Bitcoin market, cycles & ETF flows

Timeline of BTC price action, halving-cycle milestones, ETF flows and correlations with macro liquidity.

i covered more this aspect of QE in my thread about how to use yield spreads to reason about future Bitcoin price and cycles

you can read it here: https://illya.sh/threads/@1755595543-1.html

once Fed does QE, reserve account balances increase, thus directly increasing base money

broad money either increases indirectly or directly if the Fed credits a non-bank institution

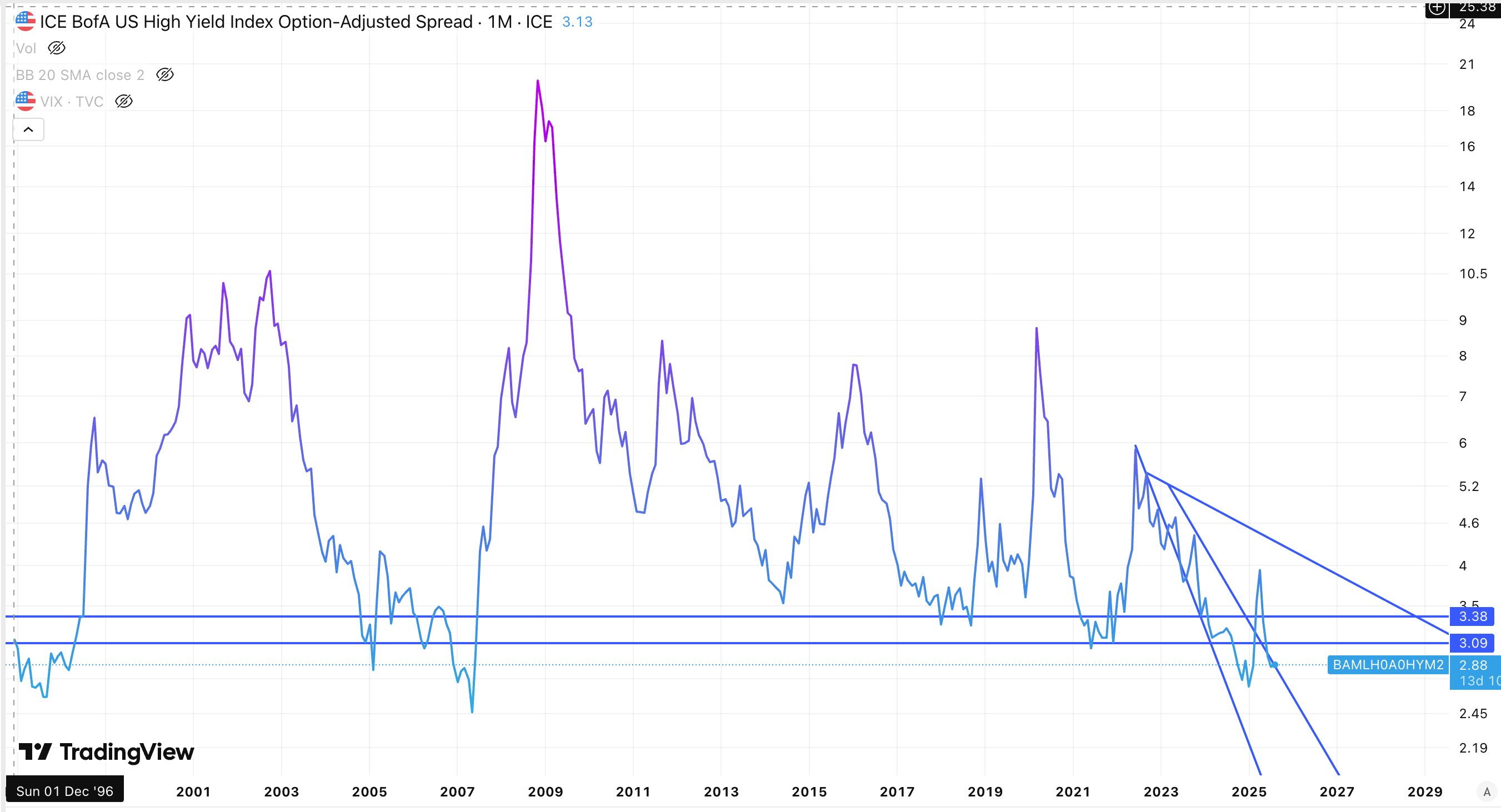

cryptocurrency prices perform well when yield spreads are low/decreasing and bad when yield spreads are high/increasing

this is specifically true when you analyze it at a higher timeframe - think monthly timescale instead of daily one. and the larger the spike/change

eventually this carry trade unwinds, and yield spreads soar. balance sheet constrains, existing positions get too expensive too roll-over/re-finance that’s where you get the big(er) financial crisis

