Global liquidity indicators & flows

Short-form analysis of TGA, RRP, money aggregates, credit growth and cross-border USD flows that drive risk assets.

Here's why bond yields skyrocketing worldwide ⬇️

Countries own a lot of US debt (bonds)

Moody's downgraded the US credit rating

Now, countries are at a higher risk of default, because the US debt they own is now less valuable = higher chance of country's default

(simplified)

🇷🇺 Ruble outflows into USD 🇺🇸

A lot of liquidity moved from RUB back into USD. This is also telling by the rebounded USD index

But gold will appreciate further. Russian Central Bank's massive gold reserves will pay off

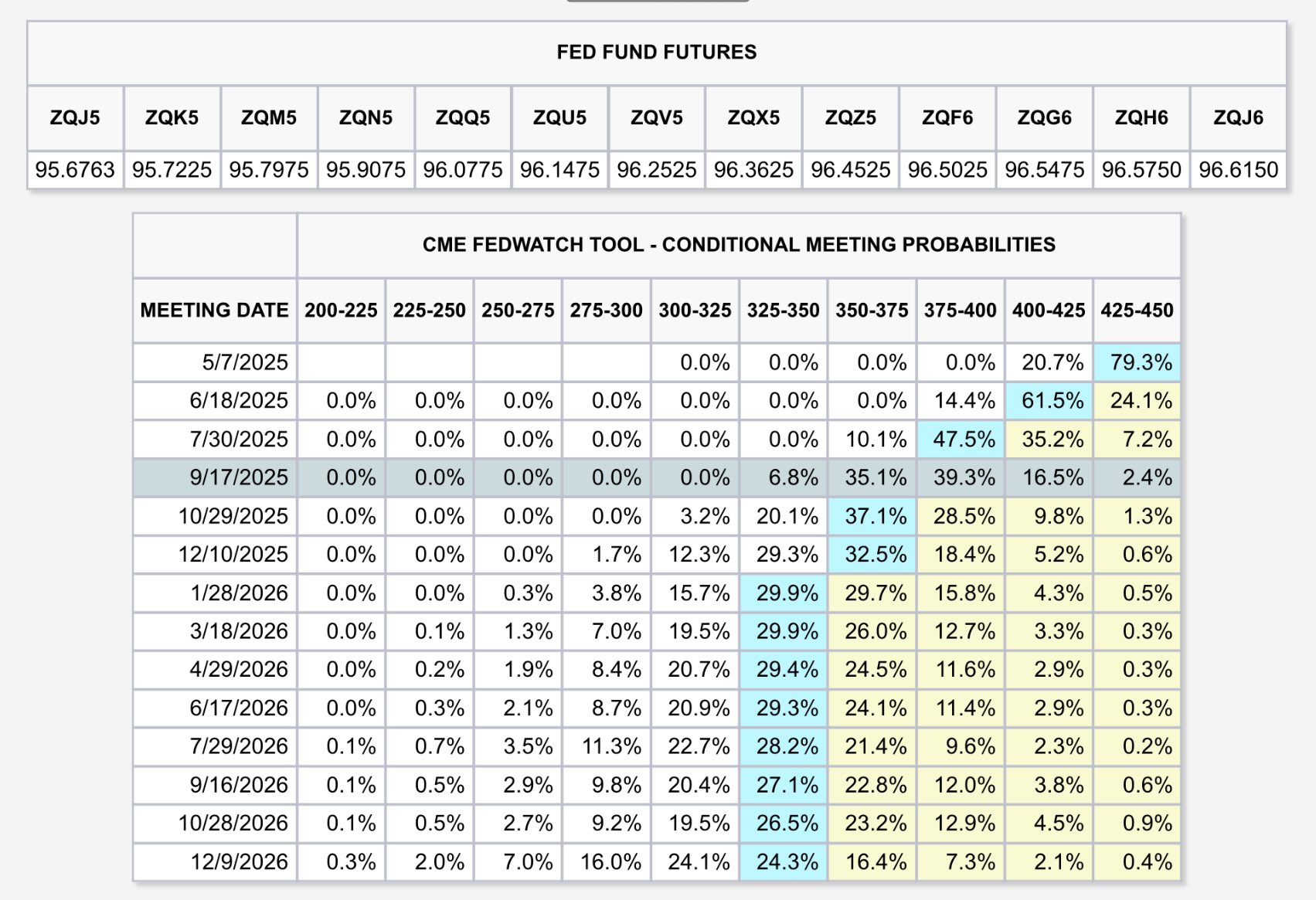

2Y US Bond is a good factor/signal of FED funds rate, but there's an even better one!

CME's 30-day FED Funds futures is a derivative for this exact purpose. The market prices them according to the expectations of upcoming FED Funds Rates

🔗

This is definitely good news short-term for the USD!

Today, short-term funding got 1.25% cheaper for the US government, and once the FED lowers the interest rates, the yields will fall more. Now ofc this will lead to inflation & devaluation of USD, but that's a a different story

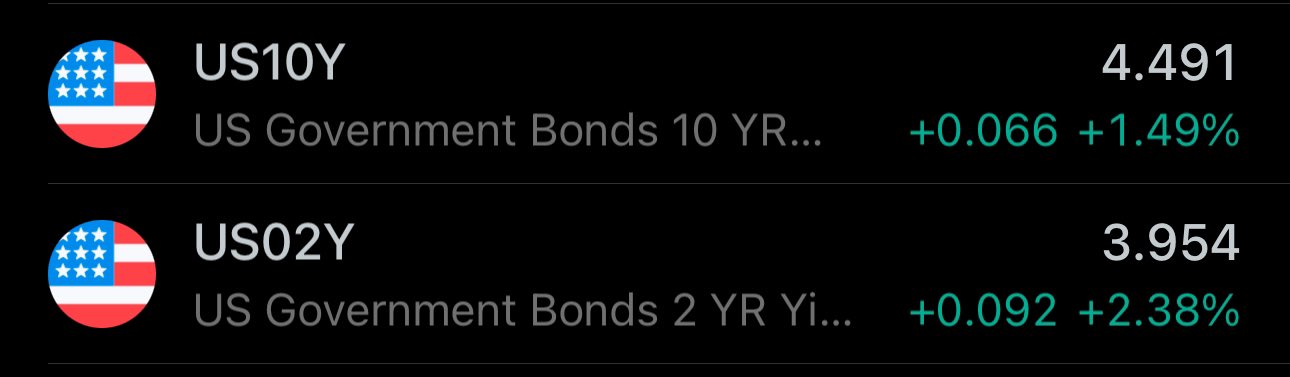

Look at that liquidity moving from short-term Chinese bonds(CN01Y), to short-term US bonds(US02Y) 👀

