Russia & ruble macro updates

Regular insights on RUB moves, CBR policy, sanctions, reserves and broader Russian macro developments.

Central Bank of Russia Denies Return to USD Payments

Just like I argued yesterday, claims by Bloomberg and other financial media suggesting that Russia is to return to USD settlement were misguided/wrong.

Not only those claims lacked factual basis, but also didn't make sense in terms of a macro picture.

Remember: just because a large-following news source claims something, it doesn't make it true. And do not discount for the existence of coordinated campaigns with ulterior motives. It doesn't have to be necessarily market manipulation -- just the engagement on its own can be a strong motivator.

Fact-Check: Russia Moving Back To USD?

Today, financial news sources are flooded with information claiming that Russia is planning a return to the US dollar, as a part of wider strategic-economic partnership with Trump, but it is true?

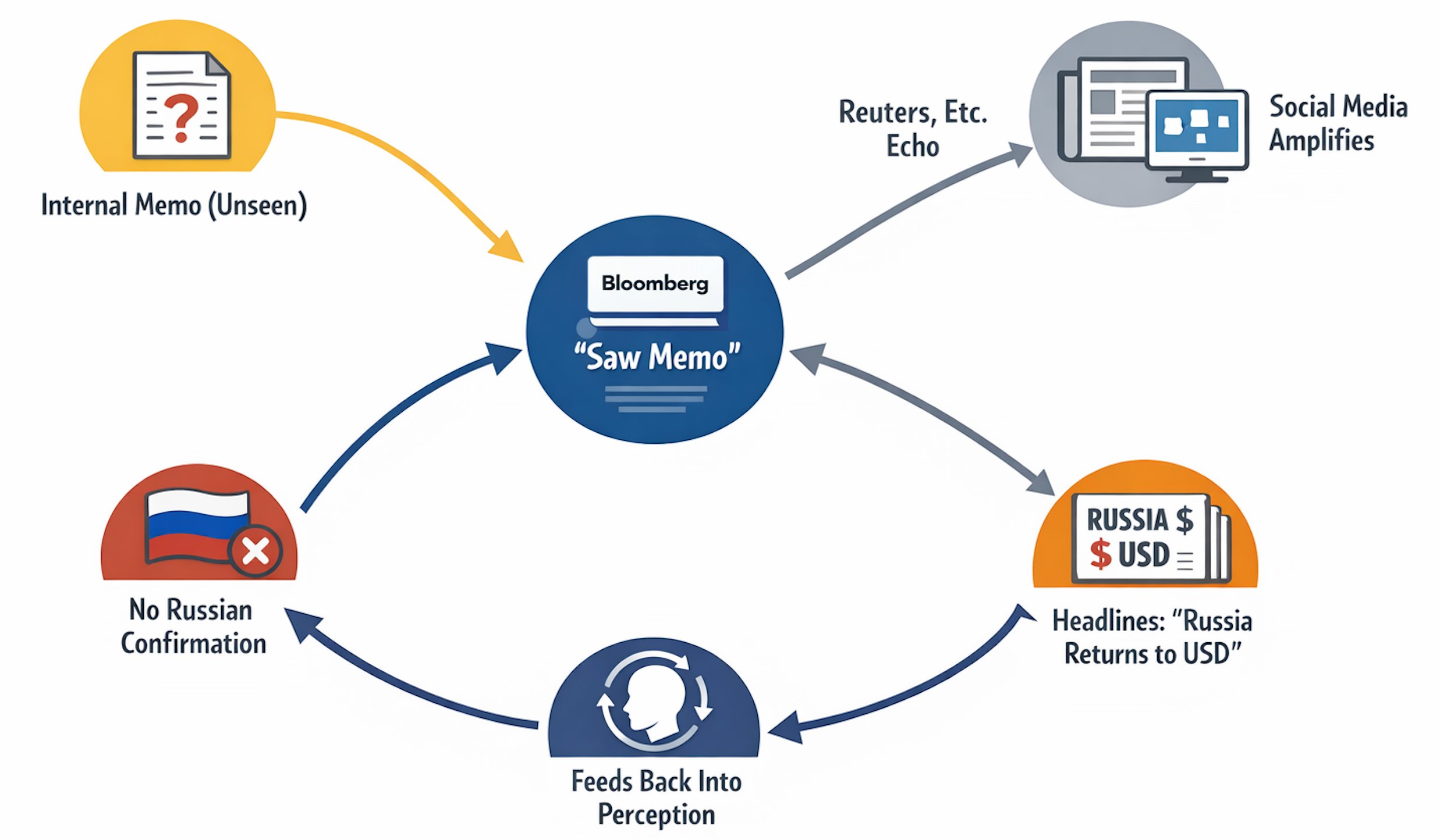

Reportedly, Russia’s move back to USD comes packaged with other economic cooperation points, mostly around commodities (fossil fuels in particular). This is what mainstream financial media like Bloomberg, Reuters and accounts with millions followers on X have been spreading viciously today, many of which frame this as the end of BRICS and/or the successful policies of the Trump administration.

What bothered me, is that none of them seem to clearly outline the source, mostly citing it as “Bloomberg reports”. This brings the obvious question: what sources did Bloomberg use in making this report? Well, reports regarding “Russia returning to USD settlement system” arise from an "internal Kremlin memo" that Bloomberg supposedly had access to. No further information is provided regarding the nature of this memo. No Russian state sources confirmed this information. It’s also not clear why Russia would seemingly sidestep their main strategic partner - China with this move (especially for those claiming the end of BRICS). So we are in a situation where Bloomberg claims they’ve seen X, and X gets spread as a fact, based on the claim by Bloomberg.

Major news sources are reposting this memo and framing it as Russias’s return to USD without stepping back to analyze it critically. Why would Russia, which gradually moved away from USD throughout the last 20 years, would suddenly reverse their policy to accept USD as the preferred medium of settlement? Would Russia trade in USD again — of course, I don’t believe they ever refused that.

Eventually, I fully expect Russia to be reintegrated back into international trade, and that includes trading in USD. I’ve written about that many times. What I do not expect is the Central Bank of Russia to dramatically increase USD instruments in their FX reserves. They were already sanctioned once, and that will remain a perpetual risk. Russia has successfully moved away from the U.S. Dollar, by replacing it with gold and renminbi, and they don’t have a serious dependency on US trade. If you think that you will have American companies owning Russian fossil fuel production in the near future you are mistaken.

So my take on this: claims of Russia’s return to USD settlement are overblown. This looks more like a coordinated campaign than something with real substance.

Even As Central Banks Bought Gold, The Market Analysts Remained Bearish

* This goes to the list of "things that are obvious in hindsight"

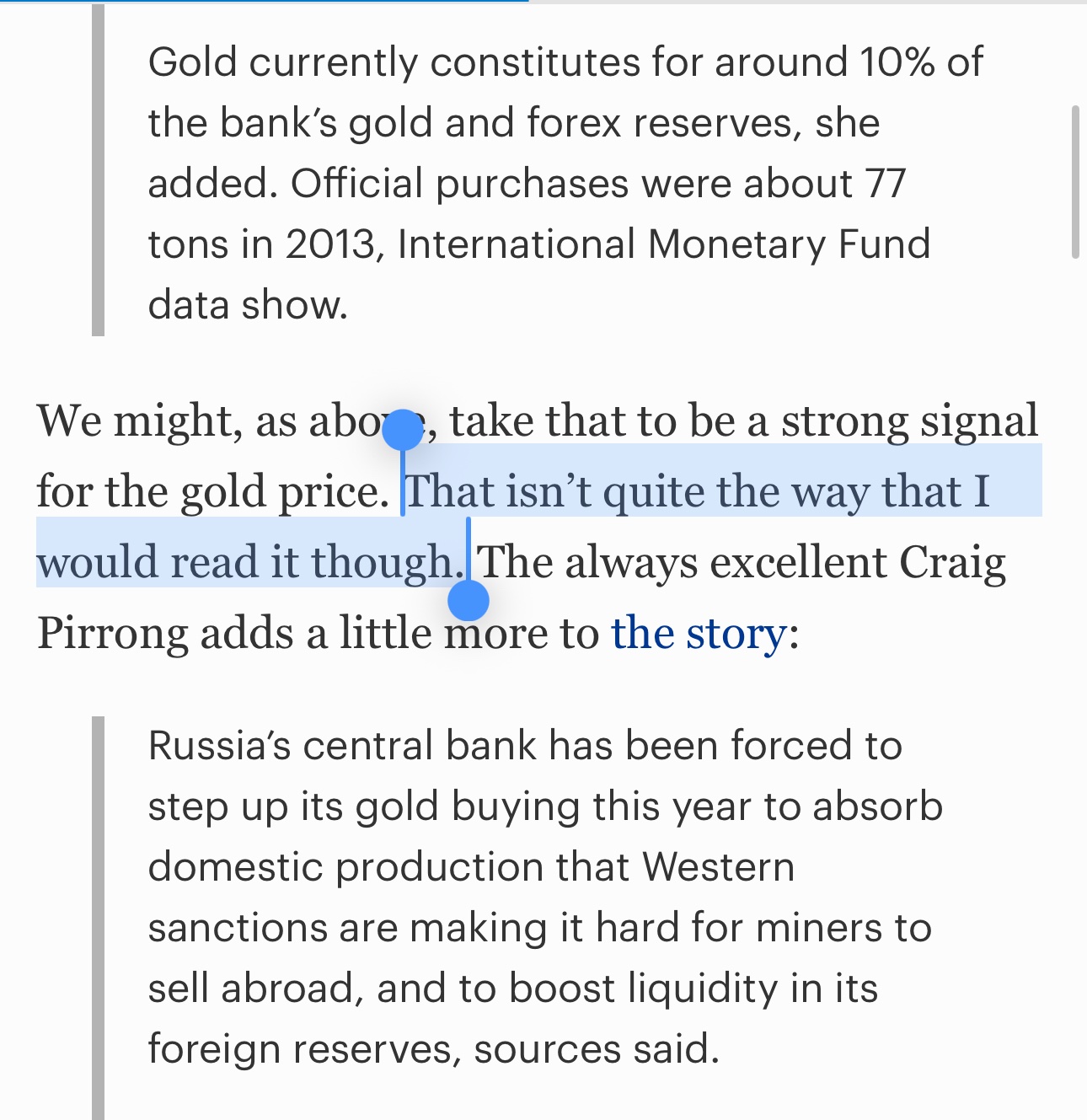

In 2014 Forbes published an opinion saying that increased gold buying by Central Bank of Russia (CBR) isn't an indicator of positive price pressures for gold.

