Silver price, volatility & gold ratio analysis

Short-form views on silver price moves, gold/silver ratio shifts and industrial demand trends.

and there you go 😄

once the short-term suport line was broken, silver's price fell down to another support

(silver) a breakdown below the bottom orange line will likely push the price further down, at least to ≈$43.35

so now, watch the orange trend line/triangle 👀

1h candles

silver and gold move differently, which why I generally refrain from referring to these commodities in conjunction, even though a lot of what I write about gold also applies to silver

both, gold and silver are currently great investments, but they exhibit a different risk profile

silver is a lot more volatile, meaning its moves are amplified in both directions

if you’re planning to hold in the treasury/balance sheet it can play a big difference, as you’ll generally be less liquid with your silver holdings - in the sense that you may find it in a significant pullback from a previous high if you try to liquidate it ad-hoc, especially short-term

silver's key short-term trend support is the green light from the chart

we can only talk about potential pullbacks or consolidations once it's broken

watch it closely 👀

expect silver to correct down by ≈18%

if the correction starts at the current level, that would bring the price down to ≈$36.22

but you may want to place orders above if you want to enter, somewhere from $37.5

silver's current move is already up >25%. it's better to have a pullback somewhere around the current level

it can move up even further, extending the total move to ≈60%, but then you’ll get a larger and longer lasting pull back

when silver moves in smaller increments, it has shorter-lasting consolidations/pullbacks. so this is what i mean by "better"

≈$39.6 is a great area to long silver during the pullback

similar to gold, there is also a strong support below, which will further fuel buying pressure

adapt the exact price to your ticker/derivative. chart below shows how to identify it (dashed line)

in addition to being a store of value, gold is also acting as an investment

it's up ≈40% YTD

this is gold catching up to inflation and accumulated leverage

the financial system infrastructure, including monetary policies of the central banks are correlated

they're heavily exposed to the same set of assets - a lot of which are USD-denominated

this is of course extremely pro-cyclical

quick update on gold:

everything according to the plan - the thesis remains valid. now just wait and let the price action unfold 😄

use these trend lines as a guide

gold tariffs put further upside pressure for gold towards a new all time high on spot

this is in addition to the global monetary, geopolitical and fiscal positive price pressures

a significant part of the markets will be closed for the weekend. there could be a gap on reopen

you can see how accurately gold price has been respecting the trend lines and channels you've seen in my graphs for months now 😄

gold tariffs ping-pong introduced volatility, but like i wrote in my other posts - its upside price pressure

a new all time-high will arrive

new all time high for gold is near 😄

i wrote a thread about the rumored tariffs on gold and what that means for the gold price

also what's coming next

you can read the thread here ⬇️

https://illya.sh/threads/@1754662712-1.html

the tariffs are not on all gold imports - just on a specific configuration - 100oz/1kg bars

this alone won't skyrocket the price of gold, but it adds to the existing breakout pressure

tariffs on gold decentivize gold imports

higher import tax is a disincentive. not sure what' the benefit to having less gold come into US

there's plenty of buyers in Asia who will happily take it. soon you will see more central banks expanding their balance sheets with gold

when you see gold hitting a new all time high very soon - just remember that it wasn't caused by a single event

gold has a growing buying pressure for monetary, geopolitical and fiscal reasons

I've written about it in depth, so search through my post history if interested

it's not only futures of course - the broader physical supply chain of gold is also affected

the more imminent impact is on users of 1kg/100oz gold bars. in the future markets the effect is much more visible and quantifiable - so it will start the price movement from there

🚀 silver price reaching 14 year ATHs

🍷 adding this to list of my predictions that aged like fine wine

the upside price action won't stop here. i explained the reasons for it and what comes next in my previous posts

stay tuned 📻

silver was another spot-on prediction ✅

2.5 months later the price is up ≈25%

silver's price uptrend will continue

when silver's price increase is in the magnitude of risky assets - it's clearly telling you something

listen to it 🦻

💾⏰ Just like with my post about the price of gold a few months ago - feel free to save & set a reminder for this one

