Financial regulation, securities & banking law

Brief analyses of Basel changes, securities rulings, CBDC law and cross-border tax and credit frameworks shaping markets.

Bulgarian Lev has been pegged to Euro since 1999

Bulgarian National Bank (BNB) has been operating under a currency board arrangement (CBA) regime since 1997. First, it was pegged to the Deutsche Mark, then to the Euro. They also redenominated their currency from Old Bulgarian Lev (BGL) to New Bulgarian Lev (BGN).

Under CBA, BNB's monetary liabilities must be fully covered by foreign reserves. In other words, if Bulgaria's Central Bank wanted to increase the base money supply of their national currency (i.e. monetary liabilities on BNB's balance sheet), they needed to foreign reserve assets backing them up at a fixed rate of 1 EUR ≈ 1.96 BGN. In practice, ≈90% of BNB's reserves were Euro-denominated, which makes sense, since BGN is pegged to the Euro.

For those claiming that by adopting the Euro as its official currency on January 1st 2026 Bulgaria has given up its monetary sovereignty - how exactly? BNB has been extremely limited in pursuing discretionary monetary policies since 1997.

Just wait until Bitcoin hype accounts find out that Czechia has not adapted the Euro, so it's not a part of the Eurozone.

Thus, the Czech National Bank (CNB) is a part of European System of Central Banks (ESCB), but not a full Eurosystem central bank, so it's not represented in and not bound by the ECB Governing Council's monetary policy decisions.

No Eurozone National Central Bank (NCB) is holding Bitcoin in their reserves, and ECB's current policy rejects the idea of BTC as a reserve asset.

Watch what they do, not what Bitcoin hype media says.

European Investment Funds Explained: UCITS, AIFs, AIFMD and the ELTIF Regime

As I’ve previously written, I am working on a framework for tokenizing European Long Term Investment Fund operation (ELTIF 2.0) on a public, smart-contract enabled blockchain like Ethereum. You can read more about it here: https://illya.sh/threads/tokenizing-european-long-term-investment-funds-eltif-2-0-on

This is financial markets legislation heavy topic, and it involves several regulations and directives, each one meticulously outlining rules and exceptions which together form a framework for operating various investment funds in the European Union.

I come across many negative commentaries regarding EU regulations in general, but not so many explaining those regulations. In general, there is not much information covering this topic on the internet, and if you ask ChatGPT to explain it - it will likely take you several iterations and back-and-forth to understand it.

Since this falls under my current area of work - I thought that it would be useful to share the knowledge, and provide a clear and concise starting point for anyone looking into investment funds legislation and practical application in the European Union.

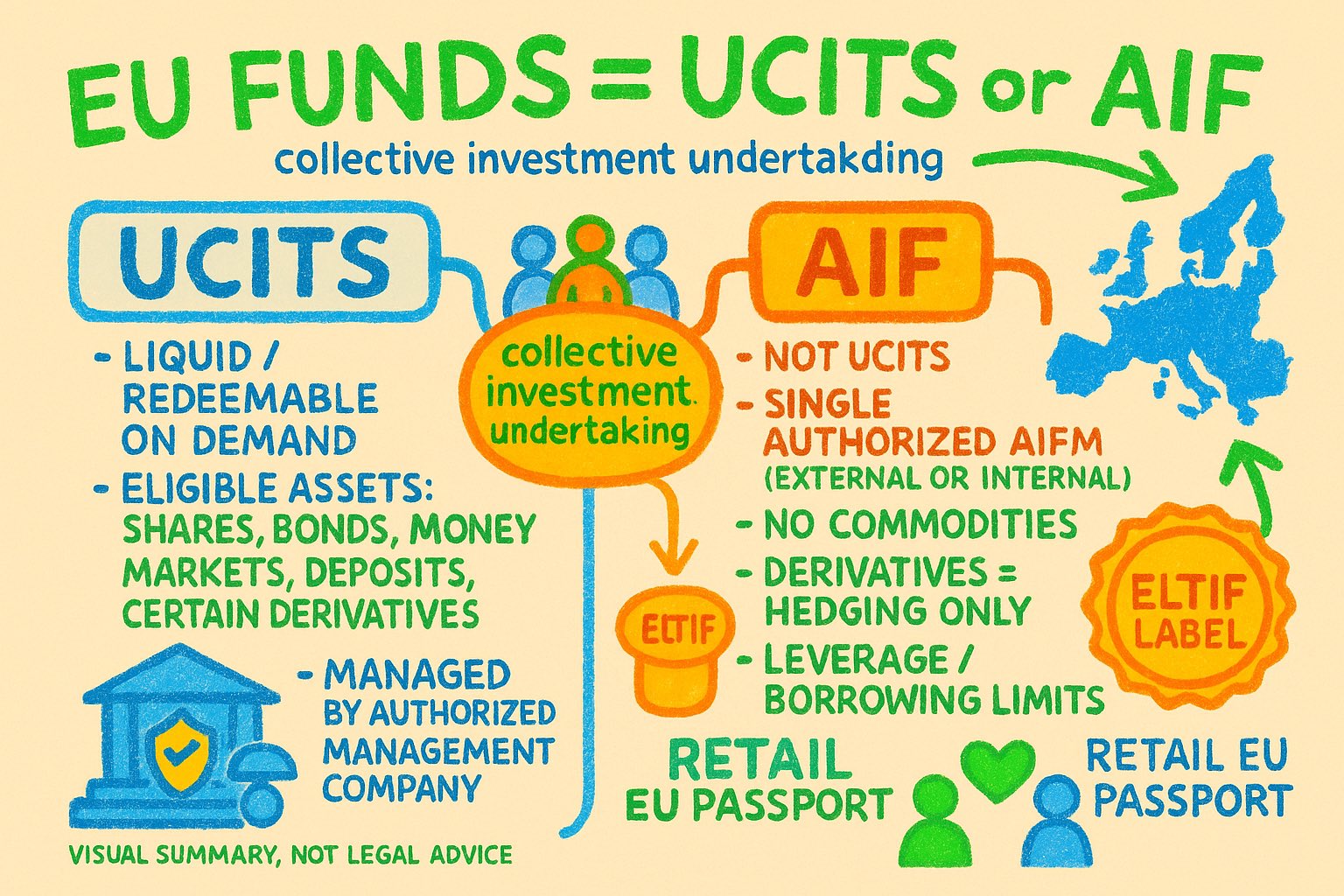

So first of all let’s start with the definition of a “fund”. EU law doesn’t have a unanimous definition for what constitutes a fund. Instead, it defines rules for two collective investment schemes:

1️⃣ Undertakings for Collective Investment In Transferable Securities (UCITS) defined in Directive 2009/65/EC

2️⃣ Alternative Investment Funds (AIFs) defined in AIFMD Directive 2011/61/EU

UCITS is defined as an undertaking whose sole purpose is collective investment in transferable securities and other liquid financial assets, with the holders of UCITS units/shares being able to redeem/repurchase them on demand out of UCITS’s assets/holdings. The strict list of eligible assets is defined in Article 50 of Directive 2009/65/EC and it includes:

1️⃣ Transferable securities, which are securities that are negotiable/tradable on capital markets, such as shares/equities and bonds.

