Tariffs, trade policy & market impact

Updates on tariff announcements, trade negotiations and their effects on FX, commodities and risk assets.

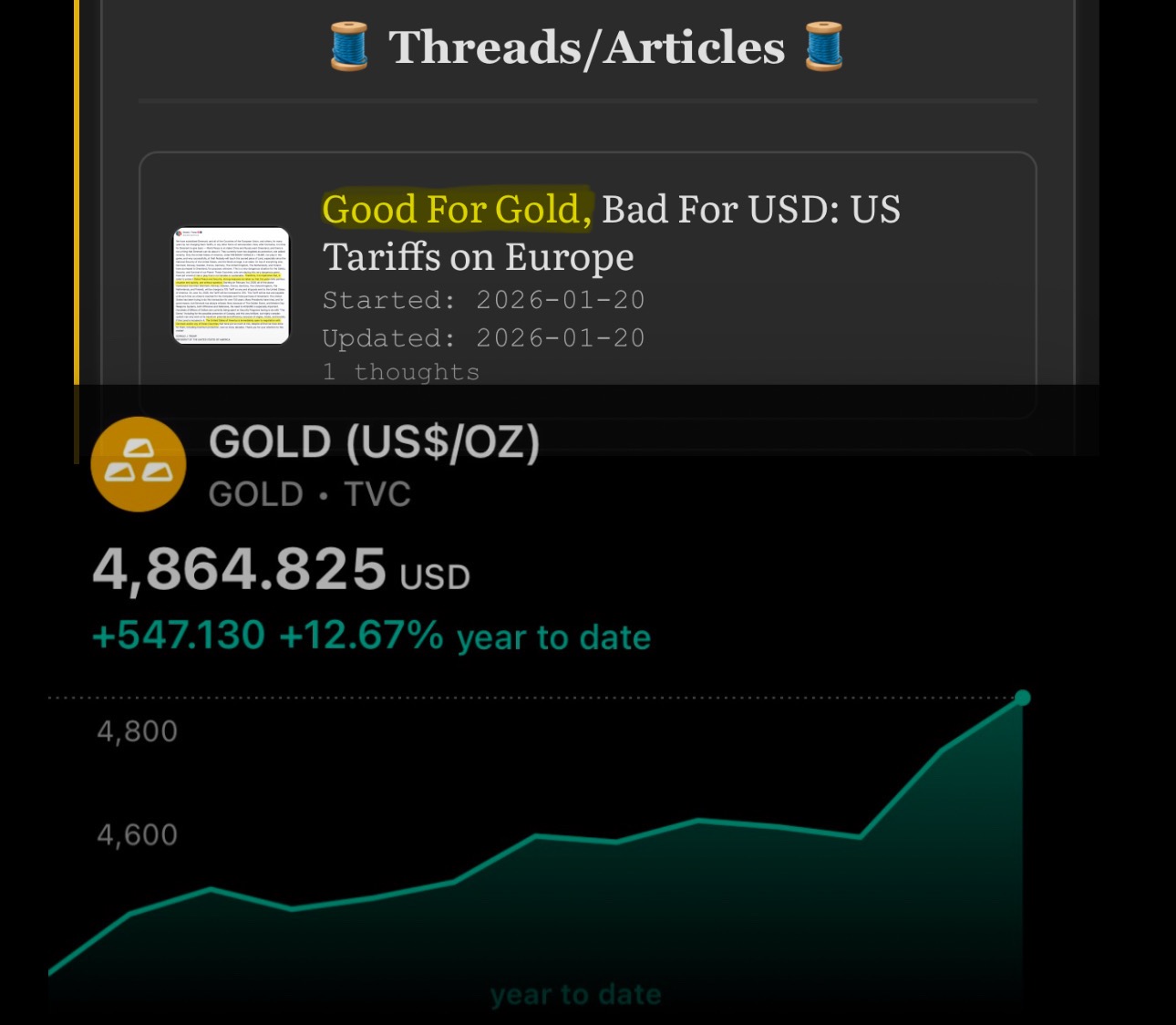

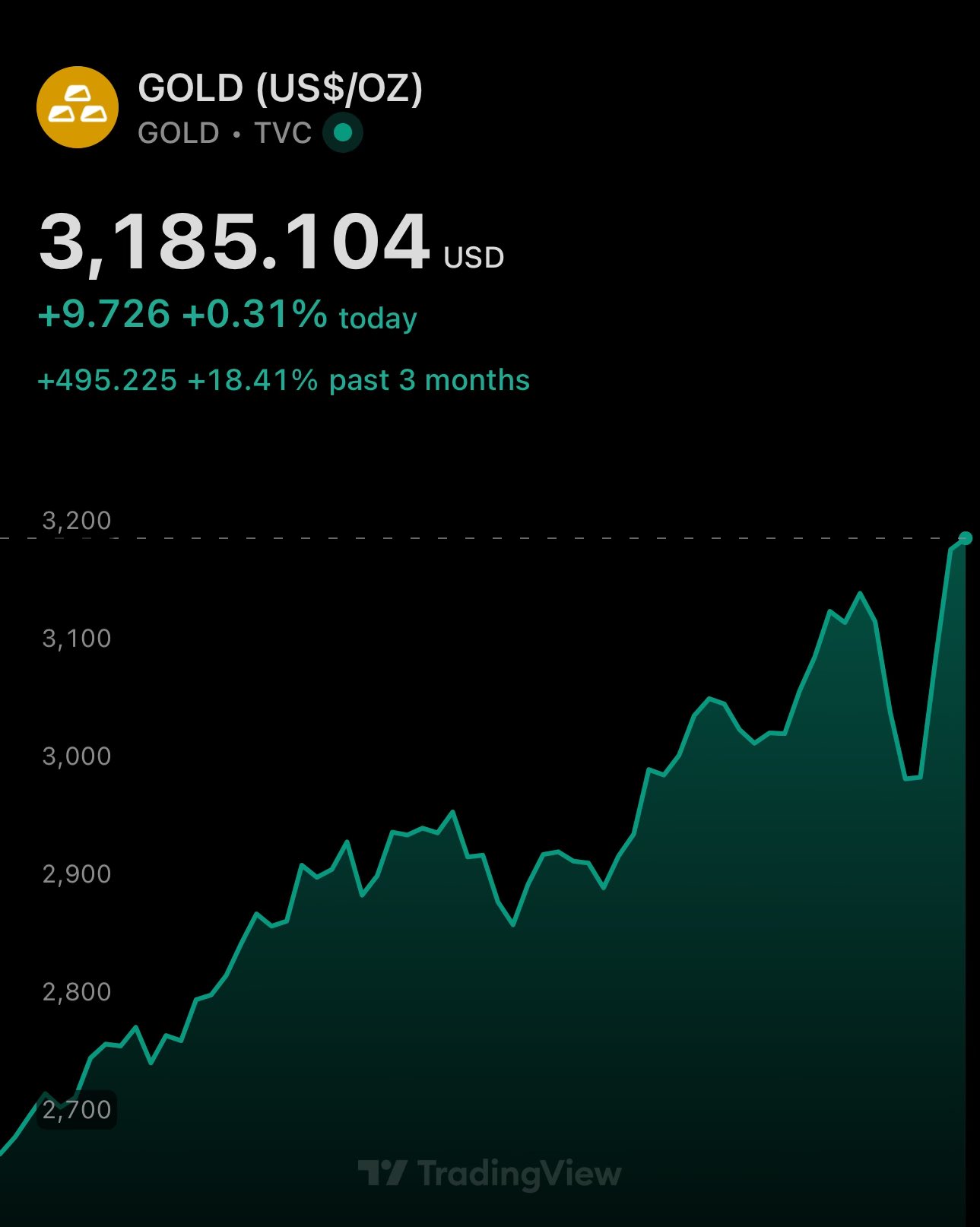

Yesterday I wrote an article explaining why US tariffs on Europe mean more expensive gold and cheaper US dollar

Today, gold hit a new all time high & you should expect this trend to continue

If you haven't read the article yet, you can do it here: https://illya.sh/threads/good-for-gold-bad-for-usd-us-tariffs-on-europe

Every day it becomes more obvious how US tariffs, unilateral sanctions & multi-faceted geopolitical aggression including towards its allies and major trade partners is a strategic mistake

