Global liquidity indicators & flows

Short-form analysis of TGA, RRP, money aggregates, credit growth and cross-border USD flows that drive risk assets.

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

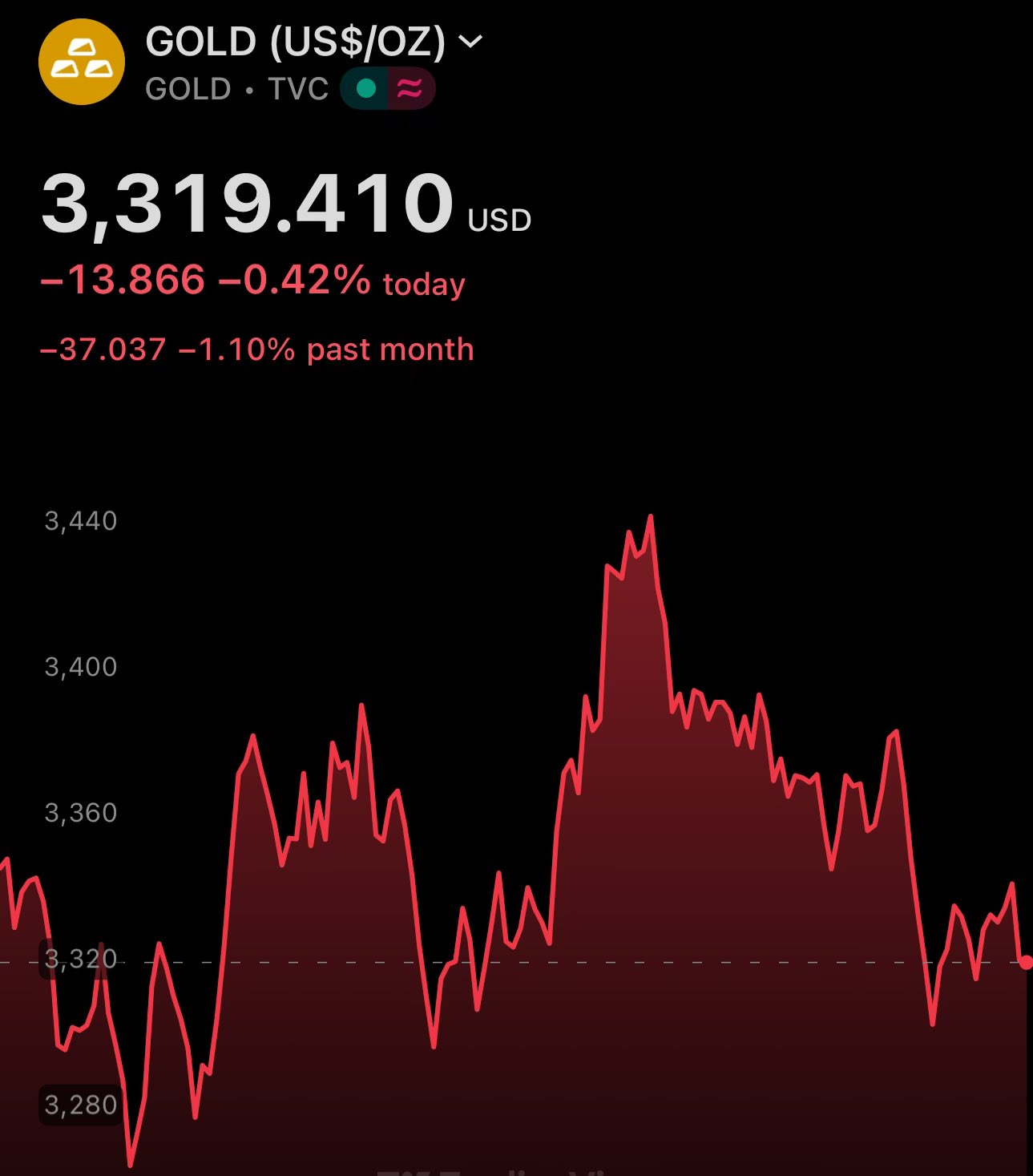

this means inflation & gold up

at least short-term: equities up, crypto up

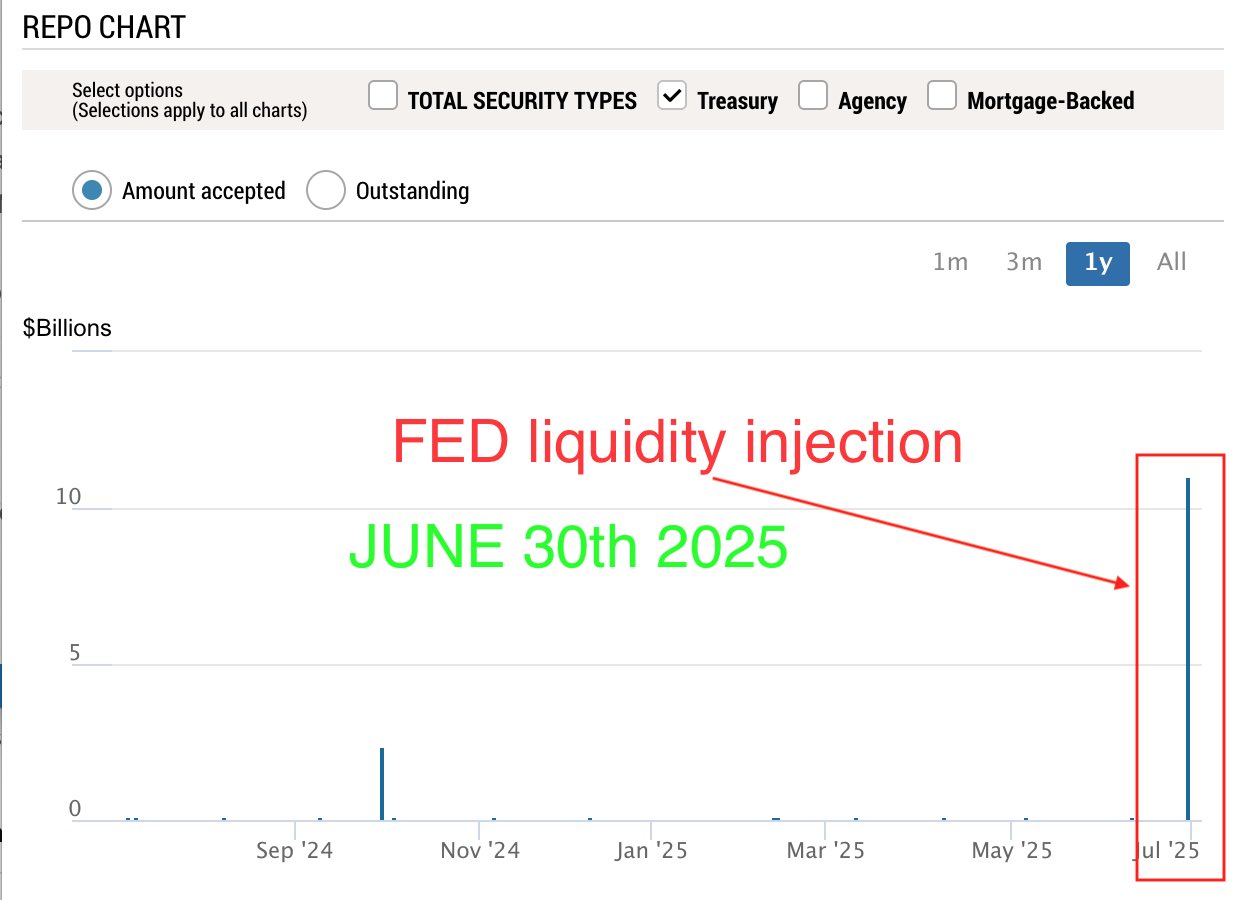

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

repo funding rates are predictors within this global, multi-factor liquidity context

you can use them to understand liquidity flows in the near future

this is also because repo markets are short-term debt instruments - so the signal is also more short-term

repo funding rates are predictors within this global, multi-factor liquidity context

you can use them to understand liquidity flows in the near future

this is also because repo markets are short-term debt instruments - so the signal is also more short-term

regarding liquidity flows - repo markets are just one of the sources

so it's more useful when you combine it with others, such as the central bank policies, how much short-term debt is maturing, and the overall leverage level

regarding liquidity flows - repo markets are just one of the sources

so it's more useful when you combine it with others, such as the central bank policies, how much short-term debt is maturing, and the overall leverage level

if regulatory ratios are breached, they must be restored

there is only so much a dealer/market maker can do

so you can deduce their next action with a high degree of certainty

then, deduce its implication on the liquidity flow & into which sector the funds are flowing

if regulatory ratios are breached, they must be restored

there is only so much a dealer/market maker can do

so you can deduce their next action with a high degree of certainty

then, deduce its implication on the liquidity flow & into which sector the funds are flowing

so the market operations of dealers/market-markers is quite predictable

you just have to look at their business & regulatory model - from there it's almost plain math under regulatory constraints

in a monthly maturity/tenor timescale - the repo funding rate has very direct effects

this makes sense - if your bond is maturing in ≈1 month, every day is significant

so you see more immediate effects from federal reserve's SRF operations / repo funding fee increases

