Europe, ECB & Eurozone market analysis

Ongoing views on ECB policy, Euro FX, EU regulation and how European markets differ from US markets.

Maybe, just maybe the EU will start swapping their USD-denominated reserves for gold and (at least eventually) renminbi 😉

Good For Gold, Bad For USD: US Tariffs on Europe

The tariffs imposed by the U.S. on the European countries are detrimental to USD's position as a reserve currency. A capital outflow out of the U.S. dollar creates positive price pressure on gold via increased demand.

This is true regardless of the U.S. Supreme Court's decision on whether President Trump can lawfully impose unilateral broad tariffs via executive order using the the International Emergency Economic Powers Act (IEEAP).

At the high level, there's two moves for gold here:

➖ If the tariffs are deemed illegal and the collected tariff revenue must to refunded - which would lead to an increase of USD supply accessible to the wider economy. The refund would come either from existing reserves, thus directly increasing broad money or from newly issued debt, which may reduce broad money in the short-term, but the newly issued bonds will eventually be rehypothecated, thus effectively increasing USD credit/effective supply. This is positive price pressure on gold, at the very least due to the increase in liquidity. This is negative price pressure on USD, due to increased supply & public debt of the issuer.

➖If the tariffs are deemed legal, and/or do not need to be refunded, the geopolitical and liquidity risk remains, which materializes in a lower incencitve to own USD. After all, why would you want to hold a currency, whose purchasing power/liqudity may be reduced every other week after the markets close on a Friday? Gold is the natural outflow path from USD, especially at sovereign/central bank level.

If the Eurozone wants to reduce their USD exposure in the next 5 years, what can they do? The European countries may not want to start significantly increasing the share of renminbi in their FX reserves just yet. Additionally, EU could position Euro as an alternative to USD for settlements, as EUR is already the second most used currency for international trade & FX turnover, second only to USD. Gold presents itself as an attractive alternative to USD, even if the focus on increasing its tonnage in the reserves is transitory. At the very least, increasing the share of gold relative to the balance sheet size in the Eurozone, would increase foreign exchange rate value of Euro and/or would provide basis for monetary expansion in the future.

Many forget that the "gold and foreign exchange reserves" are a single asset-side item in central banks balance sheets. "Gold" is explicitly discriminated among all other assets/commodities, while all currencies and their derivatives (e.g. sovereign bonds) are clustered under the generic "FX reserves" name. Across all currencies, renminbi is best positioned to increase its share in reserve assets and international settlement. Unlike renminbi, gold is nobody's liability and has no counterparty risk (assuming no jurisdiction risk, which can be greatly mitigated by storing the gold bullion domestically).

Given this, I expect the European countries to increase their gold holdings, via a combination of swaps from USD-denominated assets for gold and other FX currencies like the Chinese Yen.