The market liked the removal of tariffs, however, you can't undo the massive volatility over the past 2 weeks

Moreover, US Dollar index is still below 100

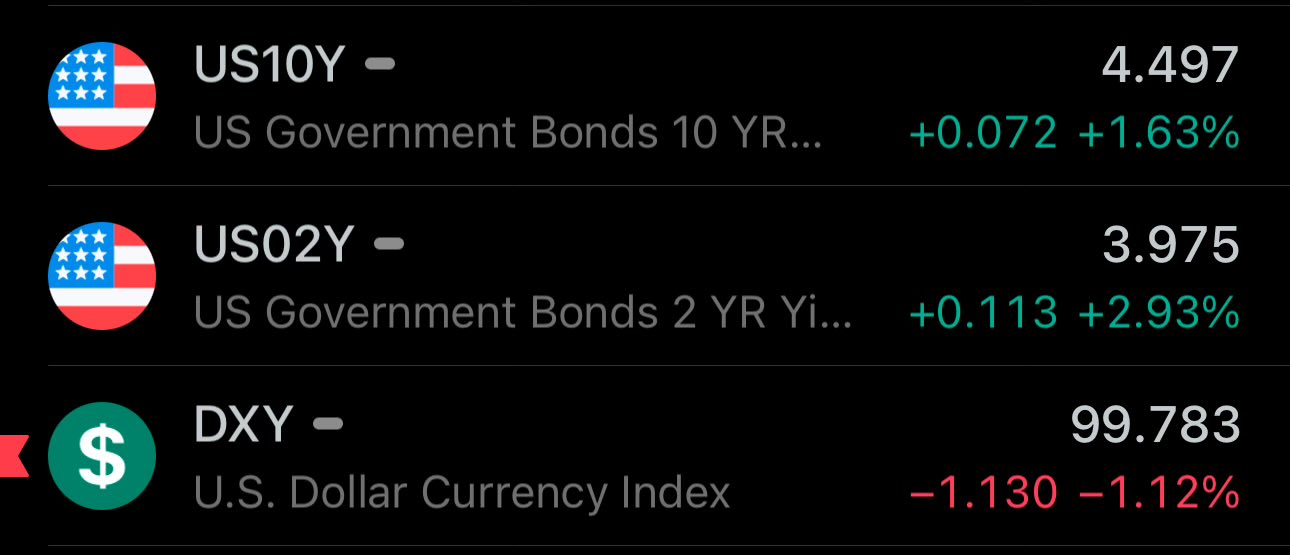

🚨US 10 Year Bond yield spikes above 4.5% at open

I previously posted about the move of liquidity towards the Chinese bonds

The USD is facing an increased perceived risk, which in addition to the public debt puts questions on its role as the reserve currency