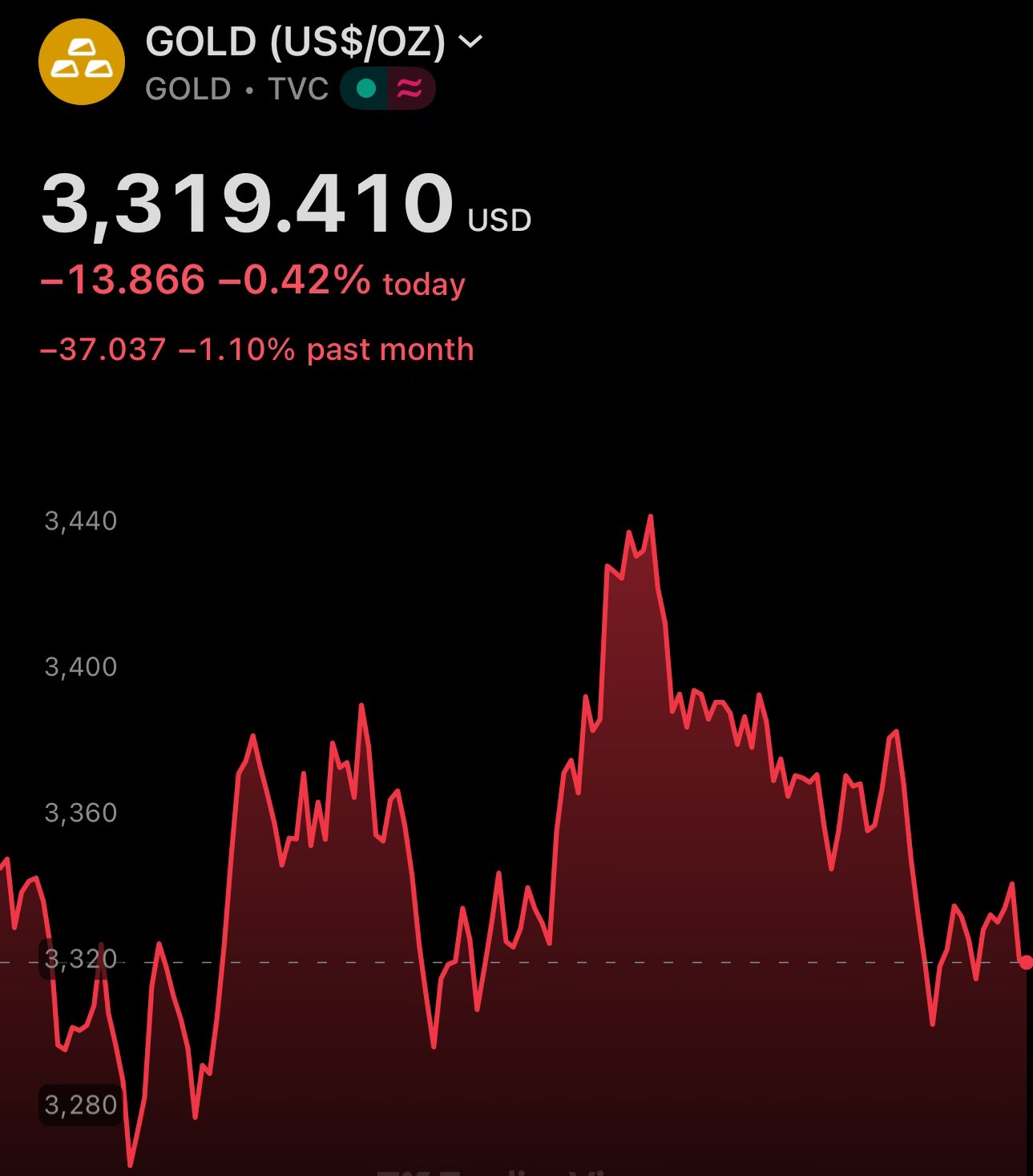

Gold's price has more than quadrupled since then, going from ≈$1600/oz in November 2014 to ≈$4600/oz as of January 19th 2026.

The article frames the purchase as "forced", when commenting the fact that CBR decided to increase the share of gold in the "gold and foreign exchange reserve assets" item in their balance sheet. It is not by chance that this central bank accounting item explicitly includes "gold" in its name.

The Forbes article also seems to assume that miner profit margins don't spread cross-border.

Another thing that the article omits is that a central bank can buy gold without expanding the base monetary base (i.e. "printing" new currency), for example by swapping FX reserves for gold via a single or multi-leg sale.

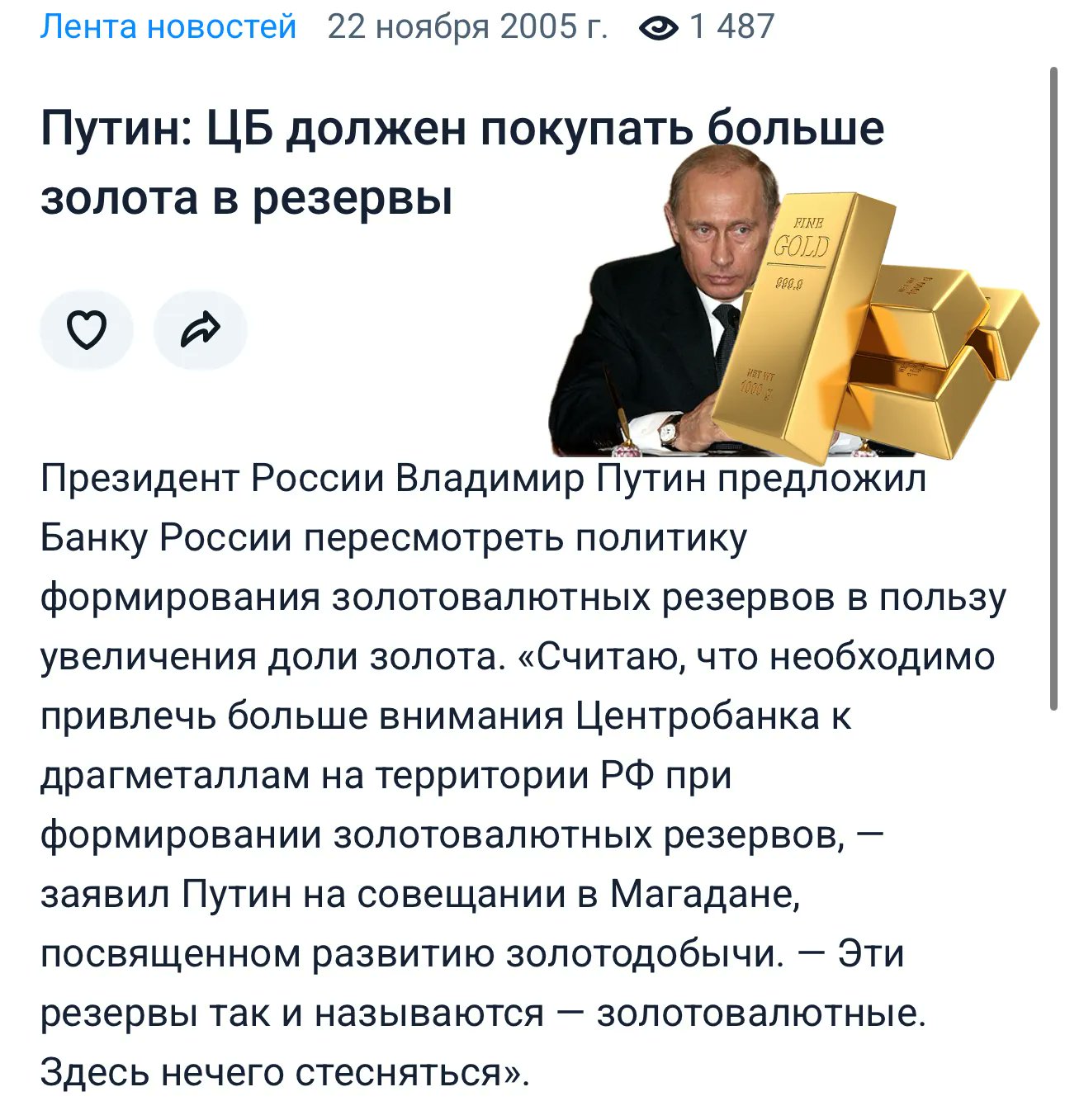

Putin Instructed Central Bank of Russia To Buy Gold In 2005

In 20 years, Russia's share of gold in their central bank's international reserves account increased by a factor of ≈12.1 times.

At the start of 2026, gold represents ≈43% of Bank of Russia's (BoR) international reserves. Back in 2005, gold accounted for a mere ≈3.5% of the same reserves account.

The move to gold was mainly motivated by the desire to diversify away from the U.S. Dollar and the explicit goal of increasing BoR's holdings of gold relative to foreign exchange assets. On November 22nd 2005 Putin stated:

➖ "I believe it's necessary for the Central Bank to pay more attention to precious metals within the territory of the Russian Federation when forming gold and foreign-currency reserves. Those reserves are even called 'gold and foreign-currency' reserves. There's nothing to be shy about here."

Since Vladimir Putin instructed Bank of Russia to start buying more gold, gold is up ≈840%, i.e. almost 10 times. In the same period, S&P 500 TR increased ≈726%, or almost 9 times. This means that Putin's strategy outperformed the U.S. stock market index by ≈14%. Perhaps the president of Russia should start his own investment fund?