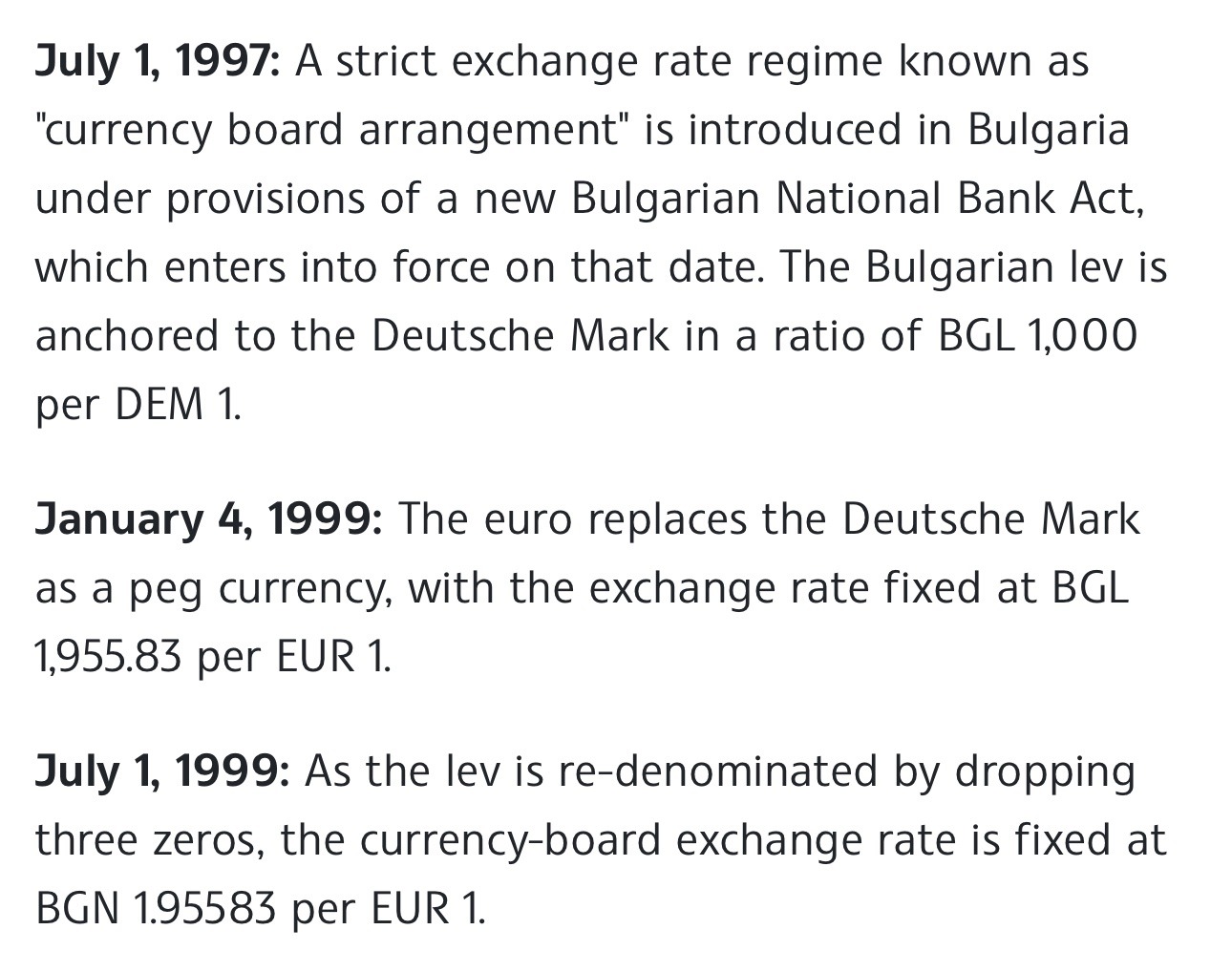

Bulgraria has been pegged to Euro since 1999 🇧🇬

Bulgaria has adopted Euro as its official currency and legal tender on January 1st 2026.

As you may have expected, there is now a lot of discourse about how this is bad for Bulgaria, because Euro is bad and Bulgaria has now given up their "monetary sovereignty".

What the ones pushing that narrative have not expected is for the Bulgarian lev (BGN) to be a proxy for Euro for almost 3 decades now. So it's not very clear which sovereignty Bulgaria gave up on January 1st 2026, when it became a full Eurozone member.

Since 1997 Bulgaria has operated under a currency board arrangement (CBA), which is an exchange rate regime where a country commits to keep its local currency to a fixed exchange rate against an anchor currency.

Under CBA, the adhering country fixes the exchange rate of its local currency to an anchor currency, its national central bank fully backs its monetary liabilities with foreign reserves (to create local currency the national central bank must have foreign currency assets to back it up, thus ensuring stable convertibility), and the country foregoes its right to adapt discretionary monetary policy (e.g. inflation rate targeting).

On July 1st 1997, Bulgaria introduced the currency board, pegging lev (BGL) to the Deutsche Mark (DM). On January 1st 1999, Bulgaria switched the anchor currency from Deutsche Mark to Euro, with the exchange rate fixed at €1 = 1.95583 BGN (≈0.5 BGN/EUR).

So the Bulgarian National Bank (BNB) neither had the sovereignty to manage the broad and base supplies of its local currency (Bulgarian lev/BGL/BGN), nor to freely pursue monetary policies since July 1st 1997.

Given this, any discourse about how Bulgaria's entry into the Eurozone implies a dramatic change to its monetary sovereignty is likely unfounded. It didn't happen overnight - it's been an almost 30 year long process. Joining the Eurozone does, however, remove the pegging frictions for Bulgaria, and allows them to fully integrate into the monetary union.

Bulgarian Lev has been pegged to Euro since 1999

Bulgarian National Bank (BNB) has been operating under a currency board arrangement (CBA) regime since 1997. First, it was pegged to the Deutsche Mark, then to the Euro. They also redenominated their currency from Old Bulgarian Lev (BGL) to New Bulgarian Lev (BGN).

Under CBA, BNB's monetary liabilities must be fully covered by foreign reserves. In other words, if Bulgaria's Central Bank wanted to increase the base money supply of their national currency (i.e. monetary liabilities on BNB's balance sheet), they needed to foreign reserve assets backing them up at a fixed rate of 1 EUR ≈ 1.96 BGN. In practice, ≈90% of BNB's reserves were Euro-denominated, which makes sense, since BGN is pegged to the Euro.

For those claiming that by adopting the Euro as its official currency on January 1st 2026 Bulgaria has given up its monetary sovereignty - how exactly? BNB has been extremely limited in pursuing discretionary monetary policies since 1997.