Regarding the bond market collapse ⬇️

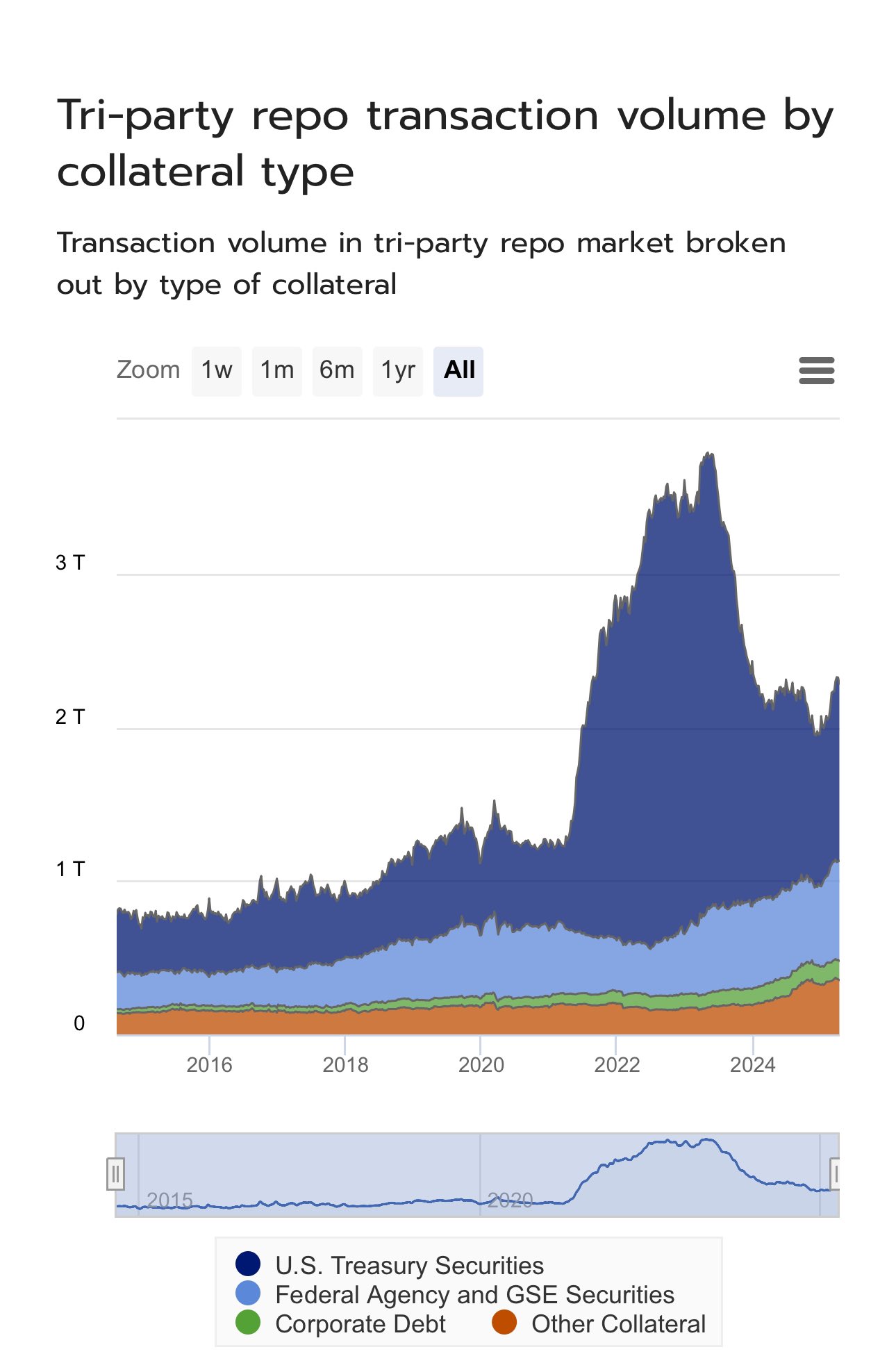

US Treasury Securities are the main collateral used in repurchase agreements. Given that these are short-term, the yield spike is unlikely to lead to defaults

However, the fall in bond prices will reduce credit, adding to liquidity crunch

Lower USD Index = USD Devaluation = Higher premium for USD loans = Lower bond prices = Higher bond yields

It's all connected

🇺🇸 US Treasury bond yields are acting as a risky asset

Over 2% daily moves is something you see in crypto 👀

And I don't believe the FED will be raising rates - so it's a market-driven US debt premium increase

Lower rates incoming, but sovereign premium will still increase

🇪🇺🇺🇸US tariffs present a unique opportunity for EU's capital markets

Billions of $ are flowing out of US markets. Let that liquidity be parked in the EU. All that's needed is inviting conditions

It can start with a small, less-regulated market subsection to allow seamless foreign funds flow

Of course, this also gives China leverage - if The People Bank's of China (China's Central Bank) dumps their US Securities in the market, it will skyrocket bond yields, by reducing their prices

Who will lend to the US then, and at what premium? And at 125% debt to GDP 😬

Sure, if you:

Put tariffs

Lower interest rates

Remove tariffs

the maket will skyrocket

But that also means increased:

Asset bubble

Inflation

Public debt/deficit

Tariff income won't offset it

Monitor the hedge fund's shorts on risky assets, and when the

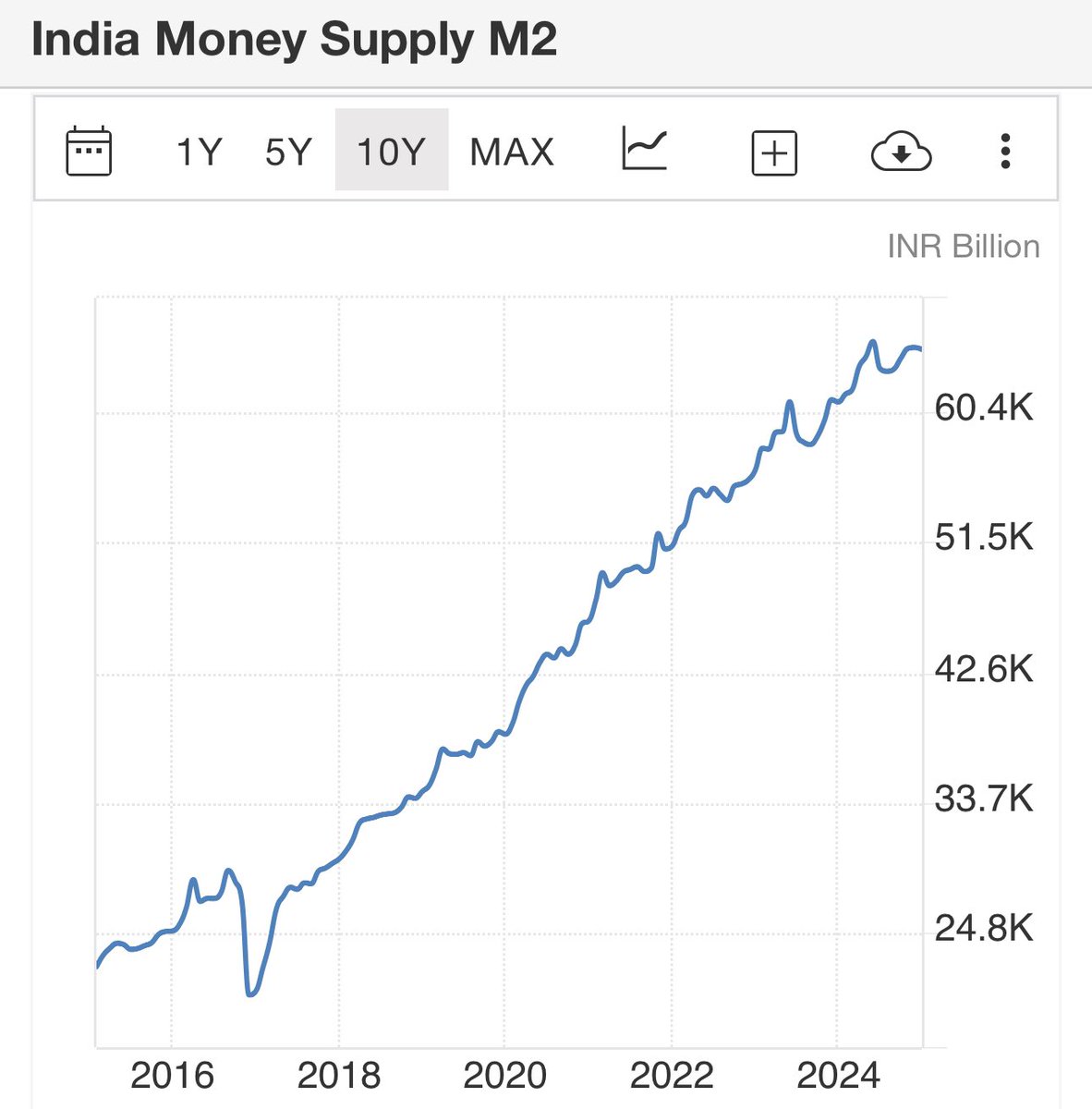

🇮🇳 Indian Rupee's M2 supply makes it even worse

Net importer + currency inflation is a recipe for depreciation and external dependence

