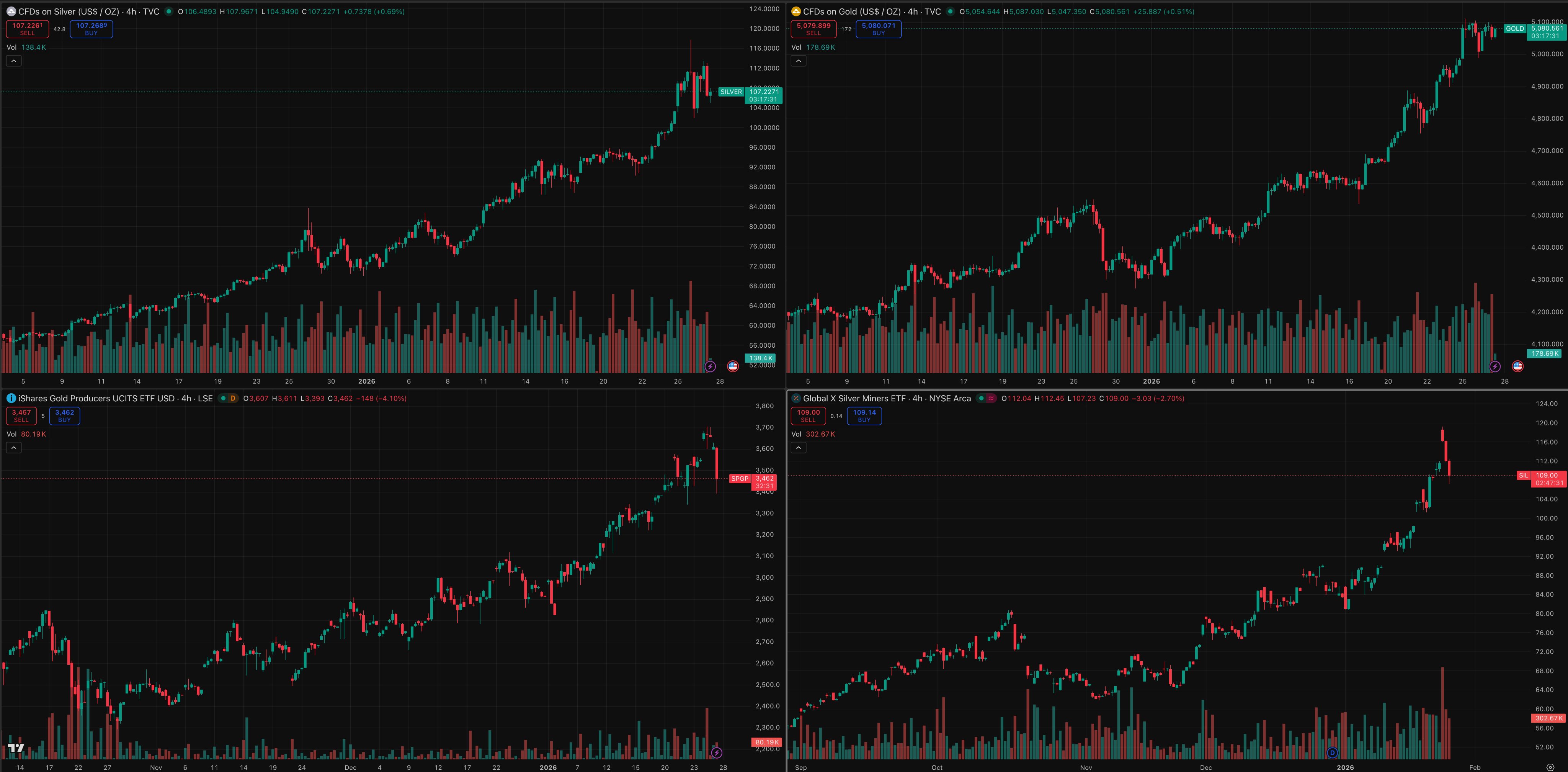

Silver price, volatility & gold ratio analysis

Short-form views on silver price moves, gold/silver ratio shifts and industrial demand trends.

As I've explained in my prior posts: the commodities rally isn't over

Gold is back above $5000

Silver is back above $80

Copper is back above $6

Prices below the above remain a buying opportunity

Enjoy!

Copper extends its gains to ≈9% on the day, and its appreciating more than gold and silver

A week ago I wrote an article explaining why this upwards move in copper (and copper miners!) was imminent, from both fundamental and technical standpoints.