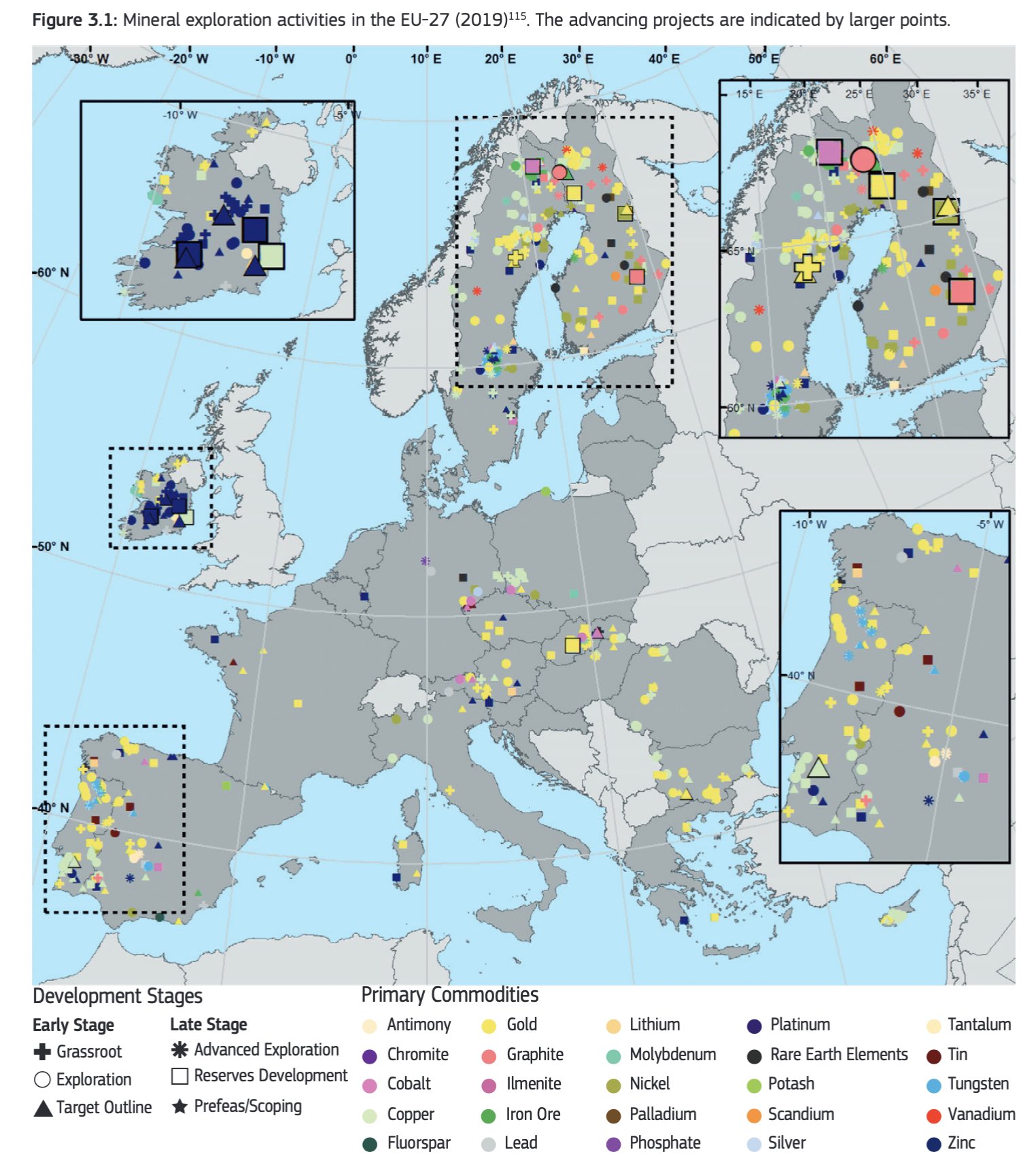

Europe's Gold Imports and Exports Explained

Europe has gold mines in Finland, Sweden, Türkiye and Romania among others.

Together they account for <2% of world output (≈70 tones of gold/year). Europe is heavily dependent on gold imports, with >90% of the gold for its needs being imported.

Switzerland is the world's largest gold refining and transit hub, with at least ≈50% of all of the newly minted gold passing through Swiss refineries. Refining and re-exporting is by far the largest driver of European gold imports.

Europe imports ≈3900 tones of gold per year, but only keeps 10% of it.

Just wait until Bitcoin hype accounts find out that Czechia has not adapted the Euro, so it's not a part of the Eurozone.

Thus, the Czech National Bank (CNB) is a part of European System of Central Banks (ESCB), but not a full Eurosystem central bank, so it's not represented in and not bound by the ECB Governing Council's monetary policy decisions.

No Eurozone National Central Bank (NCB) is holding Bitcoin in their reserves, and ECB's current policy rejects the idea of BTC as a reserve asset.

Watch what they do, not what Bitcoin hype media says.

This is how The Soviet Union kickstarted Eurodollar markets in the 1950's

Eurodollars are USD deposits held at banks outside the U.S. Originally, they were held mostly in European jurisdictions, thus the "Euro" in the name.

URSS needed U.S. dollars for international trade, but they didn't trust keeping balances directly in New York, as they feared that U.S. would freeze or seize those deposits.

So URSS placed their USD deposits in European banks, often via Soviet-linked banks. Those European banks then re-deposited or lent out those dollars to other banks and institutions.

I've written extensively how the policies of the current U.S. administration are a negative for the USD. Asian countries have been progressively moving away from USD, and this is a sign from Europe in that direction (but don't expect heavy de-dollarization in the near future).

Overall, I view this as a net positive for the sovereignty of EU/Europe as a whole. A more developed financial system infrastructure is crucial for attracting the use of Euro, which is already the 2nd most used currency in the world.