Expect this trend to continue throughout 2026

China Is Hoarding Commodities

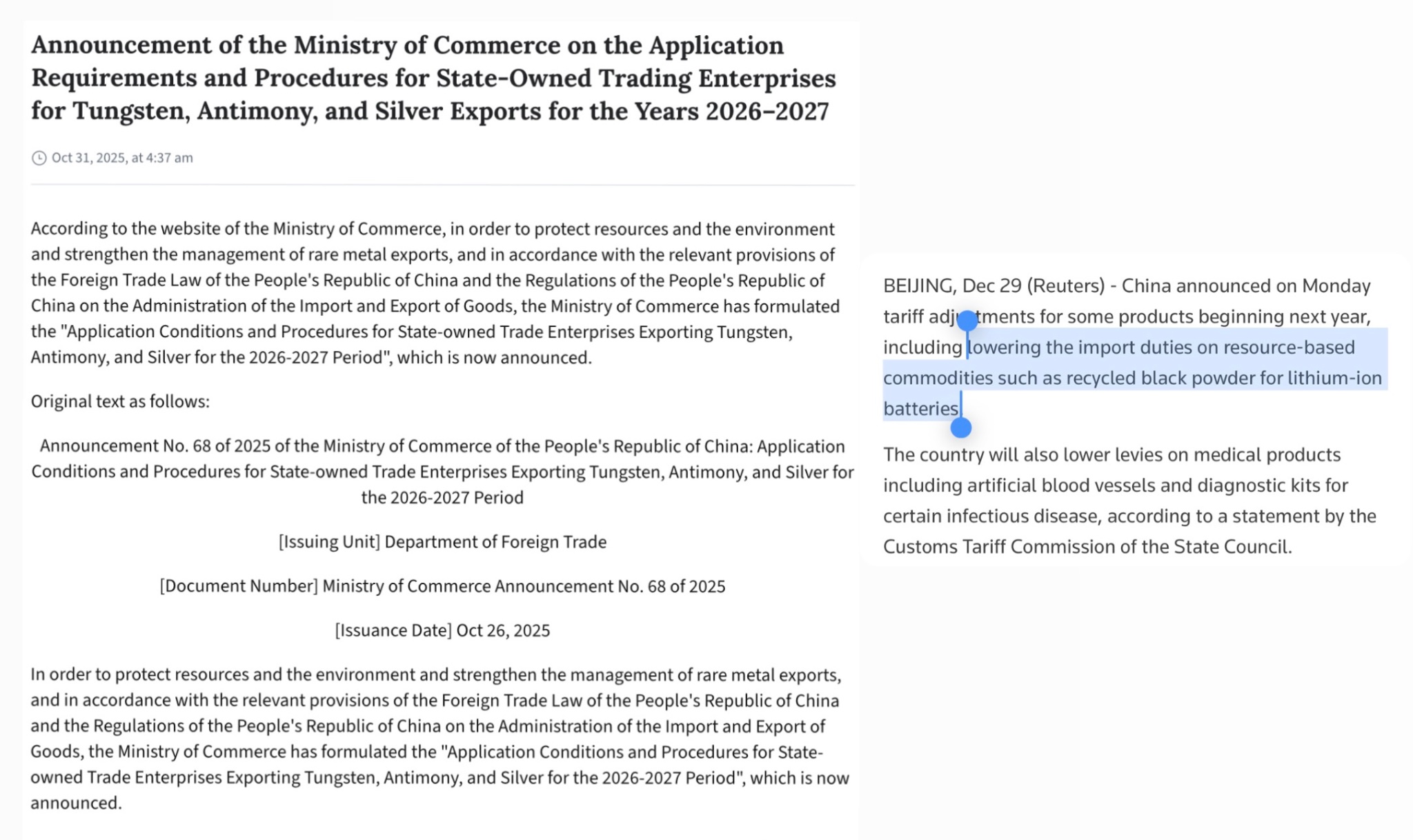

While the U.S. is pumping a crypto & AI bubble, China is pumping their commodity reserves.

Not only PRC is limiting silver exports, but they're also lowering the cost of commodity-related imports.

The net result will be more positive commodity import/export ratio, i.e. more physical commodities within China, which will be used for strategic and industrial needs (China is the world's number one producer).

It also means that there will be less commodities available outside of PRC, and since the global demand won't decrease - that's further positive price pressure on the commodity sector.

I have been writing about gold, silver and other commodities for over 2 years. The same bullish narrative remains valid. These geopolitical developments provide further confirmation.