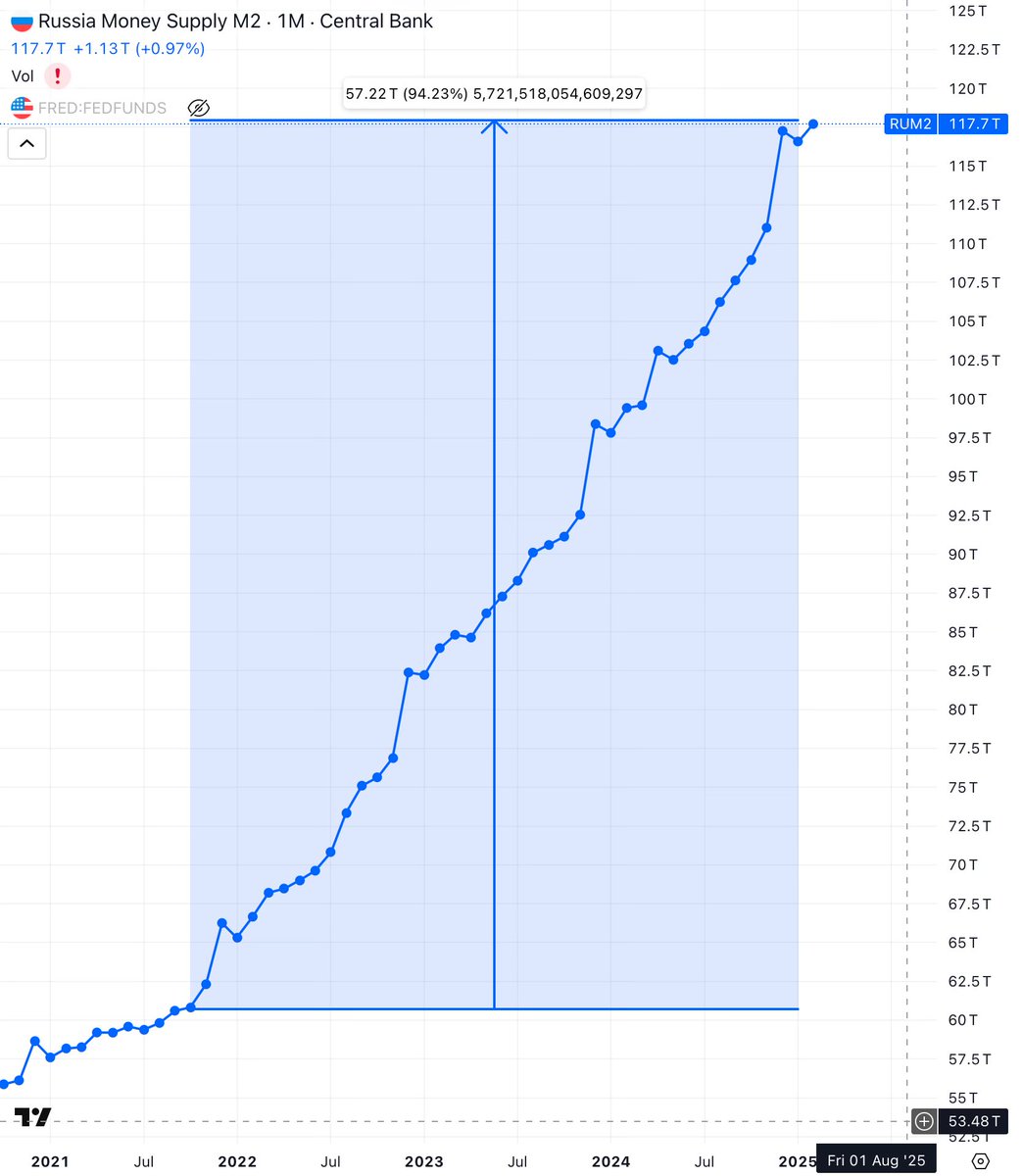

If you think 🇺🇸USD M2 is bad, look at 🇷🇺Russia's

In 3 years, Ruble DOUBLED in supply. Up by a 100%

How come despite this, Ruble maintained its value in FOREX?

The answer is GOLD, more specifically its expansion in the balance sheet of Central Bank of Russia