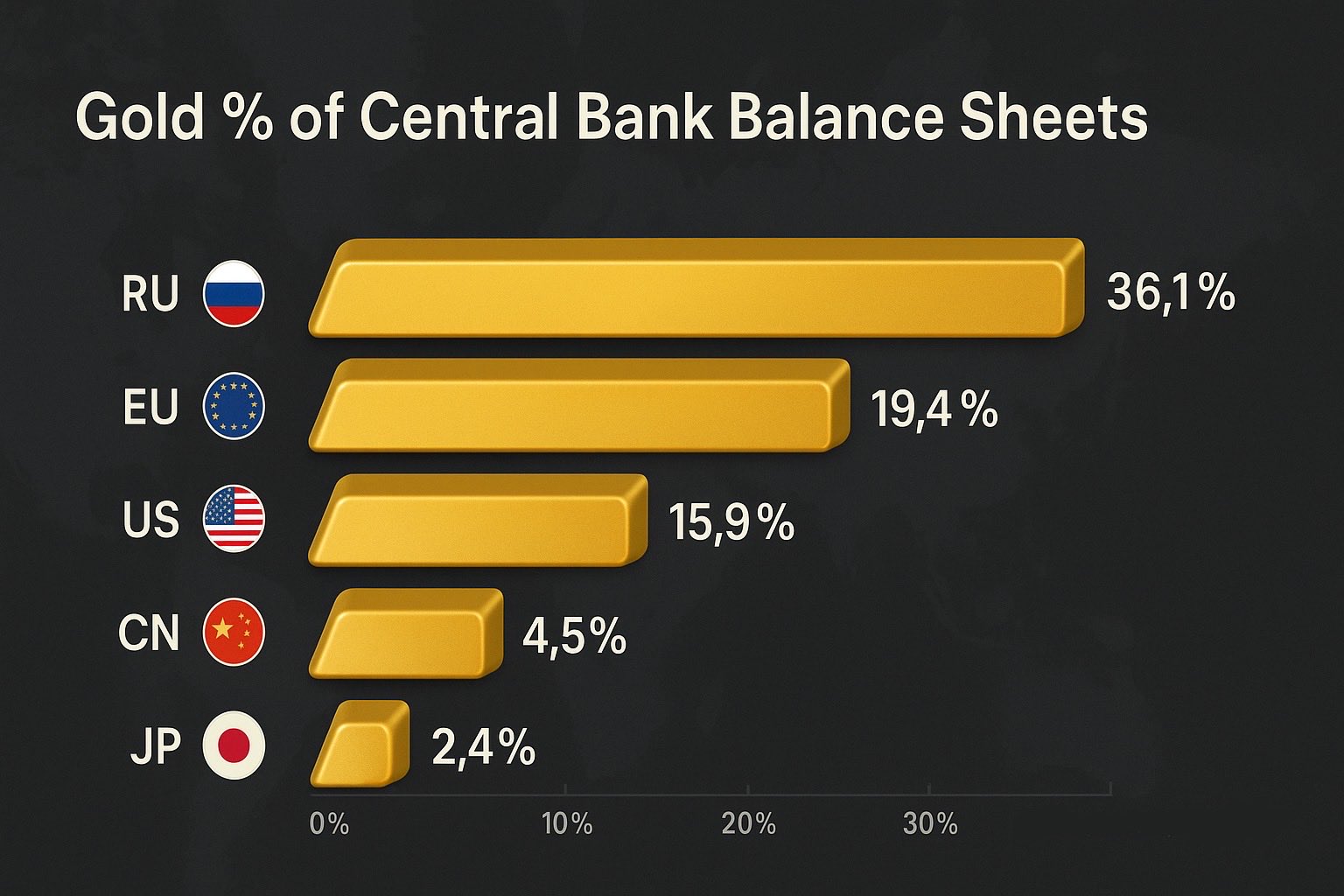

Gold as a percentage of balance sheet size in Central Banks (ranked):

🇯🇵 Japan (MoF + BoJ): ≈2.4%

🇨🇳 China (PBoC): ≈4.5%

🇺🇸 U.S. (Fed gold certificates): ≈15.9%

🇪🇺 European Union (ECB + Eurosystem): ≈19.4%

🇷🇺 Russia (BoR): ≈36.1%

All of the above will expand their balance sheets, but it's mostly China & Russia actively buying more gold.

Conclusions you can take from here:

➖ China's gold holdings are relatively small when compared to their Central Bank's balance sheet size, and given their efforts to promote renminbi as the invoice currency worldwide, you can expect PBoC to continue their gold purchases for the medium-long term. The gold share must at least double to come close to the current reserve currency - the U.S. dollar. All reserve currencies started on a gold and/or silver standard - and the pressure towards this direction won't be different for renminbi/yuan. When the USD became the world reserve currency with the Bretton-Woods agreement - gold certificates accounted for ≈40% of the Fed's balance sheet.

➖ Russia has built up a massive balance sheet capacity for the future. Once the international trade markets with Russia re-open, there will be a plenty of reserves to back-up a massive wave of Ruble credit. Expect Russian capital markets to rally then.

➖ European Union has a healthy relative position. Given that the Euro is currently the closest alternative to the U.S. Dollar - it's a good idea to both, expand gold reserves and promote capital markets. The latter is an explicit goal via the Capital Markets Union (CMU). Given that EU will further expand the balance sheet, it's necessary to increase the gold reserves - repricing won't be enough. Gold will make Euro more attractive, and with it the FX holdings of Euro by sovereigns.