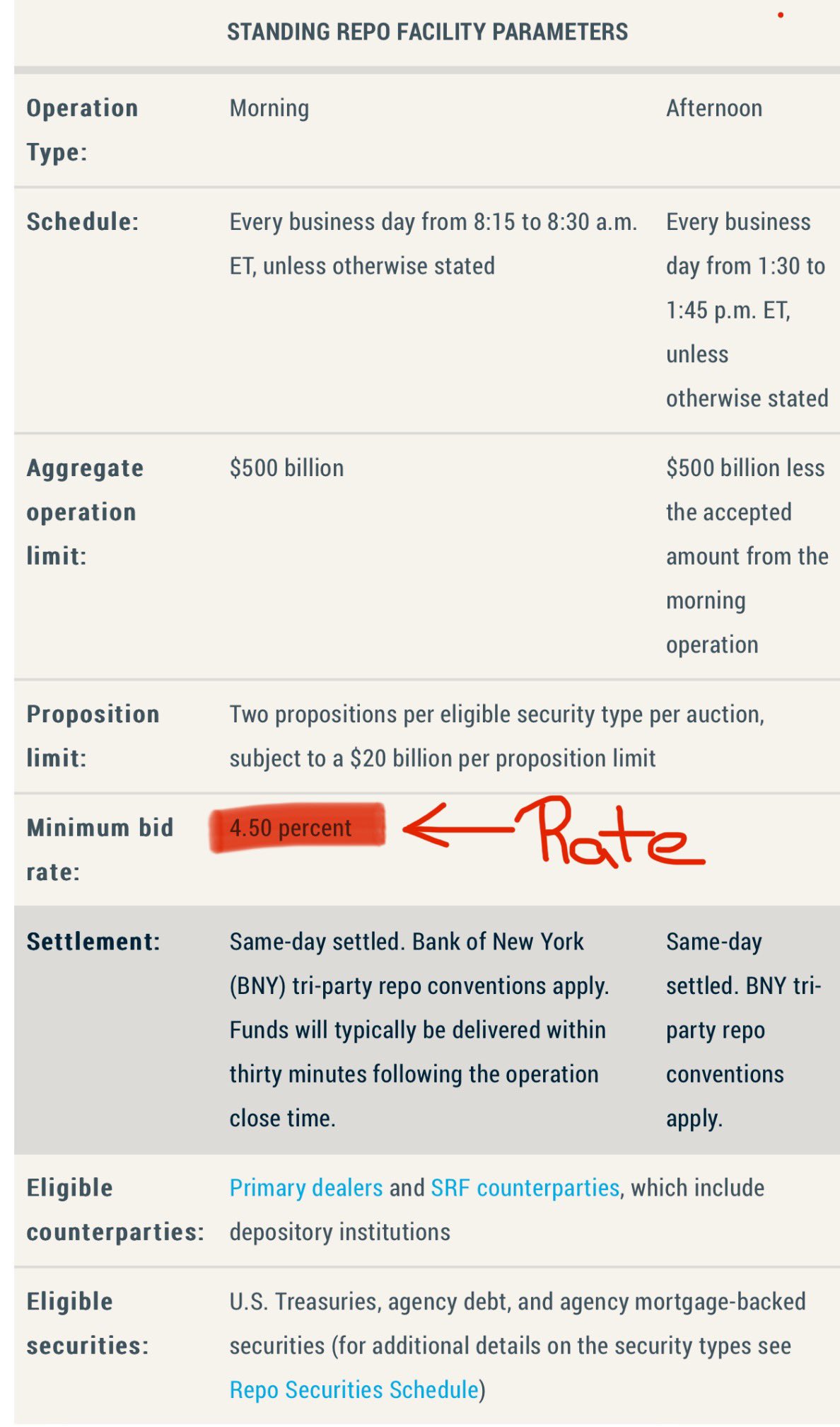

in practice, FED's SRF is used when there is a scarcity of liquidity/cash

the market has US bonds & needs cash, so lenders increase rates

SRF sets a daily rate. if that rate is smaller than in the smaller repo market - the dealers instead borrow USD directly from the FED

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs

🚨FED just injected $11B of liquidity

👉 TL;DR: interest rate cuts & QE incoming

$11B is insignificant - but it's an early sign: there is a lack of liquidity/cash

if undressed, will lead to systemic defaults. existing debt needs to be refinanced

the fix/what's next? see TL;DR

ex: in the 1980's US fought high inflation by raising interest rates towards ≈20%

if the FED did that today - the global financial markets, alongside the US would be destroyed. there wouldn't be enough liquidity to refinance the debt

using historical behavior can be a great alpha - but you should probably focus on the patterns from this century

perpetually low ≈0% interest rates have been a norm only post ≈2009 (but the bubble started before)

so you want to look at the behavior in that environment

this new liquidity will reach financial markets first, before reaching the "real economy"

equity, cryptocurrencies all go up in prices. bubble further fueled. you know what (eventually) happens to all bubbles

Gold & Co. is a great hedge

once FED lowers interest rates, it's likely to put downward pressure on yields - assuming term premia doesn't increase by more

in the end, the yields will be higher than in the last 20 years, for the same FED funds rate