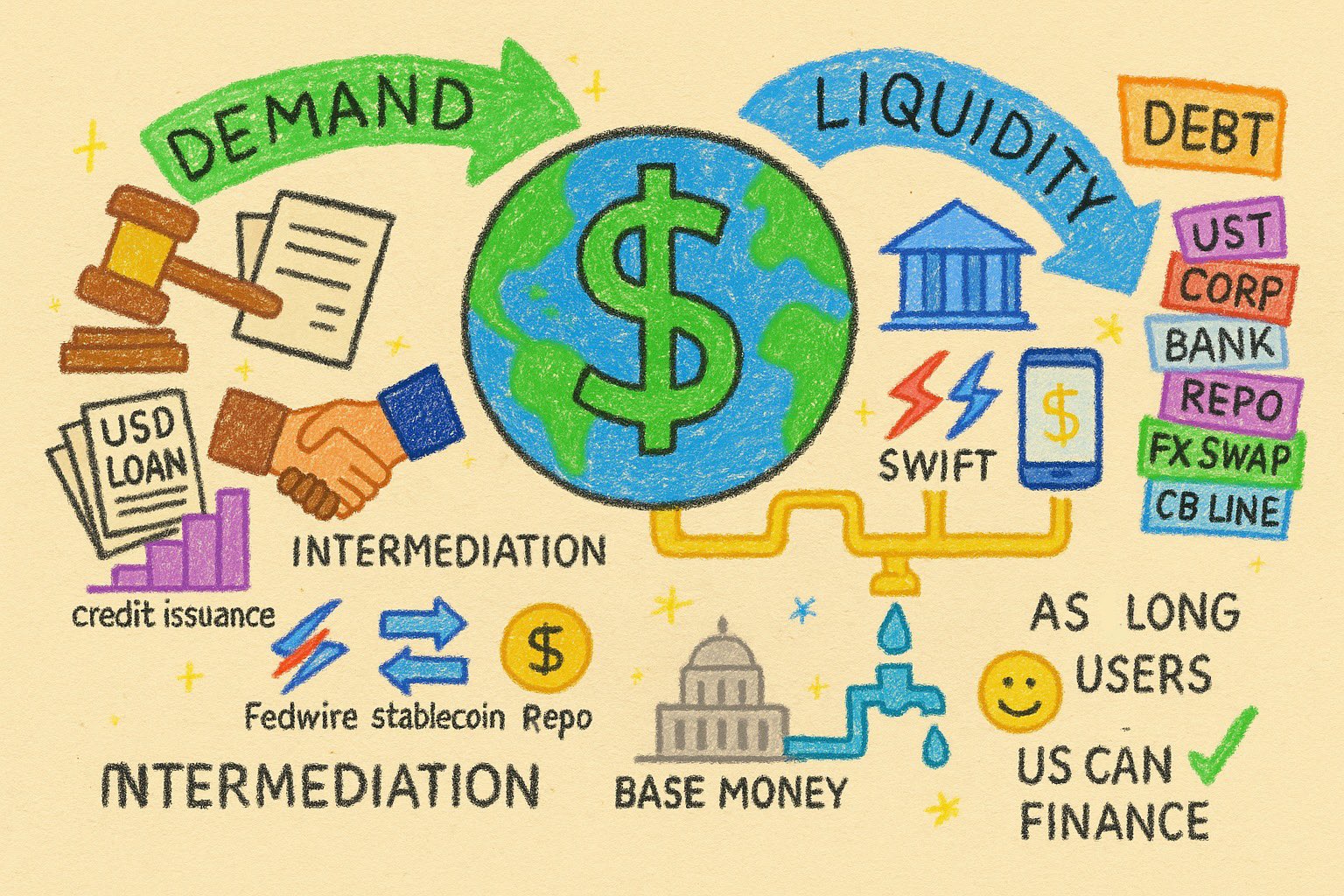

no, the U.S. will not pay off its debt with tariffs

i think this is obvious for everyone now. if not - go read my past posts

the vast majority, if not all of tariffs set be the US will be removed in the next 4 years

latest - by the next US administration. it will be an easy way to mitigate price inflation a bit, and mobilize the overall US economy

tariffs are a net negative - i've said it from the very start. it's a lot more obvious now

demand is created legal/regulatory environment and open market forces

legal/regulatory environment includes international bilateral agreements and national laws

open market forces influence the evaluation of USD against other currencies and assets

