Commodities, metals & energy market updates

Short updates on commodities and commodity markets, including precious metals, industrial metals (e.g. copper), energy (oil/crude, nuclear/uranium, power/electricity themes) and agriculture — plus miners, producers and supply/demand dynamics.

As I've explained in my prior posts: the commodities rally isn't over

Gold is back above $5000

Silver is back above $80

Copper is back above $6

Prices below the above remain a buying opportunity

Enjoy!

Palladium Is A Great Investment In 2026

Palladium already more than doubled since 2025, but its upwards move won't stop here, as it's setup to appreciate against both, USD and gold.

As I've previously explained, the current commodities supercycle will lead to a price increase across the whole set of commodities, which includes precious and industrial metals and their miners. Palladium is very well positioned for the next leg of liquidity inflow.

Against USD, palladium is currently trading at ≈$2075/oz. My 2026 target for Palladium is at least ≈$2500/oz, or up another ≈24% from current price levels. Platinum has recently rebounded from its monthly support line.

Against gold, palladium is in a similar situation, as its rebounding from a monthly support trend line. The current Palladium/Gold ratio is at ≈0.38. I expect it to rebound upwards to at least ≈0.7, meaning that palladium is setup to appreciate against gold. Even if gold retraces in the short-to-medium term, I don't expect that price drop be to neither permanent, nor long-lasting.

There is also an ongoing deficit of palladium supply relative to its demand.

Copper extends its gains to ≈9% on the day, and its appreciating more than gold and silver

A week ago I wrote an article explaining why this upwards move in copper (and copper miners!) was imminent, from both fundamental and technical standpoints.

And don't be alarmed by near-term volatility. Keep the macro picture in mind under the lens of liquidity inflow into the commodity sector. I've explained this extensively in my articles. You can read them all on my website for free (there is also an RSS feed you can subscribe to).

Today's Commodity Miners Sell-Off Is A Buying Opportunity

I've made numerous such calls in the past, and they were correct 100% of the time. Today, I'm making one of such calls again.

Gold, silver and copper miners are down today, with indices and individual large caps falling by as much as ≈8%, despite the underlying metals remaining in the green. This is exactly the situation where you can leverage the increased volatility in the mining sector to increase your exposure to the underlying metals during an uptrend.

I expect the prices of gold and silver miners indices to increase by ≈30% from current levels within roughly 10 trading weeks from now. It may happen sooner than though - pay close attention to the price action.

It's also possible for the price to dip lower than the current levels before the upwards move described above materializes. This mainly depends on the price action of the precious and industrial metals in the next few weeks, but I don't believe that either one of them has topped for the cycle, thus uptrend resumption is imminent.

I've written several articles explaining why commodities and commodity miners are a great investment for 2026. I suggest you to read them if you haven't done so yet.

Don't Overthink Commodity Miners Investments

I'm now coming across several large finance accounts on X, which are sharing the results of their miner equity picks from 2025 made available to groups/newsletters/communities with paid access. The results from their buy calls from just a few months ago look impressive - price more than doubling isn't uncommon. The keywords here are *isn't uncommon*. A 2x gain in the mining sector since November 2025 isn't impressive. When evaluating the quality of the calls, it's important that you establish the correct baseline.

One examples of such buy calls was shared by Peter Schiff, who posted his investment suggestion from November 2025 on Nexa Resources S.A. (NYSE: NEXA), which is a miner/producer of zinc, copper, silver and some gold. Since November 2025, its stock price has more than doubled. This was shared as a part of a paid newsletter, whose November 2025 issue was made available to the public. While a >100% price increase may seem impressive, you could've been better off by just investing in a larger, well established miners like Hecla, which are subjects to a smaller set of risks.

Speaking numbers, you could've achieved a similar x2 gain since November 2025 by acquiring Hecla Mining Company stock (NYSE: HL) instead. Hecla is a well-established gold, silver, zinc and other metals miner with more than 60 years of price action dating back to 1964. In contrast, Nexa's price action dates back only by less than a decade - to 2017. As such, you can achieve the result at the cost of a smaller risk. I've shared Hecla Mining several times in my lists on my website throughout 2025 at no cost. I probably also shared others, but Hecla is the one that first comes to mind.