QE/liquidity injections will further devalue USD

liquidity abundance leads to the narrowing of spread between riskier and safe assets (mostly government bonds)

safe assets fall in price, with their yields increasing towards the riskier ones

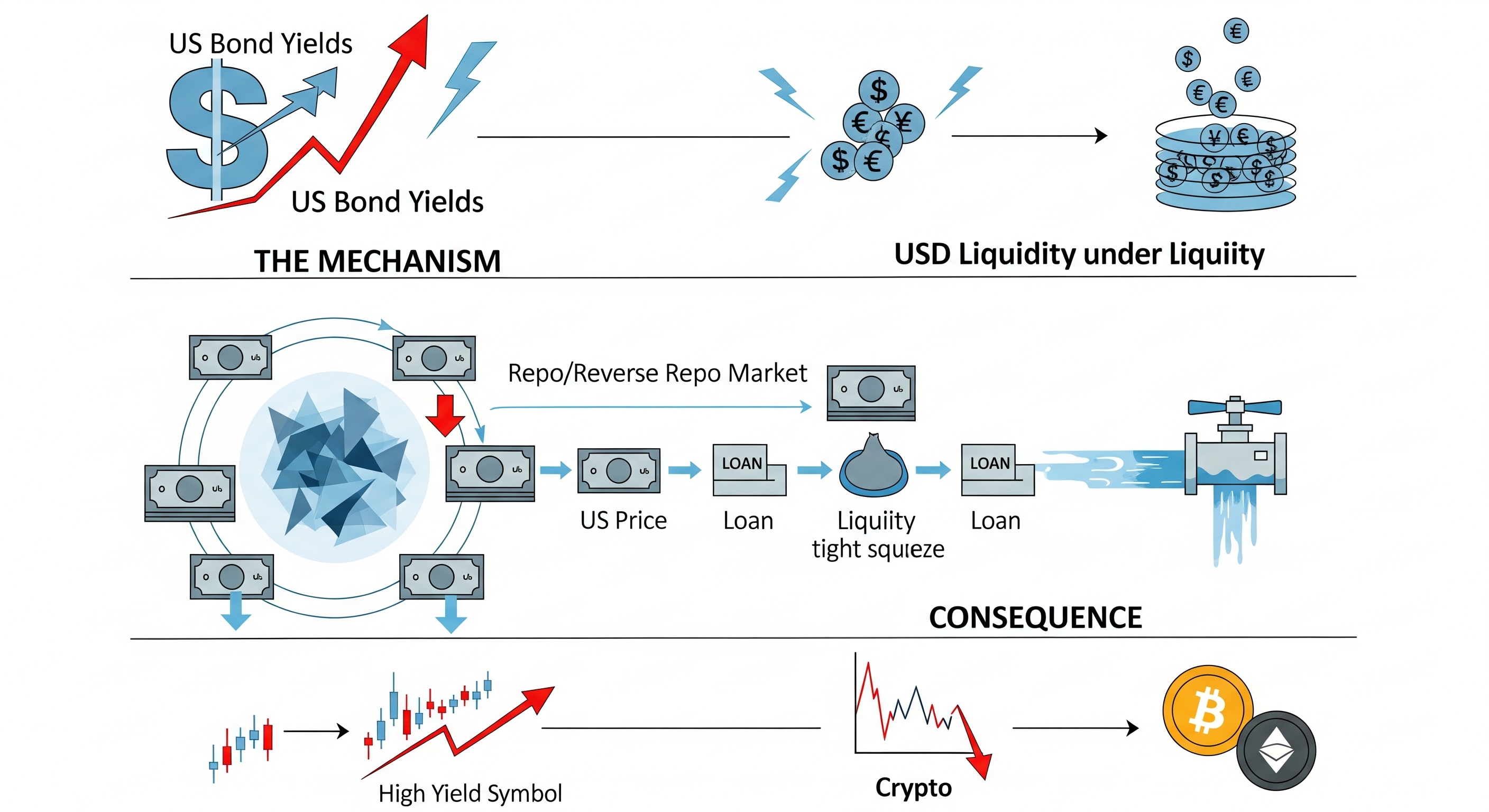

US bond yields are high under tighter monetary conditions - liquidity is pro cyclical

the higher use of lower quality collateral has pro-cyclical effects

if the price of collateral falls during economic downturn - you'll get a lot of margin calls & insolvencies. this will further put pressure on short-term funding mechanisms, which already lack HQ collateral

