Tokenization & RWA on-chain adoption

Timeline of tokenized treasuries, funds and real-world assets, plus infrastructure and regulatory developments.

Tokenizing European Long-Term Investment Funds (ELTIF 2.0) on a Public Blockchain

Currently I'm working on a practical framework for tokenizing European Long Term Investment Fund (ELTIF) instruments on a smart contract-enabled public blockchain like Ethereum. While there have been some ELTIF tokenization initiatives by some funds in the EU - they all used non-public (e.g. in-house) distributed ledger technology (DLT) solutions, with scarce public information on the implementation details.

The idea of fully on-chain ELTIF is attractive for several reasons:

➖ It taps into trillions of USD of readily available on-chain liquidity

➖ It reduces processing, compliance, distribution and infrastructure costs

➖It's fully compliant with the existing EU legislation

In terms of DeFi, bridging the real world financial system on-chain enables investment vehicles, which are fully compliant with the legal systems in the EU, and by extension most jurisdictions. This increases the value of the whole DeFi ecosystem, by making it more attractive for institutional and retail investment.

To date, there isn't a clear and practical framework for operating an ELTIF fund on a public, permissionless DLT. Such a framework must encapsulate not only the legal aspects (those already exist - the relevant regulations themselves!), but also the technical details of operating the ELTIF fund via smart contracts, while remaining fully compliant with the EU legislation. This is the gap that I’m aiming to address.

I’ll be focusing on real-estate based ELTIFs - where the fund pools money from investors, invests it into real estate and collects yield from rents and appreciation, as it goes inline with my current area of work.

no, permissioned assets running on blockchains are NOT sheep in wolves' clothing

blockchains need to integrate with our existing legal systems - and the permissioned aspect is often required by law

i'm currently looking into implementing a real estate European Long Term Investment Fund (ELTIF) on-chain with smart contracts

the EU regulations governing such funds explicitly require a permissioned control. for example, an ELTIF must be managed by an Alternative Investment Fund Manager (AIFM), as per Directive 2011/61/EU (AIFMD). so there must always be an AIFM behind the token/smart contacts. it can't just be "ownerless" decentralized contracts. by design that someone also bears legal responsibility

you're also legally not allowed to allow retail investments into the fund without KYC, which is also a permissioned component

in order to be able to have the unit's funds tradable on-chain without qualifying as a trading venue under MiFID II (so you don't need additional licenses), you may want to use ELTIF RTS, which under certain conditions exempt your ELTIF smart contracts from being classified as a multilateral system. to qualify for this exception, the law requires the manager to operate windows, decide on execution prices, etc - i.e. the fund's units get traded in a permissioned manner

these are just some of practical examples. as you see, there are many reasons for using a permissioned design in your blockchain assets

permissionless is great, but practical value is more important. we need more solutions that work with the existing legal and financial system infrastructure