And don't be alarmed by near-term volatility. Keep the macro picture in mind under the lens of liquidity inflow into the commodity sector. I've explained this extensively in my articles. You can read them all on my website for free (there is also an RSS feed you can subscribe to).

A week ago I wrote an article explaining why copper is a great investment in 2026

Today, copper is up ≈5%, hitting a new all time high

The article covers copper's technicals and fundamentals. You can read it here:

https://illya.sh/threads/copper-is-a-great-investment-in-2026-technicals-fundamentals

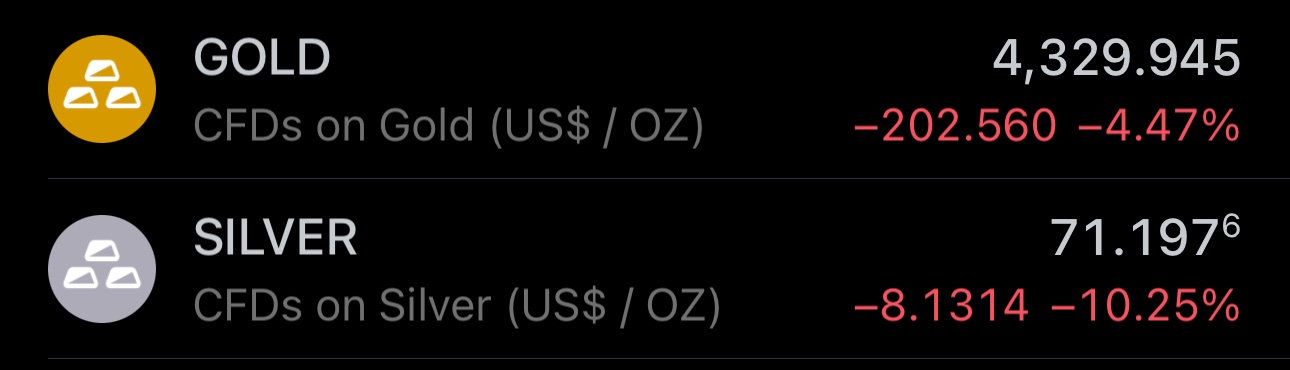

Today's Commodity Miners Sell-Off Is A Buying Opportunity

I've made numerous such calls in the past, and they were correct 100% of the time. Today, I'm making one of such calls again.

Gold, silver and copper miners are down today, with indices and individual large caps falling by as much as ≈8%, despite the underlying metals remaining in the green. This is exactly the situation where you can leverage the increased volatility in the mining sector to increase your exposure to the underlying metals during an uptrend.

I expect the prices of gold and silver miners indices to increase by ≈30% from current levels within roughly 10 trading weeks from now. It may happen sooner than though - pay close attention to the price action.

It's also possible for the price to dip lower than the current levels before the upwards move described above materializes. This mainly depends on the price action of the precious and industrial metals in the next few weeks, but I don't believe that either one of them has topped for the cycle, thus uptrend resumption is imminent.

I've written several articles explaining why commodities and commodity miners are a great investment for 2026. I suggest you to read them if you haven't done so yet.