2️⃣ Money market instruments

3️⃣ Deposits with credit institutions

4️⃣ Certain financial derivatives

As per Article 5, a UCITS must be managed by “management company”, which is defined as a company whose regular business is to manage UCITS (Article 2(1)(b)), or set up as a self-managed investment company under Articles 29-31. As per Article 6(1) this management company must be authorized. Before a UCITS is authorized its’s management company must be authorized.

Alternative Investment Fund (AIF) is defined in Directive on Alternative Investment Fund Managers (AIFMD) to encompass all undertakings that raise capital from investors, invest according to a clearly defined investment policy for the benefit of the investors, and do not require UCITS authorization. In this sense, AIF is a functional classification, and it explicitly captures other collective investments that do not fall under the UCITS definition, as per Directive 2009/65/EC.

As a general rule, anything that’s a collective investment undertaking, but not a UCITS is an AIF. That definition comes directly from AIFMD Article 4.

An AIF must always be managed by an Alternative Investment Fund Manager (AIFM). Under Article 4(1)(b) of AIFMD, an AIFM is defined as “legal persons whose regular business is managing one or more AIFs”. Article 5 from AIFMD further reinforces this idea by requiring every AIF to have a single AIFM legally responsible for its compliance. This management entity can either be external (external AIFM) or the AIF may be managed internally with the AIF itself obtaining AIFM authorization. Article 6(1) mandates that no entity may manage an AIF, unless they are authorized as an AIFM (i.e. the managing entity must be authorized). The AIFM in an AIF is equivalent to the “management company” in UCITS.

European Long Term Investment Fund (ELTIF), defined in Regulation (EU) 2015/760, and later amended by Regulation (EU) 2023/606 , is a type of Alternative Investment Fund (AIF). All ELTIF are AIF, but in order for an AIF to be ELTIF, it must meet the requirements outlined in the regulation and is subject for authorization.

As such, under the EU law, ELTIF is not a distinct class of funds/collective investment schemes, but rather a legal label that an AIF can apply for. Since an ELTIF is an AIF, it is also managed by an AIFM.

So what distinguishes an ELTIF from a “regular” AIF? In short, it’s the type of assets that the collective investment undertaking holds. Among others, an ELTIF must invest ≥55% of its capital into eligible assets, which include real assets (e.g. real estate) and STS securitizations. Moreover, an ELTIF cannot invest into commodities, the use of financial derivatives is only allowed for hedging and there are limits on borrowing/leverage.

So why would one bother with the ELTIF label? Well, having the ELTIF label means your collective investment undertaking product is available to retail (i.e. to non-professional investors) EU-wide. An ELTIF allows you to offer illiquid investments to retail in the whole European Union

In conclusion - EU law defines a fund as a collective investment undertaking, and it can be of two types: UCITS or AIF. An ELTIF is a type of AIF, which comes with retail EU passport benefits.

This article doesn’t aim to be exhaustive, but rather to be used as the basis for forming a mental model on the legal structure of funds in the European Union, and how the ELTIF fits into the framework.

no, permissioned assets running on blockchains are NOT sheep in wolves' clothing

blockchains need to integrate with our existing legal systems - and the permissioned aspect is often required by law

i'm currently looking into implementing a real estate European Long Term Investment Fund (ELTIF) on-chain with smart contracts

the EU regulations governing such funds explicitly require a permissioned control. for example, an ELTIF must be managed by an Alternative Investment Fund Manager (AIFM), as per Directive 2011/61/EU (AIFMD). so there must always be an AIFM behind the token/smart contacts. it can't just be "ownerless" decentralized contracts. by design that someone also bears legal responsibility

you're also legally not allowed to allow retail investments into the fund without KYC, which is also a permissioned component

in order to be able to have the unit's funds tradable on-chain without qualifying as a trading venue under MiFID II (so you don't need additional licenses), you may want to use ELTIF RTS, which under certain conditions exempt your ELTIF smart contracts from being classified as a multilateral system. to qualify for this exception, the law requires the manager to operate windows, decide on execution prices, etc - i.e. the fund's units get traded in a permissioned manner

these are just some of practical examples. as you see, there are many reasons for using a permissioned design in your blockchain assets

permissionless is great, but practical value is more important. we need more solutions that work with the existing legal and financial system infrastructure

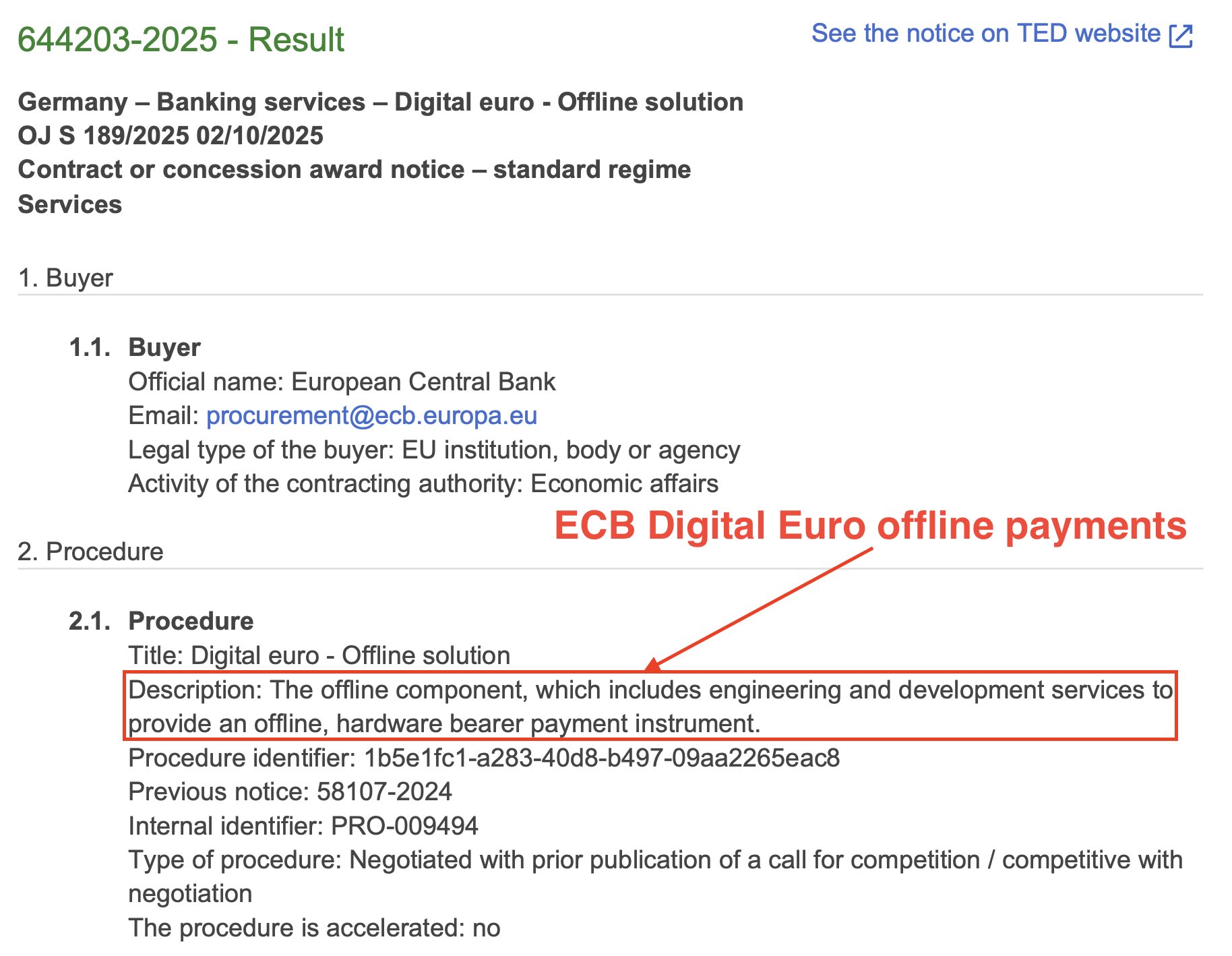

decentralized digital Euro will not work, because the ECB needs to have full control over it

retail CBDCs are direct central bank liabilities on the balance sheet. so "neutral market infrastructure" would not work, because the ECB needs to have full control over it. you can also imagine how many regulations need to be accounted for by the implementation

it most likely won't use a public blockchain for base implementation, and it's definitely not like stablecoins 😄

digital euro also needs to support offline payments, which isn't currently widely supported in DeFi. Zero Knowledge Proofs enable some potential solutions for this, but I don't believe that that's with what the ECB is going with now