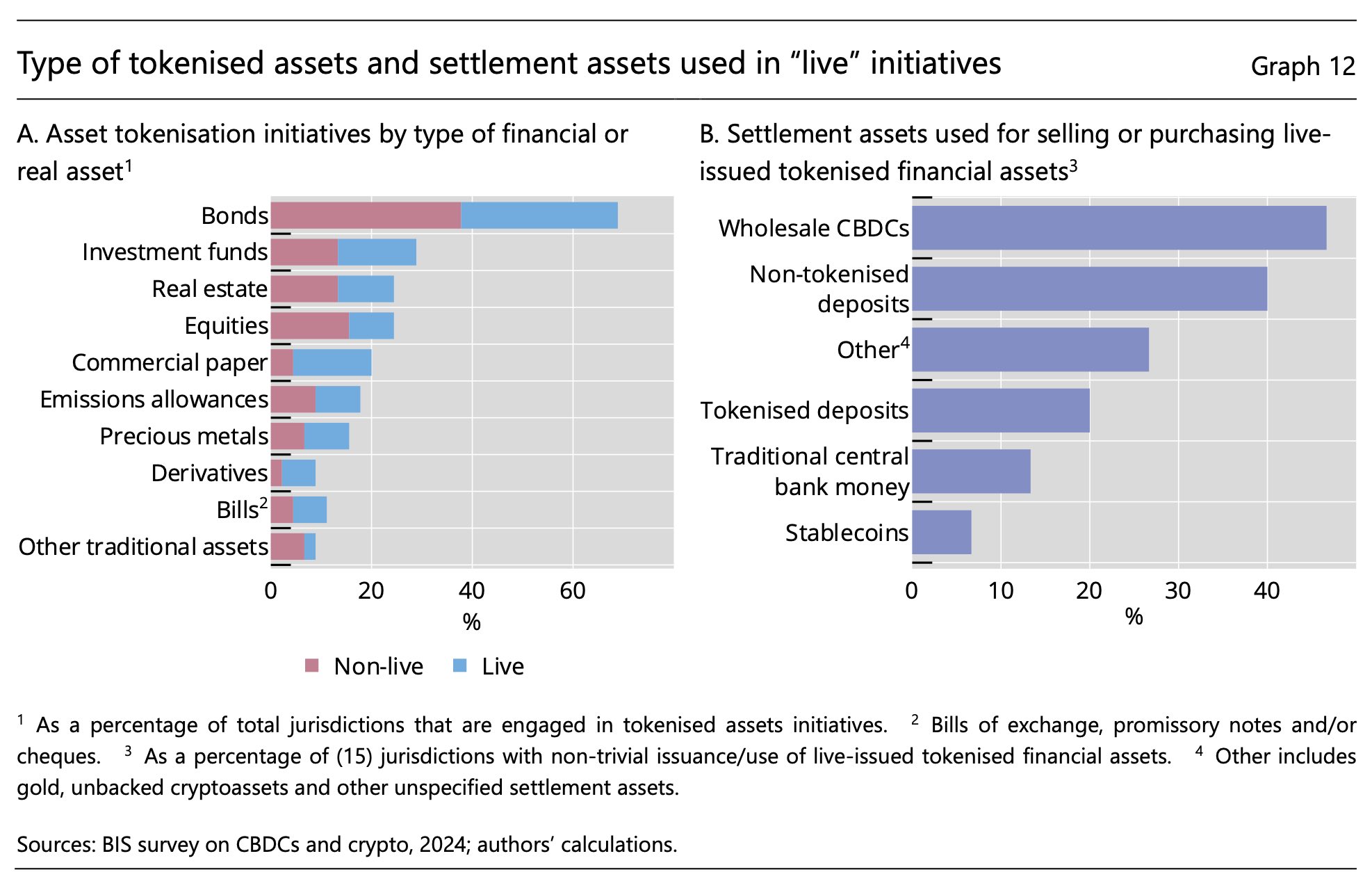

real world and financial asset tokenization is ongoing worldwide, with transactions mostly settled in CBDCs

government and corporate bonds are the most common RWA to be tokenized

thus, wholesale CBDC is a tokenized/digital version of central bank reserves used by the financial market infrastructure (FMI) and banks

it also lives on the liability side of the central bank

wholesale CBDC will be used by financial institutions only, such as commercial and central banks for interbank and market settlement

wholesale CBDC will only be transacted between select financial institutions - it's not something you'd use as a regular business or consumer

there should be more blockchains running over mesh technologies like LoRA

this way you can keep the consensus and payments running even when internet is down

polynomial commitments (ZK) can be used to store-and-forward transactions

stablecoin issuers could intermediate the issuance process, so you don't need to get all credit institutions on-chain from the start

non-algorithmic stablecoin issuance already happens off-chain and presumes trust in a third party

this would just be faster. more liquidity

now imagine when credit institutions can tokenize new credit and allow automated stablecoin issuance backed by that credit