Here's what's important to understand:

There's a global liquidity inflow into the commodities sector, which includes miners, producers & Co equities. The alpha comes from identifying outperformers relative to the index, conditional to risk. Well-established, long running companies generally come with a lower risk profiles, compared to less well established or juniors.

The question isn't whether you can get more upside gain with smaller cap miners/juniors, the question is whether that extra potential gain justifies the extra risk and cost. Frequently the most obvious choices are the best ones. Investing into several miner/producer indexes, alongside a few individual well established, large-cap picks may be all that you need.

Copper Is A Great Investment In 2026 - Technicals & Fundamentals Explained

*A big part of this analysis also applies to copper miners, but I prefer to cover that in a separate article

From a technical standpoint, copper is currently flipping a ≈20 year old resistance for support. On a monthly chart, copper is in a multi-year upwards channel, and it’s now close to the upper trend line of that channel. Copper is also at record lows when priced in terms of gold and silver.

From a fundamental, supply/demand perspective, copper is required for electrification, data centers, new buildings, electric vehicles, and electric appliances in general.

International Copper Study Group (ICSG) expects refined copper’s demand to surpass the available supply/production in 2026. Given that new copper mines are slow to build, increasing the supply of copper requires great investments of capital and time, and in case of continued increase of global copper demand, it may take decades for the production to meet that demand fully.

This creates a setup for a significant upwards price pressure on copper from current levels.

It's also important to be aware of the metal's general price action. Copper is not gold - copper is significantly more volatile, but post 2021, the volatility has been more compressed to the upwards channel structure described above and shown in the chart.

Regarding the maximum drawdown from the current price levels (≈$5.90/lb), I don’t believe that copper will correct more than ≈15%, as there it will find a strong support area, and soon after the bottom support trend line from the monthly upwards channel, both of which will exert strong buying pressure. Within 6 months from now, I expect copper’s price to be above the current levels. This a risk-adjusted timeframe in which you should frame the current thesis - so it means that, for the same amount of capital, your investments in copper from today will be yield significantly more than they would in at the prevailing rate in money market funds. Realistically, I think it will happen much sooner than 6 months.

In addition to everything above there is also monetary debasement, debt refinancing walls and negative pressures on USD dominance as a reserve currency. These 3, alongside the geopolitical tensions present an additional source of positive price pressure on the whole commodity sector. My copper price thesis is positioned within this liquidity flow into commodities. I’ve covered these points in detail in my previous posts.

Silver miners are up another ≈4% today, and more than 10% in the last 5 days 😄

But this is unsurprising to you if you read my articles from a few days ago on miner/producer equity prices and why they present a great investing opportunity for this year

Yesterday, I explained why silver mining stocks are undervalued in 2026

Today, silver miners are up almost 6% across major FX currencies 😄

Of course, it's to early to tell whether my thesis is correct, but I'll throw in another prediction: this upward price movement in miners to continue.

Silver Mining Stocks Are Undervalued In 2026

*Below is my 5-minute analysis on silver miners equity prices for 2026

The price ratio of silver miners to silver is at some of its lowest levels in history, roughly at the same values as it was in the 2000’s. The ratio is currently sitting on a support from 2014-2015 inside of a multi-year upward price channel. Alongside the macroeconomic and geopolitical fundamentals, this setup’s potential upside gain justifies the limited downside risk. Unless silver experiences a large medium-to-longterm pullback, silver mining equity prices are set to increase against the price of silver. For this to happen, there are 3 high-level scenarios:

1️⃣ Silver price remains above ≈$88: silver miners appreciate more than silver

2️⃣ Silver price remains above ≈$83: silver falls in price, miners fall less or increase

3️⃣ Silver price remains above ≈$70: silver falls in price, miners fall less (more likely) or increase

Given the increasing demand for physical silver combined with currency debasement driven by refinancing needs, I don’t believe silver’s spot price will experience a pullback to lower than the ≈$70 level in 2026. Pullbacks below ≈$70 are more likely to trigger a larger sell-off in silver miners, potentially even pushing the ratio further down, meaning that silver mining stocks fall in price more than silver.

Silver producers/miners, royalty and streamers can be a great source of diversification and even "hedging" of your silver investments without ever leaving the commodities sector. You can further diversify your exposure to other metals by acquiring fund units and/or equities in producers, royalty and streamers that focus on more than two metals (e.g. there are companies mining gold, silver and copper).