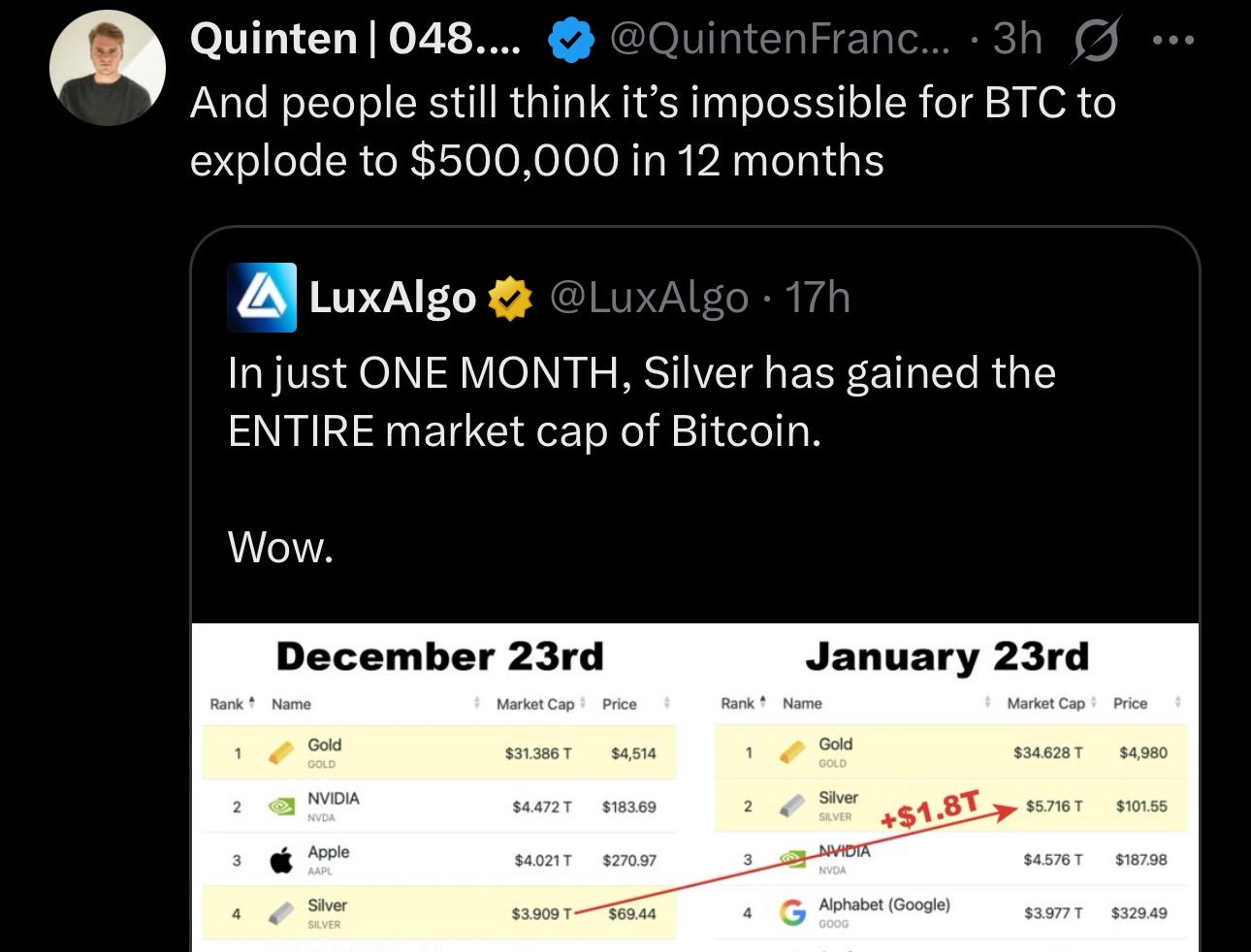

And people still think that silver and Bitcoin are within the same category of assets

(hint: they're not)

Silver Miners Are Up ≈12% Since My Recommendation From 4 Days Ago

On January 18th 2026 I wrote an article explaining why silver mining stocks are undervalued, and how you should expect a price increase/breakout in the sector soon. 4 days after I published the article, the silver miners index is up more than 10%, and some individual large-cap names like Hecla Mining (whom I use for my longer-term silver miners proxy) are up more than 20%.

You can read the article on silver miners outlook for 2026 here: https://illya.sh/threads/silver-mining-stocks-are-undervalued-in-2026

Silver miners are up another ≈4% today, and more than 10% in the last 5 days 😄

But this is unsurprising to you if you read my articles from a few days ago on miner/producer equity prices and why they present a great investing opportunity for this year