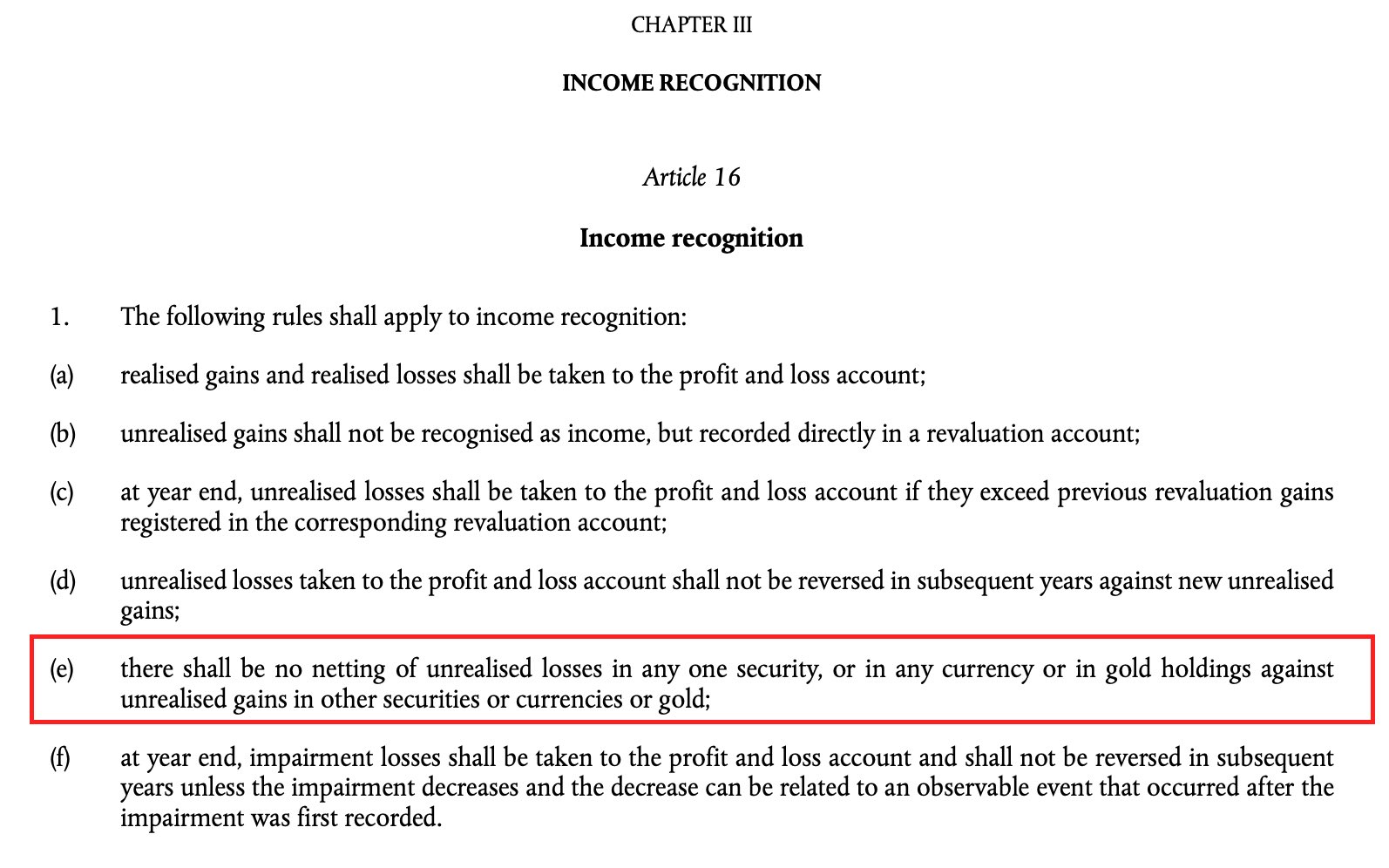

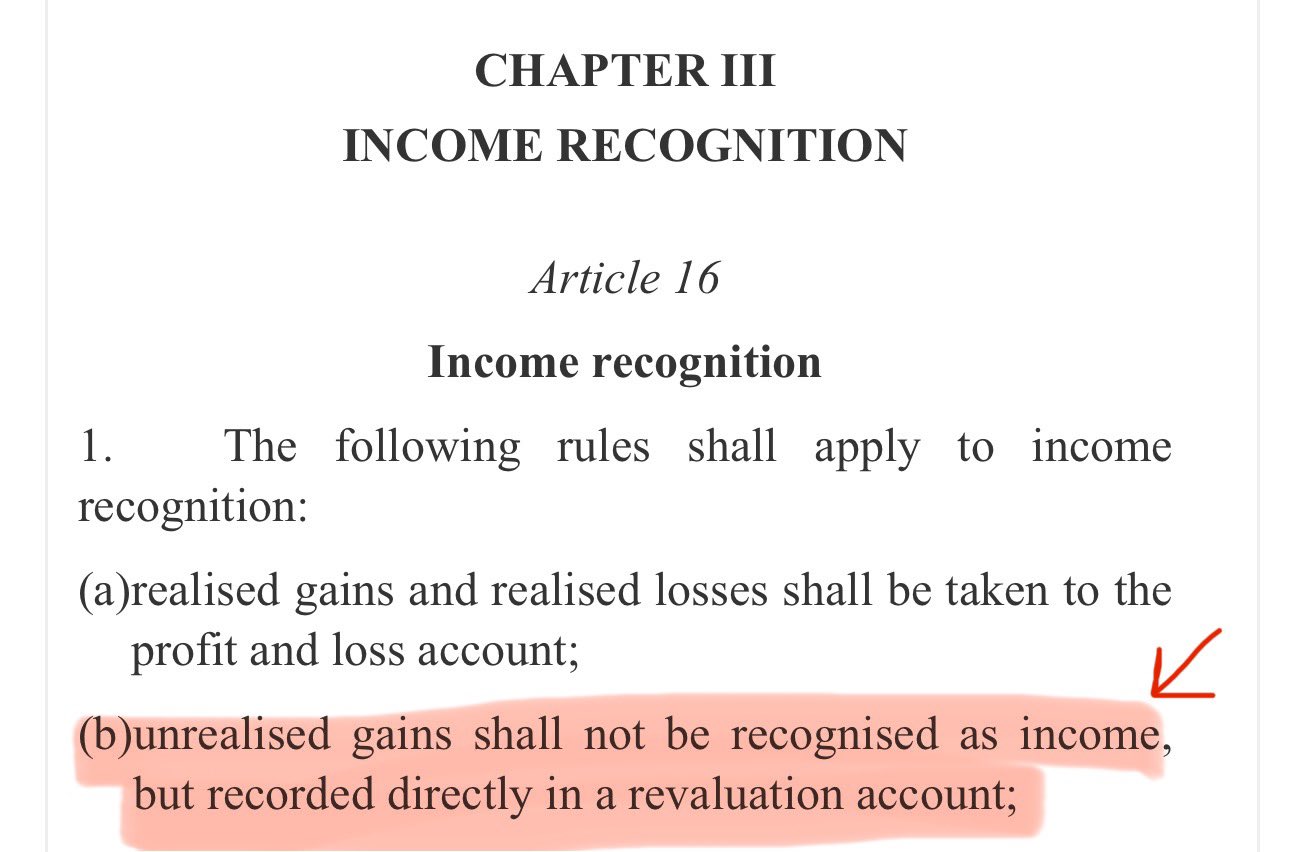

this means the ECB can only use unrealized gold gains to cover/offset future unrealized losses on gold

these unrealized gains can neither offset an operational, nor a loss in another security bucket, such as FX

ECB's legal framework forbids the use of gold revaluation proceeds to pay expenses or operating losses

unrealized gains are not recognized as income and are instead credited to the revaluation account

revaluation account is under liability/equity on the ECB's balance sheet

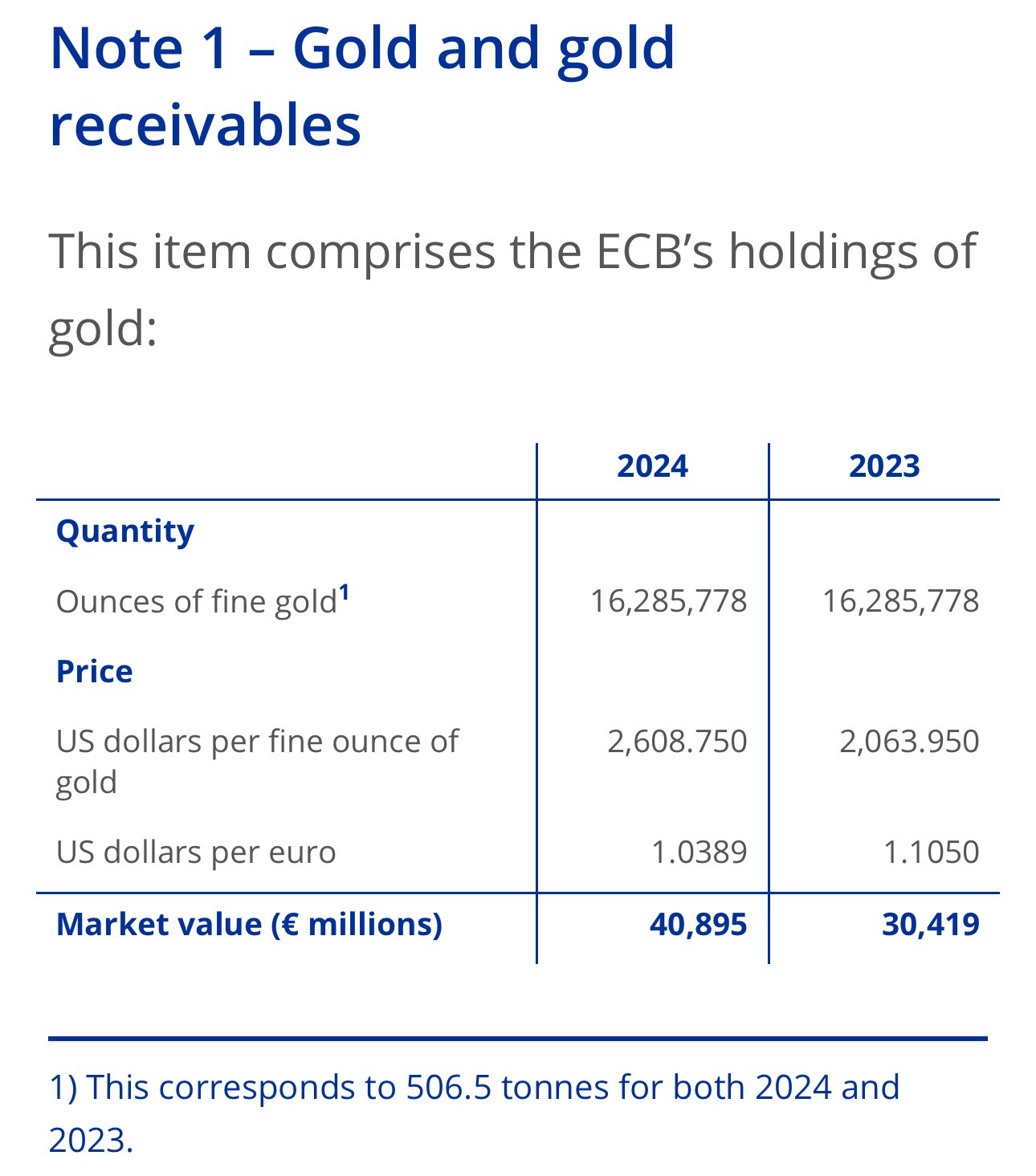

🇪🇺 ECB gained €10.5B on gold from 2023 to 2024

2025 YTD running gains add another net positive ≈€10B & likely to be higher by the year end's gold revaluation

that's an implied ≈8% yield on gold appreciation - much more than the ECB earned from other asset buckets

the financial system infrastructure, including monetary policies of the central banks are correlated

they're heavily exposed to the same set of assets - a lot of which are USD-denominated

this is of course extremely pro-cyclical

gold is a great asset to hold for the next 5 years

it's a hedge against the credit & refinancing bubble of the US equity markets + government debt

but not only against USD - all FIAT & risk assets including crypto

in order to understand the mechanics of gold revaluation - it's important to understand the unique legal position of banks to issue broad money, and that their mode of operation differs greatly from non-credit issuance businesses