and then you get more QE/lower rates to address that

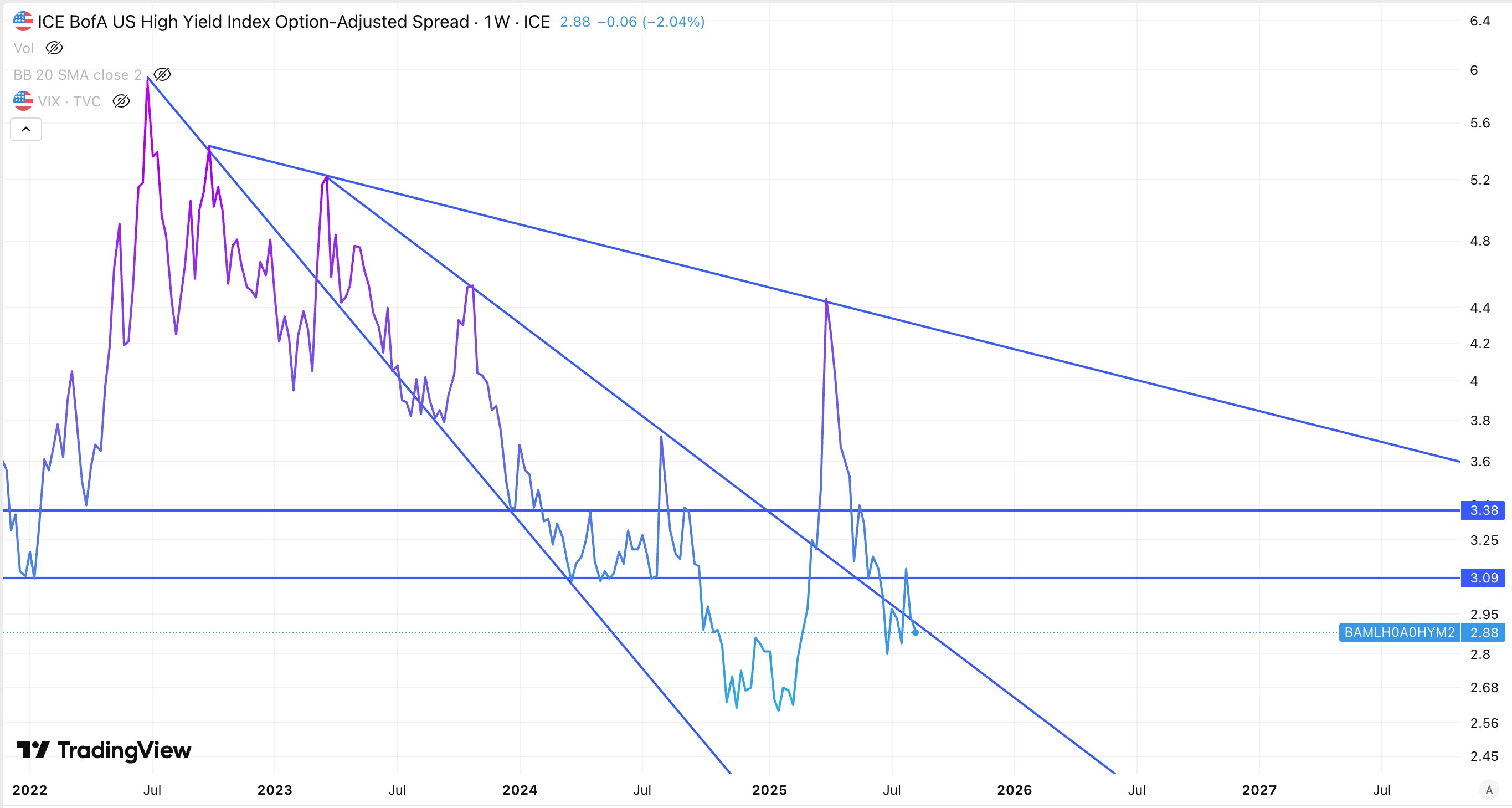

here's what yield spreads are saying about Bitcoin

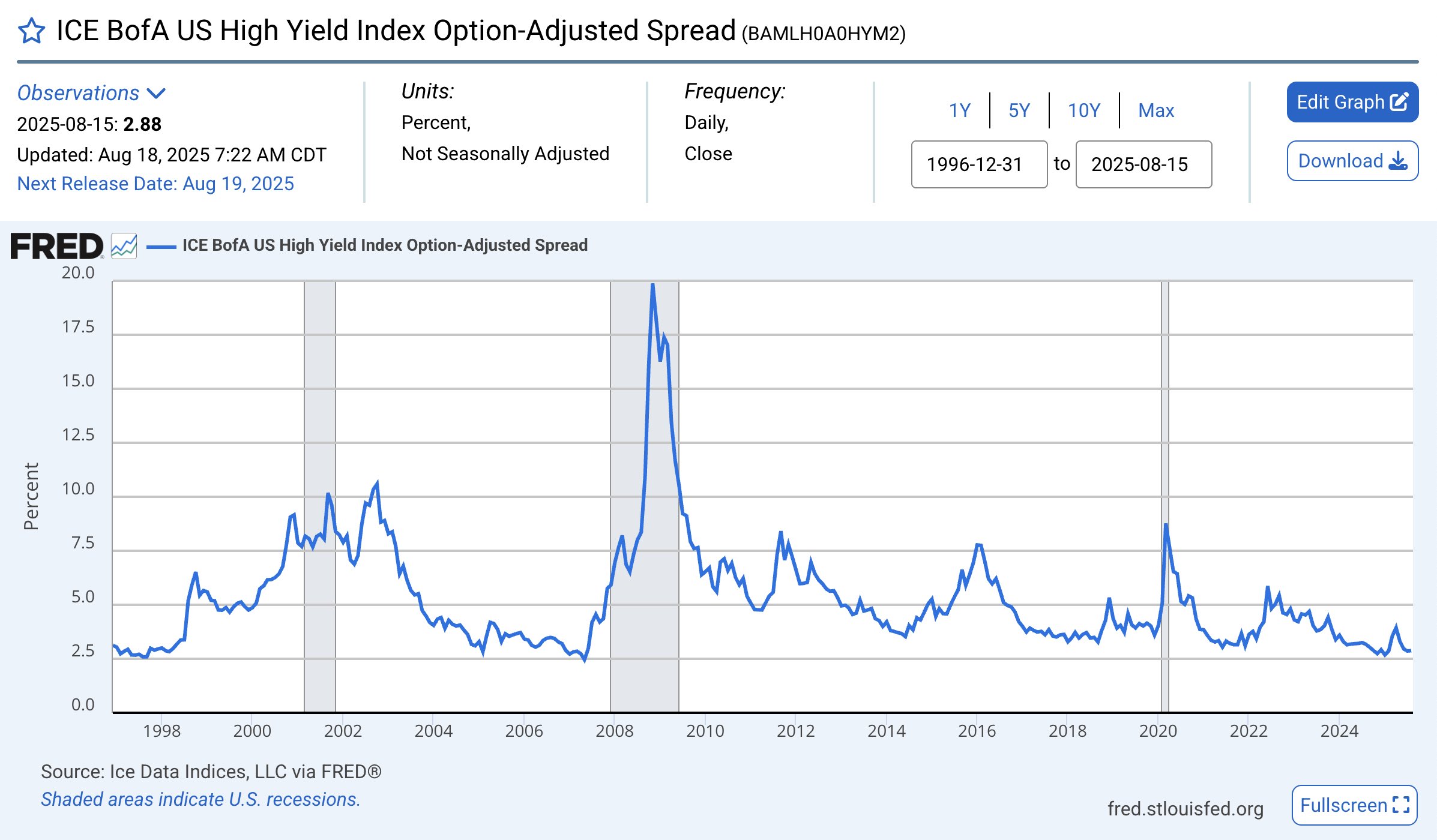

≈3-3.40 is an important historical band which served as support bottom several times, including during COVID, and partly during the 2008 GFC

so far it looks like a trend-reversal in the short-term, with the spreads heading up

so when market signals a higher risk appetite - Bitcoin tends to see inflows

when market is more risk-averse - bitcoin tends to see outflows, alongside other risk assets

you can use the US Treasury/riskier bonds yield spreads to understand BTC's trend direction. it's an alpha

if you overlay Bitcoin's price history over those yield spreads, you will notice a significant level of correlation

⬆️ Bitcoin appreciates when spreads are lowering and/or low

⬇️ Bitcoin depreciates when spreads are increasing and/or high

makes sense - Bitcoin is a risk asset

if you overlay Bitcoin's price history over those yield spreads, you will notice a significant level of correlation

⬆️ Bitcoin appreciates when spreads are lowering and/or low

⬇️ Bitcoin depreciates when spreads are increasing and/or high

makes sense - Bitcoin is a risk asset

thus, you interpret yield spreads between US Treasuries and riskier bonds as:

📈 increasing/high yield spread = risk-off

📉 lowering/low yield spread = risk-on

yield spreads between US Treasuries and riskier bonds mirror the price of Bitcoin

in practice, there is a correlation between them:

📈 yield spreads up = ⬇️ BTC down

📉 yield spreads down = ⬆️ BTC up

why? because those spreads are proxy for market's risk appetite

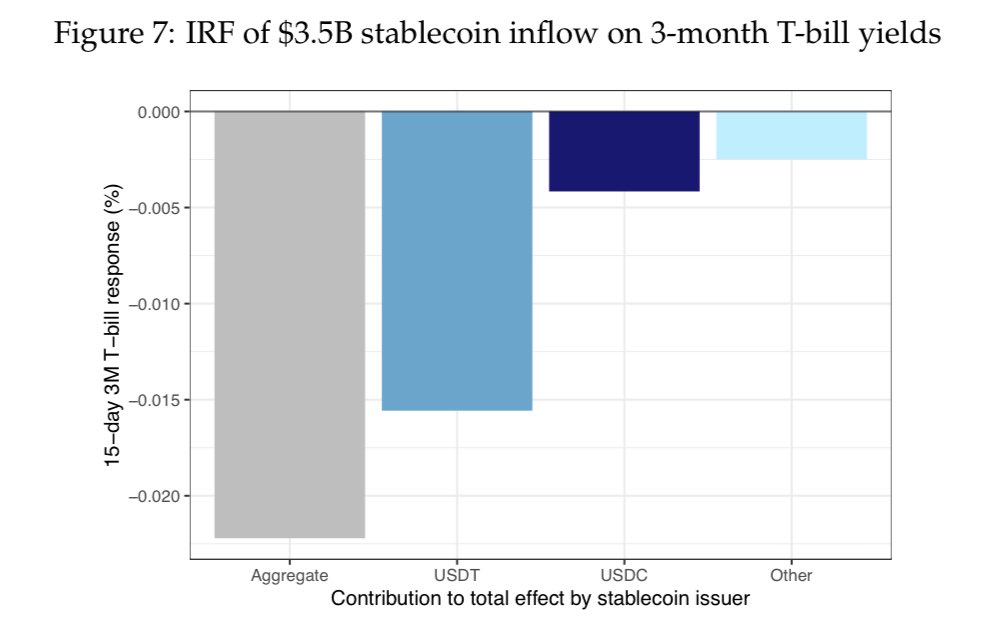

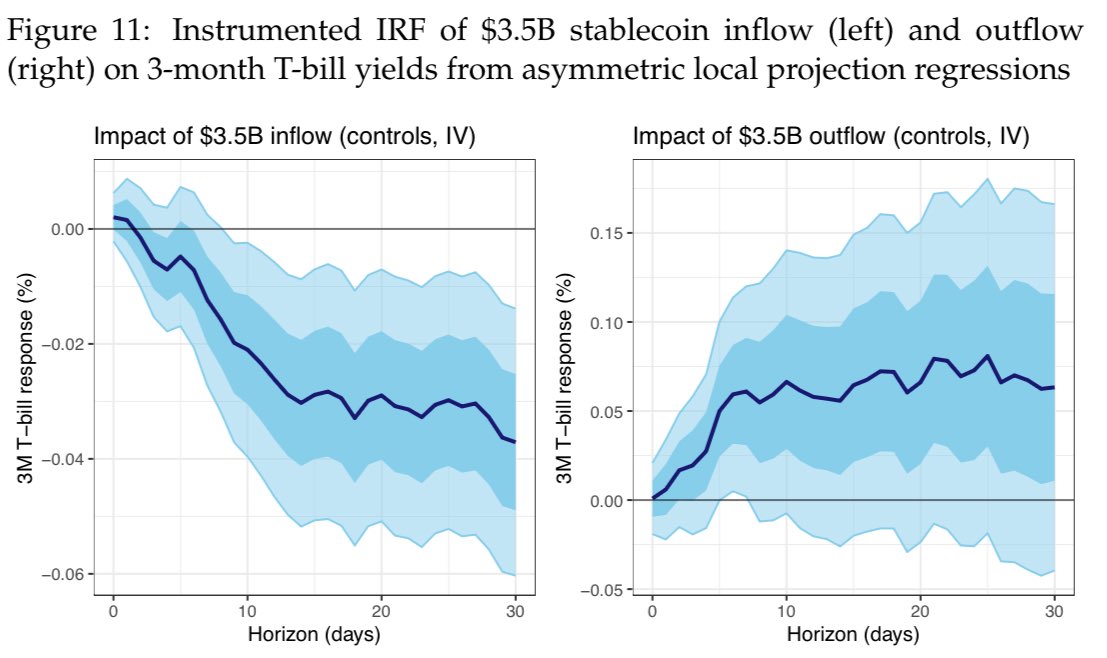

this is because a stablecoin mint/creation on-chain is the proxy for a T-bill purchase by the company issuing that stablecoin (e.g. Circle, Tether)

so stablecoin inflows proxy T-bill purchases, which raises their price and lowers the yield

and there it is - a new BTC all time high in Euro 🇪🇺🥳

and soon the Eurozone will join the new BTC all time high party 🇪🇺🥳

Bitcoin still hasn't seen a new high in EUR since January 2025

this happened to due the relative appreciation apprtetiation of Euro against US dollar

and there you go, Bitcoin reached a new all time high 😄

notice how precisely it respect the trend lines

and the crypto market cap has now been sitting at $4 trillion for the 3rd day 🤝

bitcoin went up 6% from the weekly support line

until the end of this month, bitcoin will either see a new all time high or retest the ≈$0.1095M support

this is the daily timescale of the same chart - the blue and red lines are weekly, green is daily

just a quick check-up

Bitcoin is still in a weekly uptrend it must either go up or down to ≈$109500 - a strong weekly support

two factors in play here:

1️⃣ USD index - inverse correlation

2️⃣ Global liquidity- correlation

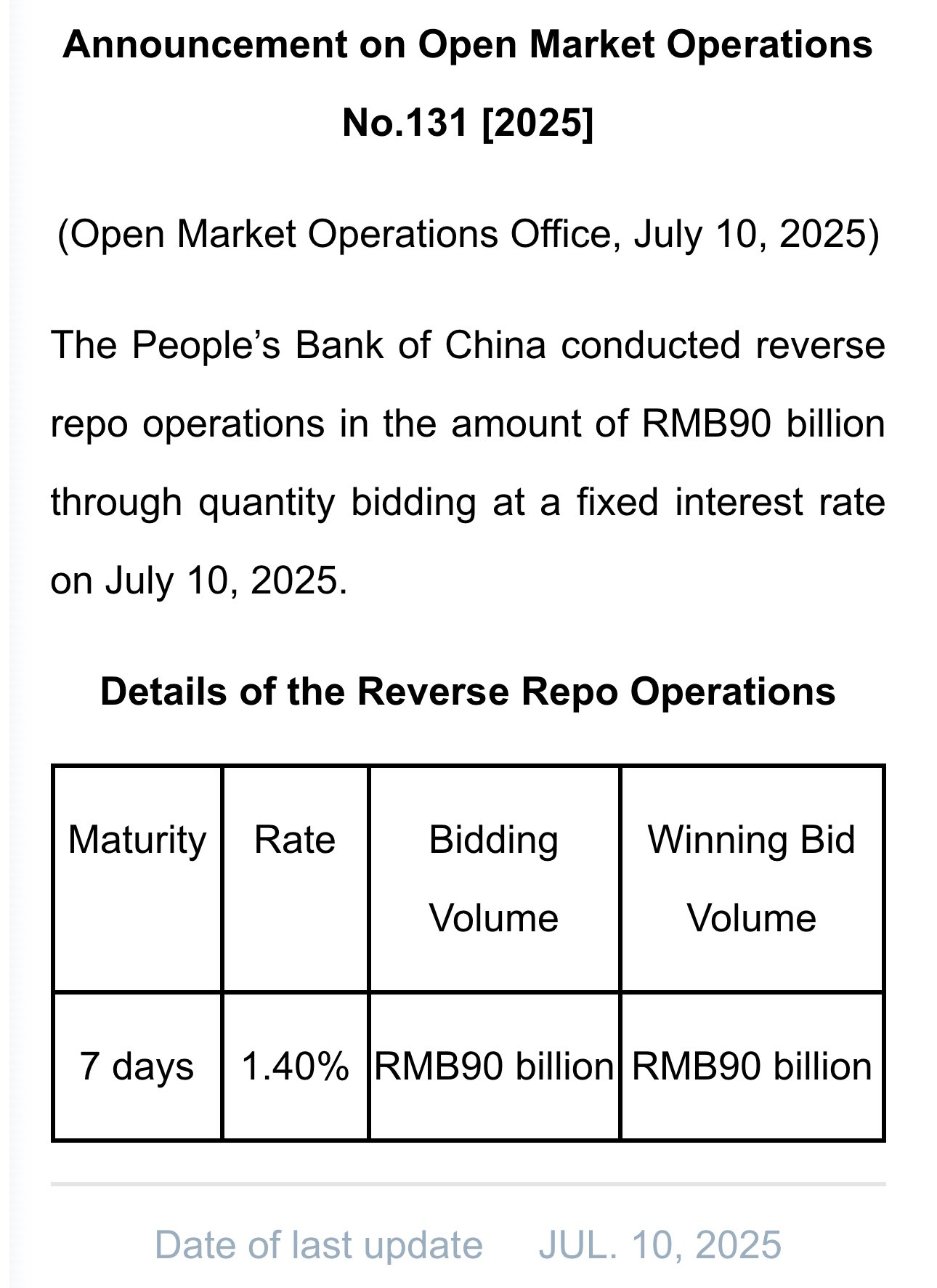

keep watching central bank's open market operations & balance sheets

🇪🇺 in the EU, Bitcoin still hasn't reached a new all time high

but a little bit more depreciation of EUR against USD can finally bring the FIAT party to the Europeans as well 😂

although in these cases being late to the party is better

when your favorite altcoin goes up in price soon remember one thing:

👉 it likely has to do more with liquidity flows than an increase in the inherent value of your preferred project