It works 🤷♀️

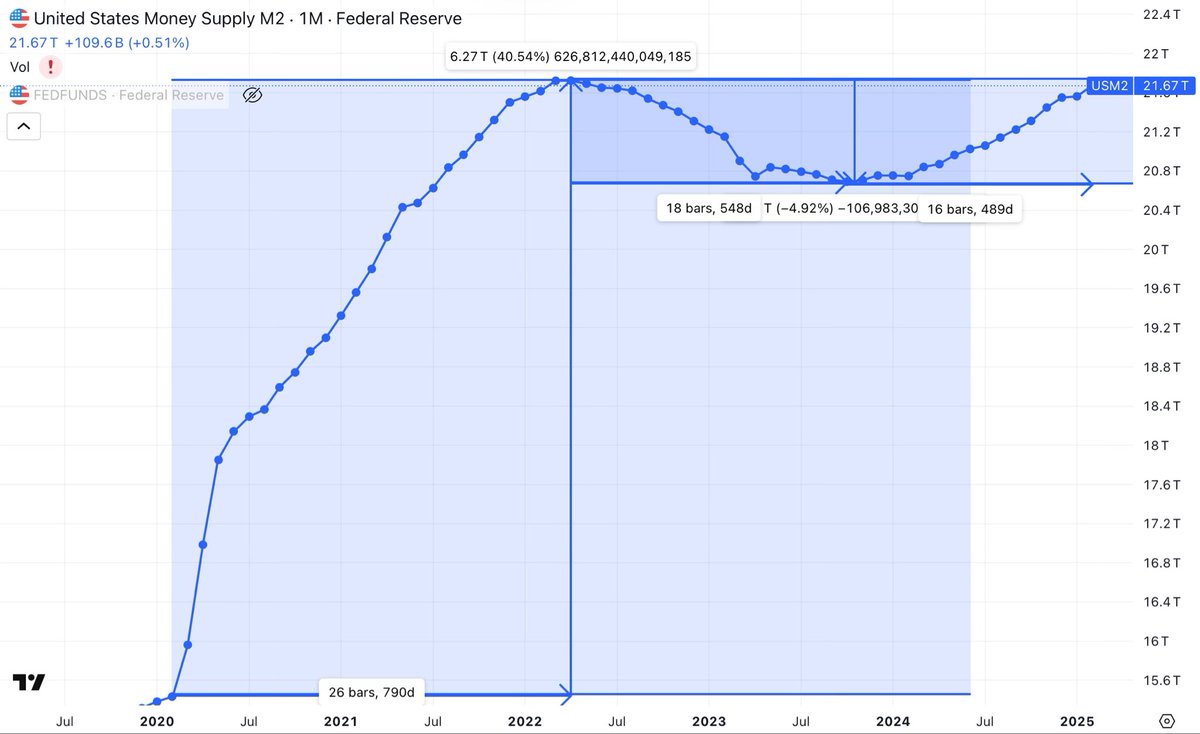

🚨🇺🇸USD M2 Money Supply

⬆️ 790 days to increase M2 by $6.3T

⬇️ 550 days to decrease M2 by $1.1T

⬆️ 500 days to increase M2 by $1.1T

⏯️ QE never stopped, it merely paused

When inflation is blamed on tariffs, keep this in mind

🚨🇺🇸 USD M2 Money Supply is almost back at pre-interest rate increase levels

That QT didn't last after all 🤷♀️

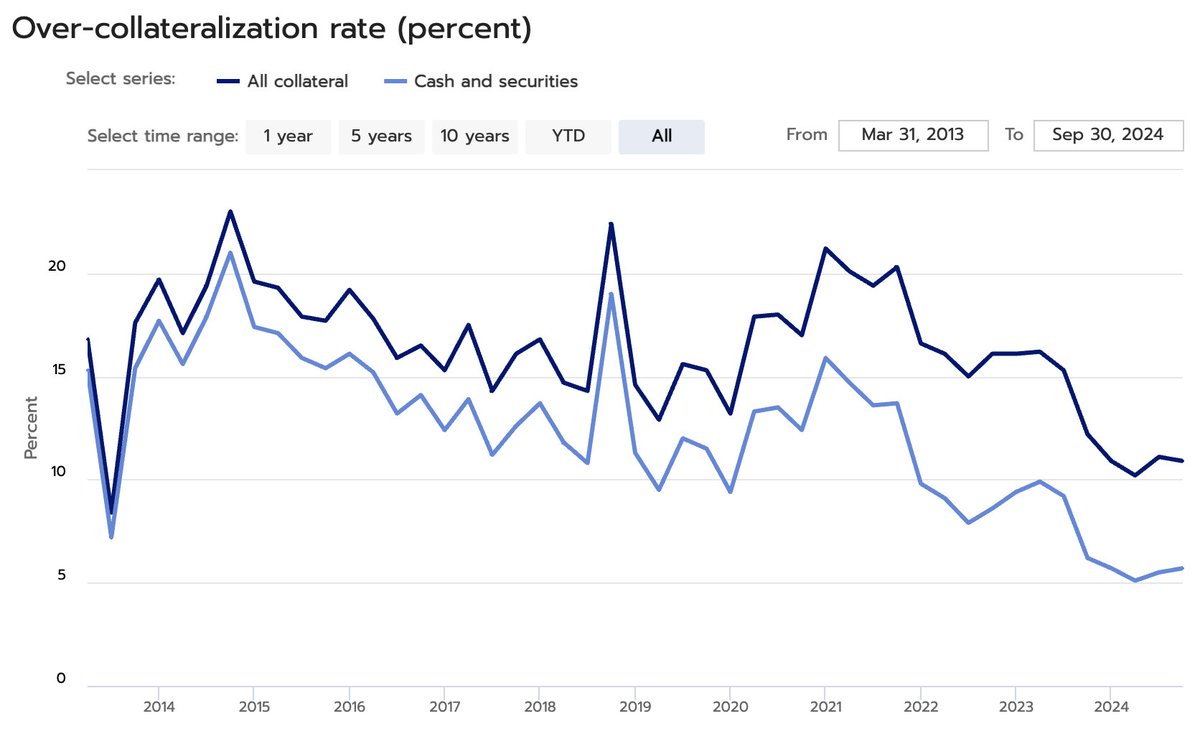

🫧 Debt bubble about to pop

Borrowing is increasing & collateralization is decreasing

These are symptoms of a highly leveraged economy

Lowest (over)collateralization rate in 10 years. Surely a lot of that is caused by the huge amount of cheap credit issued during COVID, which… http

🤯 Think about all of those US market outflows due to DeepSeek, Qwen & Co.

$NVDA's & other AI-related stock crash wasn't just about cheaper AI-compute. The outflow also represents funds that may be potentially invested in the Chinese market

This point is often omitted 🤫 https://

Very interesting alternative USD market

Usual flow:

🇺🇸 buys oil from 🇸🇦, 🇸🇦 reinvest excess back into UST

New flow:

🇸🇦 reinvests excess into 🇨🇳-issued USD bonds

Result:

USD flows to 🇨🇳, instead of 🇺🇸, as the USD-denominated debt (bonds) are issued directly by 🇨🇳

💸 The dynamic supply of the BRICS currency is defined by a formula:

M = ForT + FDI + PI + ForEx + G&EX + InterSec + Der + ForDeposit + EuroCurrency + MTransfer + Etc.