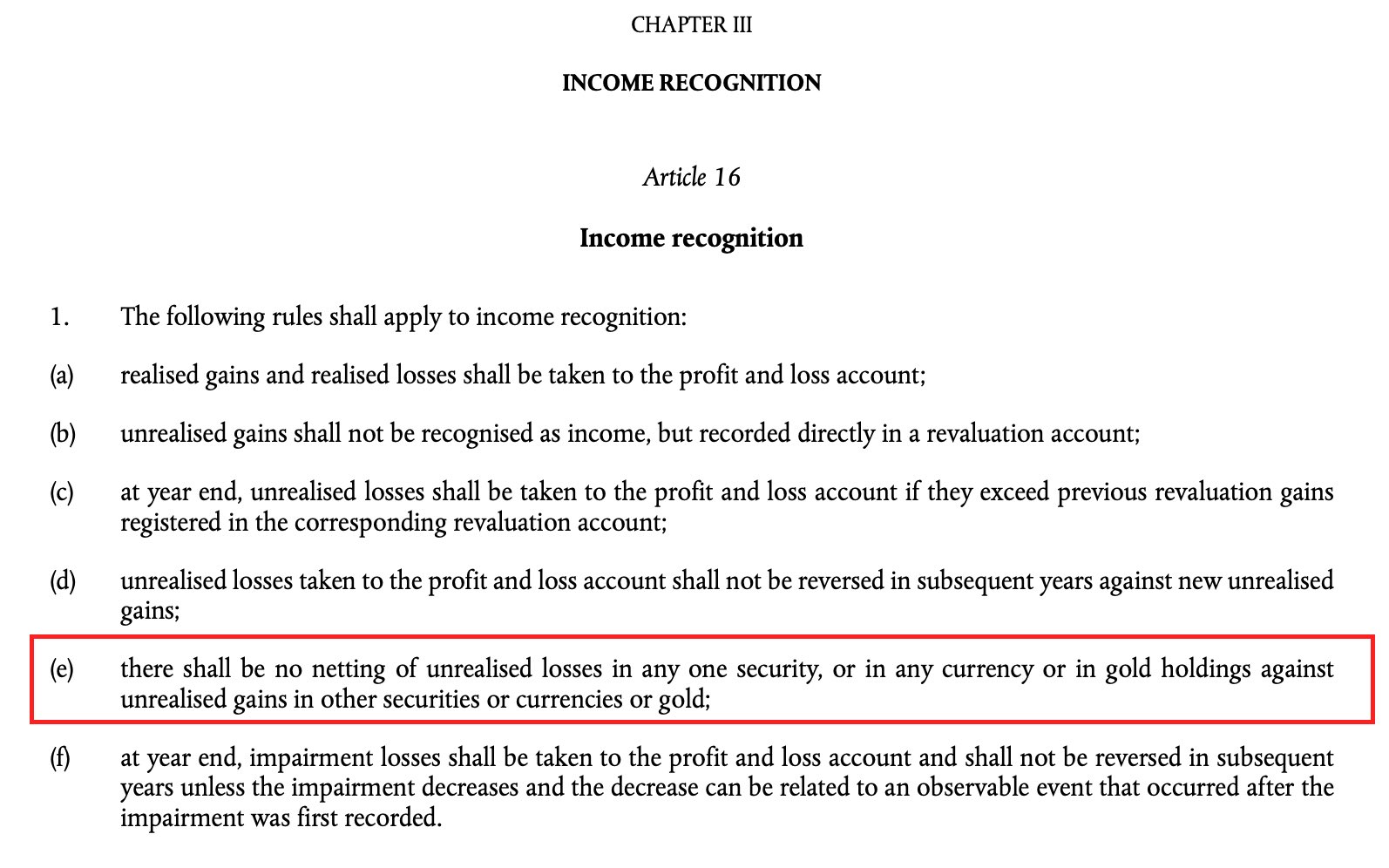

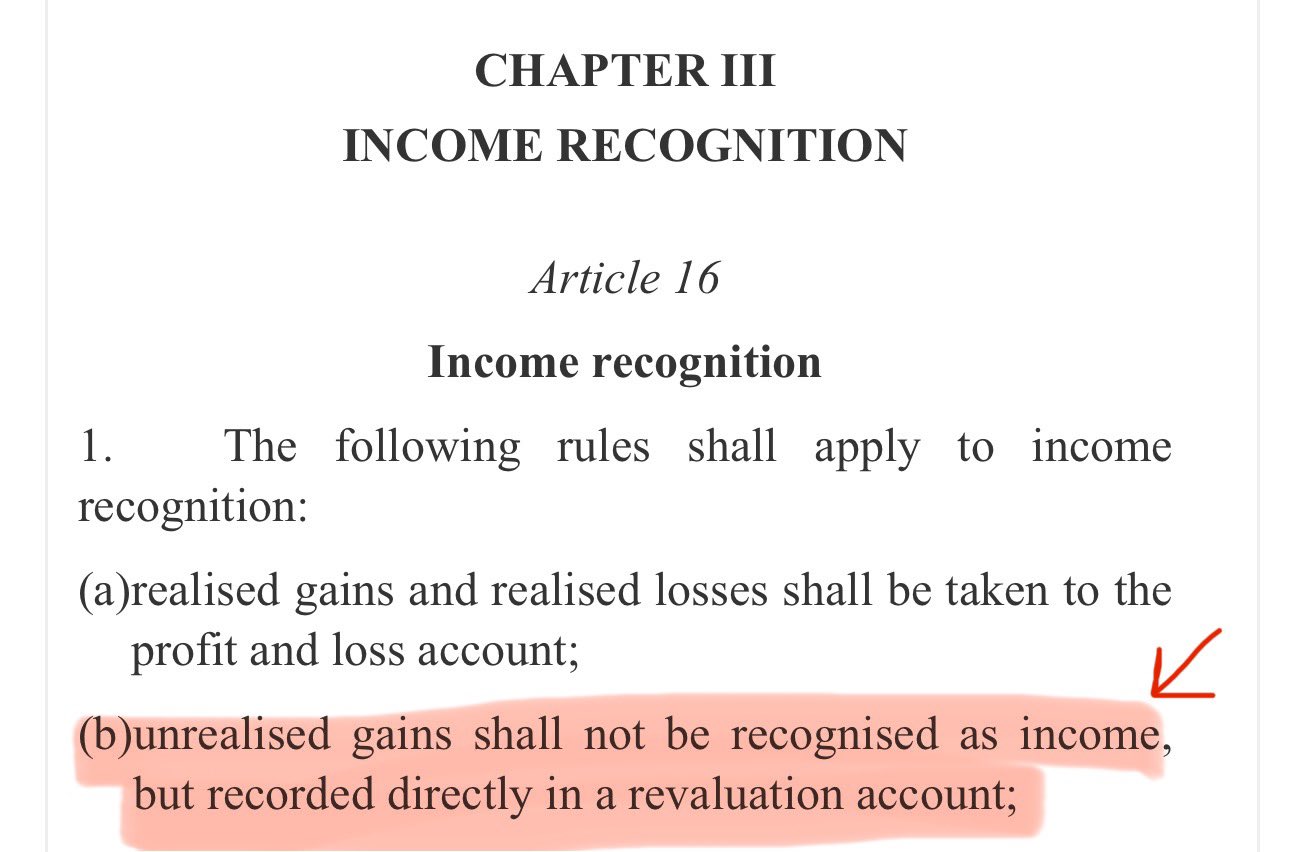

this means the ECB can only use unrealized gold gains to cover/offset future unrealized losses on gold

these unrealized gains can neither offset an operational, nor a loss in another security bucket, such as FX

ECB's legal framework forbids the use of gold revaluation proceeds to pay expenses or operating losses