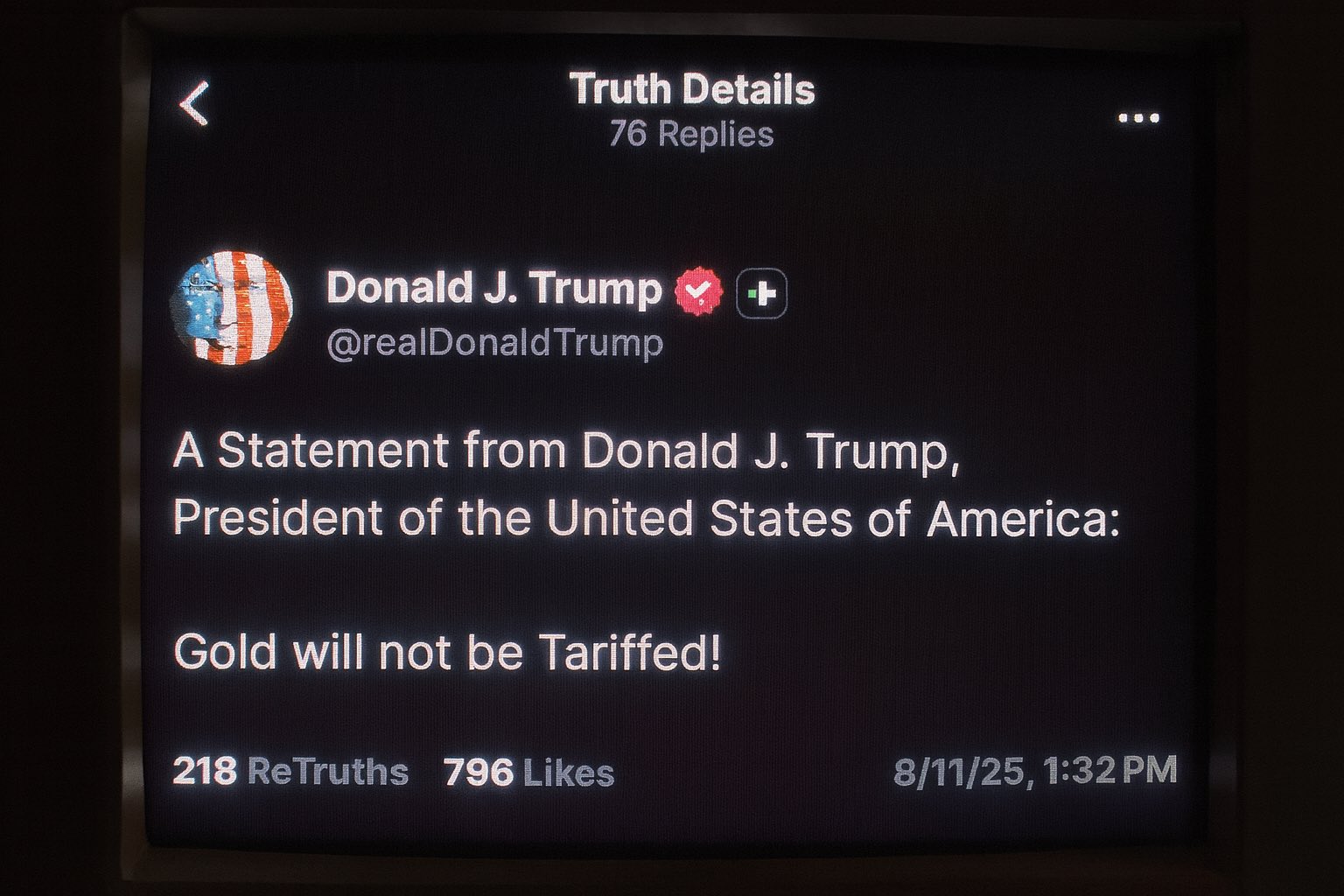

gold tariffs have been cancelled - just like I wrote in my thread on Friday (link below)

you can read about the gold tariffs, their impact on the market and why they were likely to get removed here

👇

https://illya.sh/threads/@1754662712-1.html

it's official: gold tariffs have been cancelled - just like I wrote last Friday 😄

in fact, rumors started less than 30 mins after i wrote the previous post in the thread - and the full removal of tariffs on gold has been confirmed just now

gold tariffs are unlikely to stay for a long period of time

expect them to be removed and/or heavily reduced soon

just the fact that they happened adds longer-term upside pressure on its price

of course, the markets will be volatile 😄

i wrote a thread about the rumored tariffs on gold and what that means for the gold price

also what's coming next

you can read the thread here ⬇️

https://illya.sh/threads/@1754662712-1.html

gold tariffs put further upside pressure for gold towards a new all time high on spot

this is in addition to the global monetary, geopolitical and fiscal positive price pressures

a significant part of the markets will be closed for the weekend. there could be a gap on reopen

gold tariffs are unlikely to stay for a long period of time

expect them to be removed and/or heavily reduced soon

just the fact that they happened adds longer-term upside pressure on its price

of course, the markets will be volatile 😄

the tariffs are not on all gold imports - just on a specific configuration - 100oz/1kg bars

this alone won't skyrocket the price of gold, but it adds to the existing breakout pressure

the tariffs are not on all gold imports - just on a specific configuration - 100oz/1kg bars

this alone won't skyrocket the price of gold, but it adds to the existing breakout pressure

tariffs on gold decentivize gold imports

higher import tax is a disincentive. not sure what' the benefit to having less gold come into US

there's plenty of buyers in Asia who will happily take it. soon you will see more central banks expanding their balance sheets with gold

tariffs on gold decentivize gold imports

higher import tax is a disincentive. not sure what' the benefit to having less gold come into US

there's plenty of buyers in Asia who will happily take it. soon you will see more central banks expanding their balance sheets with gold

when you see gold hitting a new all time high very soon - just remember that it wasn't caused by a single event

gold has a growing buying pressure for monetary, geopolitical and fiscal reasons

I've written about it in depth, so search through my post history if interested

it's mostly 100oz/1kg gold bullion markers that will be affected - so you're looking at futures

expect a larger basis trade (futures price higher than spot), which will eventually close down

with tariffs in place spot is being pushed up towards futures

gold tariffs means more upside price pressure

US tariffs don't apply to all gold imports - only to 100 oz and 1 kg bullion bars, which are mostly used for CME/COMEX futures