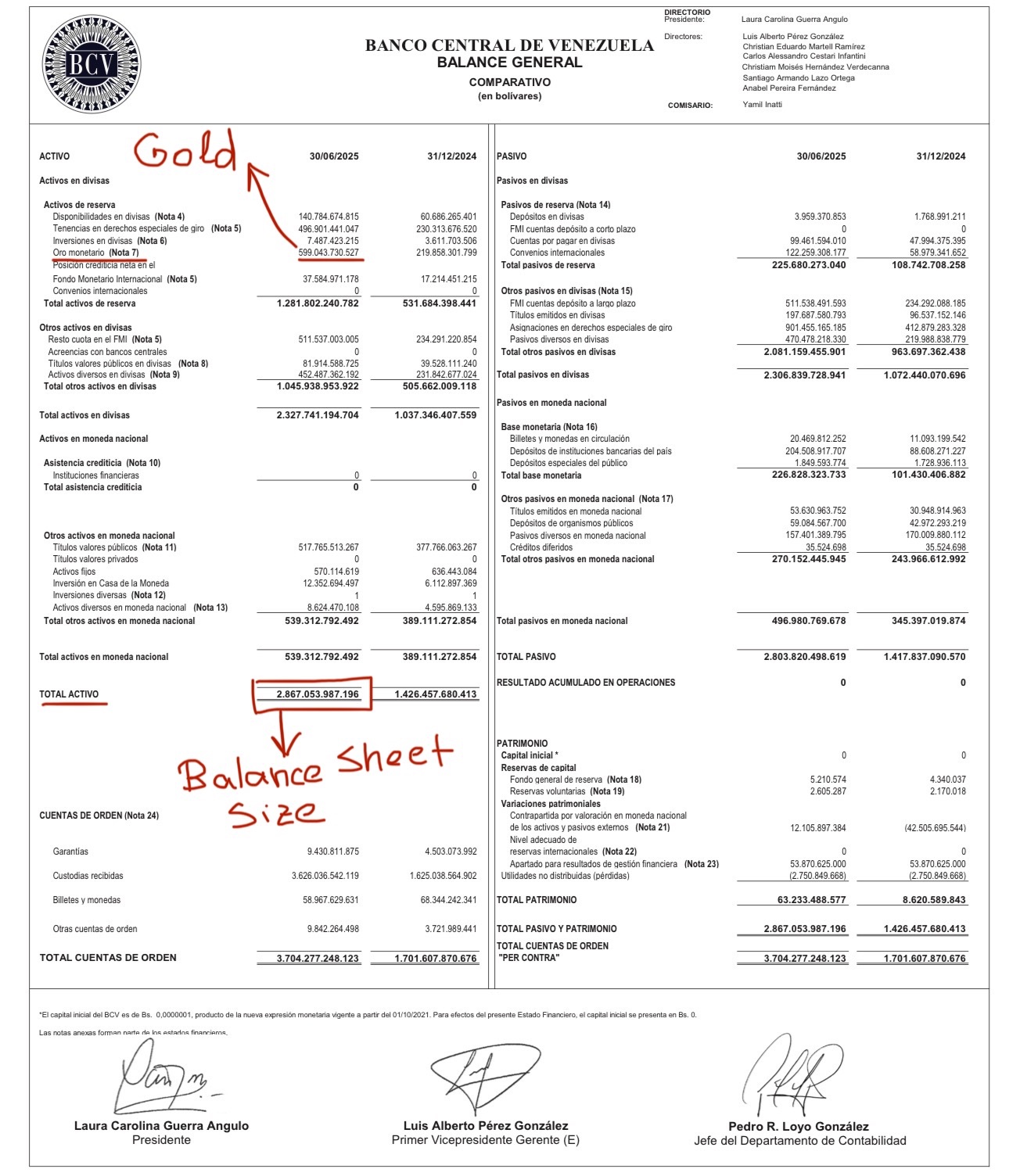

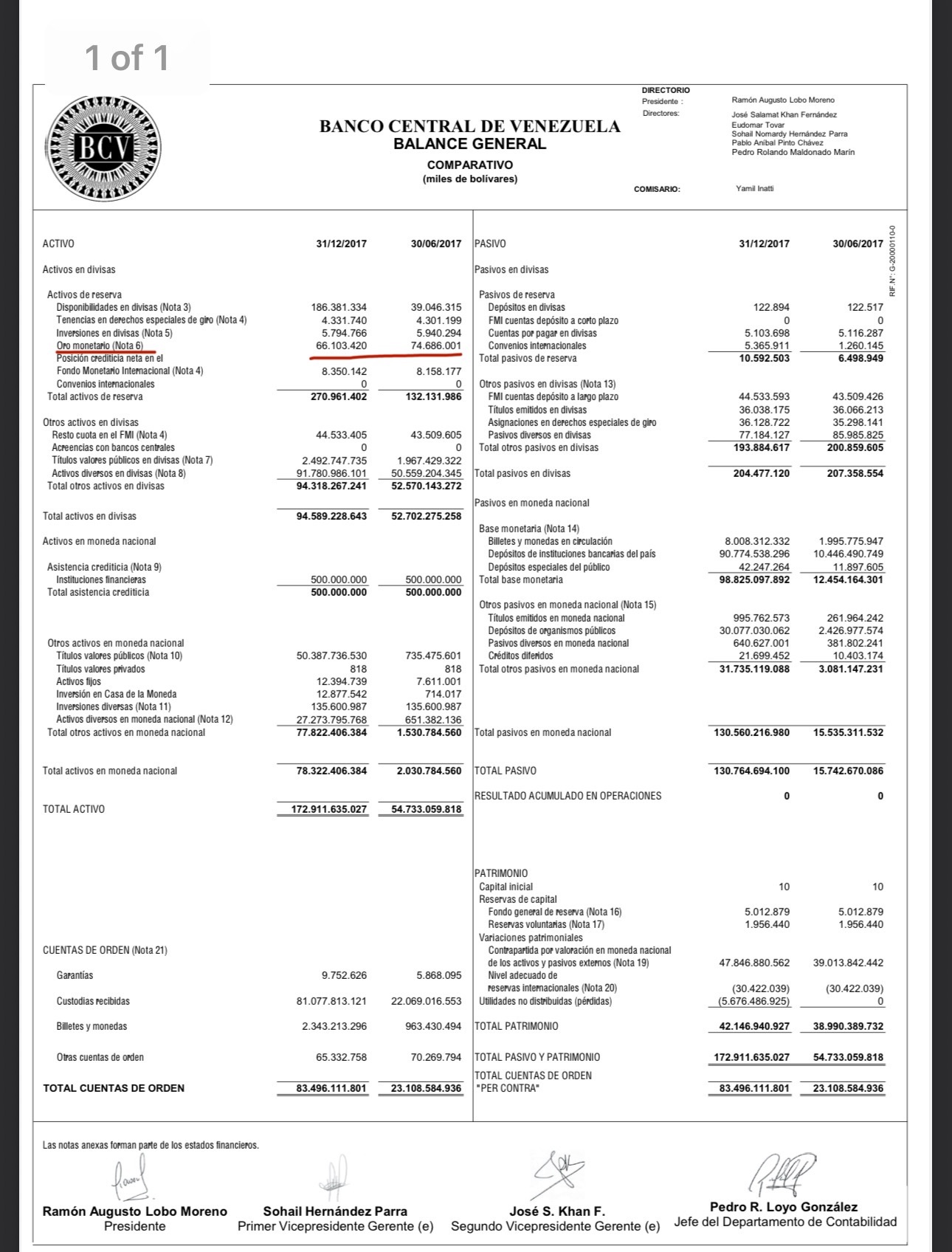

Venezuela's Central Bank Monetary Gold Holdings Constitute ≈20% of Their Balance Sheet

Gold is also ≈47% of Venezuela's international reserve assets.

This comes directly from Banco Central de Venezuela (BCV), which reports a total of ≈53 tonnes of gold worth ≈0.6 Trillion VES (Venezuelan Bolívar, also known as Bs), or ≈5.58 billion USD.

In 2021, Reuters reported that ≈31 tonnes of Venezuela's Centeal Bank gold was stored in the UK, under the custody of Bank of England (BoE). A quick search didn't yield precise figures for 2026, as it appears that that information is not reported publicly in detail. The access to that gold at BoE is currently blocked, over a legal dispute regarding who has the authority/control over that gold - Maduro-appointed BCV board or Guaidó-appointed board. Thus, a significant portion of Venezuela's gold is abroad and frozen, which matters in terms of geopolitical risk.

BNV's 20% are relatively high gold amounts against the central bank's total balance sheet size, surpassing U.S.'s Fed (≈16%), China's PBoC (≈5%) and just above European Union's ECB + Eurosystem (≈19.1%), but well behind Russia's BoR (≈36%).

In 2017, Venezuelan Central Bank (Banco Central de Venezuela/BCV) held ≈162 tonnes of monetary gold in its balance sheet

By 2025, that number was reduced by ≈67%, down to ≈53 tonnes.

I'll do a more detailed breakdown of Venezuela's gold holdings relative their balance sheet size in a follow-up post.

Ruble was the best performing major currency of 2025, and it's easy to understand why

What Russia did is replace USD-denominated securities (treasuries, bonds, etc) with gold.