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt

i'll add a link to it in this thread once it’s ready

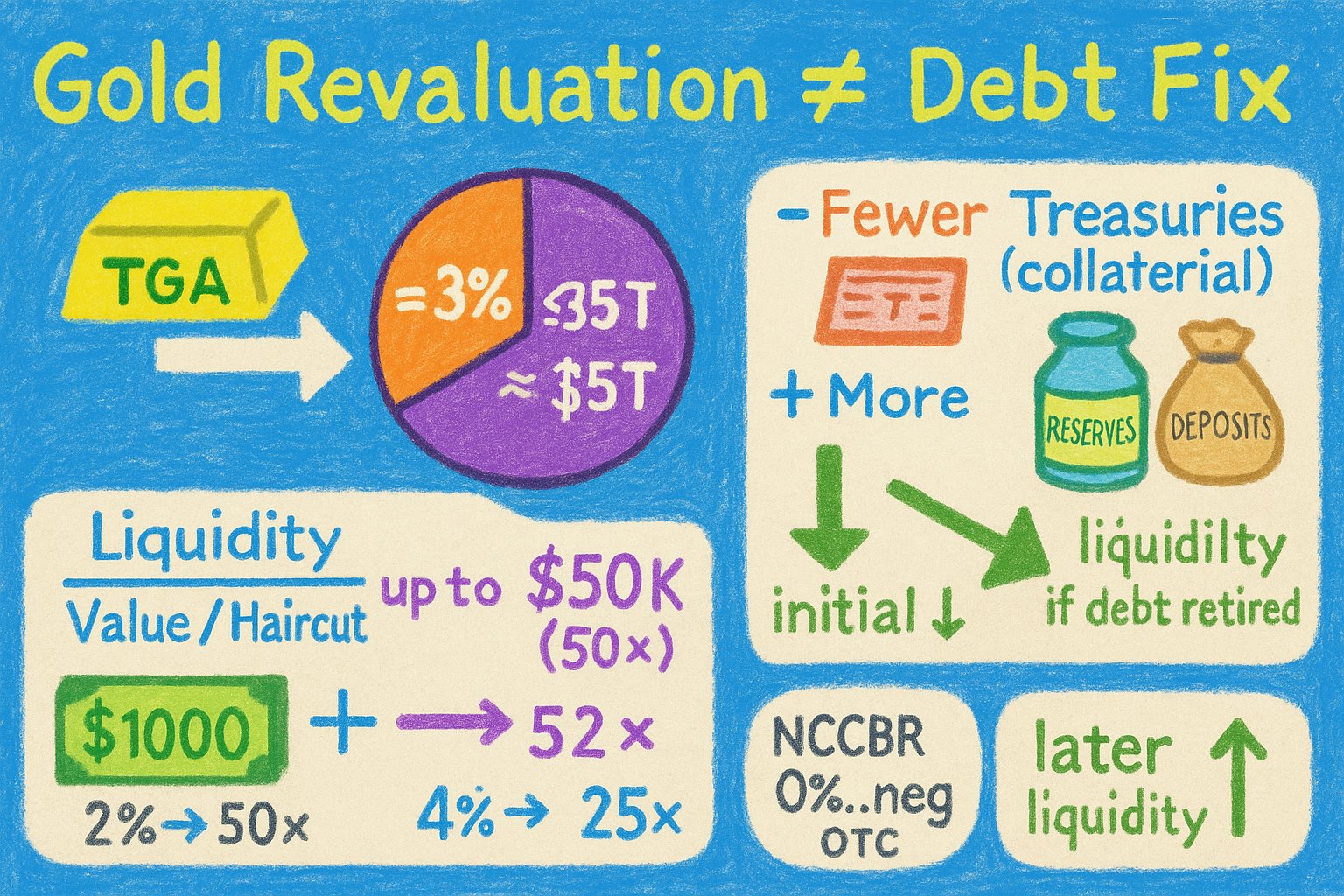

NCCBR participants are generally subject to regulations and balance sheet constraints - so don't think that null/negative haircuts means the collateral can be rehypothecated infinitely

these bilateral arrangements is where financial institutions manage their liquidity needs

NCCBR users are mostly institutions part of the financial market infrastructure - such as dealers and hedge funds

they use NCCBR to manage their balance sheets and regulatory obligations. so a high need for Treasury collateral may drive the the haircuts negative

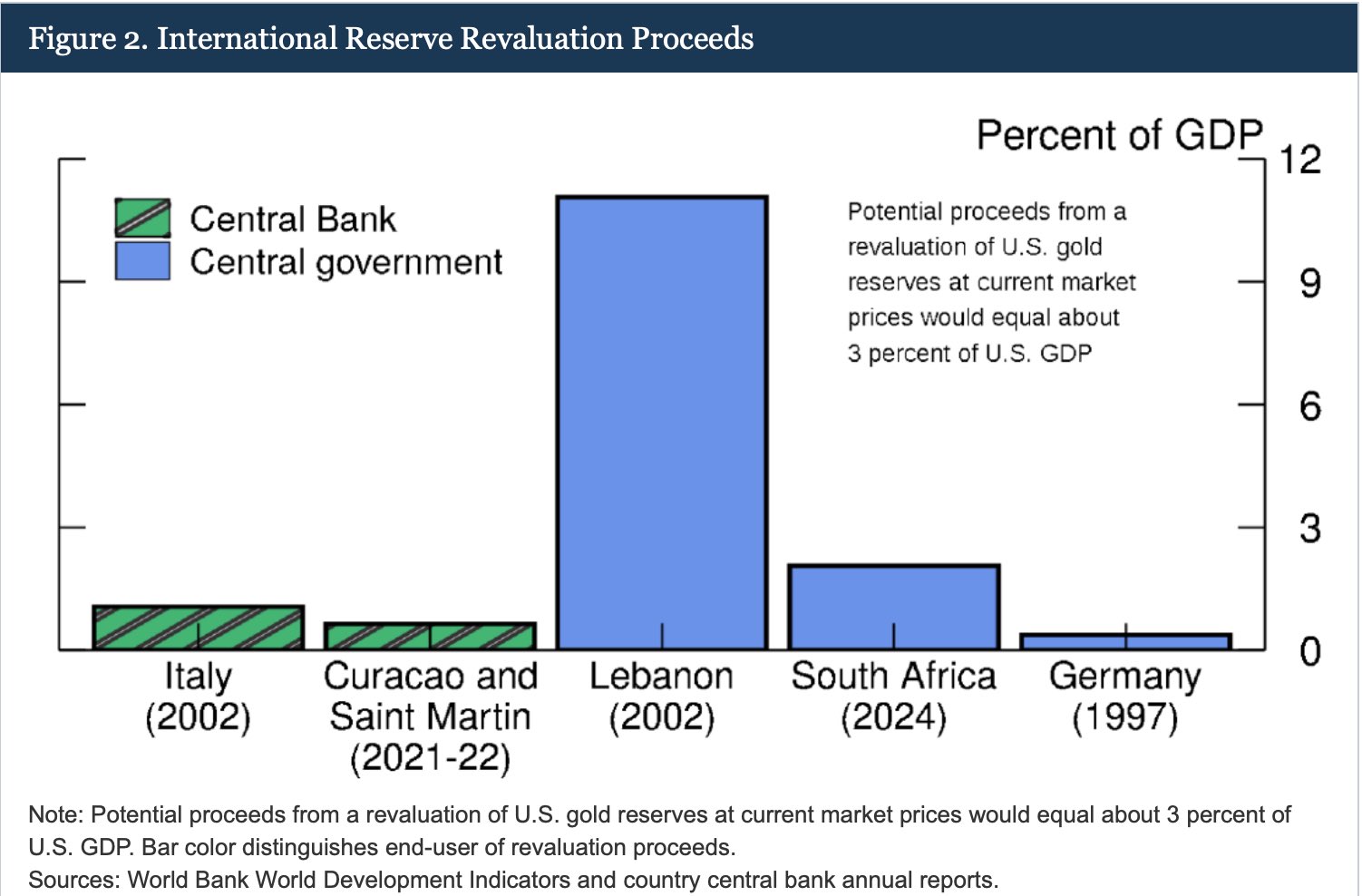

gold revaluation proceeds are not necessarily used to cover sovereign debt

central banks of Italy, Germany, Lebanon, South Africa & Curaçao and Sint Maarten reevaluated gold in the past, with some using the proceeds to finance the government, while others the central bank