in practice it's code in smart contract that wraps one token with another

i created a similar project on an Ethereum hackathon ⬇️

https://github.com/iluxonchik/eth-lisbon-hackathon-23

now imagine when credit institutions can tokenize new credit and allow automated stablecoin issuance backed by that credit

in practice it's code in smart contract that wraps one token with another

i created a similar project on an Ethereum hackathon ⬇️

https://github.com/iluxonchik/eth-lisbon-hackathon-23

liquidity abundance leads to the narrowing of spread between riskier and safe assets (mostly government bonds)

safe assets fall in price, with their yields increasing towards the riskier ones

US bond yields are high under tighter monetary conditions - liquidity is pro cyclical

the higher use of lower quality collateral has pro-cyclical effects

if the price of collateral falls during economic downturn - you'll get a lot of margin calls & insolvencies. this will further put pressure on short-term funding mechanisms, which already lack HQ collateral

btw here I'm looking at PAXG (Paxos Gold) token

essentially, a 1:1 gold-backed ERC-20 token

there is also XAUT from Tether

whenever TradFi markets are closed - it's your go-to for alpha insights

can't believe that in 2025 there is still such a thing as market closure 🤯

FYI the new BRICS banknote that has been circulating on social media today is NOT real

it's merely symbolic - NOT legal tender

before a joint currency, there will still be more bilateral trade in local currencies