A few days ago, I wrote a post about how gold miner prices are set to breakout. But silver is not gold. Silver miners will be more volatile than gold miners, but given a positive correlation between gold and silver prices, they will tend to follow the gold miner’s direction. After all, most gold mining companies mine silver and vice-versa (silver is often mined as a byproduct of other metals like gold, copper, lead and zinc). The attached chart shows the ratio between the price of Hecla Mining and Pan American Silver, so it doesn’t include all silver miners, but you’ll find a similar structure in silver equity-based indices against the spot/futures price of the metal.

In the longer timespan (e.g. 3+ years), miners may underperform the underlying metal. This analysis is written with a focus on the current price levels with a timeframe of 1 year from now. Given that this article was written in January 2026, you can consider this as a guide for the remainder of 2026. Physical silver is not the same as silver miners. The mining sector is exposed to an array of risks distinct from the metal, with the highest one currently being the geopolitical risk in the form of armed conflict (destruction, supply chain disruption) and legal changes (sanctions, tariffs, export/import limits). Thus, even if the price of the physical metal goes up, miners price can collapse. The same risks can put upwards pressure on the metal and downward pressure on the miners simultaneously. I don't believe these risks will materialize sufficiently for miners by the end of 2026, and given the upside price pressure on commodities, miners will also ride that price wave up.

The big play on precious metals mining stocks is that production costs remain (much) smaller than the metal's spot price

For gold - the cost to produce/mine 1 oz is roughly $2000. Then, those same miners sell it for more than $4000. Instant >$2000 profit per ounce (again, rough numbers) 😄

So from the current levels, assuming production costs increase less than the spot price of the metal - miners win big. I believe this will be the case.

I wrote a more detailed article explains gold mining costs and miner profits here: https://illya.sh/threads/1-oz-of-gold-production-cost-and-miner-profit

Uranium, nuclear energy, electrical grid, lithium and copper have been added to my list

Electrification will continue to increase, and that requires not only the production of electricity, but also the setup of all of the electrical infrastructure. AI runs on electricity, data centers need electricity and strong demand for electric lithium-battery powered vehicles (EVs) is here to stay for at least another decade.

You can invest in them using your favorite broker - there's plenty of ETFs, ETCs and equities.

For Uranium and nuclear energy - there are several ETFs that give you exposure to producers, distributors and infrastructure (e.g. nuclear plant maintenance).

Electrical grid investments can be done by acquiring equity in companies that expand and maintain it.

Not recommending any particular investment instruments, but the attached image provides you with a starter list.

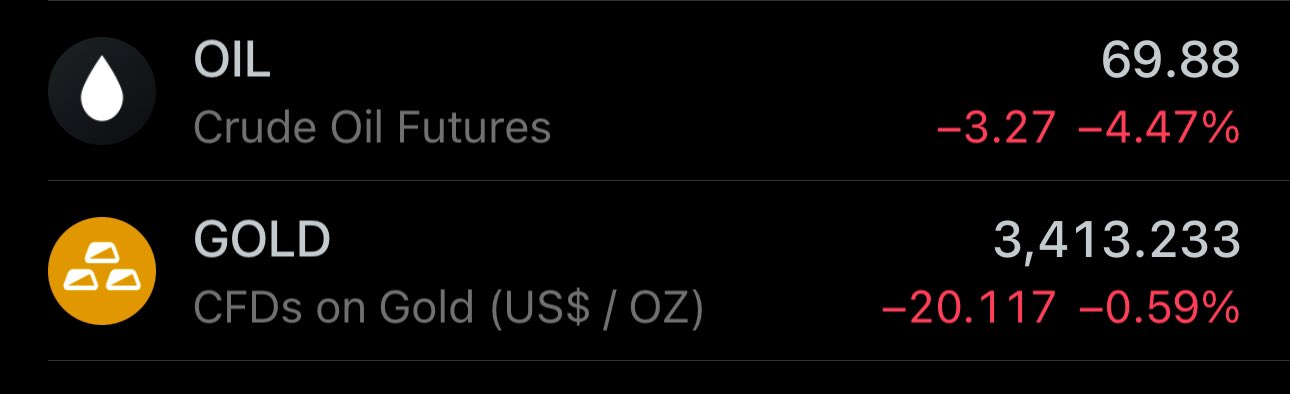

Today's gold, silver and their miners sell-off is a buying opportunity

Treat it as an early new year's gift for 2026 🥳

China Is Hoarding Commodities

While the U.S. is pumping a crypto & AI bubble, China is pumping their commodity reserves.