This can be automated using smart contracts on the blockchain 🤖

Like Algorithmic stablecoins and Uniswap

🔍 Let's explore how the BRICS currency can leverage these technologies:

✅ Dynamic supply mechanism via smart contracts

✅ Legal compliance on-chain using ZKPs

✅ Integration with DeFi and zkLocus for authenticated private geolocation

👉 A cryptocurrency for Web3

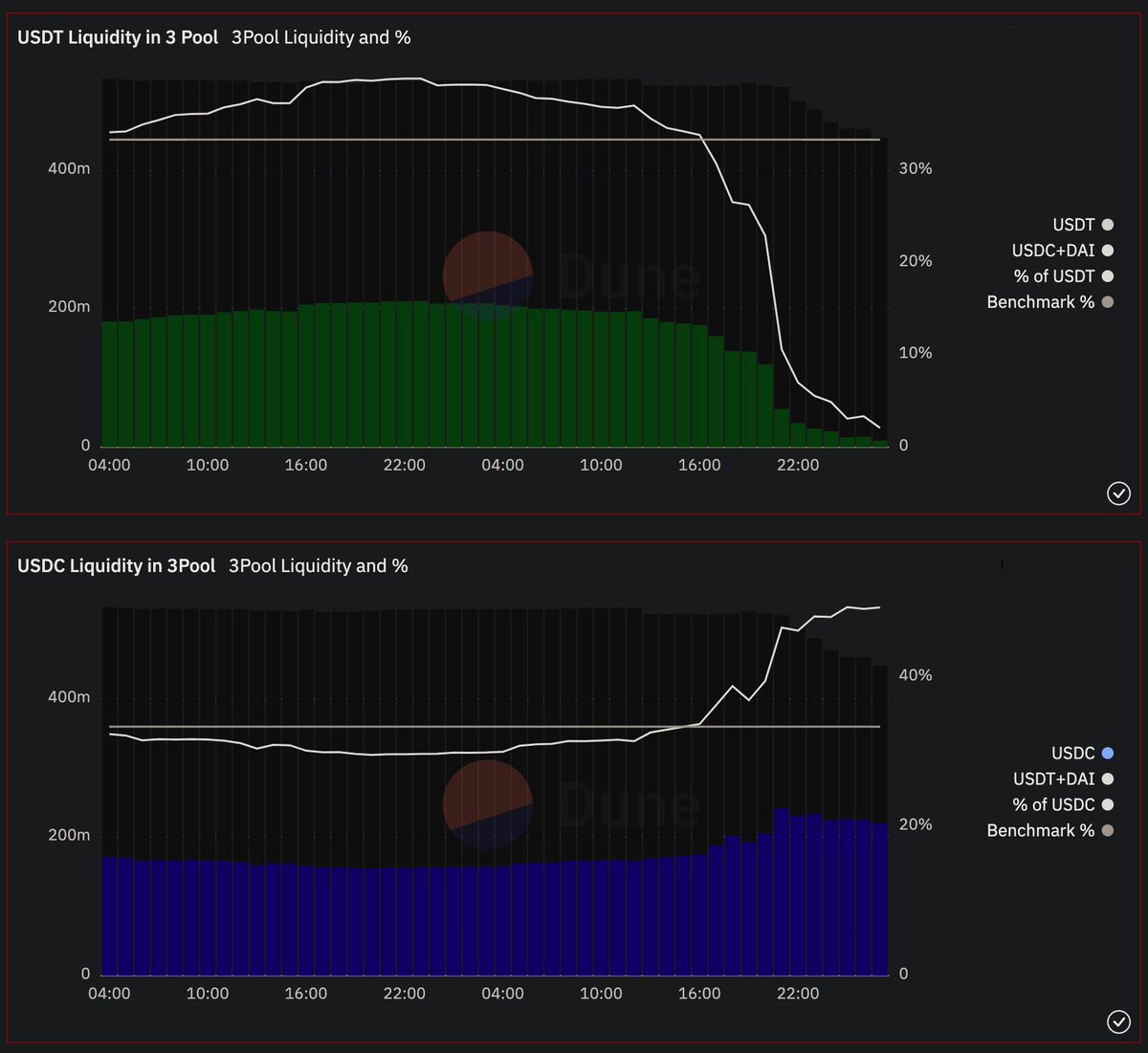

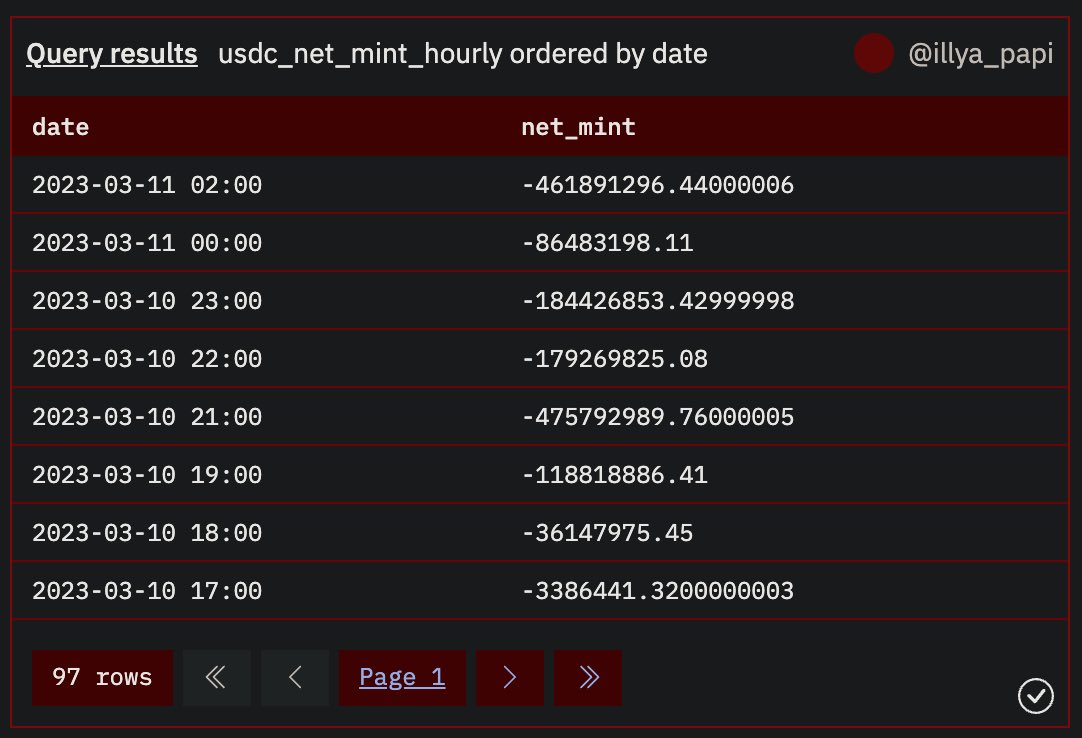

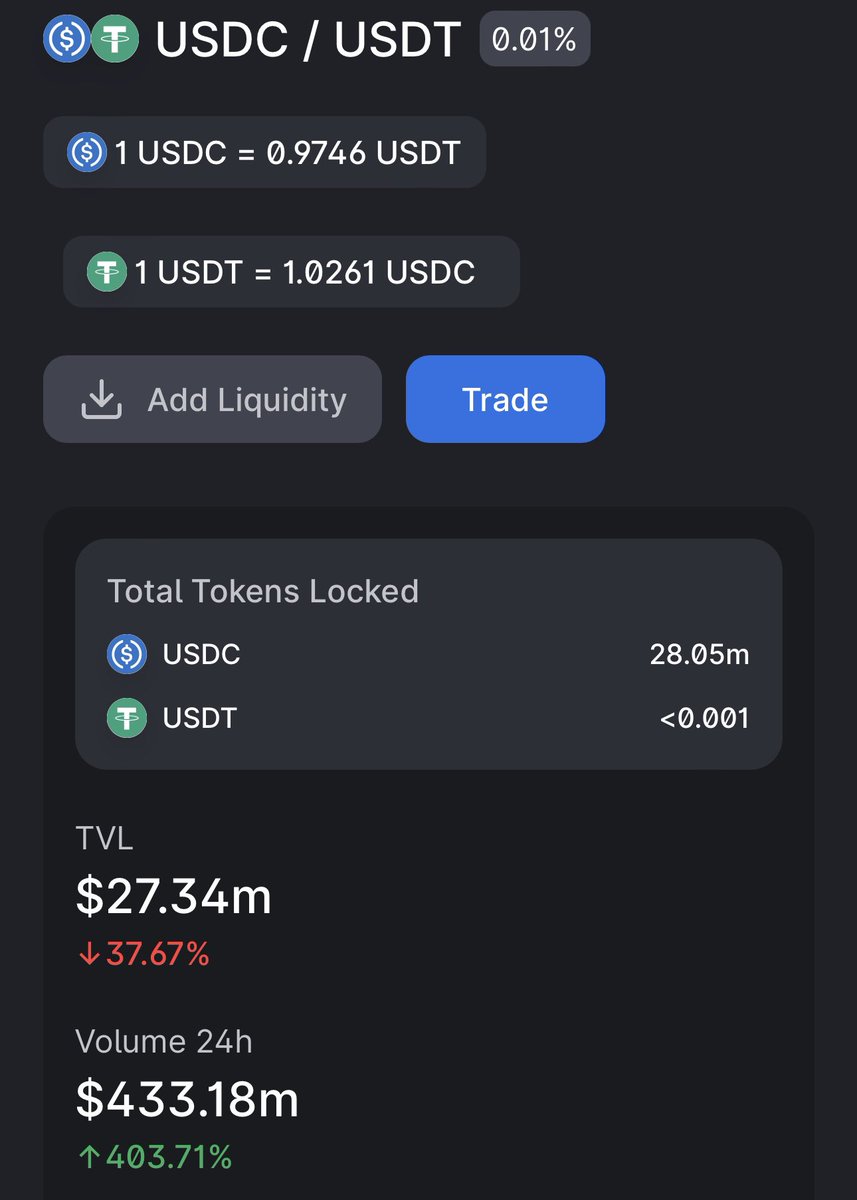

🚨📈 $USDT liquidity on #DEX pools decreased to almost ZERO, while $USDC liquidity almost doubled