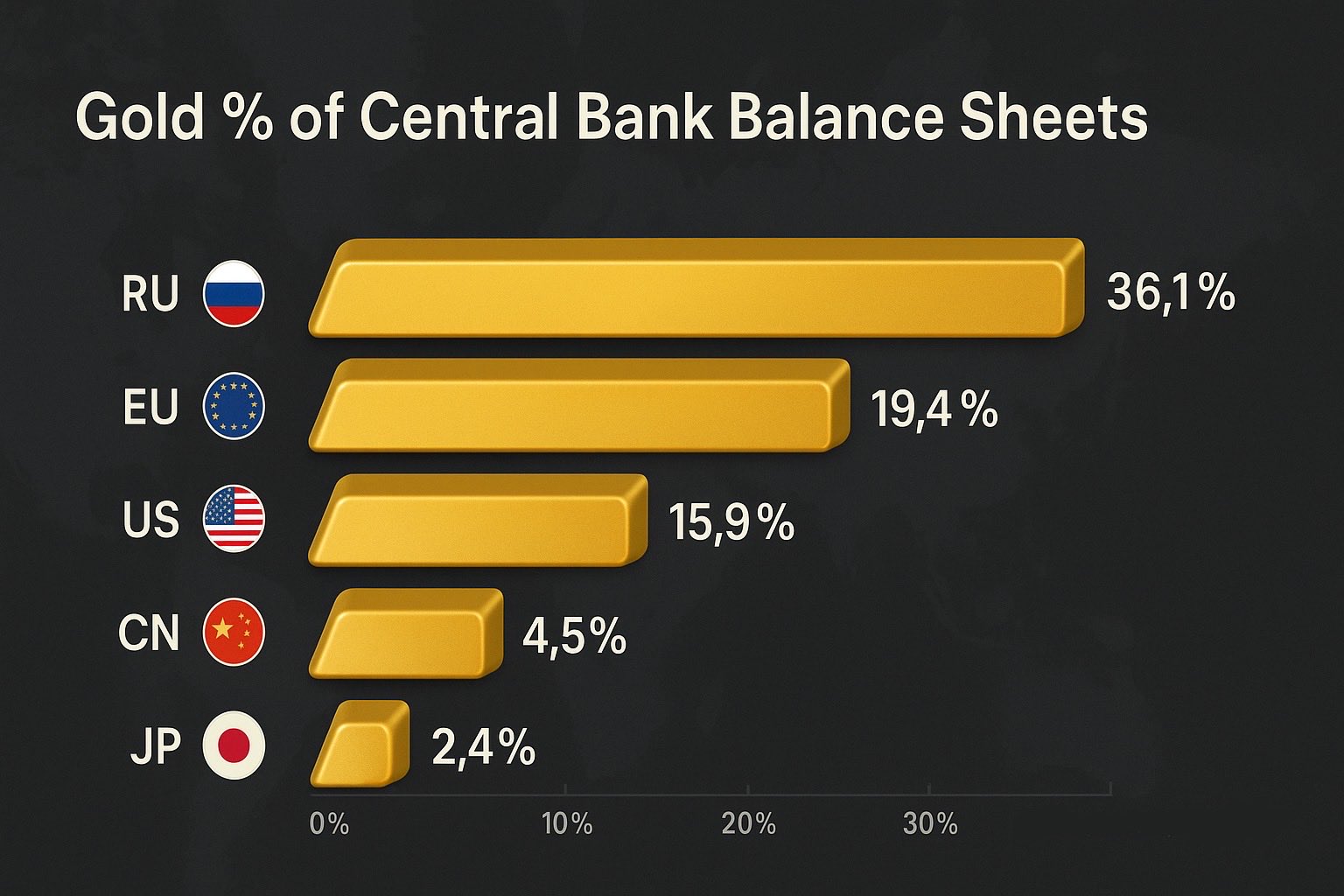

Gold is almost 40% of Russia's Central bank balance sheet, compare it to ≈20% for European Union, ≈16% for U.S. and ≈5% for China. This leaves Russia's central bank with a massive balance sheet capacity for the future and supports the Ruble price.

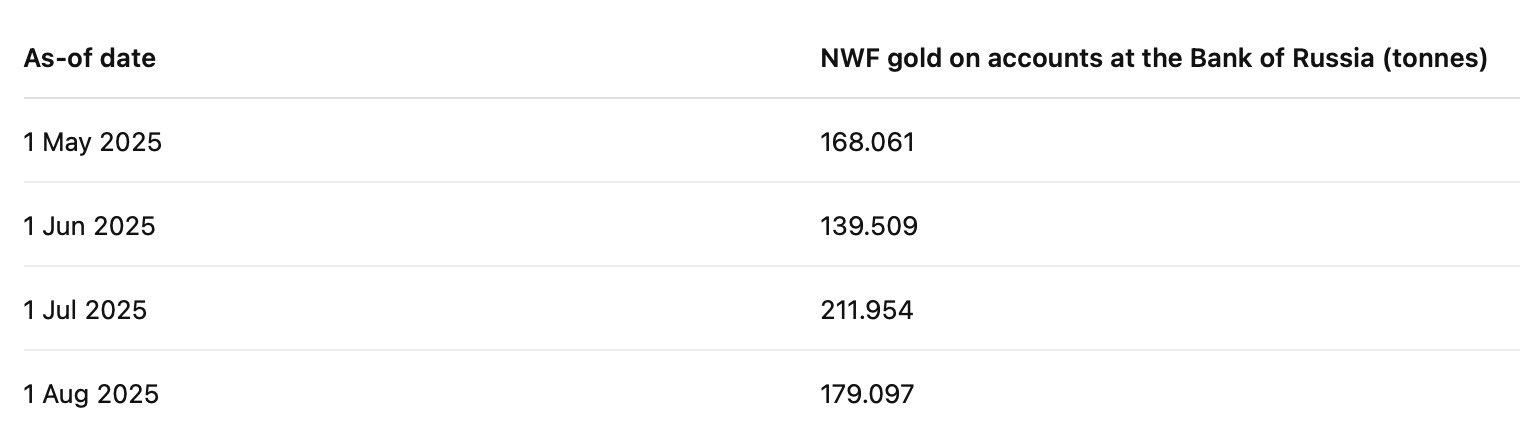

There's also the National Wealth Fund, which commits to buying gold when Urals oil is sold/traded above a certain price.

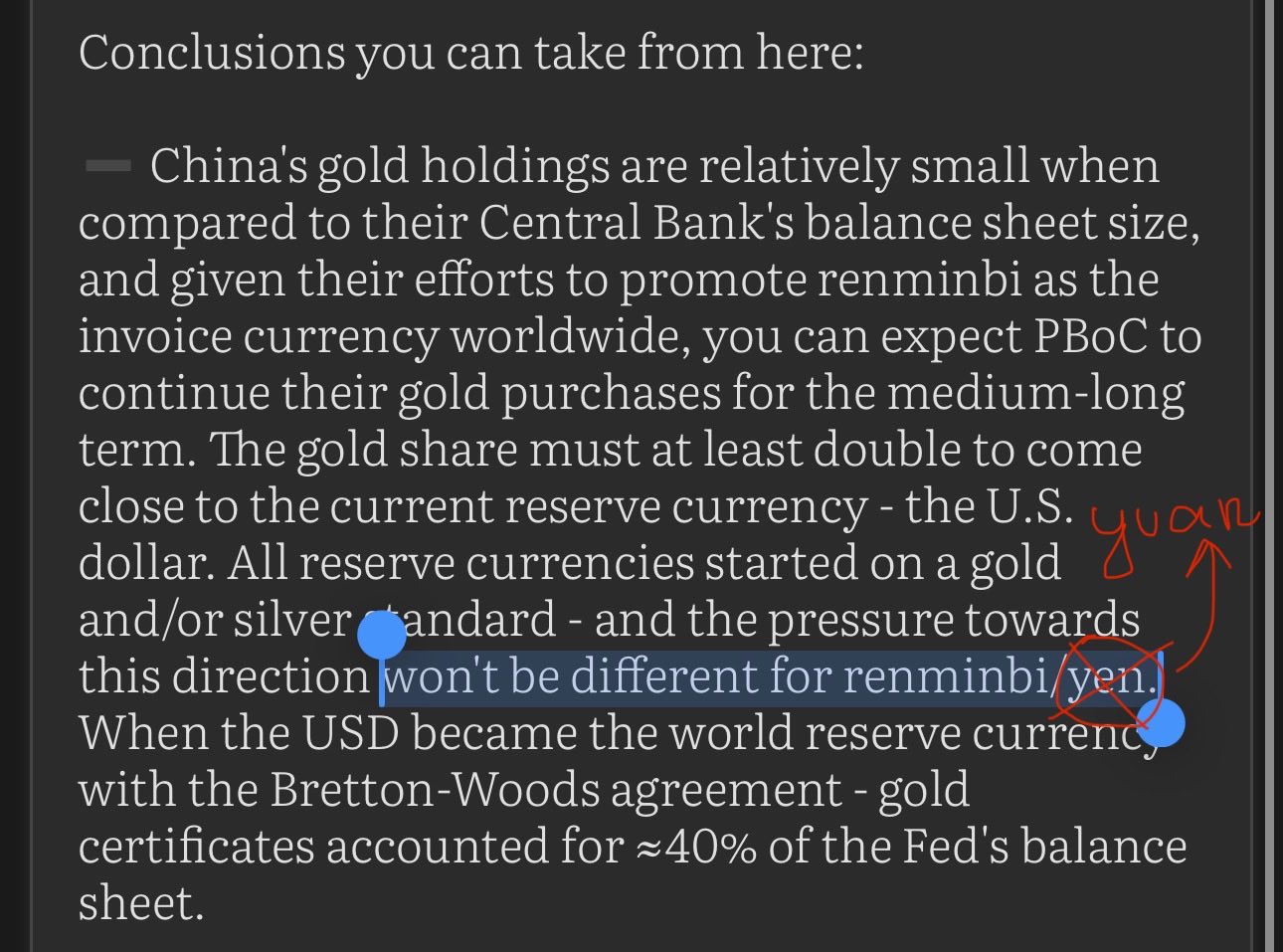

In my post ranking gold as a percentage of central bank balance sheet size I wrote renminbi/yen, when I meant renminbi/yuan

Yen is, of course, the Japanese, not PRC's local currency. I will correct this under threads & thoughts on my website, but it will remain with this typo on X (you can't update the post after 1 hour)

Russia will buy Silver as a strategic reserve until 2027

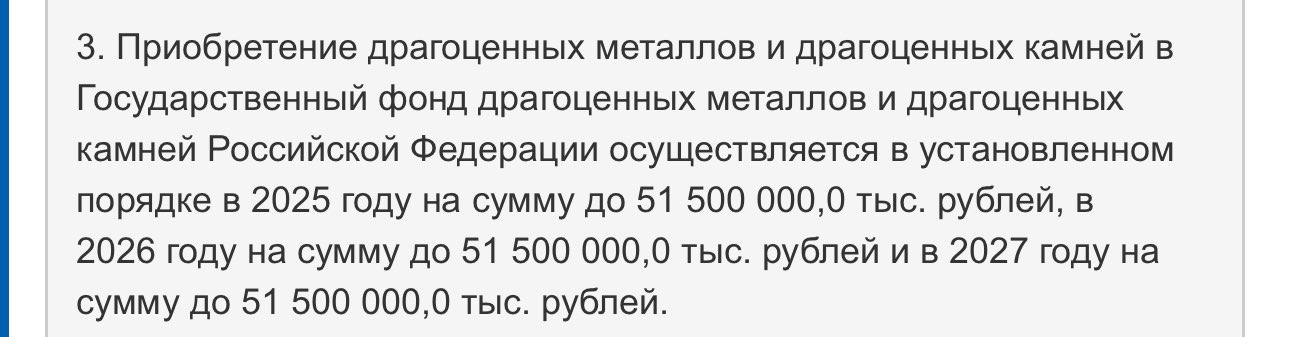

I'm not speculating on anything, this comes directly from the Russian legislation, namely the Federal Law № 419-ФЗ (in Russian/cyrilic: Федеральный закон от 30 ноября 2024 г. № 419-ФЗ) whose budget tables for 2025–2027 allocate ≈51.5 billion rubles (≈$640M) per year as budget for the "acquisition of state reserves of precious metals and precious stones".

Silver falls explicitly under the definition of "precious metals". More specifically, under Russian framework law № 41-ФЗ the term "precious metals" ("драгоценные металлы") is explicitly defined as gold, silver, platinum and the metals of the platinum group.