Not only PRC is limiting silver exports, but they're also lowering the cost of commodity-related imports.

The net result will be more positive commodity import/export ratio, i.e. more physical commodities within China, which will be used for strategic and industrial needs (China is the world's number one producer).

It also means that there will be less commodities available outside of PRC, and since the global demand won't decrease - that's further positive price pressure on the commodity sector.

I have been writing about gold, silver and other commodities for over 2 years. The same bullish narrative remains valid. These geopolitical developments provide further confirmation.

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

don't forget to set your limit buy orders

maximum bottom is around early September 2025 prices

it's getting closer

Bitcoin needs gold. Gold doesn't need Bitcoin

TL;DR: Bitcoin is a protocol that runs on computers. Computers rely heavily on electronics. Gold is widely used in electronics. Bitcoin depends on gold.

Bitcoin quite literally runs on gold. ≈99% of physical machines hosting Bitcoin nodes contain at least trace amounts of gold. The same is true for the overall electric grid infrastructure that delivers electricity to Bitcoin nodes.

While gold isn't strictly required for electronics, it's widely used to due to organic demand. Gold's ROI in signal connectors is very strong, because you need little gold to mitigate a large amount of failure risk. All of this is due to the unique chemical nature of gold, which alongside its scarcity is at the base of gold's intrinsic value.

Gold is a chemical element in the periodic table - its atomic symbol is Au. Physical gold is essentially Au atoms connected to other Au atoms in a cubic pattern. This structure is very stable, and at the same time soft/malleable. Gold is used in electronics because it provides stable, low and predictable contact resistance and corrosion immunity at low currents/voltages, including under vibration.

Electronics is of course just one of the use-cases of gold. Among others, it has been used as money for more than 5000 years. Even if Bitcoin does become money in the future, it won't be the only form of money (plus, you can always tokenize gold!). And especially not for the near long-term future.

Digital currencies are at their infancy, and they almost always depend on stable electrical grid and network connection to function properly. This includes Bitcoin. Gold doesn't have this risk. It was used as money before electricity and networks existed, and it can continue to be used alongside them

This is not to say that Bitcoin is a bad idea, but gold has a higher intrinsic value by definition

the promised gold & silver sale is here

if you didn't set your limit buy orders for silver, gold & miners - it's not too late yet

currently in late-September price ranges for many. it's also a good idea to position some buy targets below the current price levels

keep watching the gold price - it's the main driver for all

FOMC meeting is next week

⏰ don't forget to setup your buy limit orders for gold, silver and their miners

⏰ don't forget to setup your buy limit orders for gold, silver and their miners

hope you enjoyed Friday's gold, silver & miners sell-off

now await for the markets to re-open

it begins in a few hours 👀

it's not only futures of course - the broader physical supply chain of gold is also affected

the more imminent impact is on users of 1kg/100oz gold bars. in the future markets the effect is much more visible and quantifiable - so it will start the price movement from there

the demand from 100oz/1kg gold bars will be shifted to its other forms - whose prices will increase

this will increase gold's spot premium in the US, putting upside pressure on the global spot price

the demand from 100oz/1kg gold bars will be shifted to its other forms - whose prices will increase

this will increase gold's spot premium in the US, putting upside pressure on the global spot price

it's mostly 100oz/1kg gold bullion markers that will be affected - so you're looking at futures

expect a larger basis trade (futures price higher than spot), which will eventually close down