US Treasuries are by far the most popular collateral type in secured short-term funding markets (e.g. the repo market)

outstanding volume of these markets is larger than M2

notice the increase in usage of less safe assets as a collateral

not enough UST for its demand ⬇️

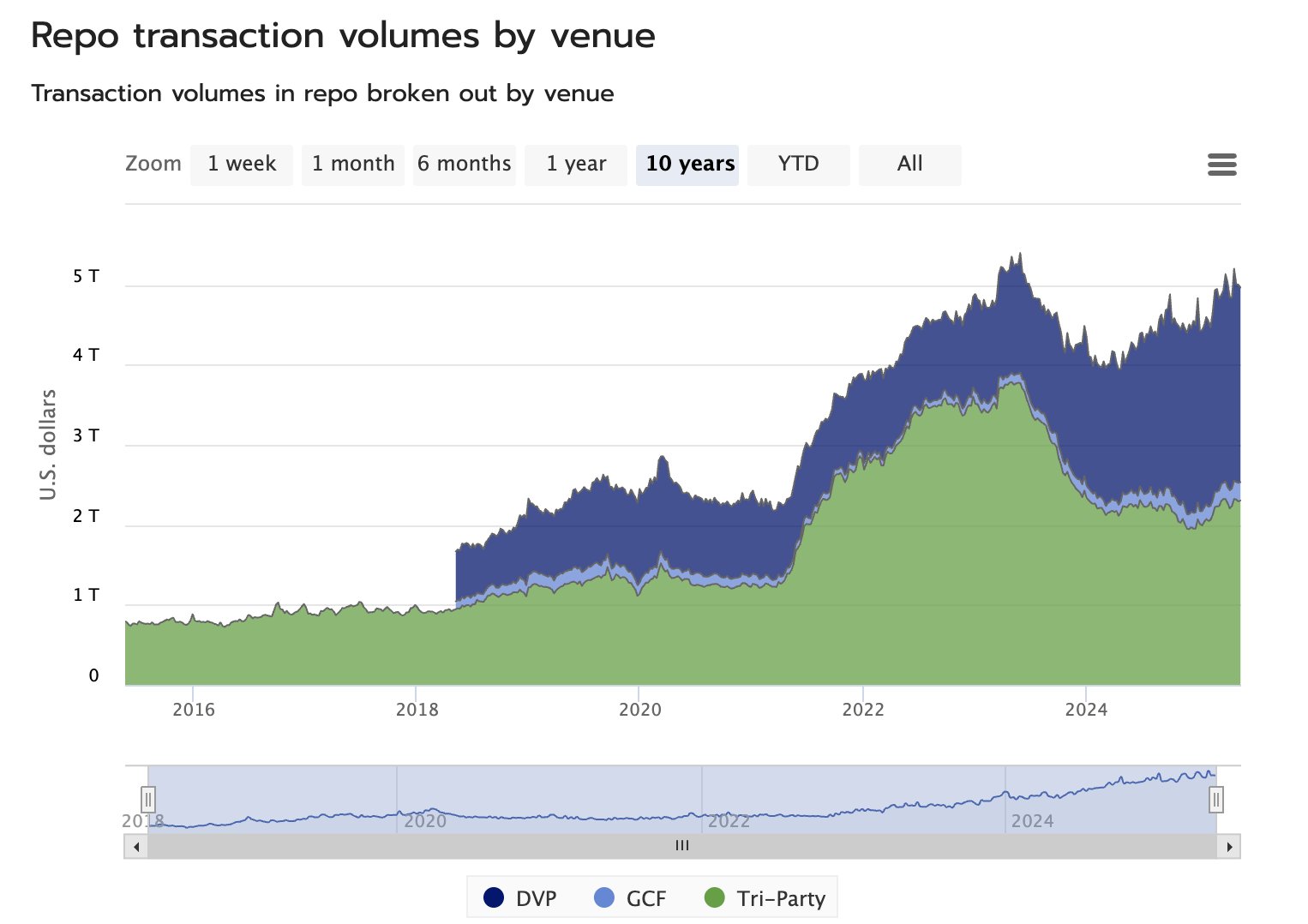

repo markets are HUGE - about the size of USD M2!

they underpin the global financial system

however, there's not many DeFi protocols addressing this part of the market

i may pick it up in the near future

if you're working on something similar - hit me up!

in the end, you get your UST bond back

and it makes sense for you to repurchase the bond (collateral) even if the price falls

as long as the price fall is < ≈haircut (2% in our case)

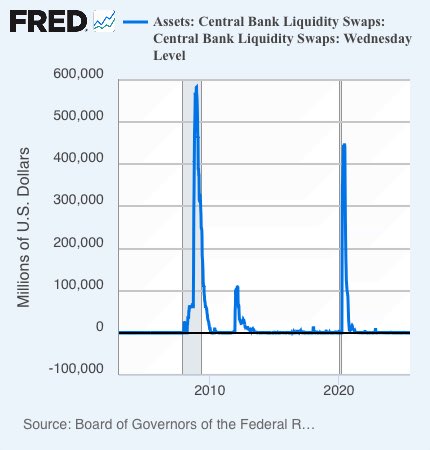

check the correlation between FED swap line volumes and Bitcoin price

large spikes in swap volume trigger an uptrend in Bitcoin

understanding these global liquidity flows helps to visualize them as a part of the larger system and understand where it's likely to move next