400 oz London Good Delivery bars are tariff-free - those are used by dealers, central banks and ETFs

🇺🇸🇮🇳 US imports for India account for mere 2.7% of its total imports - only $87 billion

you can see how selective and small the tariff applications are - and even those will eventually be dropped

nothing about China 🇨🇳 👀

fully consistent with what I wrote 2 weeks ago

🇺🇸🤝🇨🇳 US/China tariffs paused for another 90 days

if you read my post from two weeks ago - this isn't a surprise to you

once again - the US is dependent on China financially, economically & infrastructurally

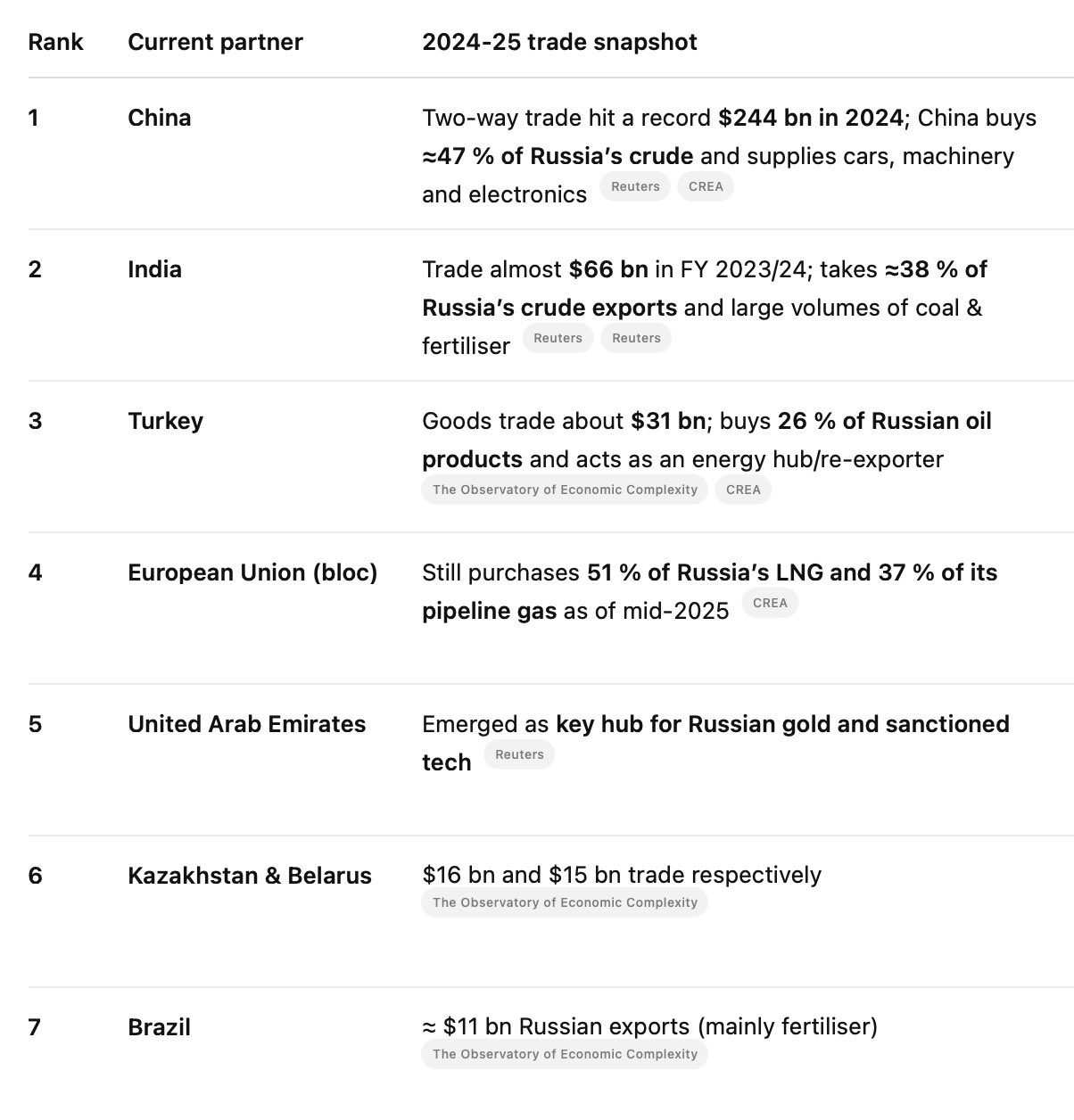

threats of 100% tariffs against Russia will NOT materialize 🇷🇺

i understand that these are secondary tariffs, but there is a grand total of 0% chance of that going in action for any substancial amount of time

🇨🇳 China is Russia's main trading partner. do you really think the US economy can sustain 100% tariffs on their main import source?