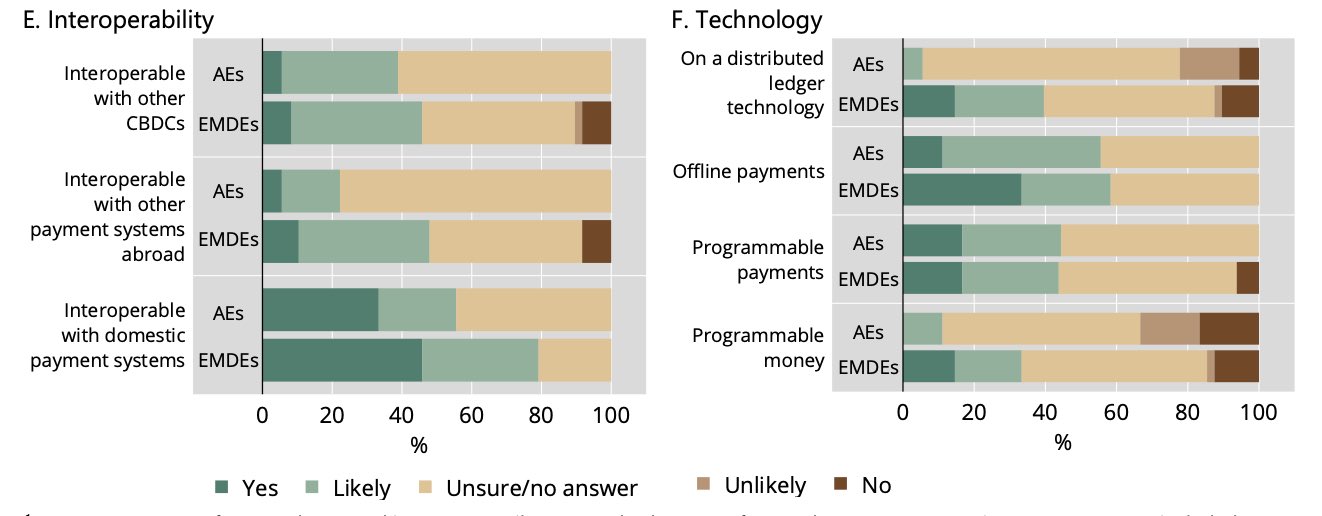

only 6% of advanced economies (AE) central banks and 40% of emerging economies (EM) central banks are considering distributed ledger technology (DLT) as an implementation layer for retail CBDCs

here, consider DLT = blockchain

91% of central banks are working on CBDCs, but not on a public blockchain

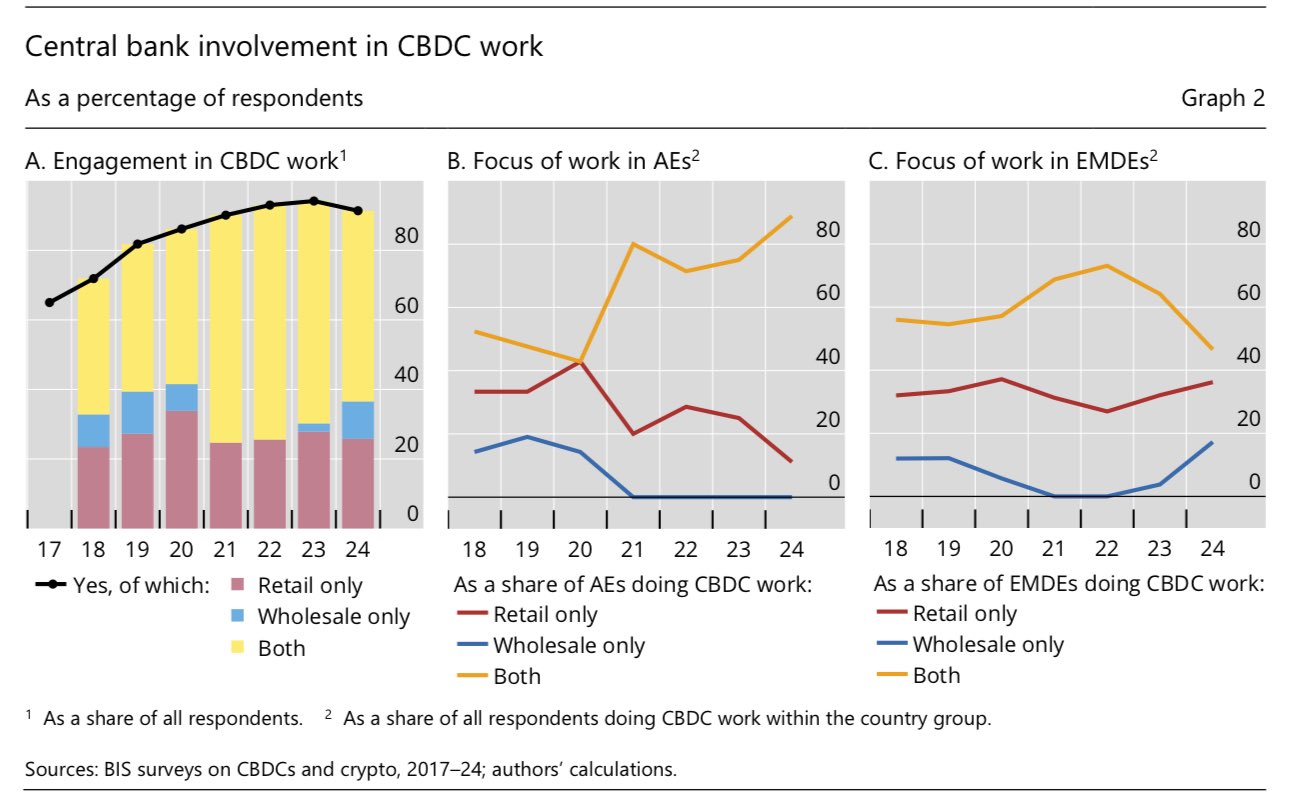

85 out of 93 central banks (≈94% of global economic output) are engaged in some form of CBDC work

however, don't expect CBDCs to be implemented on permissionless blockchains like Ethereum

