Bulgraria has been pegged to Euro since 1999 🇧🇬

Bulgaria has adopted Euro as its official currency and legal tender on January 1st 2026.

As you may have expected, there is now a lot of discourse about how this is bad for Bulgaria, because Euro is bad and Bulgaria has now given up their "monetary sovereignty".

What the ones pushing that narrative have not expected is for the Bulgarian lev (BGN) to be a proxy for Euro for almost 3 decades now. So it's not very clear which sovereignty Bulgaria gave up on January 1st 2026, when it became a full Eurozone member.

Since 1997 Bulgaria has operated under a currency board arrangement (CBA), which is an exchange rate regime where a country commits to keep its local currency to a fixed exchange rate against an anchor currency.

Under CBA, the adhering country fixes the exchange rate of its local currency to an anchor currency, its national central bank fully backs its monetary liabilities with foreign reserves (to create local currency the national central bank must have foreign currency assets to back it up, thus ensuring stable convertibility), and the country foregoes its right to adapt discretionary monetary policy (e.g. inflation rate targeting).

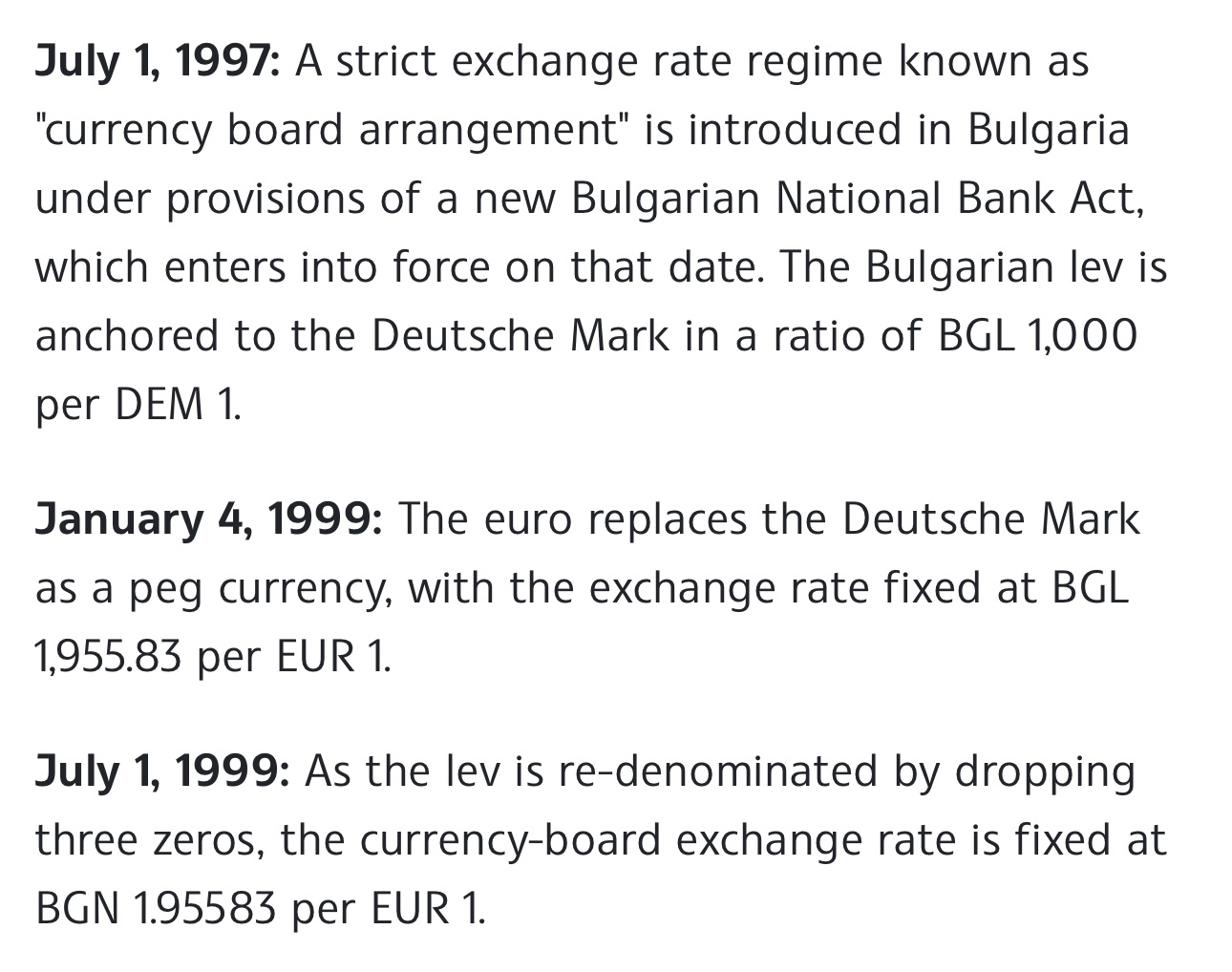

On July 1st 1997, Bulgaria introduced the currency board, pegging lev (BGL) to the Deutsche Mark (DM). On January 1st 1999, Bulgaria switched the anchor currency from Deutsche Mark to Euro, with the exchange rate fixed at €1 = 1.95583 BGN (≈0.5 BGN/EUR).

So the Bulgarian National Bank (BNB) neither had the sovereignty to manage the broad and base supplies of its local currency (Bulgarian lev/BGL/BGN), nor to freely pursue monetary policies since July 1st 1997.

Given this, any discourse about how Bulgaria's entry into the Eurozone implies a dramatic change to its monetary sovereignty is likely unfounded. It didn't happen overnight - it's been an almost 30 year long process. Joining the Eurozone does, however, remove the pegging frictions for Bulgaria, and allows them to fully integrate into the monetary union.