In addition to the above, in the official explanatory note (пояснительная записка) to the draft of Federal Law № 419-ФЗ the Russian Ministry of Finance explicitly states that the plan is to acquire refined gold, refined silver, refined platinum and refined palladium for strategic goals. More specifically, the aim is to increase the share of "highly liquid valuables" in the State Fund of Precious Metals and Precious Stones of the Russian Federation (Госфонд России).

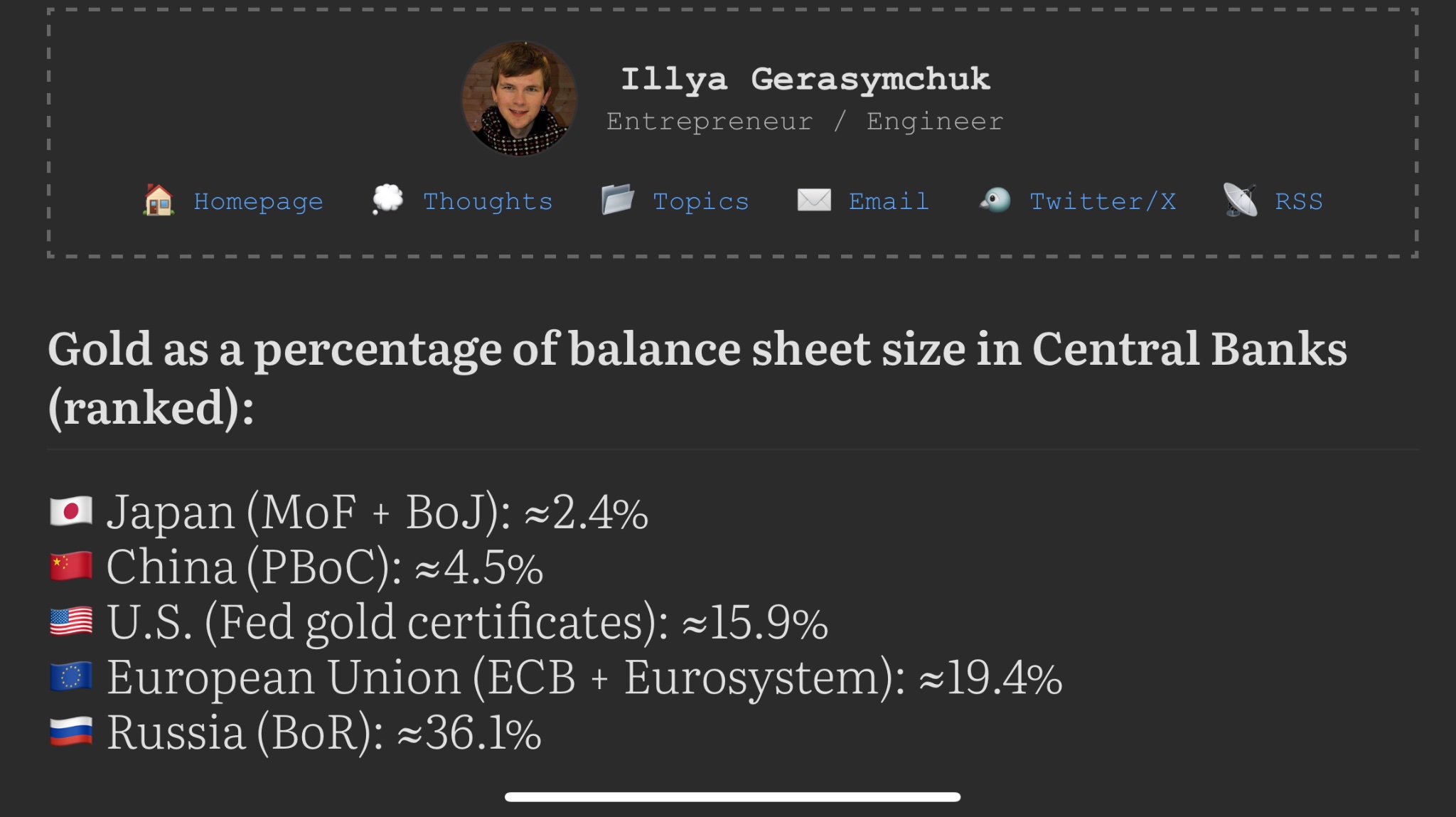

Gold as a percentage of balance sheet size in Central Banks (ranked):

🇯🇵 Japan (MoF + BoJ): ≈2.4%

🇨🇳 China (PBoC): ≈4.5%

🇺🇸 U.S. (Fed gold certificates): ≈15.9%

🇪🇺 European Union (ECB + Eurosystem): ≈19.4%

🇷🇺 Russia (BoR): ≈36.1%

All of the above will expand their balance sheets, but it's mostly China & Russia actively buying more gold.

Conclusions you can take from here:

➖ China's gold holdings are relatively small when compared to their Central Bank's balance sheet size, and given their efforts to promote renminbi as the invoice currency worldwide, you can expect PBoC to continue their gold purchases for the medium-long term. The gold share must at least double to come close to the current reserve currency - the U.S. dollar. All reserve currencies started on a gold and/or silver standard - and the pressure towards this direction won't be different for renminbi/yuan. When the USD became the world reserve currency with the Bretton-Woods agreement - gold certificates accounted for ≈40% of the Fed's balance sheet.

➖ Russia has built up a massive balance sheet capacity for the future. Once the international trade markets with Russia re-open, there will be a plenty of reserves to back-up a massive wave of Ruble credit. Expect Russian capital markets to rally then.

➖ European Union has a healthy relative position. Given that the Euro is currently the closest alternative to the U.S. Dollar - it's a good idea to both, expand gold reserves and promote capital markets. The latter is an explicit goal via the Capital Markets Union (CMU). Given that EU will further expand the balance sheet, it's necessary to increase the gold reserves - repricing won't be enough. Gold will make Euro more attractive, and with it the FX holdings of Euro by sovereigns.

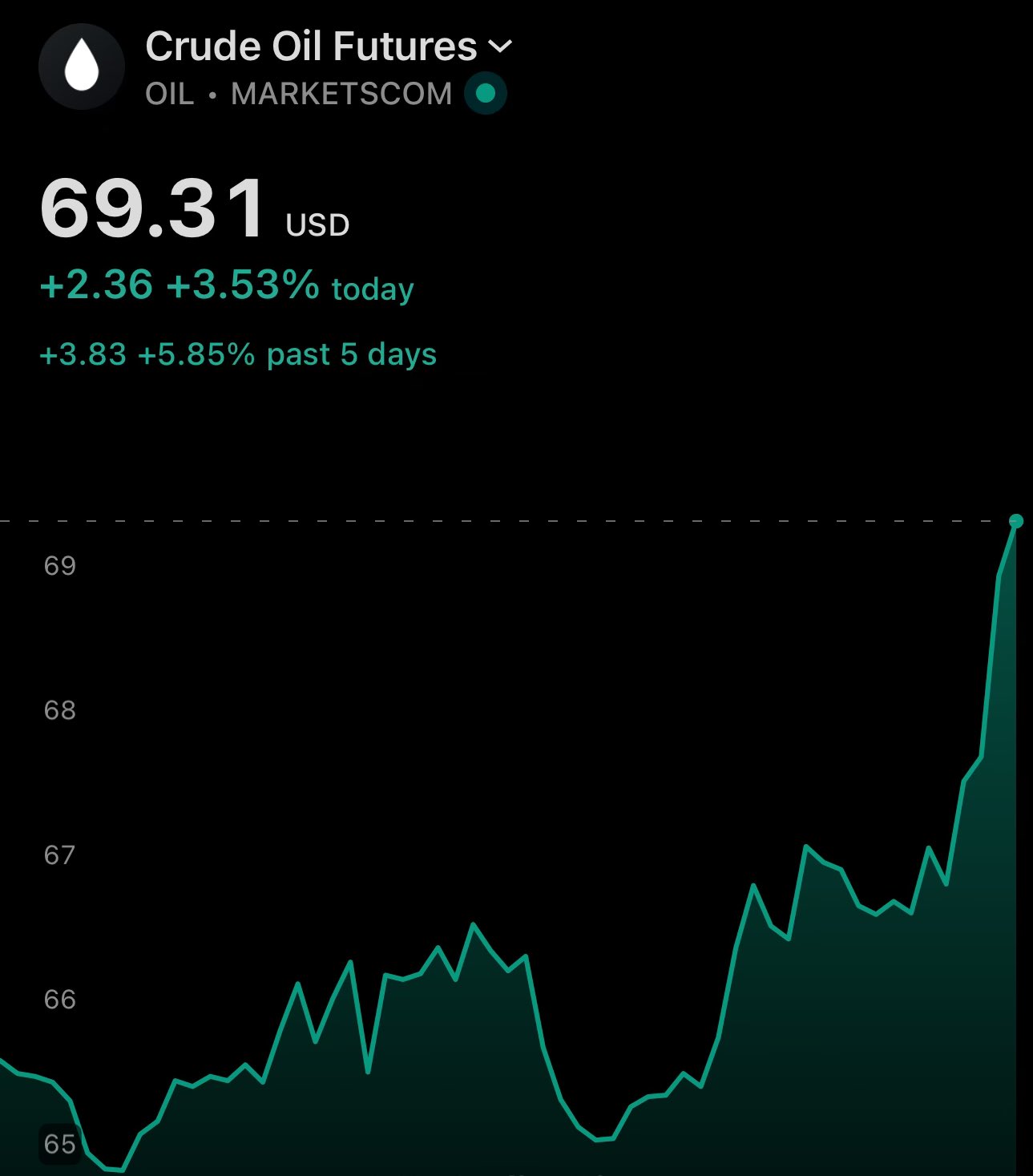

a kind reminder that higher oil prices benefit Russia and Ruble

U.S. puts sanctions on Russia --> Oil price increases --> Ruble price increases

This is driven by how Russia's National Wealth Fund (NWF) operates, plus the fact that both NWF and Russia's Central Bank have almost no exposure to USD