unrealized gains are not recognized as income and are instead credited to the revaluation account

revaluation account is under liability/equity on the ECB's balance sheet

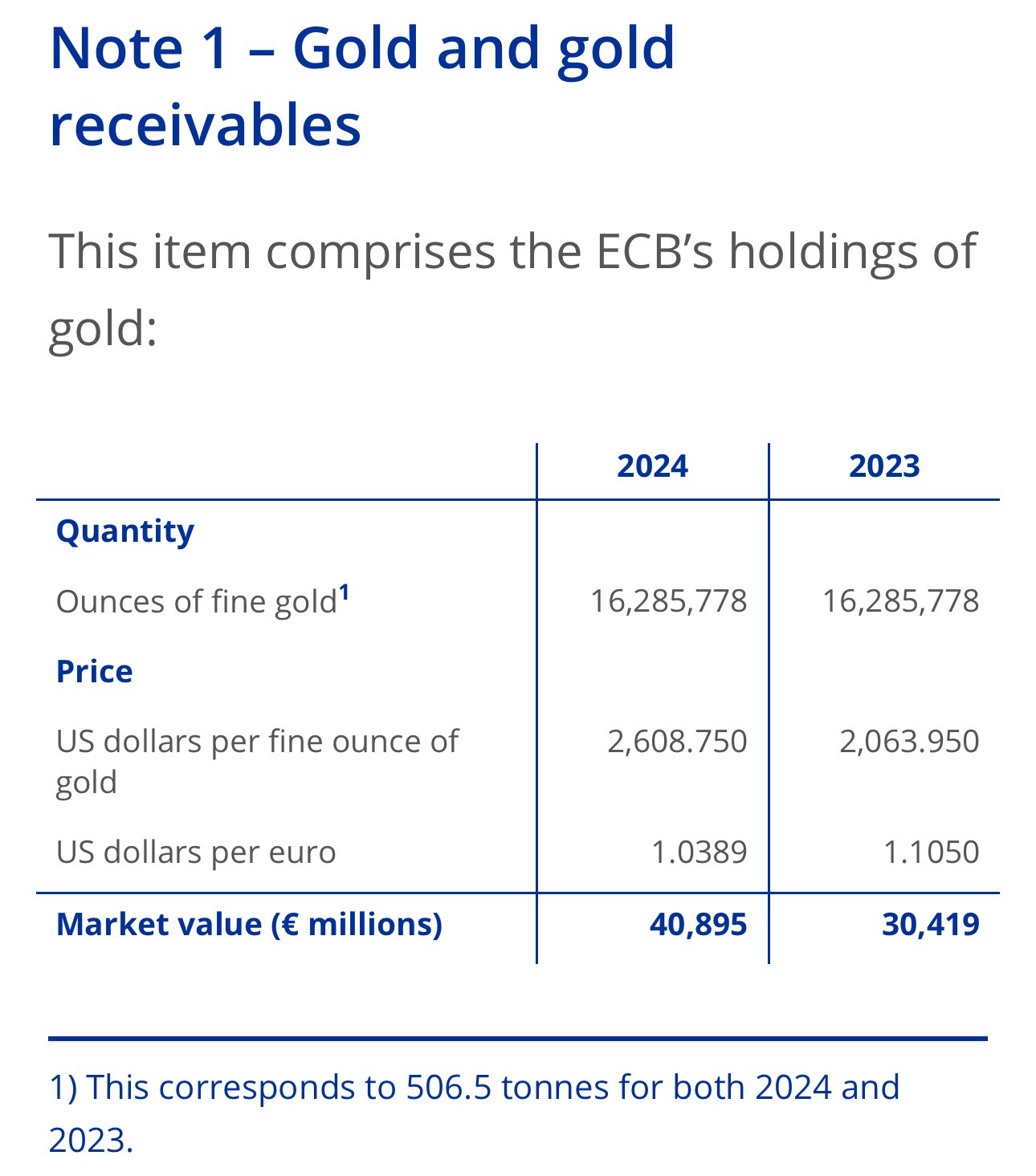

to clarify: European Central Bank didn't increase its gold holdings, but the gold that ECB already owns (≈506 tonnes) increased in value, since gold's market price increased

ECB reevaluates gold at the end of every year and credits or debits the revelation account accordingly