rule of thumb: if everything is systemically up - it's liquidity flows 😄

yes - US, China, EU & others will print a lot more as well 😄

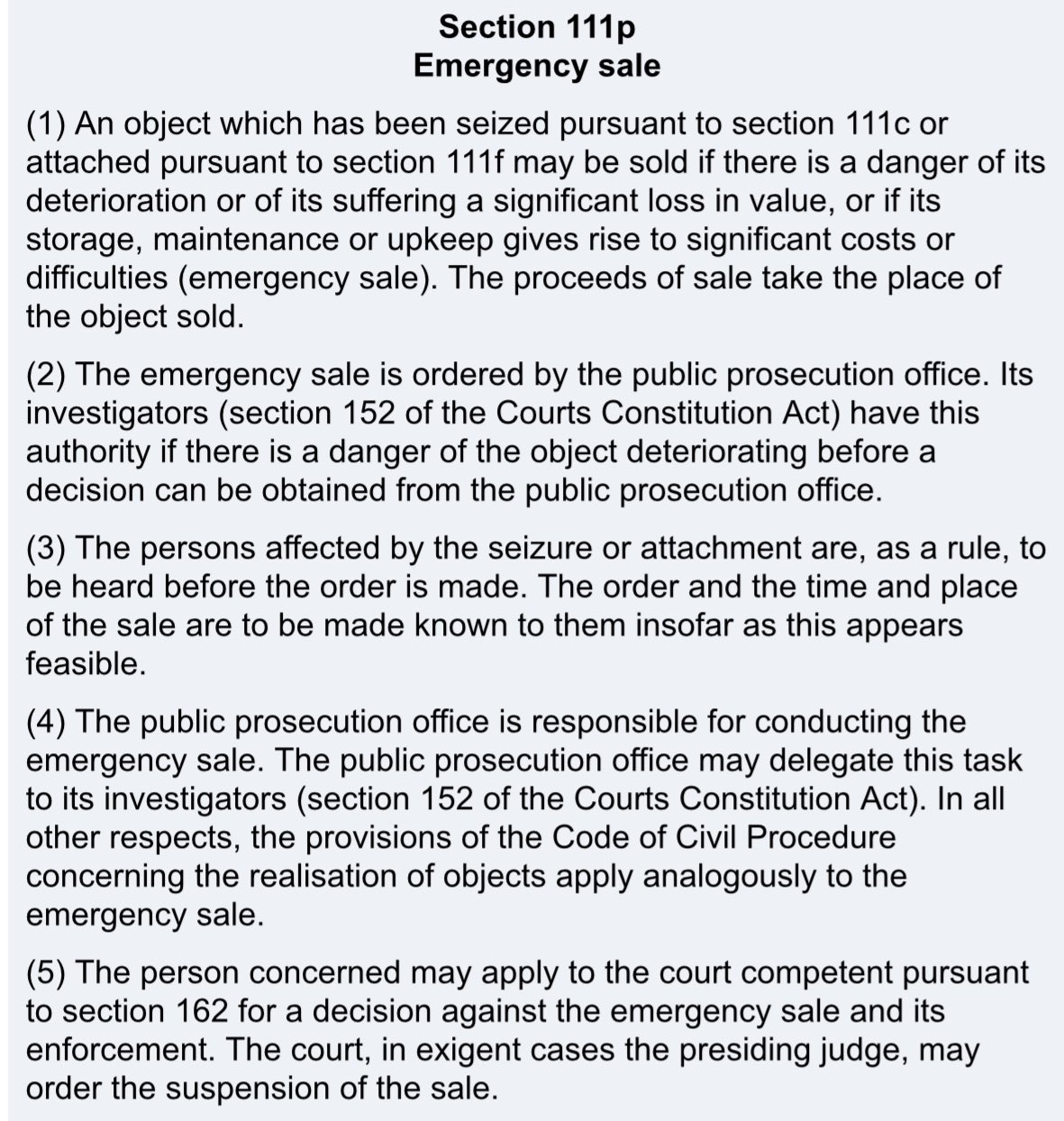

that BTC was seized as a part of criminal proceedings. German Code of Criminal Procedure (111p), allows such sales if there's a risk of significant value loss

crypto is extremely volatile & 0.1% insignificant 🤷♀️

🚀 crypto inflows materialized as expected

but wait - it's not over yet

more upside to come 👀📈

🇩🇪😱 Germany lost $2.75 billion on Bitcoin

ok, let's look at the numbers:

