Silver price, volatility & gold ratio analysis

Short-form views on silver price moves, gold/silver ratio shifts and industrial demand trends.

1 month ago I wrote that silver could extend its current move to ≈60% from the ≈$34.5 price level

silver topped exactly there at ≈$54.5

now my next notes:

treat the pullback and any price consolidation action as a buying opportunity

during the next 6 months long positions entered in this area will be in profit. likely sooner, but 180 days provides a higher confidence timeline

silver's current move is already up >25%. it's better to have a pullback somewhere around the current level

it can move up even further, extending the total move to ≈60%, but then you’ll get a larger and longer lasting pull back

when silver moves in smaller increments, it has shorter-lasting consolidations/pullbacks. so this is what i mean by "better"

the promised gold & silver sale is here

if you didn't set your limit buy orders for silver, gold & miners - it's not too late yet

currently in late-September price ranges for many. it's also a good idea to position some buy targets below the current price levels

keep watching the gold price - it's the main driver for all

FOMC meeting is next week

⏰ don't forget to setup your buy limit orders for gold, silver and their miners

⏰ don't forget to setup your buy limit orders for gold, silver and their miners

hope you enjoyed Friday's gold, silver & miners sell-off

now await for the markets to re-open

it begins in a few hours 👀

now crypto twitter seems to think that gold & silver have topped 😂

i don't think CT understands what gold & silver are

we are approaching a local top for silver and gold according to my market vibe meter

usually i'd write a longer post with an explanation & technicals, but today i'm writing of off vibes 😄

my twitter/x feed has been filled with so much euphoria regarding silver & gold that it starts to resemble those accounts which constantly promote Bitcoin

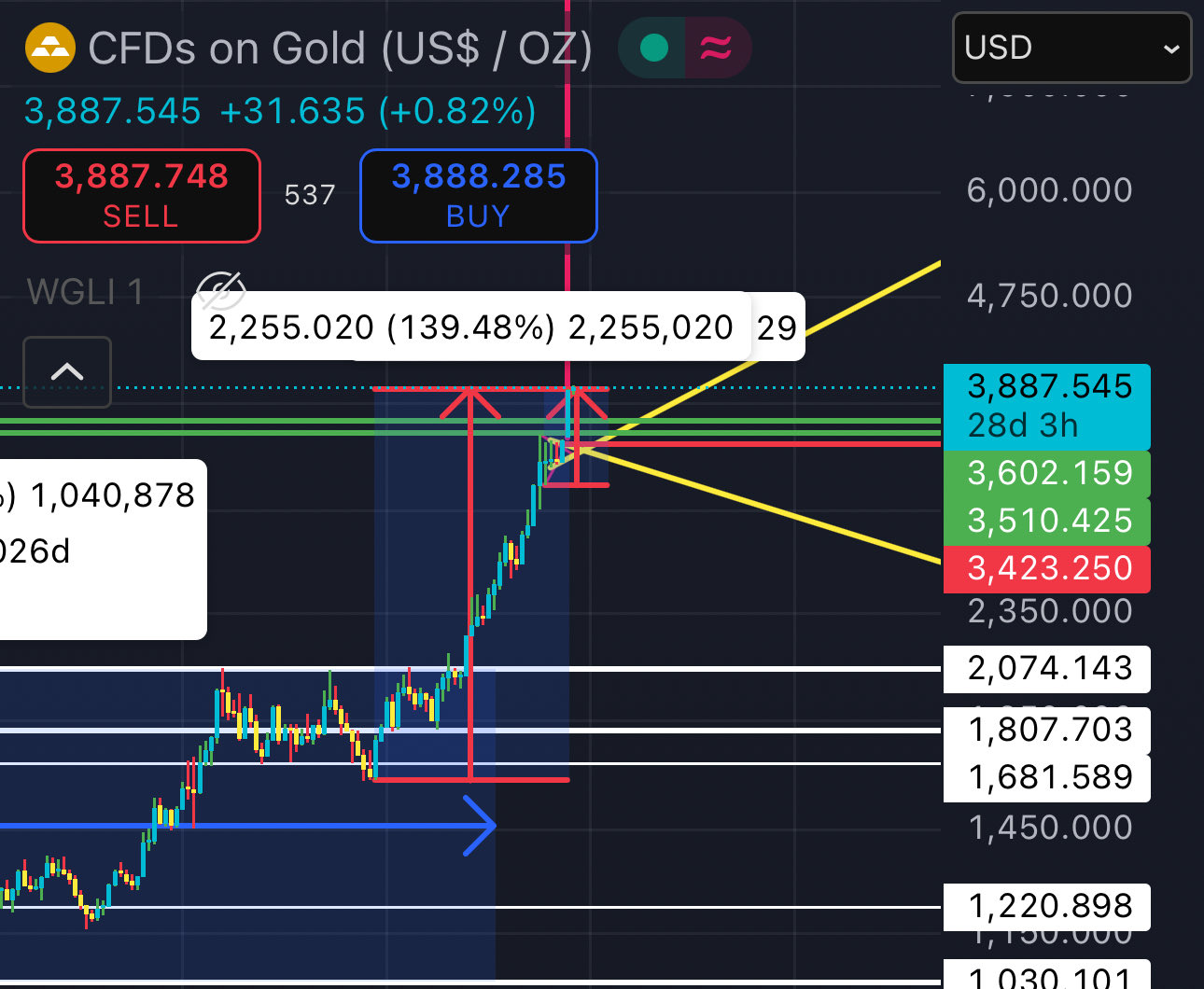

you also have to contextualize how extended gold and silver's moves have been. the graph shows monthly candles

this isn't a bearish post on gold though - still expecting $4000/oz in November 2025 😄

no, "The West" is not manipulating gold and silver prices

silver and gold had retracements many times before, but I guess when it falls on Chinese holidays it becomes "western manipulation"?

≈32% of global gold demand in 2025 comes from China (estimate for jewelry + bar & coin). China is a major buyer of gold - so a lot of demand there

a more reasonable explanation is a demand dip, due to the holiday in PRC. also the US government shutdown. although I agree the idea of a magic red button saying DUMP GOLD located somewhere in the west is more exciting 😄

it's also not clear what would be the purpose of manipulating the price of gold down, as that would be benefiting China - they can buy it cheaper!

PBoC has been buying gold for years, and they will continue to do so. PBoC doesn't announce targets publicly - and they're flexible on their purchases, so again, lowering the gold price would likely allow them to buy it at a cheaper price