🇪🇺 ECB gained €10.5B on gold from 2023 to 2024

2025 YTD running gains add another net positive ≈€10B & likely to be higher by the year end's gold revaluation

that's an implied ≈8% yield on gold appreciation - much more than the ECB earned from other asset buckets

since i've written this, gold is up ≈16%

≈25% if you count from the tariffs announcements on April 7th

i will re-iterate that in order to protect the EUR the ECB should increase their onshore gold holdings

🇪🇺 The best countermeasure that EU can take is swapping US securities for Gold

Gold is inversely correlated with USD. Such a decision can be done today and it will:

1️⃣be a response to the US

2️⃣increase value of EUR

3️⃣minimize consumer impact

Anything else will hurt the economy

ECB plans to limit the amount of digital Euro CBDC a wallet can hold

this means you will be limited the amount of digital EUR you can own

this applies only to retail European Central Bank CBDC, not wholesale. the idea is to prevent excessive outflows of deposits from banks

these regulatory constraints are synchronized to a significant degree across all jurisdictions

this means that the financial regulations in EU & USA will have an analogous functional effect (although not the same!). so you can expect similar frameworks across several countries

since all dealers are subject to functionally similar regulatory constraints, they're also subject to functionally similar set of balance sheet constraints

this is important to remember in the context of global liquidity, especially in terms of pro-cyclical effects

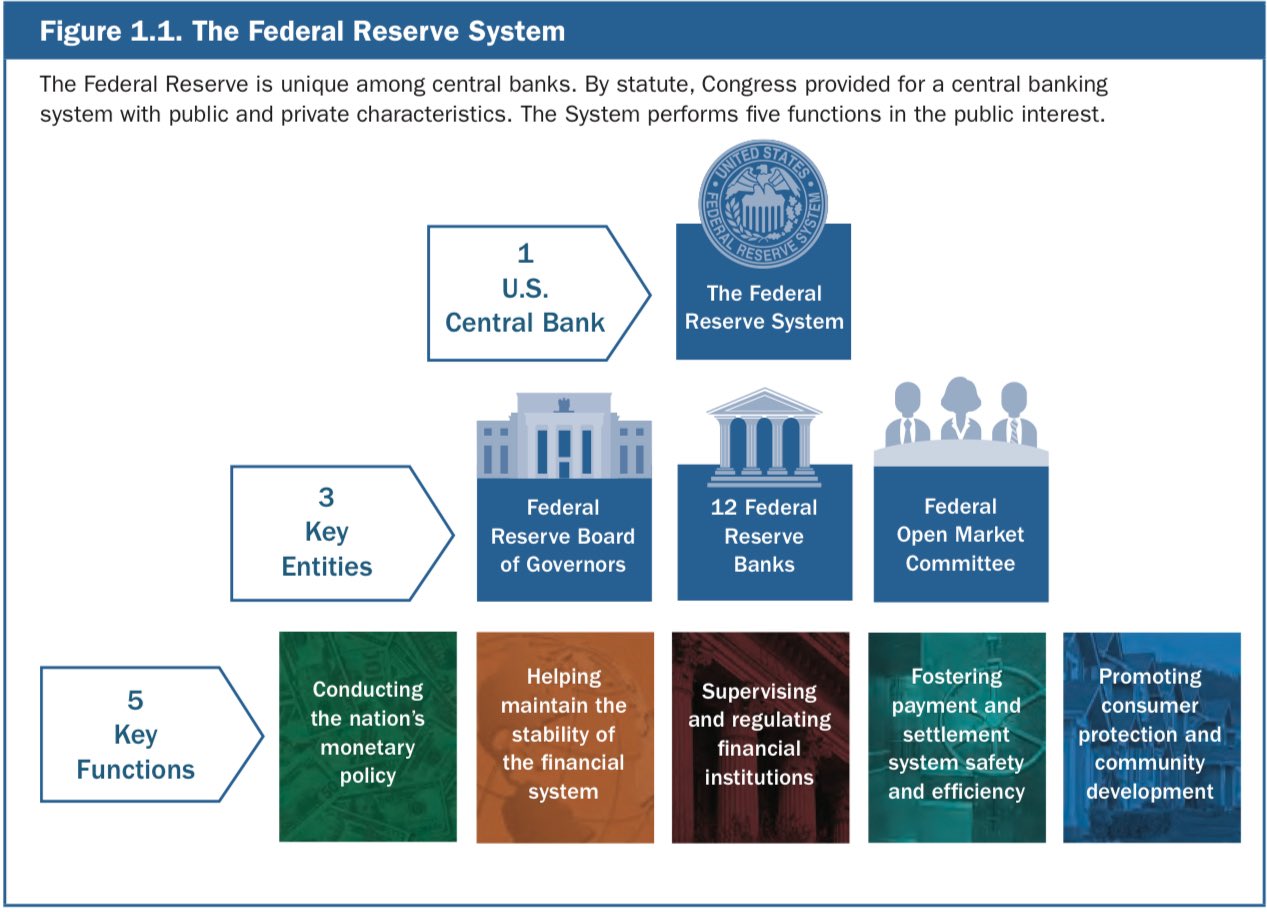

by "central bank" I'm frequently referring to the broader set of the legal framework behind the macro monetary policy

in most countries central banks plays a key role, but they frequently co-exist in a larger network of institutions

🇪🇺 ECB's "business model" is as follows:

➕ income: ECB creates money and invests it into financial assets (e.g.: FX, bonds, funds)