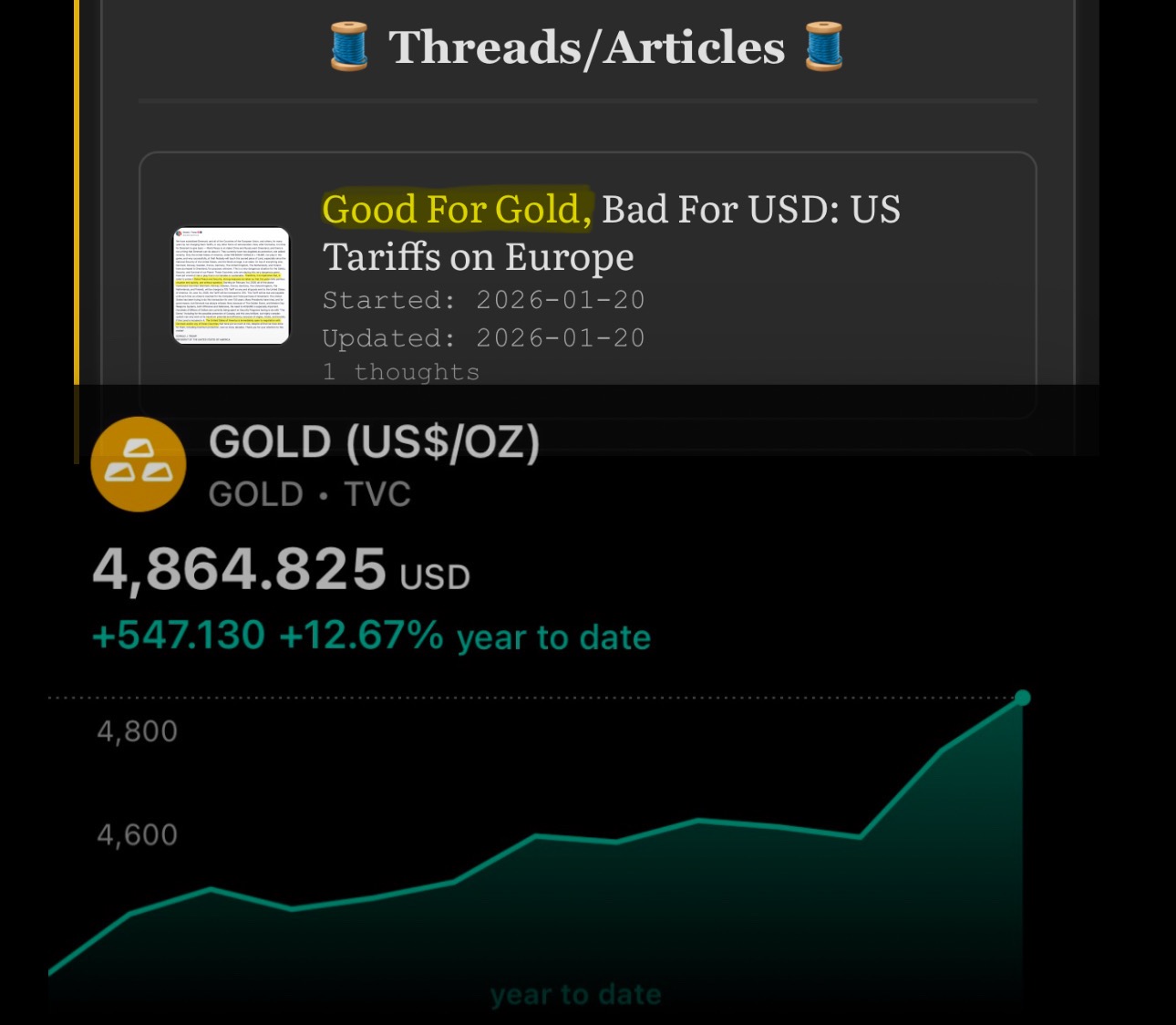

Yesterday I wrote an article explaining why US tariffs on Europe mean more expensive gold and cheaper US dollar

Today, gold hit a new all time high & you should expect this trend to continue

If you haven't read the article yet, you can do it here: https://illya.sh/threads/good-for-gold-bad-for-usd-us-tariffs-on-europe

Yesterday, I explained why silver mining stocks are undervalued in 2026

Today, silver miners are up almost 6% across major FX currencies 😄

Of course, it's to early to tell whether my thesis is correct, but I'll throw in another prediction: this upward price movement in miners to continue.

Silver Mining Stocks Are Undervalued In 2026

*Below is my 5-minute analysis on silver miners equity prices for 2026

The price ratio of silver miners to silver is at some of its lowest levels in history, roughly at the same values as it was in the 2000’s. The ratio is currently sitting on a support from 2014-2015 inside of a multi-year upward price channel. Alongside the macroeconomic and geopolitical fundamentals, this setup’s potential upside gain justifies the limited downside risk. Unless silver experiences a large medium-to-longterm pullback, silver mining equity prices are set to increase against the price of silver. For this to happen, there are 3 high-level scenarios:

1️⃣ Silver price remains above ≈$88: silver miners appreciate more than silver

2️⃣ Silver price remains above ≈$83: silver falls in price, miners fall less or increase

3️⃣ Silver price remains above ≈$70: silver falls in price, miners fall less (more likely) or increase

Given the increasing demand for physical silver combined with currency debasement driven by refinancing needs, I don’t believe silver’s spot price will experience a pullback to lower than the ≈$70 level in 2026. Pullbacks below ≈$70 are more likely to trigger a larger sell-off in silver miners, potentially even pushing the ratio further down, meaning that silver mining stocks fall in price more than silver.