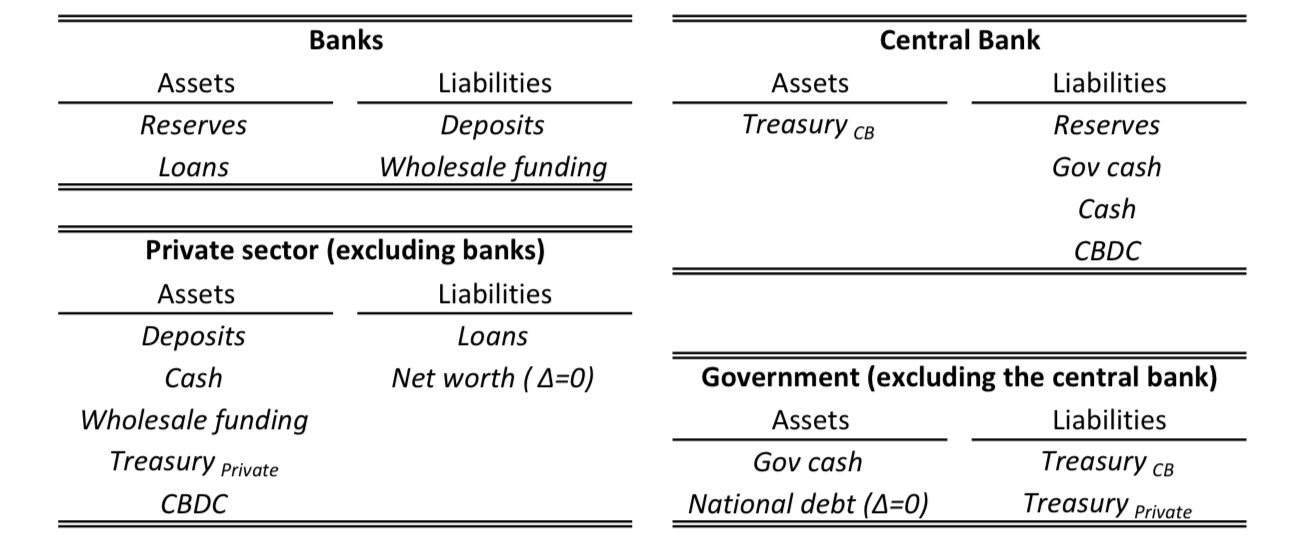

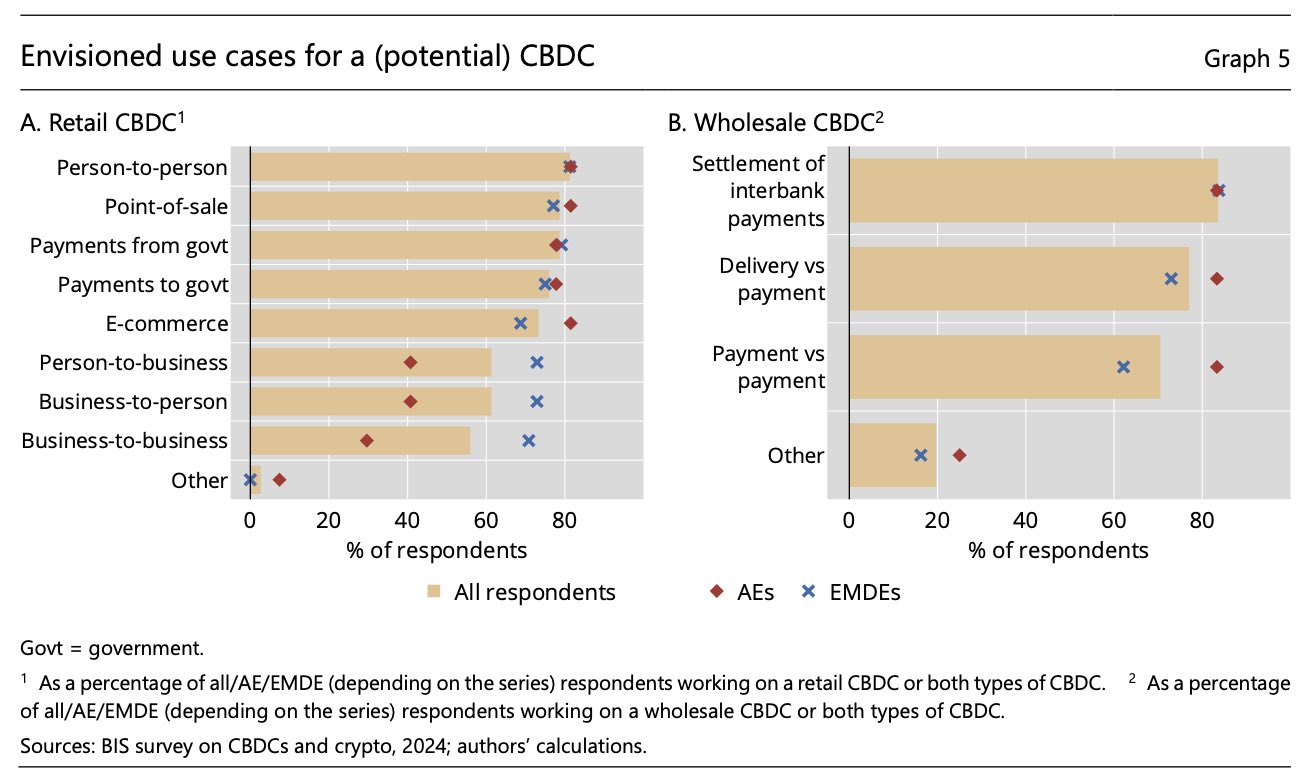

thus, wholesale CBDC is a tokenized/digital version of central bank reserves used by the financial market infrastructure (FMI) and banks

it also lives on the liability side of the central bank

wholesale CBDC will be used by financial institutions only, such as commercial and central banks for interbank and market settlement

wholesale CBDC will only be transacted between select financial institutions - it's not something you'd use as a regular business or consumer

wholesale CBDC will be used by financial institutions only, such as commercial and central banks for interbank and market settlement

wholesale CBDC will only be transacted between select financial institutions - it's not something you'd use as a regular business or consumer

retail CBDC is the digital version of currency - a liability of the central bank in the balance sheet

retail CBDC will be used for day-to-day payments, similar to the ones you do with with a credit card. this is the type of CBDC you can use for business and consumer transactions, such as paying for a supermarket purchase

wholesale CBDC vs retail CBDC - what's the difference?

there's two types of central bank digital currencies (CBDC): retail CBDC and wholesale CBDC

➖ retail CBDC = used for ordinary transactions. digital version of the cash

➖ wholesale CBDC = used for interbank/financial institution settlement. tokenized central bank reserves

retail CBDC is central bank money, so converting bank deposits into digital Euro changes the composition of the monetary base - fewer commercial bank reserves at the central bank, more central bank CBDC liabilities

retail CBDC conversions settle in reserves

ECB plans to limit the amount of digital Euro CBDC a wallet can hold

this means you will be limited the amount of digital EUR you can own

this applies only to retail European Central Bank CBDC, not wholesale. the idea is to prevent excessive outflows of deposits from banks

these regulatory constraints are synchronized to a significant degree across all jurisdictions

this means that the financial regulations in EU & USA will have an analogous functional effect (although not the same!). so you can expect similar frameworks across several countries

since all dealers are subject to functionally similar regulatory constraints, they're also subject to functionally similar set of balance sheet constraints

this is important to remember in the context of global liquidity, especially in terms of pro-cyclical effects

