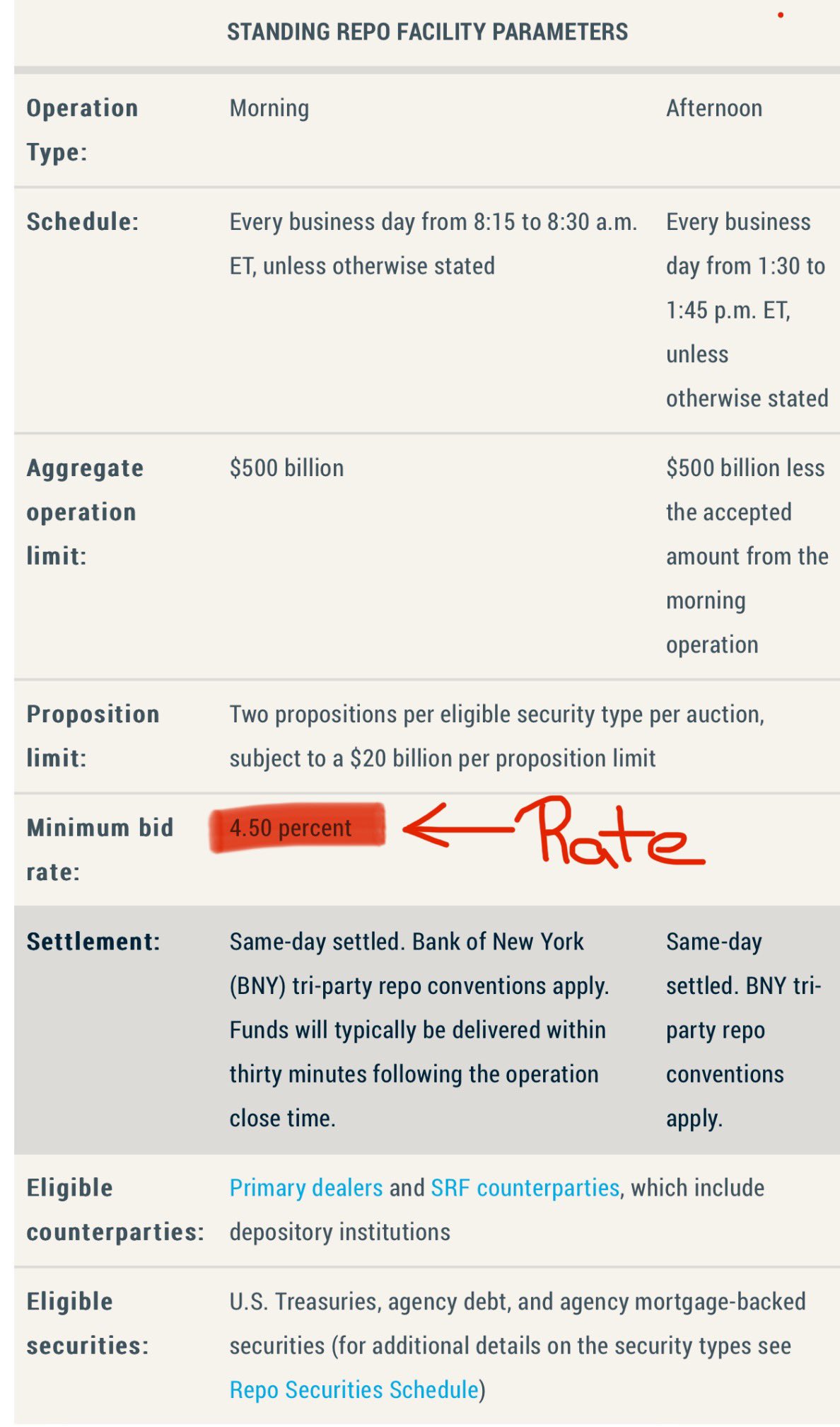

current SRF minimum bid rate is 4.5% that's the annualized rate that the federal reserve sets requires dor overnight repo loans via Standing Repo Facility dealers/market makers can borrow cash against US treasuries for 1 day at ≈4.5% annualized directly from the FED