Silver producers/miners, royalty and streamers can be a great source of diversification and even "hedging" of your silver investments without ever leaving the commodities sector. You can further diversify your exposure to other metals by acquiring fund units and/or equities in producers, royalty and streamers that focus on more than two metals (e.g. there are companies mining gold, silver and copper).

A few days ago, I wrote a post about how gold miner prices are set to breakout. But silver is not gold. Silver miners will be more volatile than gold miners, but given a positive correlation between gold and silver prices, they will tend to follow the gold miner’s direction. After all, most gold mining companies mine silver and vice-versa (silver is often mined as a byproduct of other metals like gold, copper, lead and zinc). The attached chart shows the ratio between the price of Hecla Mining and Pan American Silver, so it doesn’t include all silver miners, but you’ll find a similar structure in silver equity-based indices against the spot/futures price of the metal.

In the longer timespan (e.g. 3+ years), miners may underperform the underlying metal. This analysis is written with a focus on the current price levels with a timeframe of 1 year from now. Given that this article was written in January 2026, you can consider this as a guide for the remainder of 2026. Physical silver is not the same as silver miners. The mining sector is exposed to an array of risks distinct from the metal, with the highest one currently being the geopolitical risk in the form of armed conflict (destruction, supply chain disruption) and legal changes (sanctions, tariffs, export/import limits). Thus, even if the price of the physical metal goes up, miners price can collapse. The same risks can put upwards pressure on the metal and downward pressure on the miners simultaneously. I don't believe these risks will materialize sufficiently for miners by the end of 2026, and given the upside price pressure on commodities, miners will also ride that price wave up.

So silver didn't top for the cycle, 2011 didn't repeat and instead less than 2 weeks later it hit another all time high

Imagine my surprise 😄

More all time highs are coming and, as I've written before, you can safely ignore any calls for long-term top.

You can't find a top on chart without understanding what drives the price on that chart in the first place. Luckily for you - I've written a lot of explanations on that when it comes to gold and silver

The same X accounts that were telling you to buy the Bitcoin dip on October 1st 2025, are now telling you to sell Silver on December 31st 2025

Since October 1st:

➖Bitcoin down ≈40%

➖Silver up ≈80%

Their silver top calls will age as well, as the Bitcoin dip calls earlier this year 😄

The markets gave you an early 2026 present in the form of a systemic commodity price correction - and it's up to you to take it or not

Happy 2026 🥳

Silver didn't even break its 4 hour trend support on the pullback and many are already calling that it has topped for the cycle 😂

Silver is up ≈193% in 2025, but it only takes a ≈16% pullback for large finance accounts on X to suggest it has topped 😄

No, it's not the top for Silver yet and it's not hitting $50 this week

The current pullback in the price of silver & silver miners is a buying opportunity