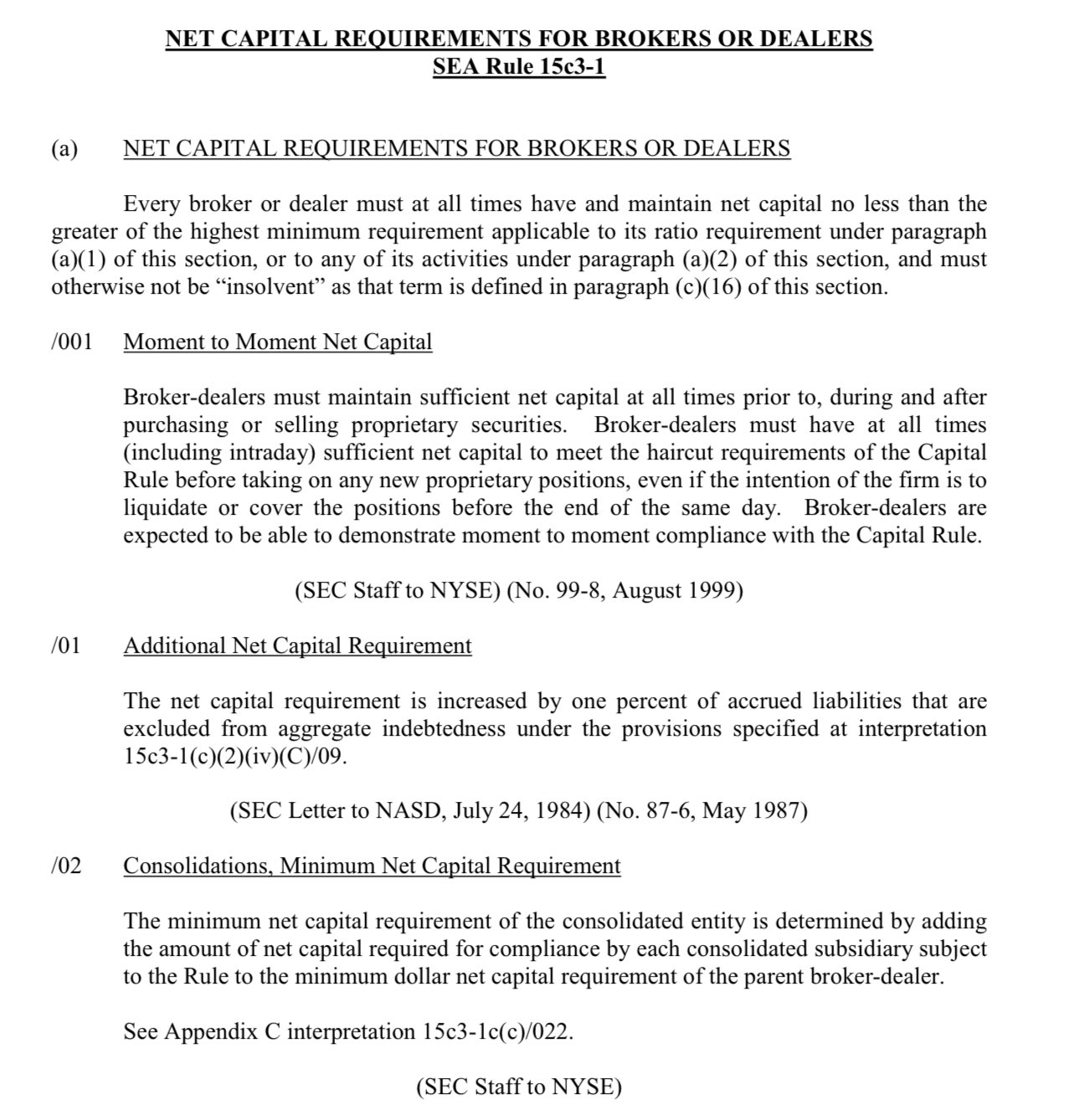

bank dealers are subject to Basel III, non-bank dealers to other similar regulations

non-bank dealers don't have HQLA or leverage ratio (Basel), but they have net capital haircuts and other leverage/margin requirements

so all dealers are subject to a similar set of regulations

market makers and other dealers are also subject to regulatory balance sheet constraints

many of them are banks, so frameworks like Basel III apply. non-bank dealers have similar regulations

this means dealers are also subject to HQLA, haircuts, leverage limits and alike

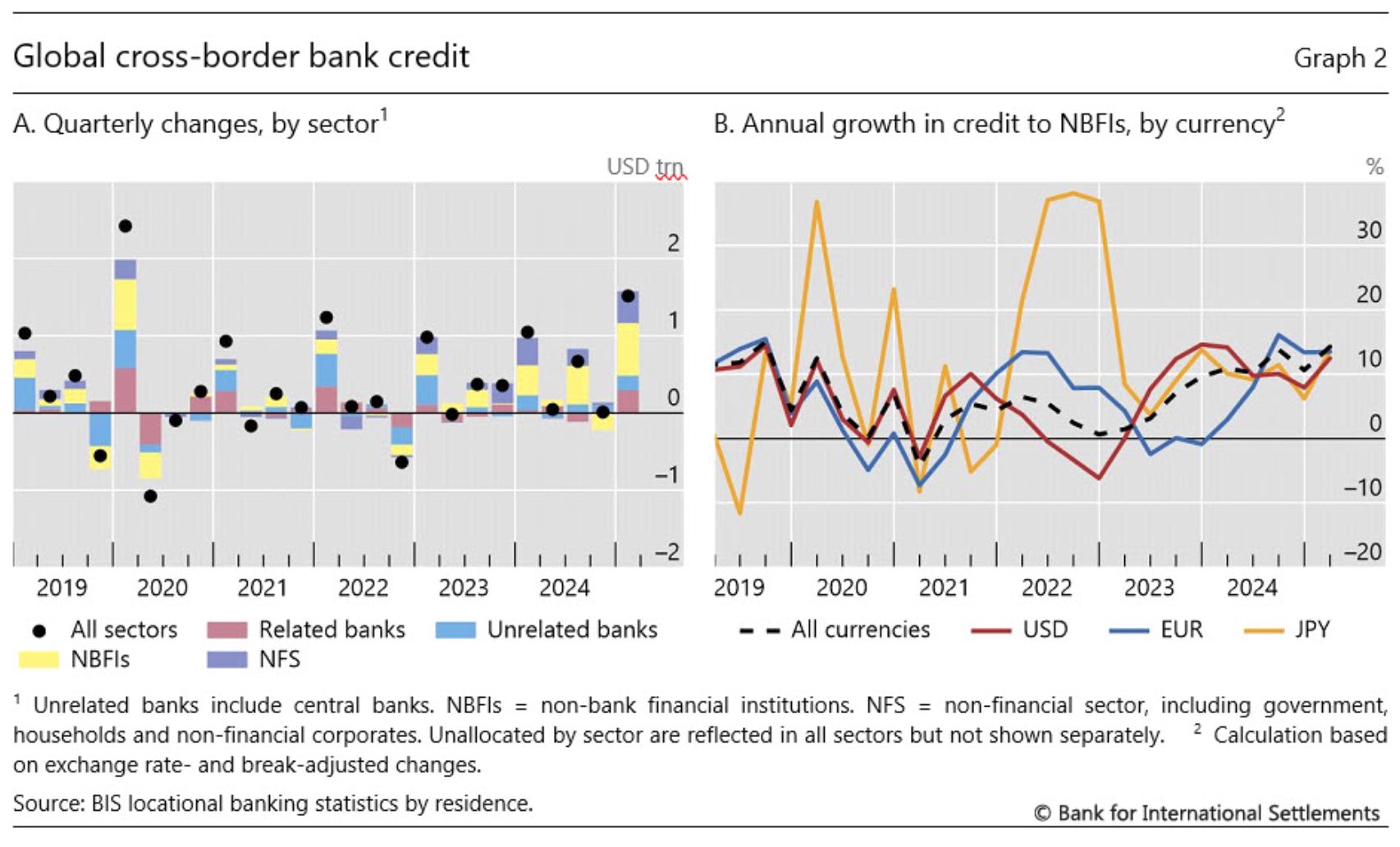

Bank of International Settlements (BIS) has a lot of interesting papers, articles and data on global liquidity and financial system

it's bank-focused, but connected to the broader scope, like the non-bank financial institution (NBFI) credit flows i posted about earlier