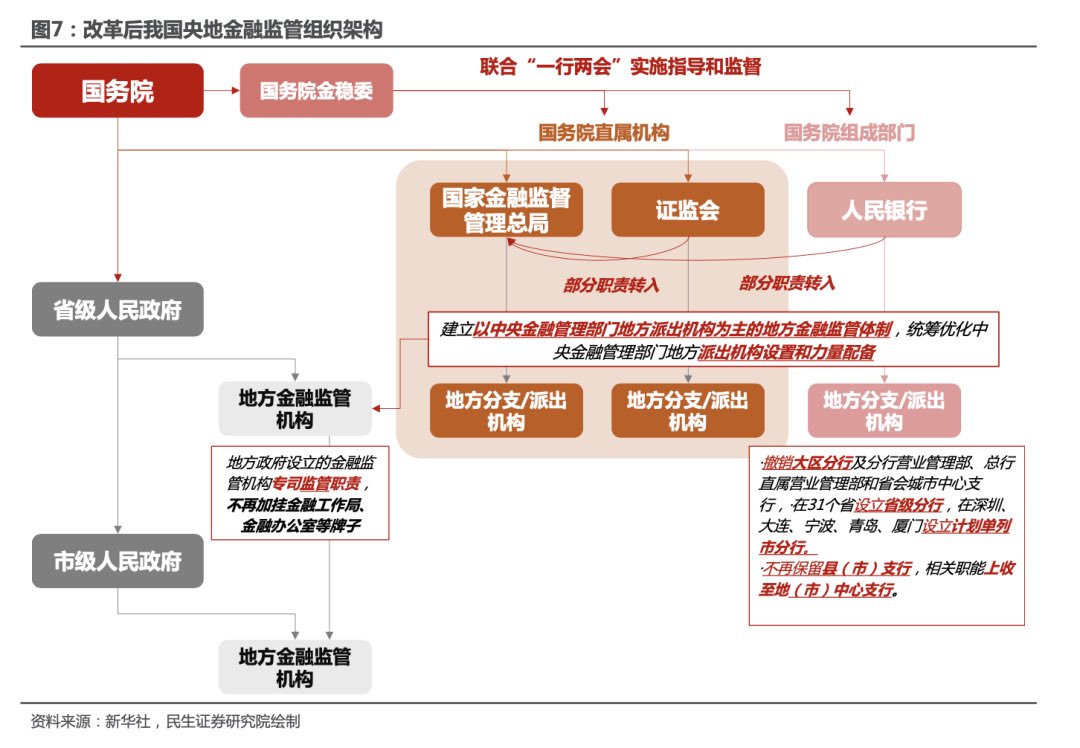

in Russia, besides the Bank of Russia there's also the National Wealth Fund (NWF), which is operated by the Ministry of Finance

in China, there's policy banks, such as China Development Bank which are supported by PBoC's facilities

this collateral (US Treasury bonds) can then be used on wholesale debt markets to issue more credit

moreover, this collateral can be leveraged/rehypothecated, thus increasing liquidity

still, in the USA the Fed continues to dominate in importance

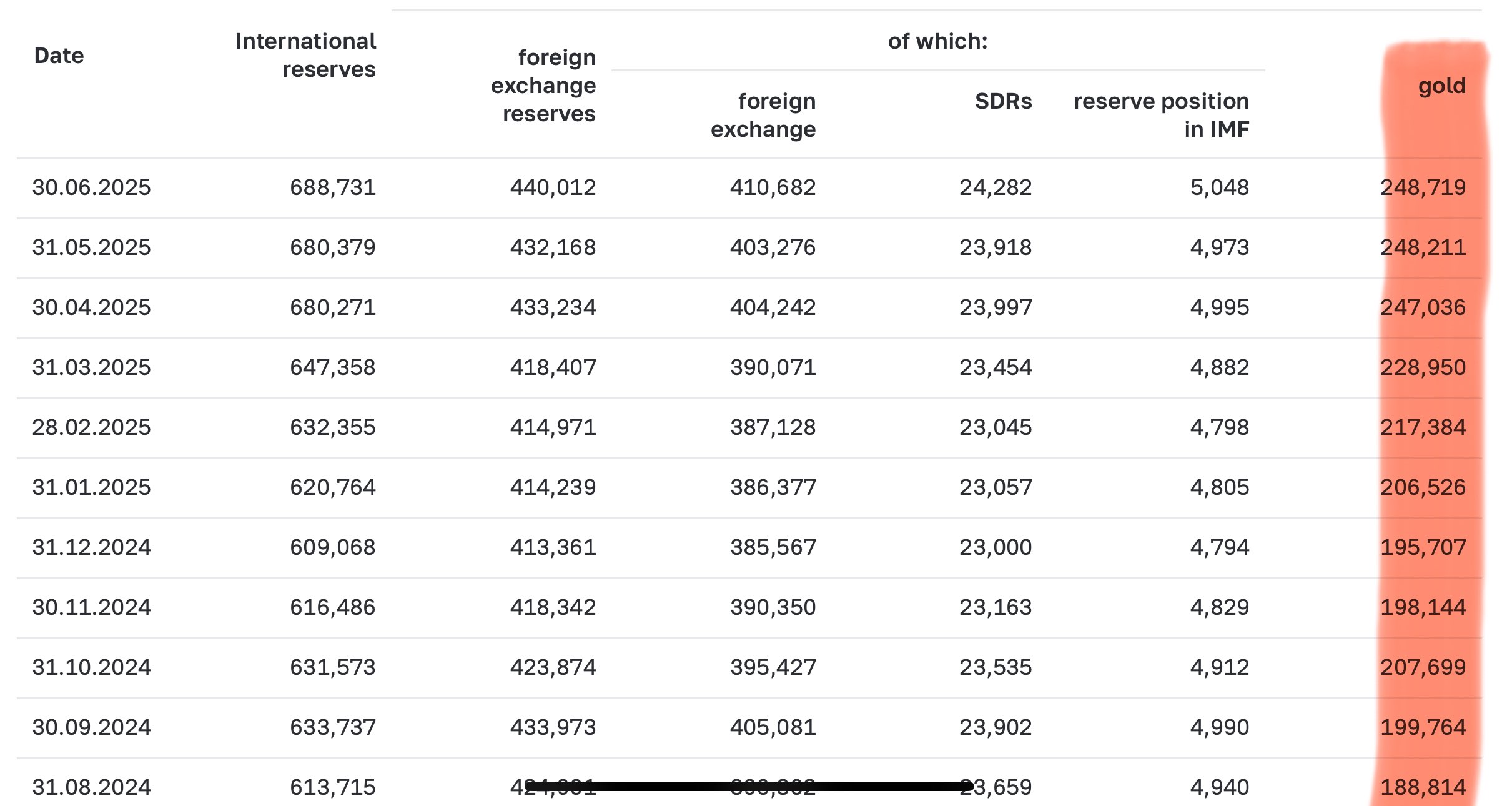

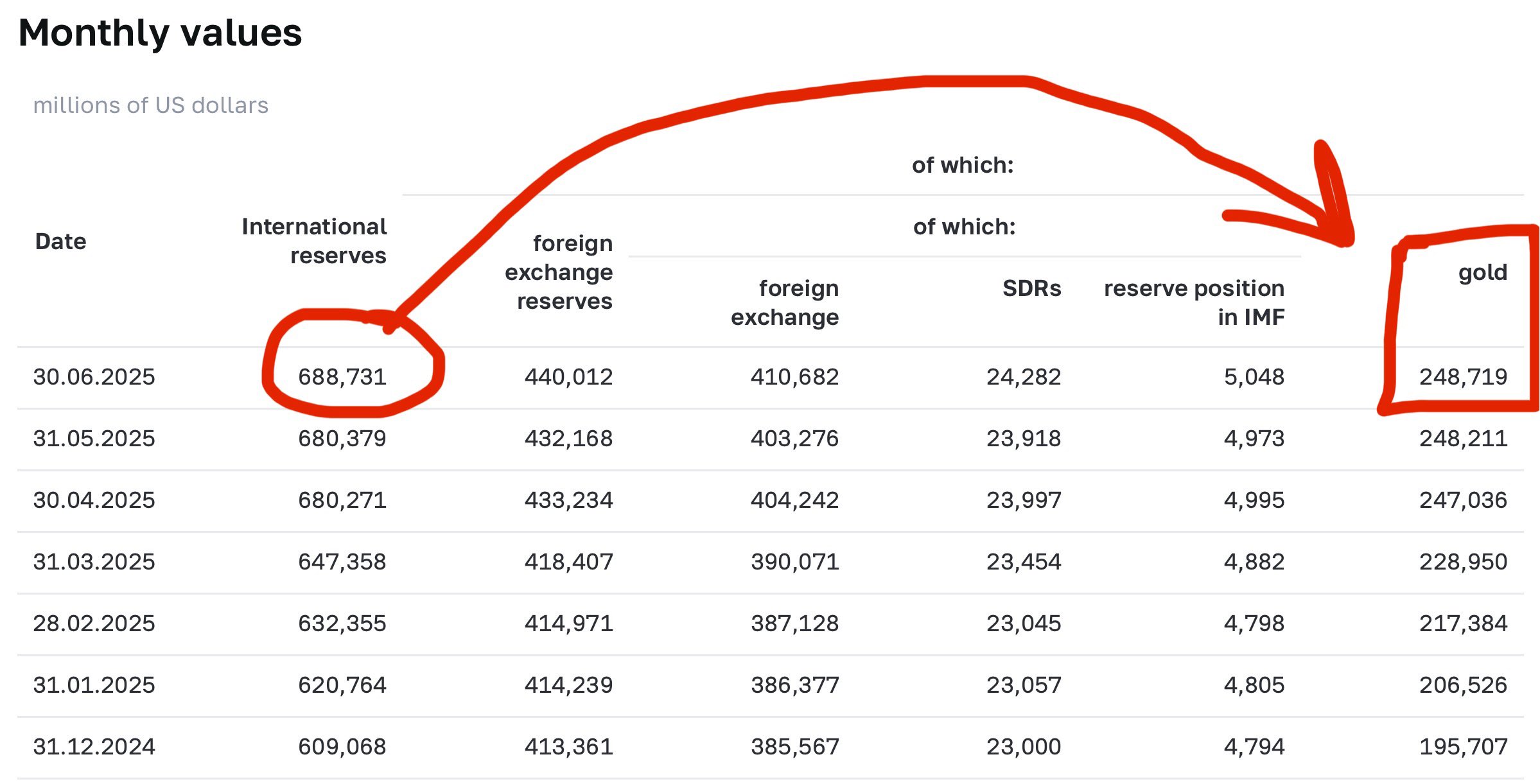

so did Russia really buy more gold?

yes! despite CBR's gold reserves remaining unchanged - Russia's NWF has increased its gold reserves