➖expenses, such as operational expanses (e.g. staff), facility and open market operation expenses (e.g. TARGET)

profit/loss = income - expenses

and soon the Eurozone will join the new BTC all time high party 🇪🇺🥳

Bitcoin still hasn't seen a new high in EUR since January 2025

this happened to due the relative appreciation apprtetiation of Euro against US dollar

🇪🇺 in the EU, Bitcoin still hasn't reached a new all time high

but a little bit more depreciation of EUR against USD can finally bring the FIAT party to the Europeans as well 😂

although in these cases being late to the party is better

NOTE: Basel III is legally non-binding

so for a step 2 you'd want to look into the transposed legislations

🇪🇺 EU: Capital Requirements Regulation & Capital Requirements Directive

🇺🇸 USA: split throughout Code of Federal Regulations

(just ask ChatGPT/LLM & read from there 😄)

🇵🇹 Portugal's Central Bank is LOADED with gold

👉 Gold reserves are >80% of total assets

Props to @bancodeportugal for a healthy balance sheet ratio

From now on - only gold-sprinkled pastéis de nata!

🇪🇺🇷🇺 So how can you buy Russian securities in the EU?

Since 2022 it's unfeasible. IBKR & KIT Finance suspended trading

Deep researching with LLMs now, but it hasn't been very fruitful so far 🤔

Once the sanctions are lifted you'll see the prices explode

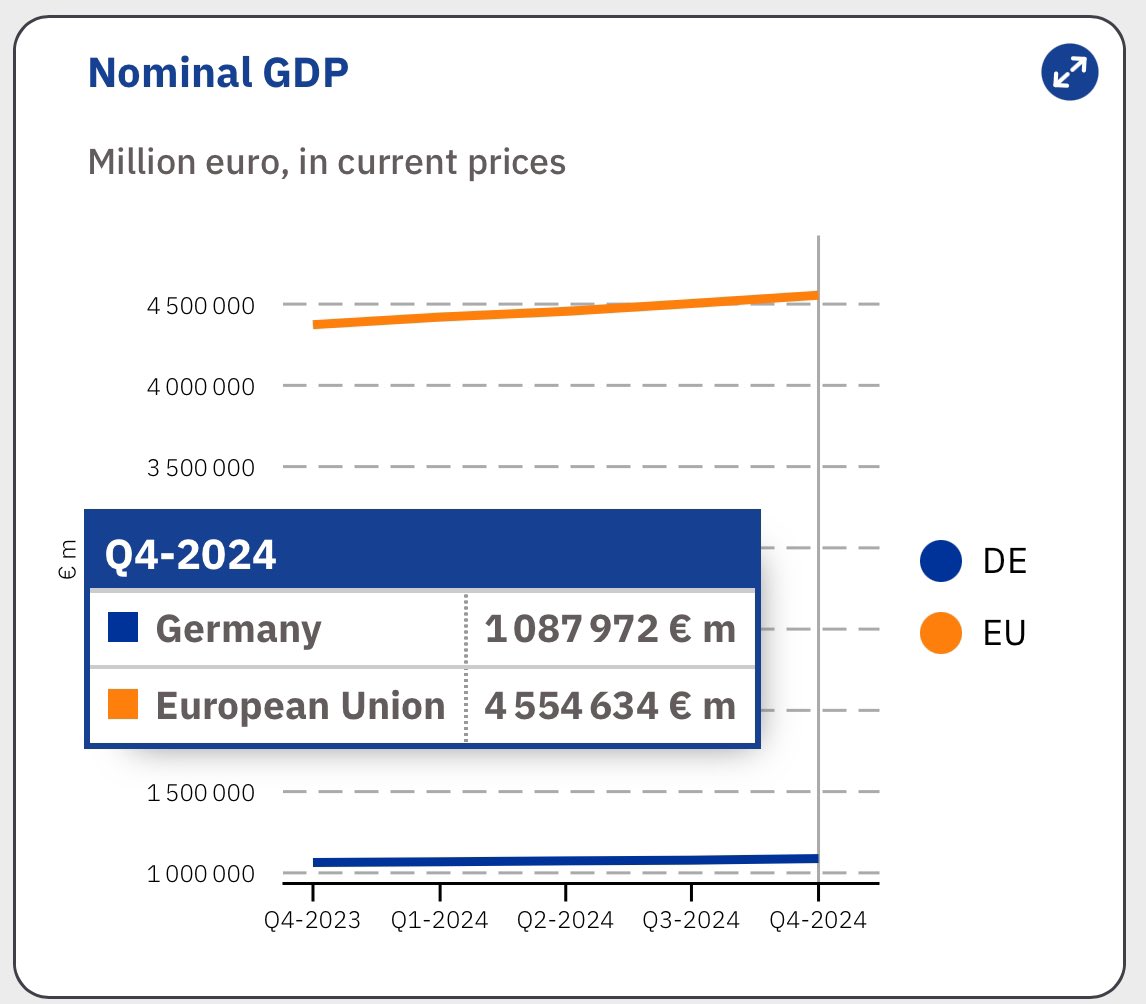

🇩🇪 Germany's GDP is 1/4 of EU's GDP

There are 27 countries in the European Union. 26 of them combined represent 3/4 of EU's GDP

Germany, France & Italy represent 52% of EU's GDP

You have to be very specific when talking about EU economy 🇪🇺

🇪🇺🇺🇸US tariffs present a unique opportunity for EU's capital markets

Billions of $ are flowing out of US markets. Let that liquidity be parked in the EU. All that's needed is inviting conditions

It can start with a small, less-regulated market subsection to allow seamless foreign funds flow