new currency in circulation is just one of the side-effects

and that transition is neither direct, nor instant

before these funds effectively become new currency, they flow into financial markets - that's why you see the stock market going up first

the same for risky assets

new currency in circulation is just one of the side-effects

and that transition is neither direct, nor instant

before these funds effectively become new currency, they flow into financial markets - that's why you see the stock market going up first

the same for risky assets

FED swap line operations reach ≈$600 bn

while the swaps are closed/repaid in less than a year, ≈80% of the repayment comes from newly issued wholesale debt

thus, ≈80% of the swap volume eventually becomes new currency in circulation

and then you wonder about inflation 😄

FED swap line operations reach ≈$600 bn

while the swaps are closed/repaid in less than a year, ≈80% of the repayment comes from newly issued wholesale debt

thus, ≈80% of the swap volume eventually becomes new currency in circulation

and then you wonder about inflation 😄

💧FED swap lines = infinite liquidity pool

👉 here's how:

1️⃣ central banks exchange their foreign currency for USD, 7-80 days later, they reverse the exchange at the same rate + fee

2️⃣ central banks then lend these new USD to commercial banks

thus, USD demand is met

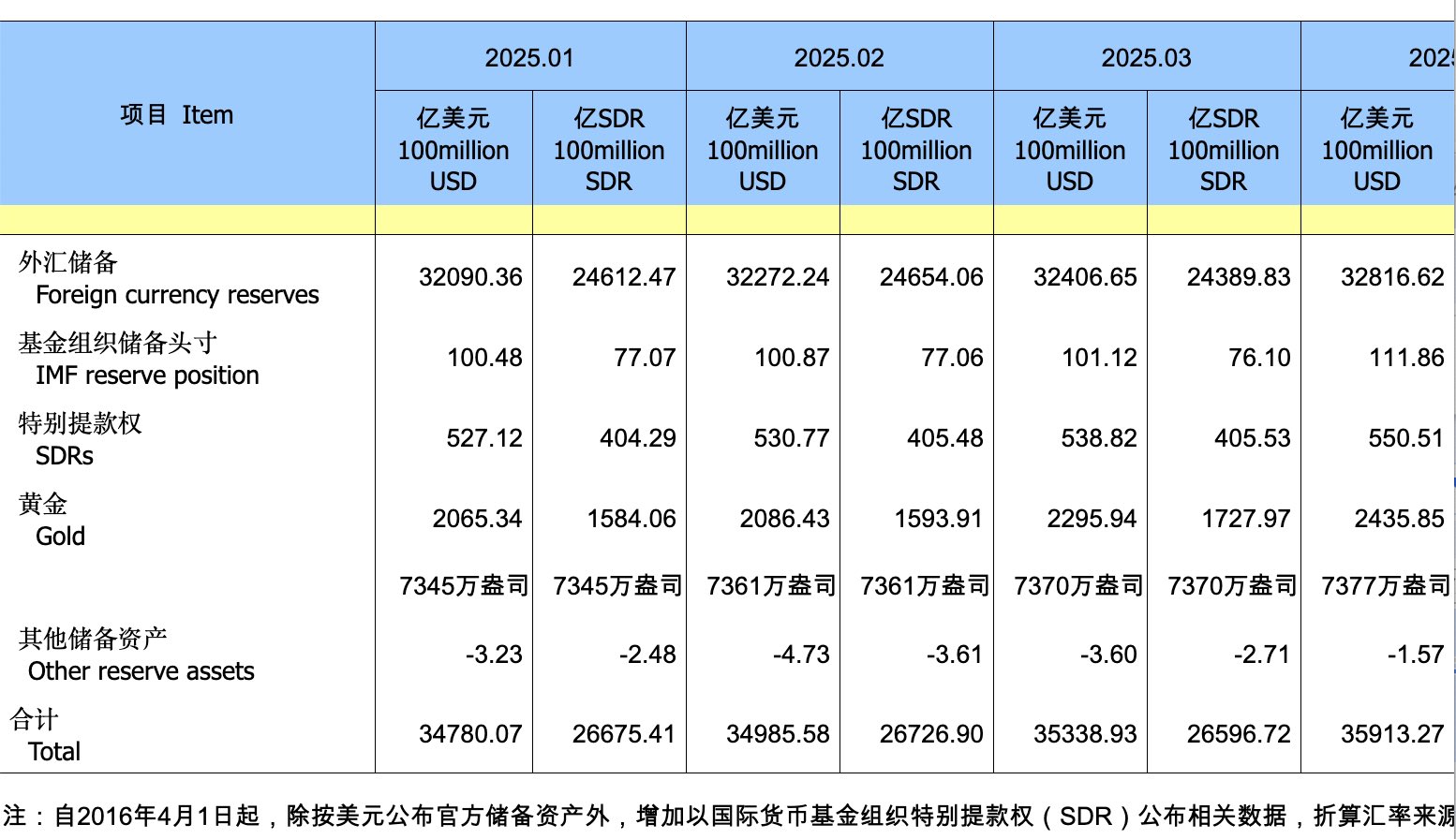

central bank balance sheets are an underrated resource for understanding the global liquidity moves