Today's gold, silver and their miners sell-off is a buying opportunity

Treat it as an early new year's gift for 2026 🥳

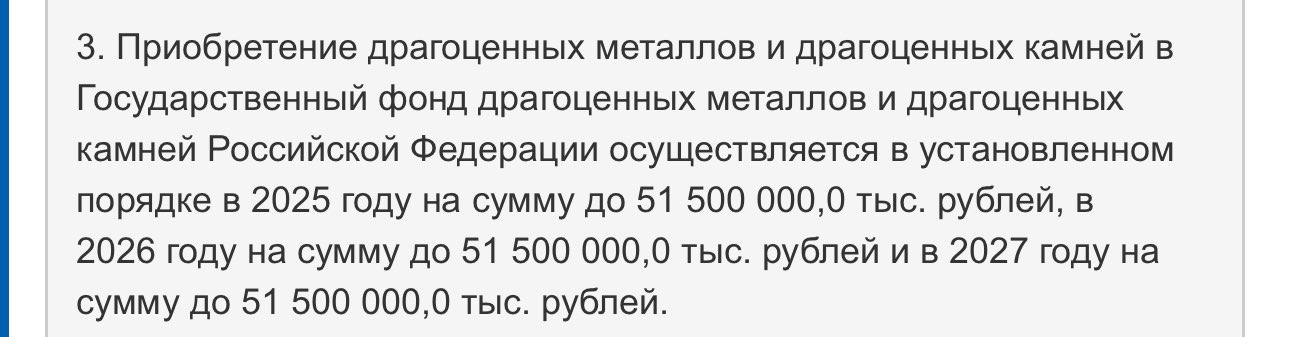

Russia will buy Silver as a strategic reserve until 2027

I'm not speculating on anything, this comes directly from the Russian legislation, namely the Federal Law № 419-ФЗ (in Russian/cyrilic: Федеральный закон от 30 ноября 2024 г. № 419-ФЗ) whose budget tables for 2025–2027 allocate ≈51.5 billion rubles (≈$640M) per year as budget for the "acquisition of state reserves of precious metals and precious stones".

Silver falls explicitly under the definition of "precious metals". More specifically, under Russian framework law № 41-ФЗ the term "precious metals" ("драгоценные металлы") is explicitly defined as gold, silver, platinum and the metals of the platinum group.

In addition to the above, in the official explanatory note (пояснительная записка) to the draft of Federal Law № 419-ФЗ the Russian Ministry of Finance explicitly states that the plan is to acquire refined gold, refined silver, refined platinum and refined palladium for strategic goals. More specifically, the aim is to increase the share of "highly liquid valuables" in the State Fund of Precious Metals and Precious Stones of the Russian Federation (Госфонд России).

As I've written earlier today, Silver will encounter corrections

These are all buying opportunities - as is the whole price range within current larger pullback. The price bottoms I written about remain unchanged. The uptrend will resume

The same is true for gold

My prediction on Silver's bottom was correct: ≈$43-45 ✅

The uptrend goes on. The price will encounter more corrections along the way, but the bottoms I described previously remain valid.

Like for gold, I would re-analyze critically all sources that were claiming that the bullrun for silver is over.

silver could pullback to ≈$40 before continuing its uptrend

this represents a ≈27% correction from the top

this is the lowest possible bottom for this move - it probably won't go this low. if it does, the move will happen fast, so have your buy limit orders ready. next week is FOMC interest rate decision. the Fed will cut the rates by another 25bps, and other things equal - it's positive price pressure for silver

if the price breaks below $47, it will likely fall closer to $45. expect a stronger support in the $43-45 area

overall, any prices in the vicinity of September 15th 2025 prices is a GREAT buying opportunity

* keep in mind the total 75 bps interest rate cut by the Fed this year is already in progress of being priced in - the market doesn't wait for the official announcement. this is one of the reasons why you had so much upside price volatility in the last month

My prediction on gold's bottom was correct: ≈$3900 ✅

You can direct anyone who is saying that gold and silver have topped to my posts.

If you think that gold and silver have topped - I'm really curious to hear your thesis. I've laid mine out extensively in prior writings.

My article on how all reserve currencies started on a gold and/or silver standard: https://illya.sh/threads/all-reserve-currencies-achieved-reserve-status-under-gold-or

My article on Gold vs Bitcoin, and how Bitcoin needs Gold, but Gold doesn't need Bitcoin: https://illya.sh/threads/bitcoin-needs-gold-gold-doesnt-need-bitcoin.html

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

gold and silver miners

don't forget to set your limit buy orders

maximum bottom is around early September 2025 prices

it's getting closer

silver could pullback to ≈$40 before continuing its uptrend

this represents a ≈27% correction from the top

this is the lowest possible bottom for this move - it probably won't go this low. if it does, the move will happen fast, so have your buy limit orders ready. next week is FOMC interest rate decision. the Fed will cut the rates by another 25bps, and other things equal - it's positive price pressure for silver

if the price breaks below $47, it will likely fall closer to $45. expect a stronger support in the $43-45 area

overall, any prices in the vicinity of September 15th 2025 prices is a GREAT buying opportunity

* keep in mind the total 75 bps interest rate cut by the Fed this year is already in progress of being priced in - the market doesn't wait for the official announcement. this is one of the reasons why you had so much upside price volatility in the last month

1 month ago I wrote that silver could extend its current move to ≈60% from the ≈$34.5 price level

silver topped exactly there at ≈$54.5

now my next notes:

treat the pullback and any price consolidation action as a buying opportunity

during the next 6 months long positions entered in this area will be in profit. likely sooner, but 180 days provides a higher confidence timeline