This is a result of mass swapping of $USDC for $USDT

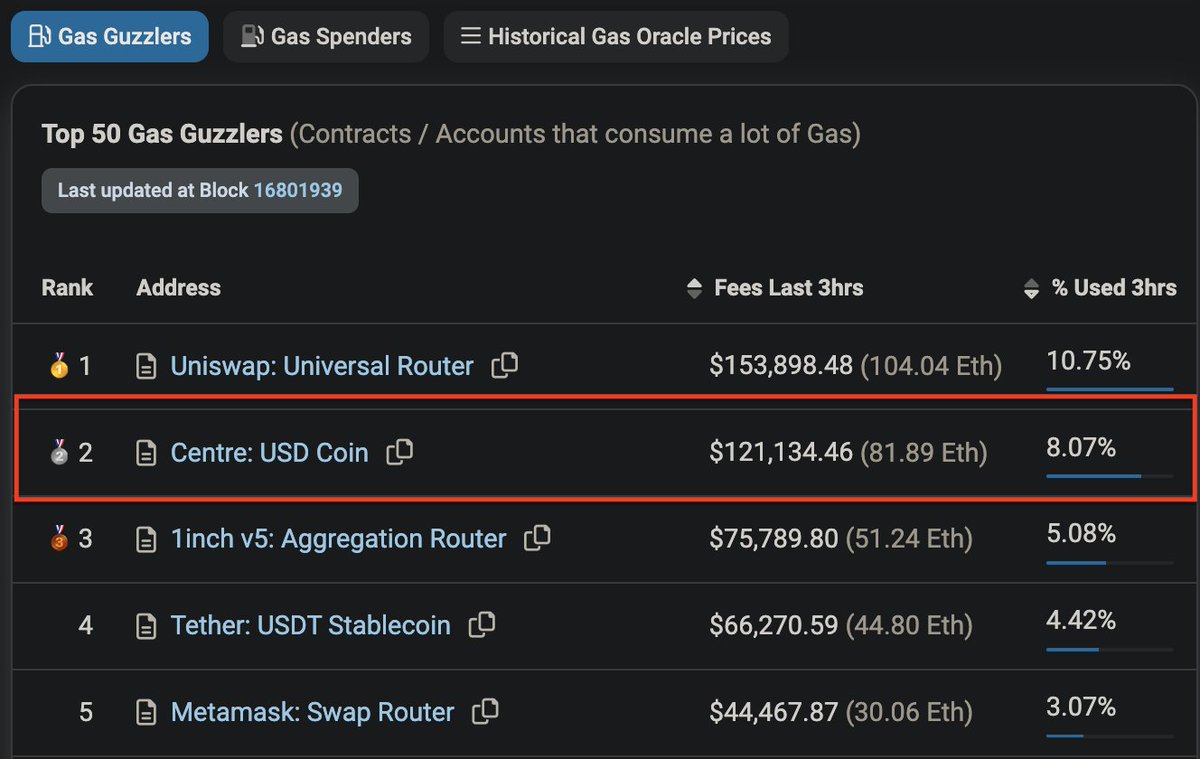

🚨📈 $USDC is the 2nd smart contract with the most gas usage on #Ethereum, second only to #Uniswap

$USDT is 4th, since massive swapping from $USDC to $USDT is taking across all pools in #DEX

Depegging of $USDC can lead to the collapse of other #stablecoins and #crypto prices

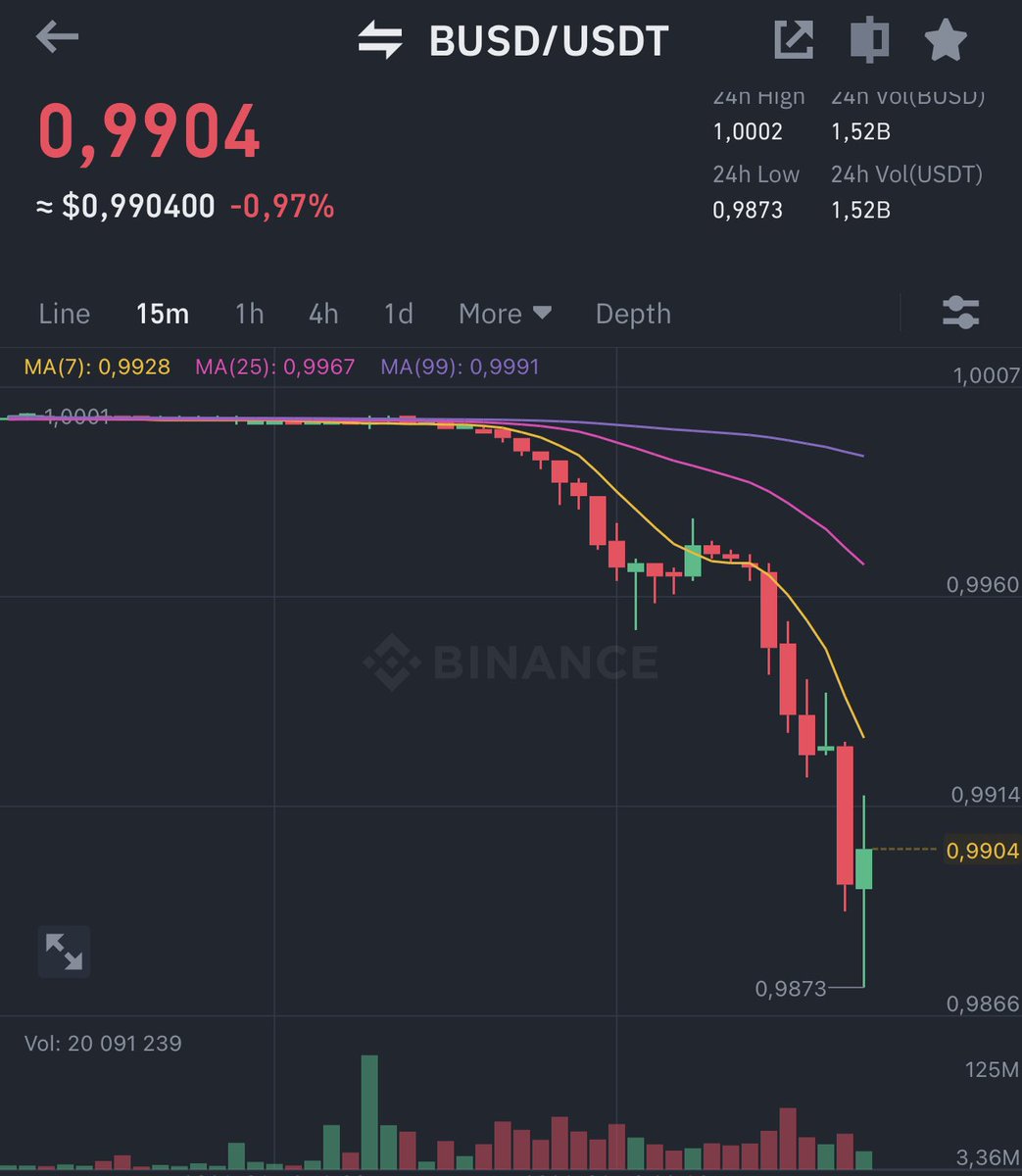

🚨📈 Mass $USDC to $USDT swapping has caused $BUSD to fall below $USDT by more than 1%

As $USDT reserves across #DEX are depleting, it's also affecting #CEX like #Binance

This is a result of the collapse of the Silicon Valley Bank, where $USDC has reserves

🚨 $USDC trading below $USD and $USDT above $USD

Looks like everyone is swapping $USDC for $USDT because of #SVB collapse