if you're following my posts - you already know that

rising US bond yields, ruble & gold

falling USD

i've been warning about it for months

90's style data = massive alpha 😂⬇️

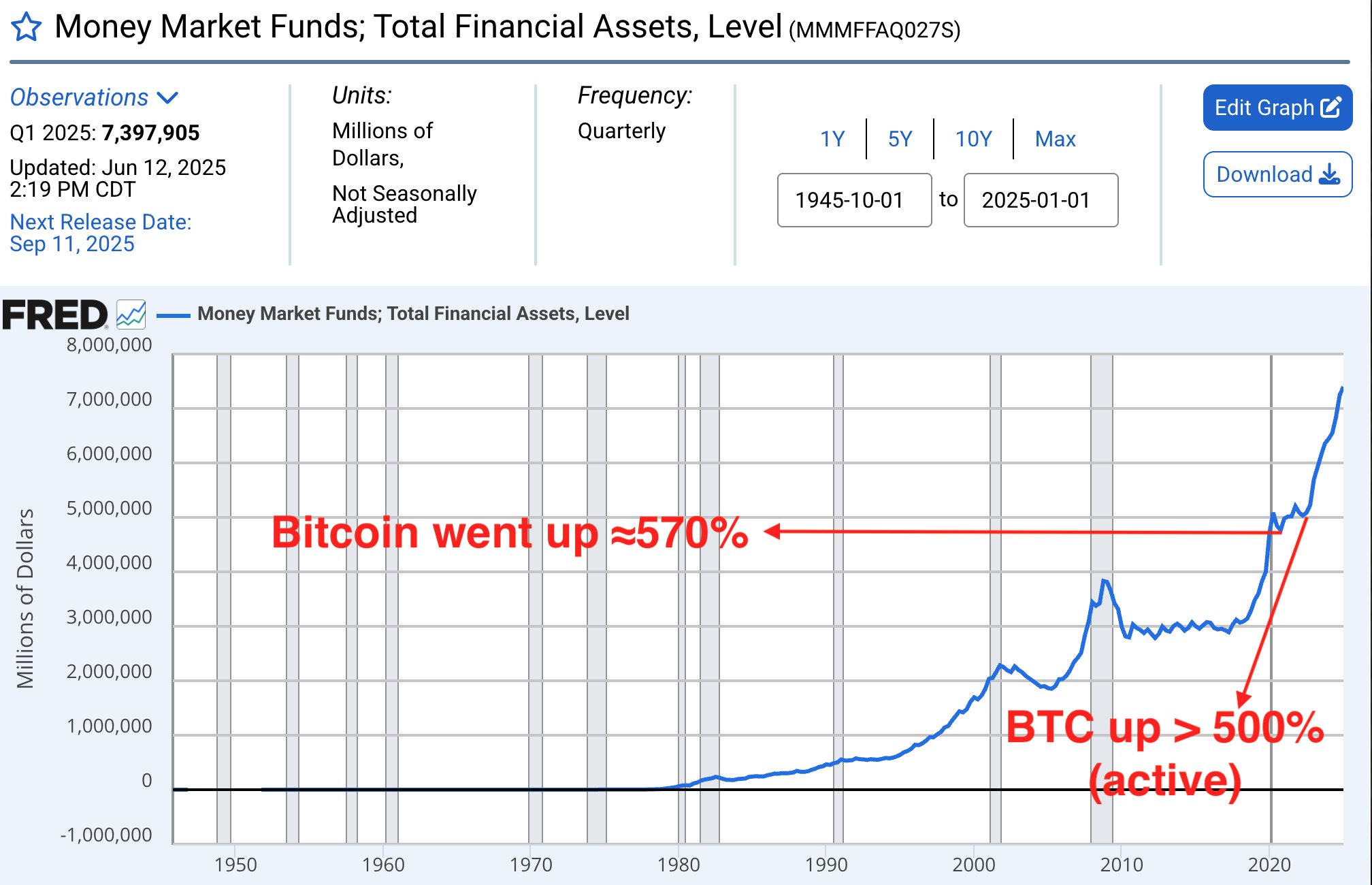

money market funds yield close to the risk free rate (think of FED funds rate in the US, or ECB deposit rate in the EU), while offering less risk due to shorter maturity

essentially, you provide a collateral (highly liquid - usually sovereign debt) and get a loan against it

record $7 trillion USD in money market funds (mmf)

this risk-averse liquidity is bound to flow into into other financial assets at some point

mmf consists of short-term collateralized loans - credit that is NOT captured by M2