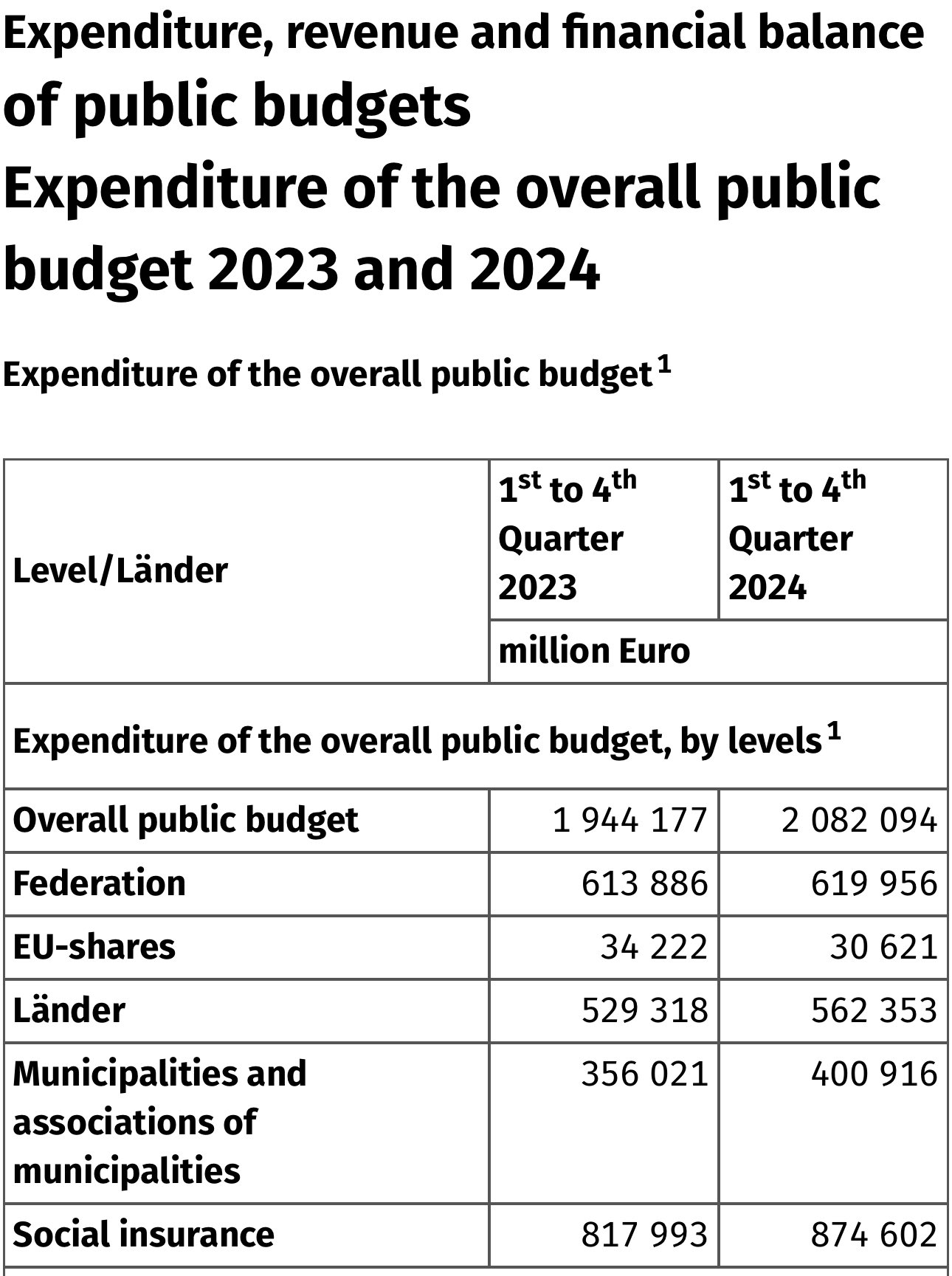

1️⃣ German's yearly public budget spending is ≈$2 trillion

2️⃣ $2.75 billion is 0.138% of $2 trillion

3️⃣ okay then 🤷♀️

*this is also assuming they didn't invest that money into something productive

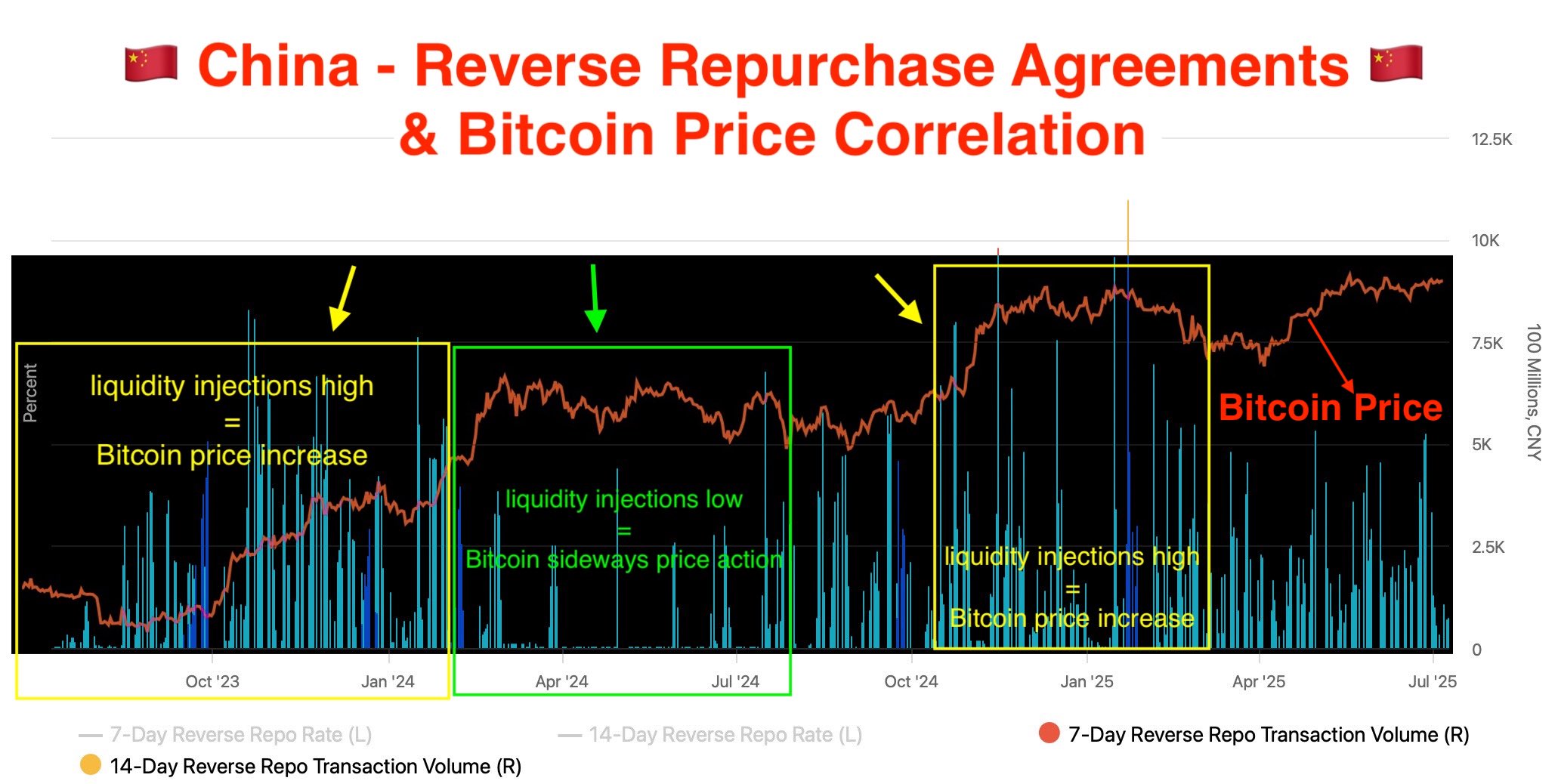

🇨🇳 China's reverse repo liquidity injections predict Bitcoin bullruns

it works like this:

📈 high PBoC injections = increasing bitcoin price

📉 low PBoC injections = sideways or decreasing

so every time China injects Yuan/reminbi, BTC price goes up 😁

btw I'm not saying Ethereum won't reach 1 million USD per ETH, but rather pointing out that comparing Ethereum to the bond market and oil is a stretch

it's also more accurate to account for the whole crypto cap in this context

the 14 year old dormant bitcoin wallet transactions are likely OTC operations

if you want to buy/sell >$1B worth of bitcoin, you're not going to do it through coinbase 😄

i've encountered numerous alternative explanations - some very creative

🪒 remember: occam's razor

check the correlation between FED swap line volumes and Bitcoin price

large spikes in swap volume trigger an uptrend in Bitcoin

understanding these global liquidity flows helps to visualize them as a part of the larger system and understand where it's likely to move next

new currency in circulation is just one of the side-effects

and that transition is neither direct, nor instant

before these funds effectively become new currency, they flow into financial markets - that's why you see the stock market going up first

the same for risky assets

now it's official 😄

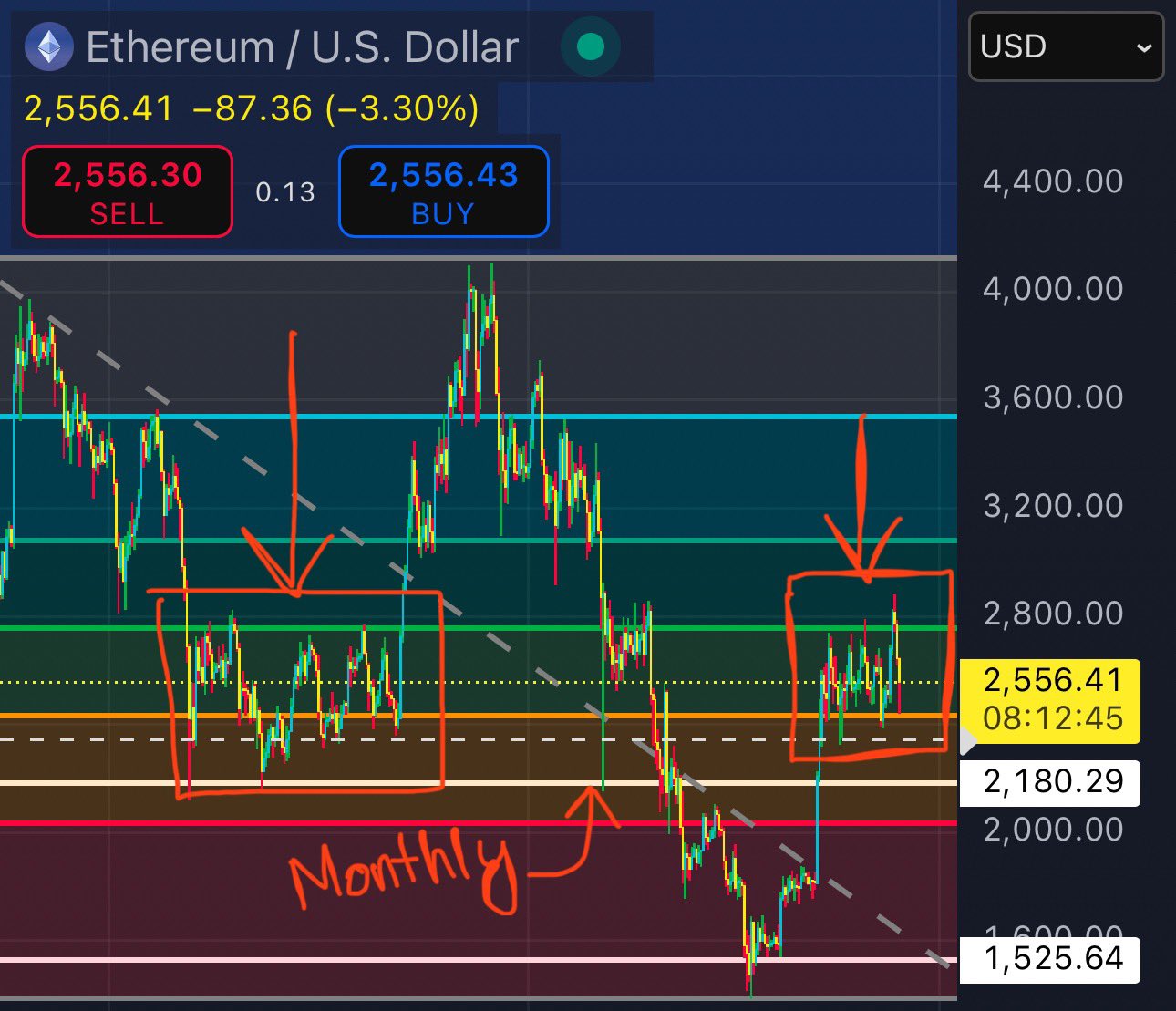

ethereum price fell to $2180 📉

interestingly, the majority sentiment of large following X accounts seemed to be bullish

please note, I wrote the original post more than a week ago - back then the market sentiment was extremely bullish

ethereum's price will very likely retrace upwards once it reaches the core monthly support area

the buying pressure there would be immense

the same is true for bitcoin's support