with tariffs in place spot is being pushed up towards futures

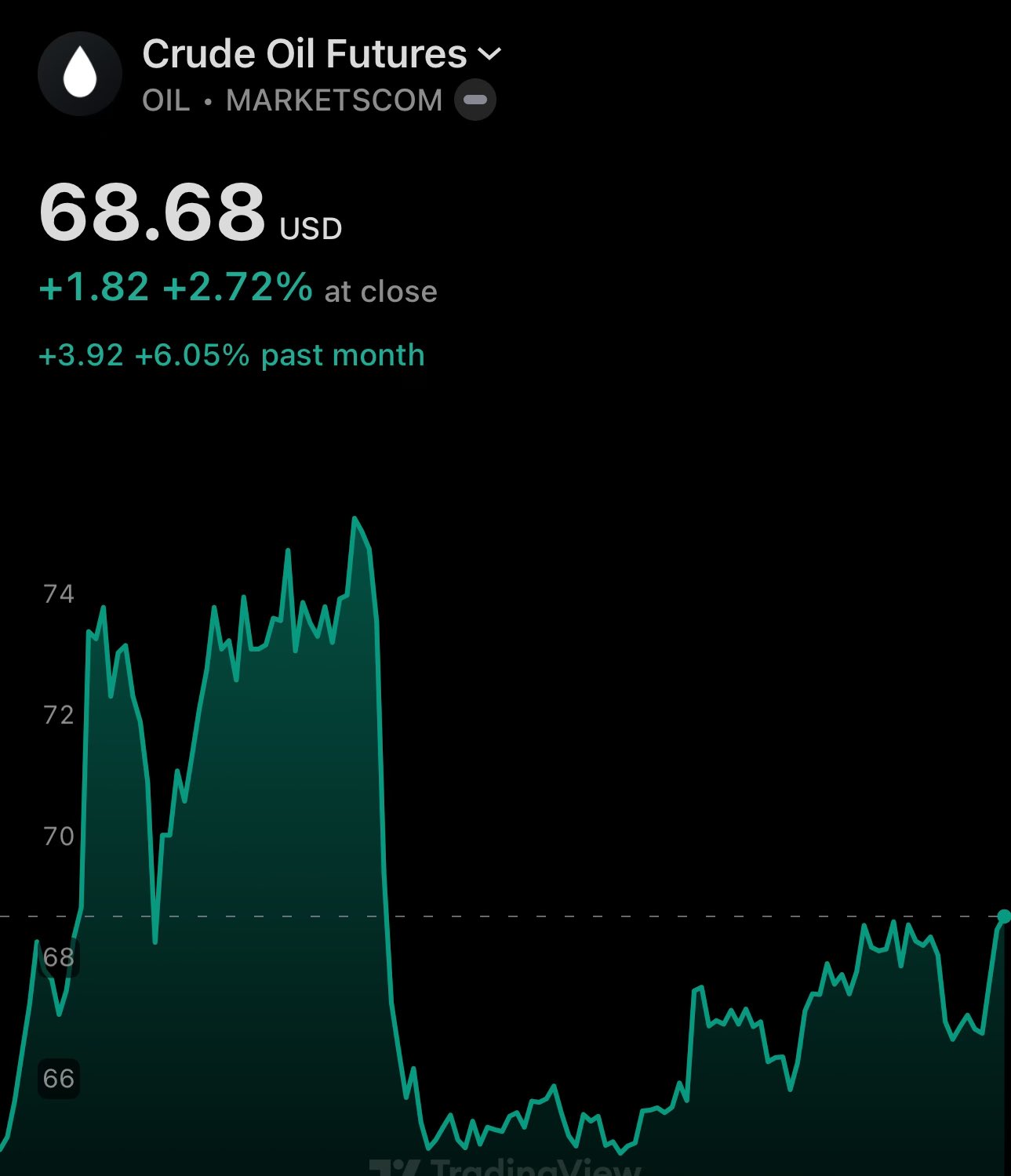

🛢️ crude oil price is heading back up - just like I wrote earlier

significant geopolitical events introduce volatility - but my thesis on increasing oil, gold & other precious metals + commodities has little to do with that

👉 it's about global liquidity flows & bond markets

all of this very bullish for gold & other commodities

it's not just gold & silver - you may have seen the recent appreciation of platinum

those commodities have still have price to catch up on & that has been signaled by their volatility

gold up 40% on the year isn't normal

so today it may not be wise to assume that the FED will hike interest rates into double digits to lower the CPI/inflation

rather - the interest rates are headed down, bc of challenge in refinancing debt

that's what I meant by focusing on historical patterns from this century