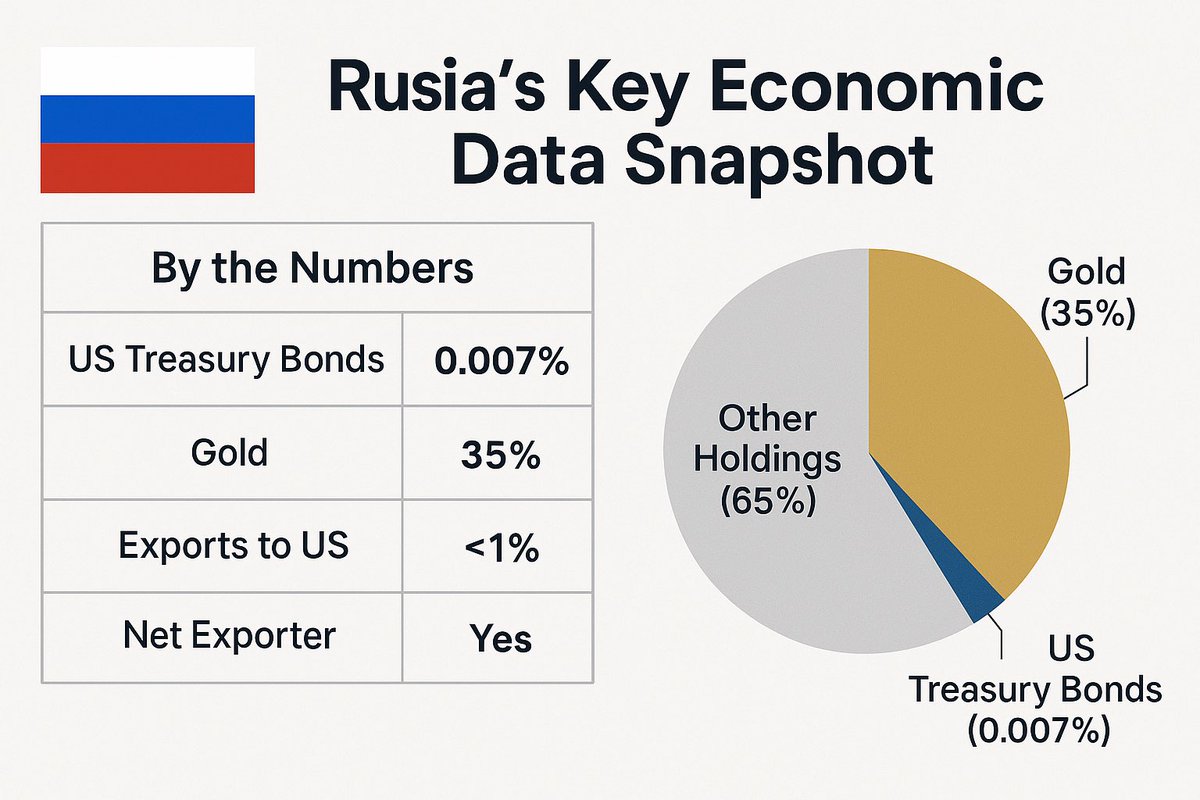

a reminder that Russia doesn't trade with USA anymore 🇺🇸🤝🇷🇺

so it's not clear what 100% or 9999% tariffs on Russia will achieve

Russia's been offloading US securities for gold since 2018

Russia's exports to the US are less than 1% of the total

a reminder that Russia doesn't trade with USA anymore 🇺🇸🤝🇷🇺

so it's not clear what 100% or 9999% tariffs on Russia will achieve

Russia's been offloading US securities for gold since 2018

Russia's exports to the US are less than 1% of the total

🇺🇸🇨🇳This makes no sense:

1️⃣ USA gets themselves into a net importer, 130% debt to GDP & higher refinancing costs

2️⃣ 🇺🇸 became so dependent on China, that 🇺🇸 economy can't survive with the tariffs

3️⃣ Now, the (not so good) student is lecturing the teacher?

Why would 🇨🇳 listen?