last two outflows coincided with bitcoin bullrun

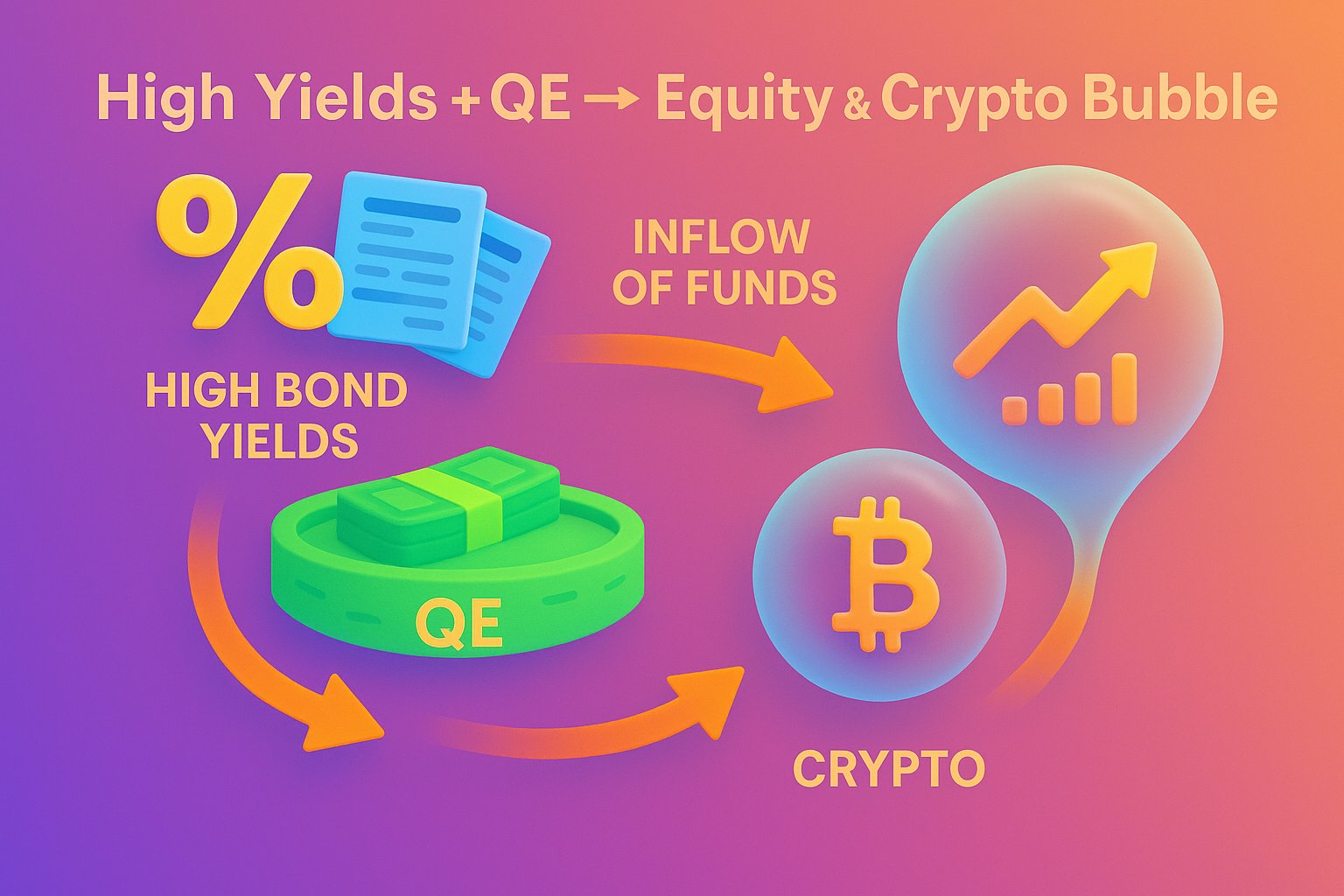

Sustained high bond yields combined with QE will lead to an inflation of equity and risk asset prices

Here's how 👇

1️⃣ High yields = high required base return

2️⃣ Inflow of QE funds into equities & crypto

3️⃣ Equities & cryptocurrency prices increase

Further fuel for the bubble

⚡️ US Bond yields directly affect USD liquidity

Here's how 👇

1️⃣ Repo + reverse repo market provides $5 trillion of liquidity

2️⃣ US bonds represent ≈70% of collateral

3️⃣ Lower bond prices means smaller loans, leading to a liquidity squeeze

🏦 Quantitative Easing (QE) by a Central Bank (CB) increase both - its assets & liabilities

👇

QE = CB buys securities from commercial banks

👆

This involves:

1️⃣ Transfer of securities to CB (asset UP)

2️⃣ Credit the bank's reserve account (liability UP)

👉 M2 Supply ≠ Liquidity 👈

M2 is only a part of the total liquidity

🔎 Here's an example:

Repurchase agreements market adds ≈$17T in the form of security-backed short-term credit, thus increasing available currency

M2 does not account for the repo market