Illya Gerasymchuk

Entrepreneur / Engineer

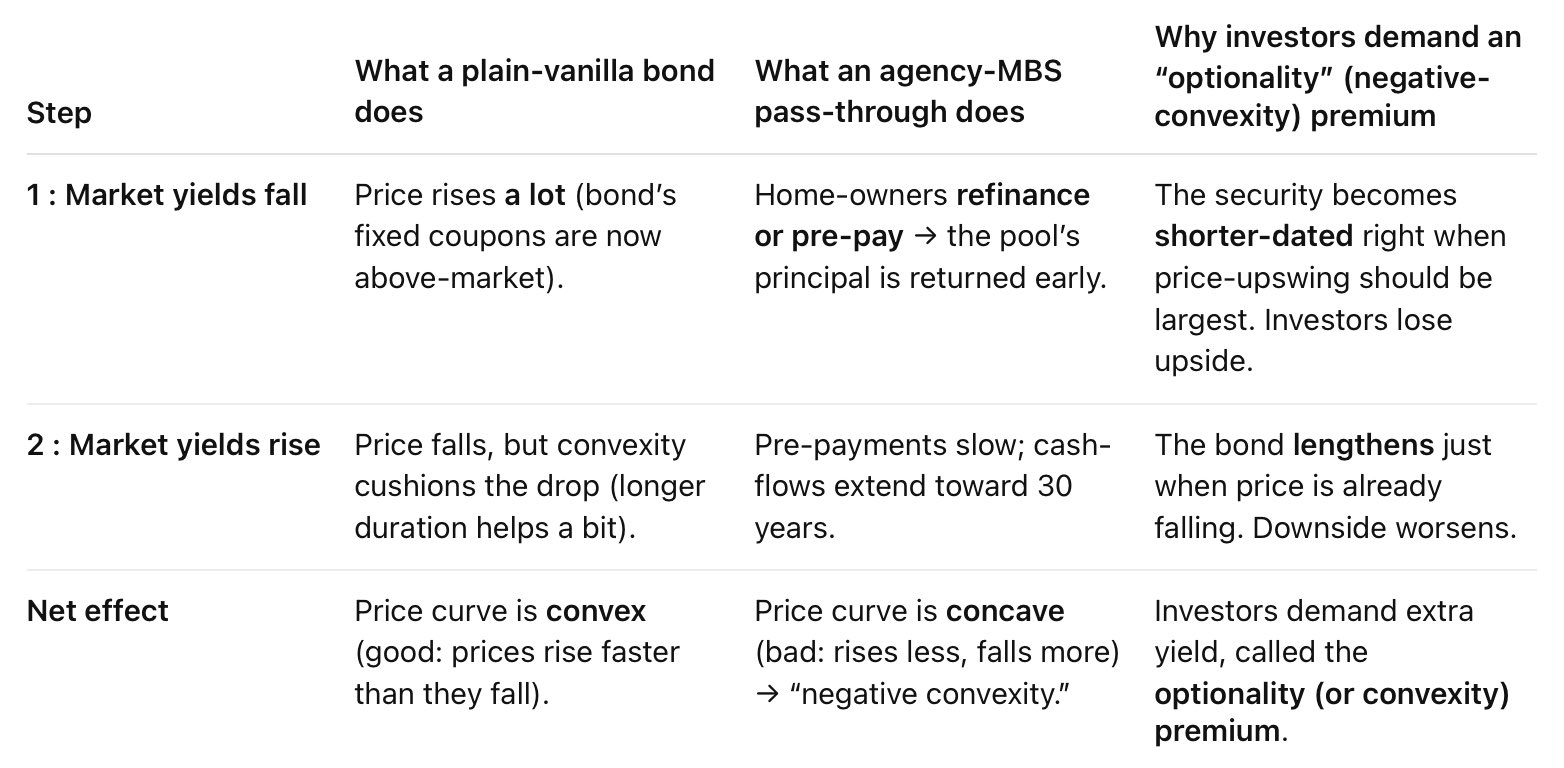

raising yields means lower incentives to re-finance mortgages which reduces the amount of pre-payments thus, the duration increases when yields are raising - so even a higher price decrease