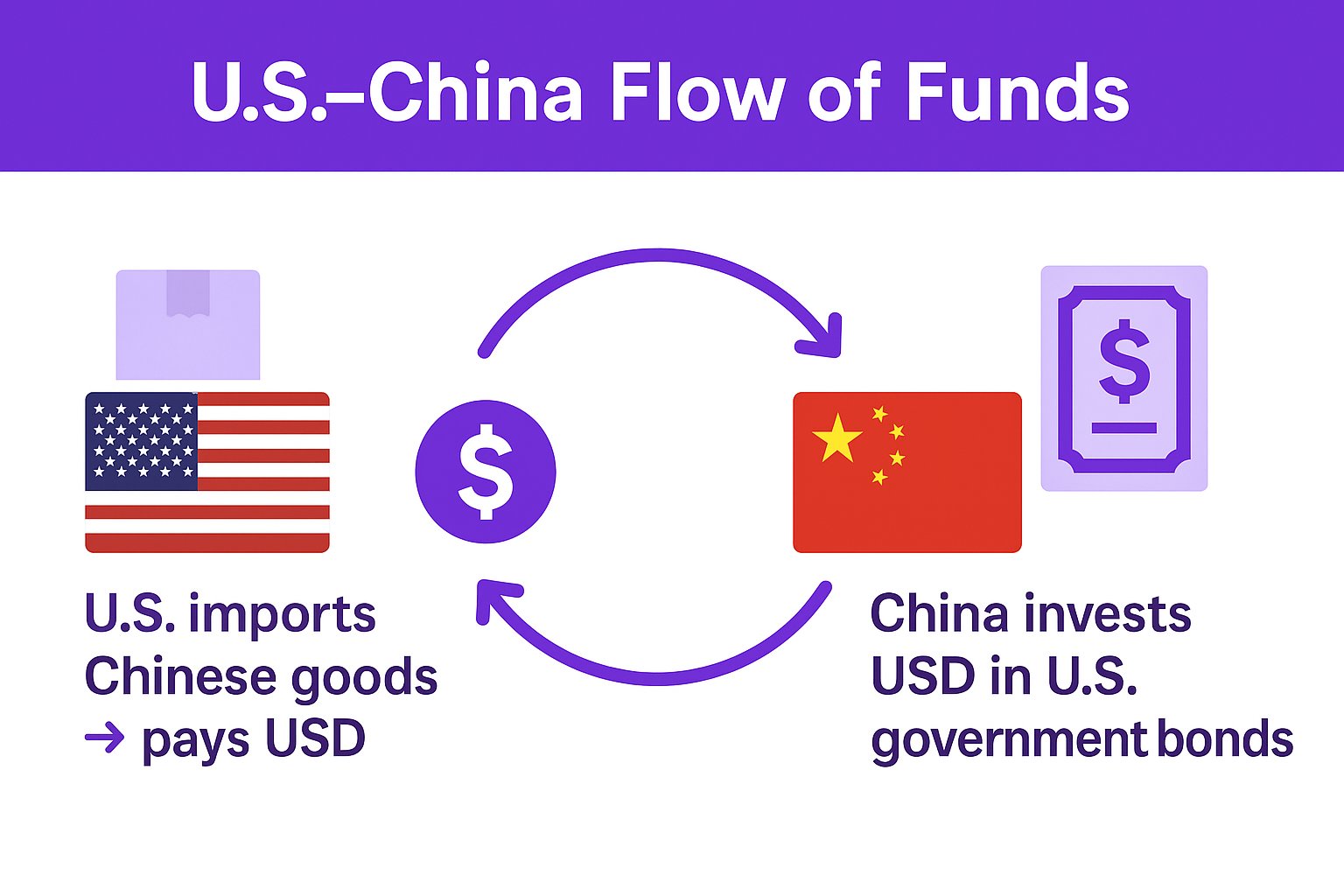

🇺🇸🇨🇳Here's why trade war with China will hurt the US

The economic relationship between US & China is:

1️⃣US pays USD for Chinese goods

2️⃣China re-invests USD back into US bonds

Thus, the same USD comes back to US!

Tariffs = less imports = less US bond investment = higher yield

🇺🇸 USD index bearish/in a downtrend

5Y timeframe weekly chart shows lower highs & lows

Ever since Trump took office, every $DXY weekly candle has been red

Greatest USD economy in history 🫠

🇺🇸🇷🇺 USD is TANKING against Ruble

… on a daily basis 😳

It's only partially tariffs. This has been a trend even prior to them

Russia loaded up on Gold & sold off their US securities. Trade with US is negligible

Russia self-administered an immunity shot

Grok summarized US tariffs effect very well

As well as what will happen to the US economy, and by extension, US Dollar - the most important currency in the world

It gets crazier 🤯

In the past 3 months, amids the tariff madness - at the time of rush into safe assets - Ruble & Gold head-to-head

You could've either bought gold or Ruble & gained 18% in both cases

And buying ruble isn't easy due to sanctions. Imagine when it opens up