The prediction will be correct once again

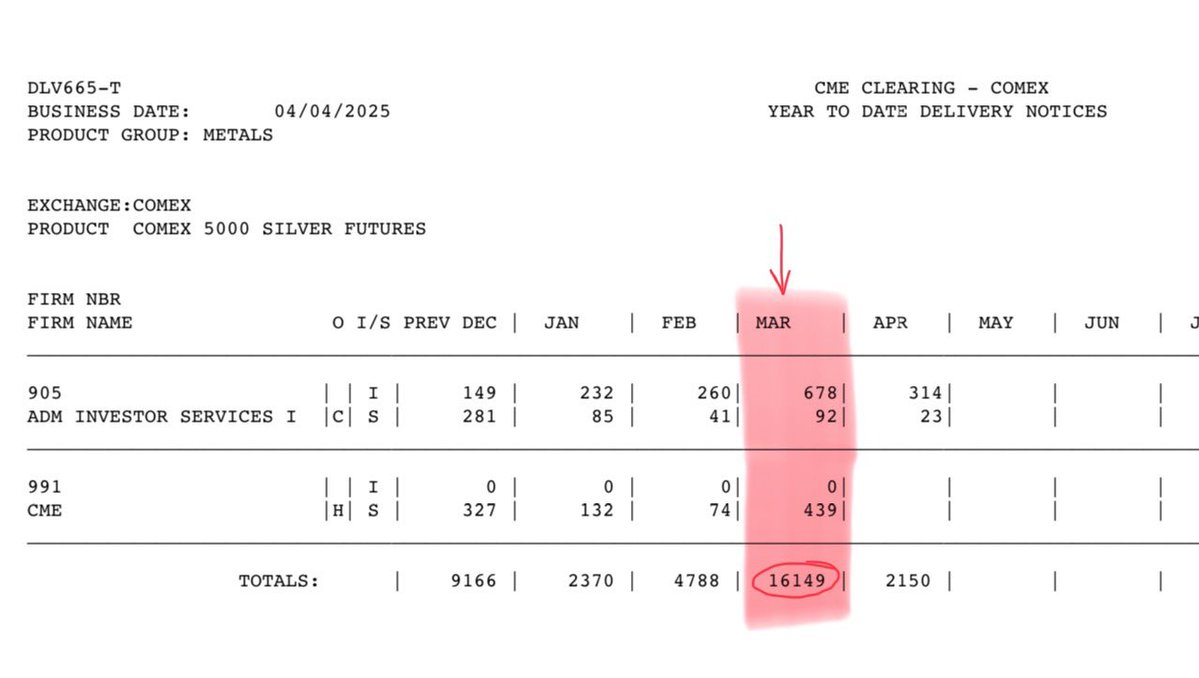

Silver Physcial Delivery Demand HIGH

CME's COMEX & NYMEX Metal Delivery Notices show a MASSIVE demand for physical silver

16.1K futures contract for delivery/physical settlement, up x3 from a year ago

A.K.A. tariffs effect on silver

Investors are HOARDING silver

Silver back to August 2020 price

After a tariffs-induced pullback of 15% today, silver is now at start of COVID prices

So much inflation that still isn't priced in

It will recover. And a lot!

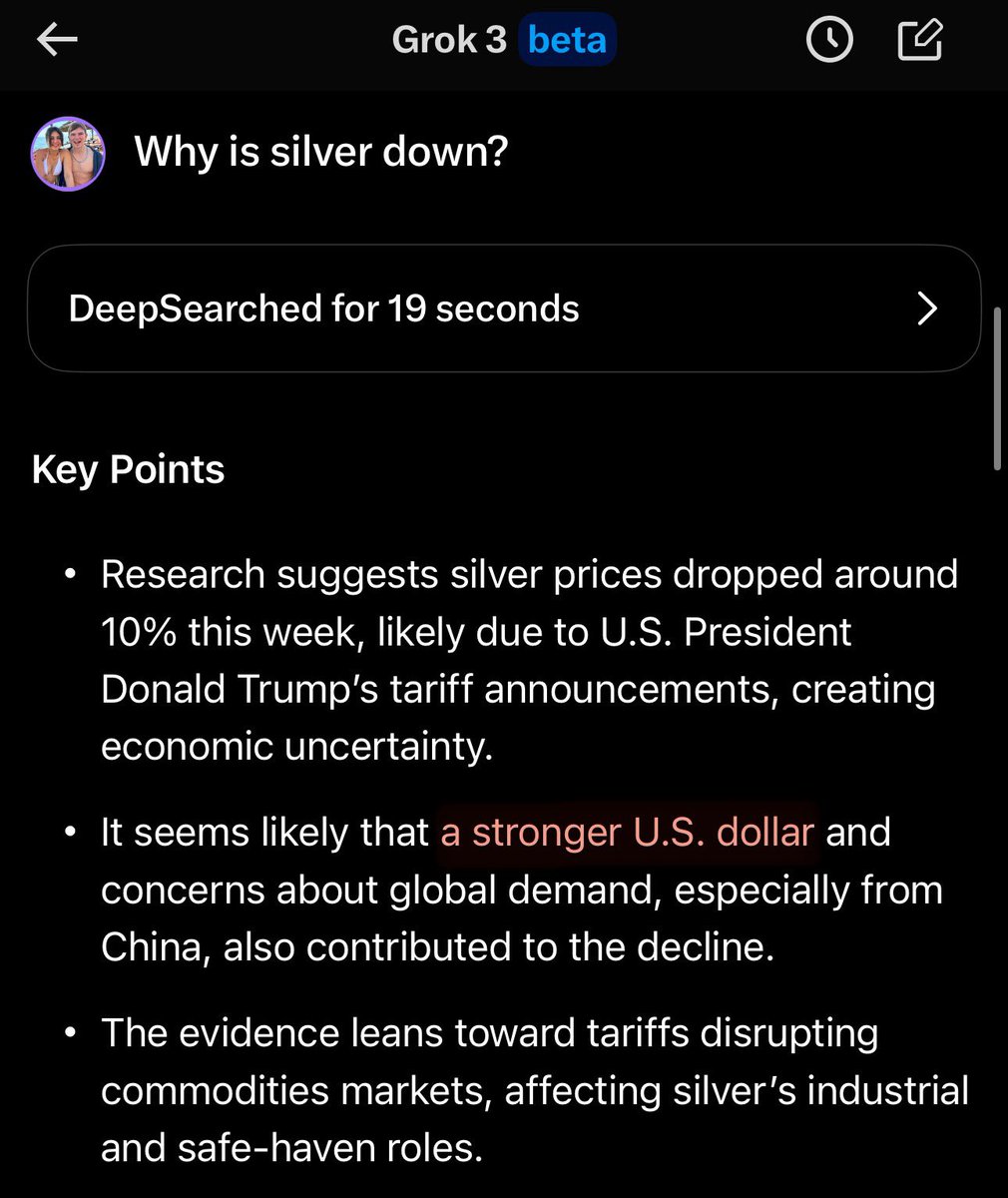

🤖 I asked Grok 3 why silver is down today

DeepSearch said that this is likely due to a stronger USD

But #DXY is also down 😂