Russia's National Wealth Fund interoperates with the Russian Central Bank, government deficits and the broader economy

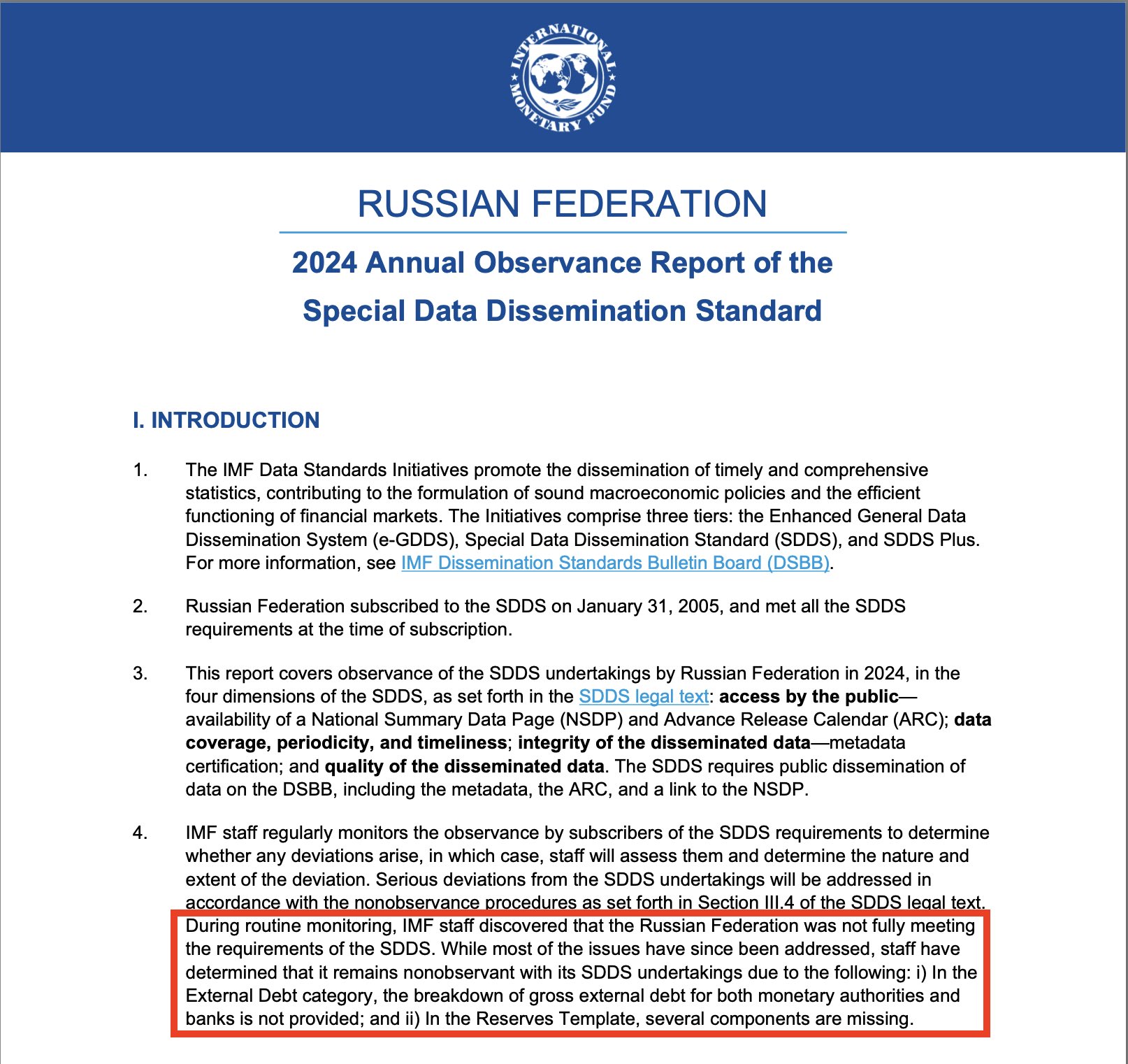

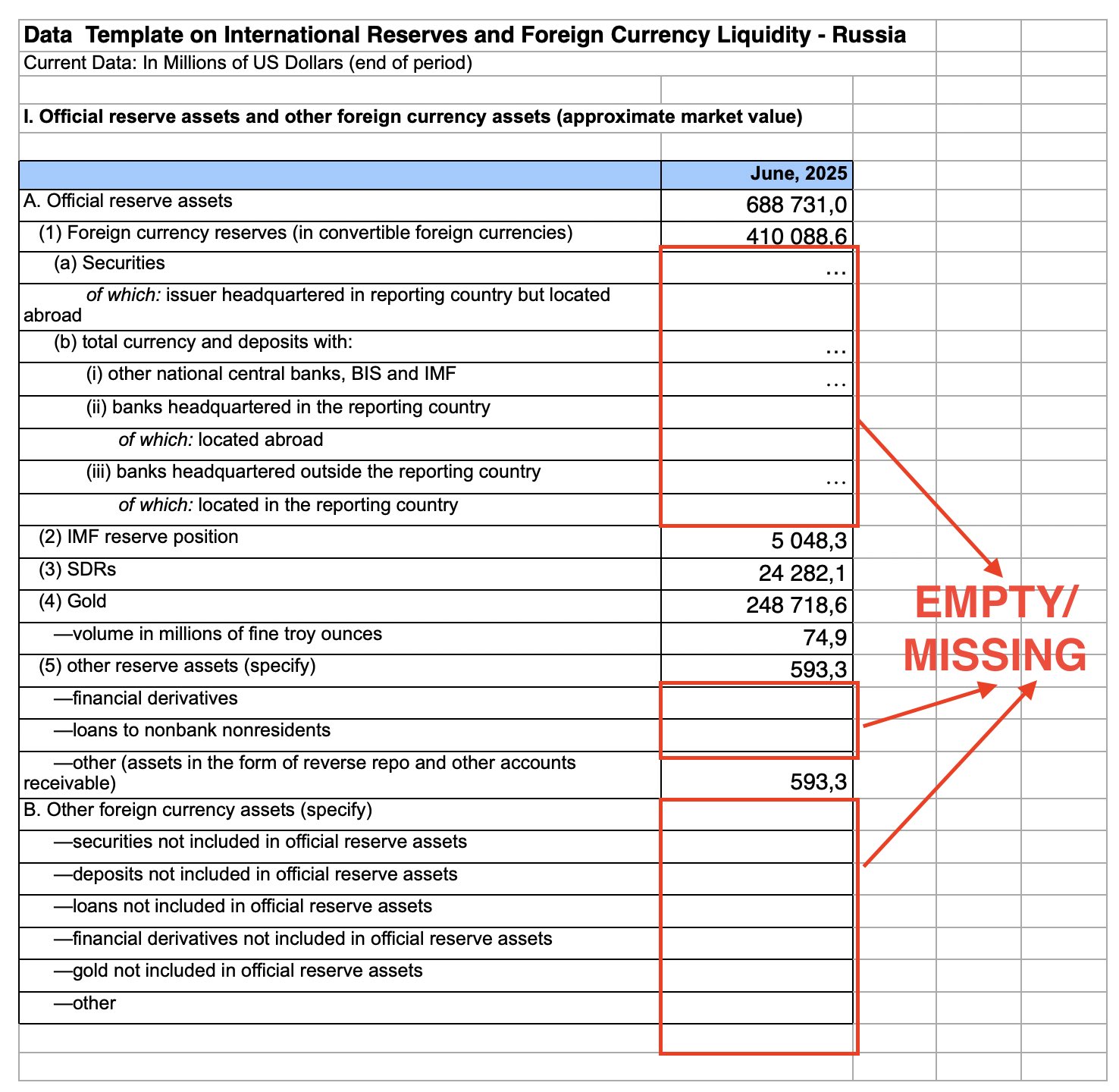

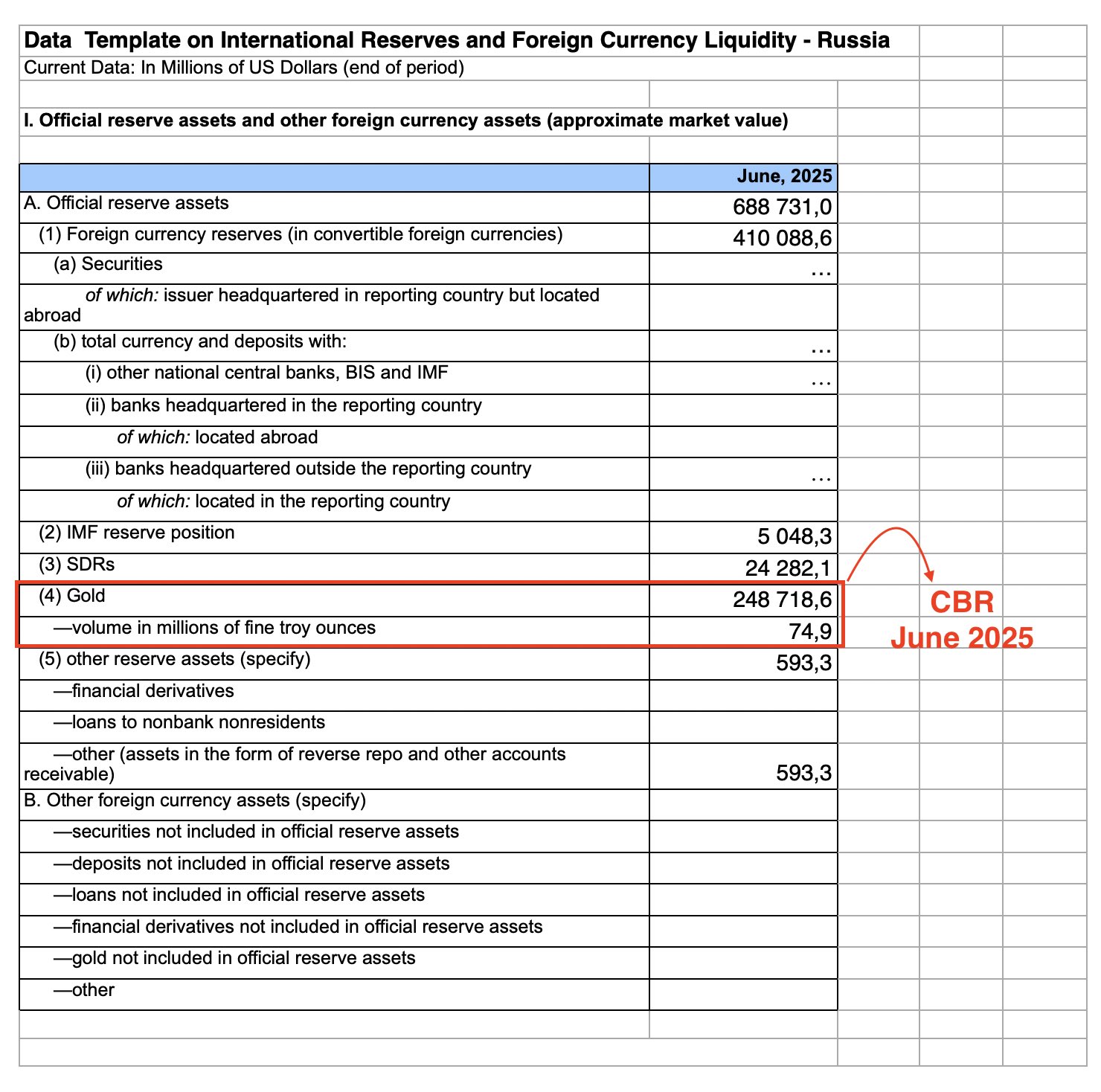

if you noticed - the IMF template reported by Russian Central Bank is missing entries

so they're actually supposed to report those values (or N/A - if it doesn't apply), but since the 2022 sanctions they have concealed some of the values

a clarification: the table is CBR's gold holdings in USD - so the value goes up if price of gold goes up and gold stock remains at least unchanged

troy ounce holdings are released in an IMF-templated PDF report, but with a lag

CBR's latest data is 79.4 M troy ounces of gold

further deprecation of USD against Ruble

now back to July 4th 2025 levels

5 days ago I wrote that USD/RUB rate will fall. 5 days later it's down ≈2%

despite oil being down - gold is up

Ruble has hedge from multiple sides

both Russia & China increased their gold holdings since I wrote this 😄

indeed - central banks are continuing to buy the gold dips

if you've read my previous posts you know that gold is ≈36% of Russia's international reserves

this is taken straight from the Bank of Russia's balance sheet statement

100% of it is stored in Russia, thus no counterparty risk

critical component of Ruble's strength

🇺🇸🇷🇺 USD/RUB rate already fell to July 24th close, below 80

although it's also important to note that there are several factors at play - USD index is also down today

despite oil down - gold is up. this is about the monetary policy of Russia and their balance sheet structure

🇷🇺 oil up is GOOD news for Russia & Ruble

every surplus above $60/barrel of Urals oil increases FX reserves in NWF (Yuan or gold) - an interplay between MoF and CBR

exporters pay taxes in Ruble - so higher buying pressure

mark my words:

👉 you'll see USD/RUB exchange rate fall

🇷🇺 3 months of Ruble gains against USD erased in 5 days 😄

but also contextualize it with the overall increase in the US Dollar Index over the past 2 days

👋 hello, volatility

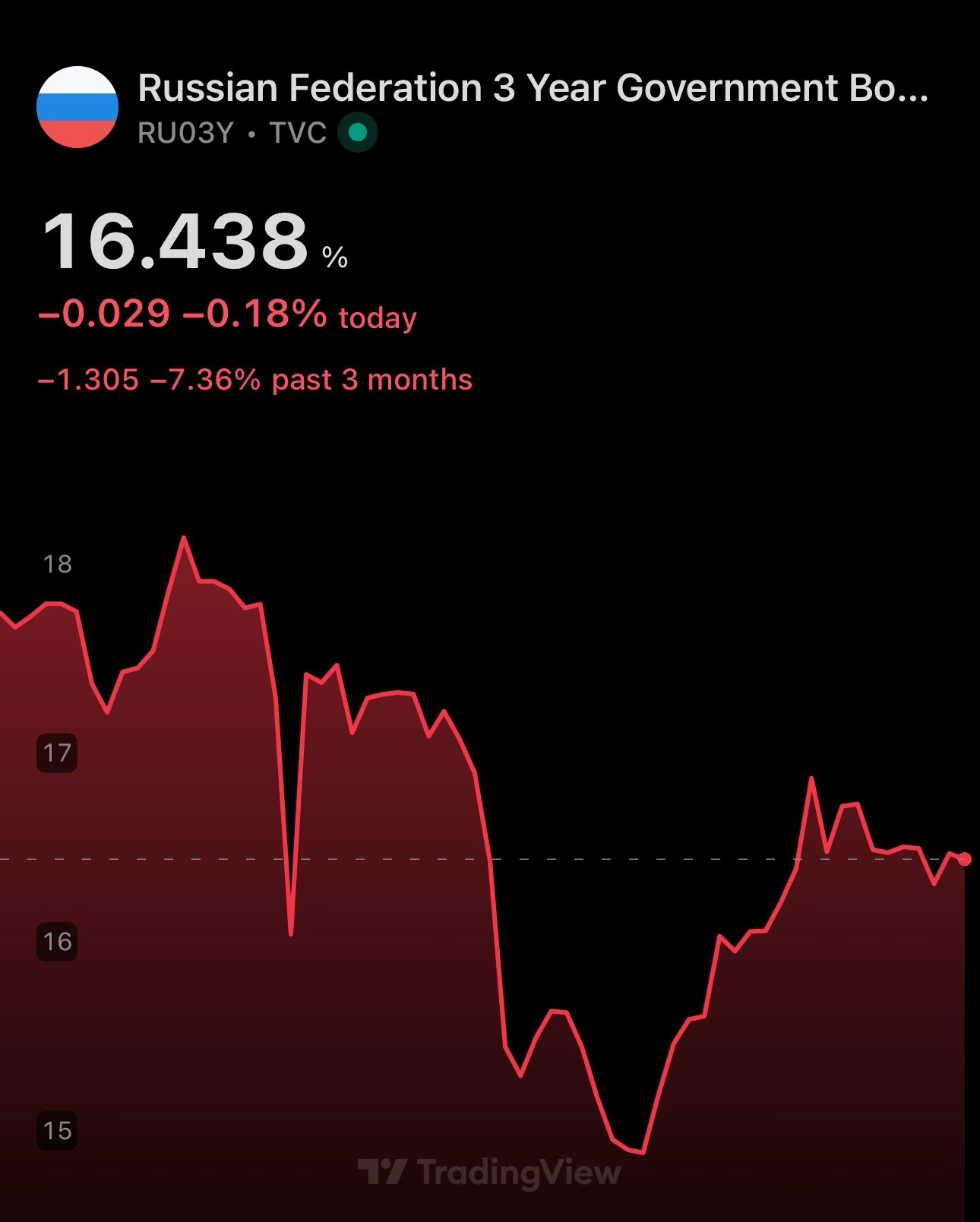

3 days ago the Russian Central Bank cut down the key interest rate by 200bp down to 18%

the only way from here is further down - and if you look at the Russian bond yields that's exactly what they're telling

but honestly you don't need advanced quant to reach this conclusion 😂

🇷🇺 and indeed Bank of Russia cuts interest rates down to 20%

3 months ago I wrote about how the Russian bond market was pricing in those cuts

a month ago the prediction materialized ✅

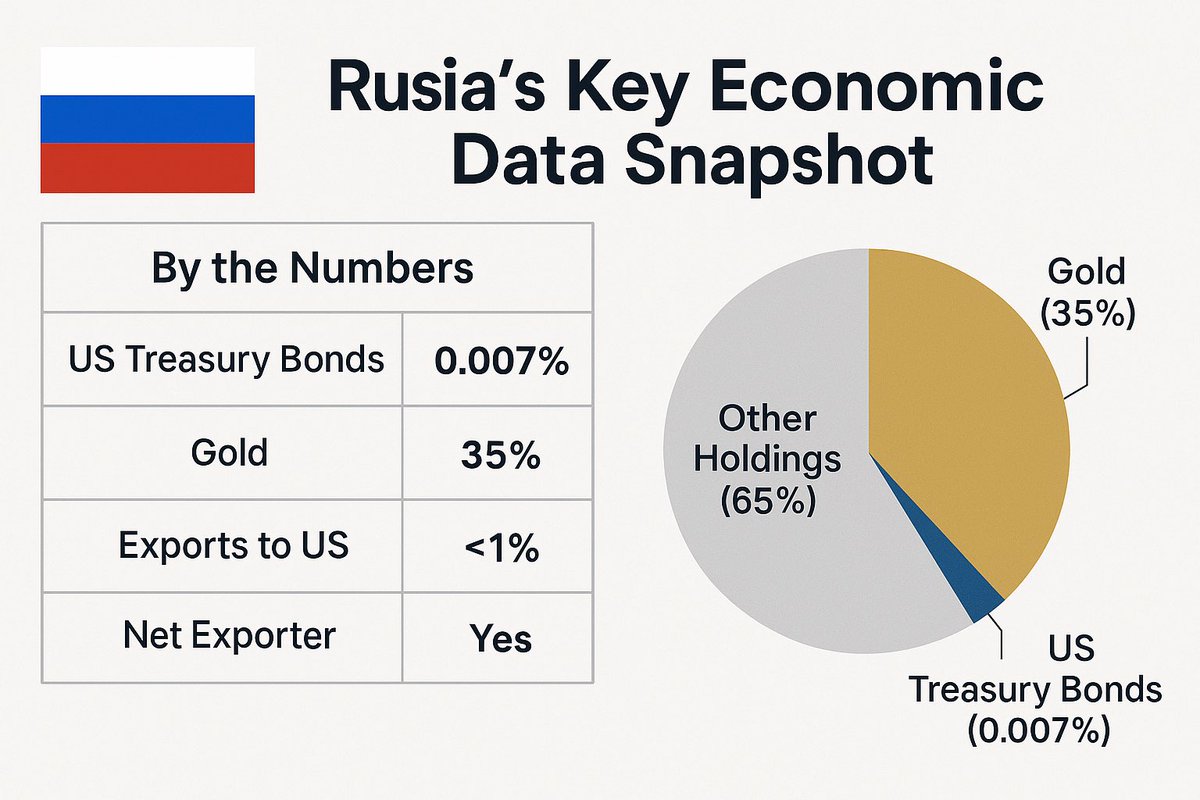

a reminder that Russia doesn't trade with USA anymore 🇺🇸🤝🇷🇺

so it's not clear what 100% or 9999% tariffs on Russia will achieve

Russia's been offloading US securities for gold since 2018

Russia's exports to the US are less than 1% of the total