unless those notes were to tokenize gold

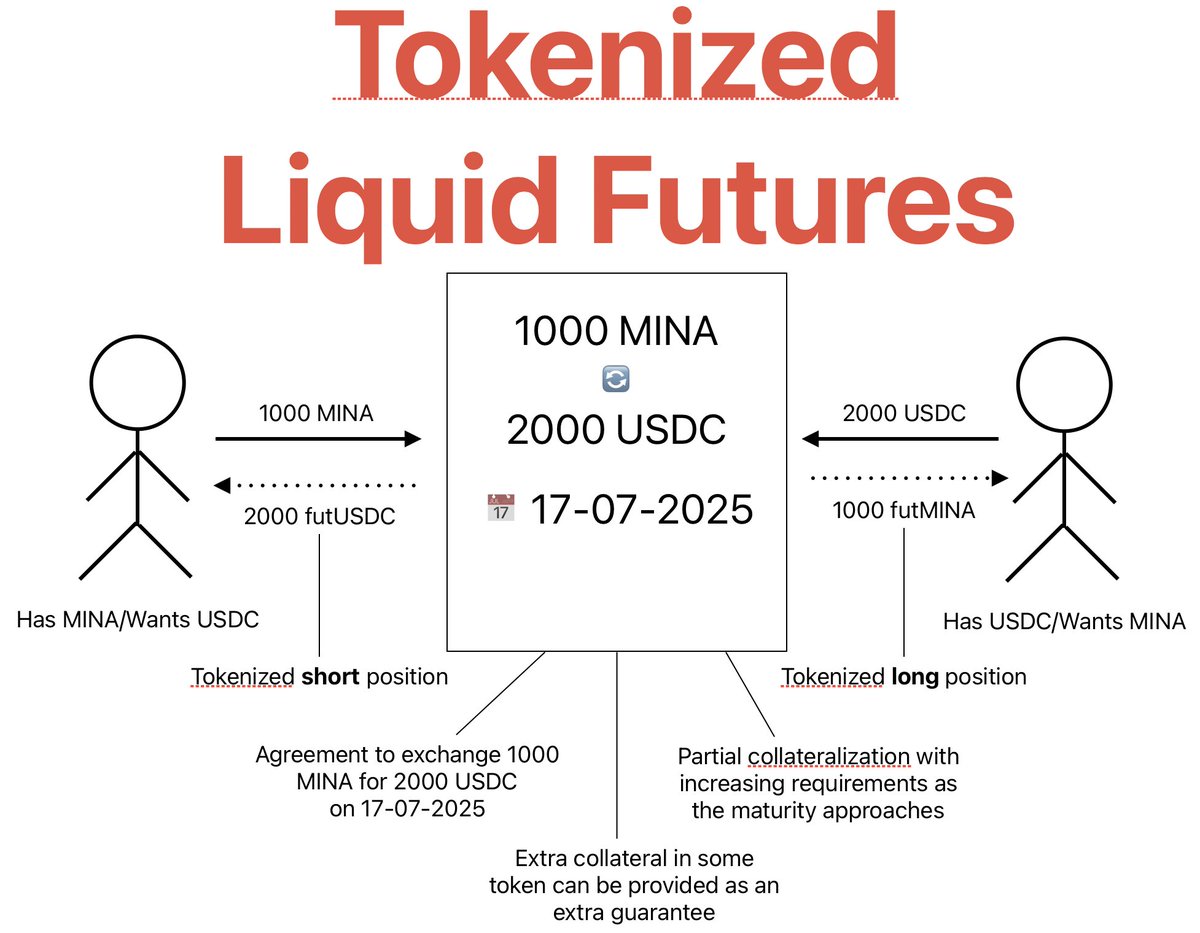

In summary, blockchain-based Tokenized Liquid Futures:

- Eliminate intermediaries

- Increase transparency

- Enhance liquidity

- Automate risk management

- Provide flexible capital deployment

Thus enabling a disruptive #DeFi use-case over its #TradFi equivalent

The smart contract automates risk management on-chain by:

1️⃣ Enforcing margin requirements

2️⃣ Handling liquidations

3️⃣ Ensuring contract settlement

Removing the need for trusted third parties and ensuring transparency 🛡️

The smart contract automates risk management on-chain by:

1️⃣ Enforcing margin requirements

2️⃣ Handling liquidations

3️⃣ Ensuring contract settlement

Removing the need for trusted third parties and ensuring transparency 🛡️

The tokenization of the long and the short positions of the futures contact allows for trading of the positions in a fully decentralized manner, without the need for need for a clearing house

This means no trusted entity or oracles are required, ensuring full decentralization

The tokenization of the long and the short positions of the futures contact allows for trading of the positions in a fully decentralized manner, without the need for need for a clearing house

This means no trusted entity or oracles are required, ensuring full decentralization

🕑 The later this default occurs, the higher this loss is to the offending party

This aligns with the principle of the time value of money

Each position (long and short) is subdivided into several fungible tokens, which can be traded independently

The native token support of Mina Protocol blockchain means that a smart contract encodes both: the futures agreement, and its tokenization 🪙

🔐 Smart contracts on the blockchain enable full tokenization of futures contracts

📈 Both long and short positions become tokens, representing a "promise of future asset or money"

This allows partial selling of positions, increasing liquidity, flexibility and reducing risk 💧

🔐 Smart contracts on the blockchain enable full tokenization of futures contracts

📈 Both long and short positions become tokens, representing a "promise of future asset or money"

This allows partial selling of positions, increasing liquidity, flexibility and reducing risk 💧

Futures pricing is deterministic, and its main goal is to prevent arbitrage:

💰 Futures Price = Spot Price * e^(rT)

- r: risk-free rate (e.g., $MINA staking yield)

- T: time to maturity

This formula approximates pricing at maturity in both TradFi and DeFi 🧮

🏦 Traditional futures require centralized clearing houses

On the blockchain, smart contracts eliminate intermediaries, enabling decentralized peer-to-peer agreements

Example: A contract to trade 1000 $MINA for 2000 $USDC in 1 year, regardless of future $MINA price 📊

Futures contracts serve crucial roles in finance:

1️⃣ Hedging against price volatility

2️⃣ Speculation on future asset prices

3️⃣ Price discovery for underlying assets

Smart contracts on the blockchain will disrupt this $1T+ market. Here's how ⬇️

🚀 Exploring Tokenized Liquid Futures Contracts

A deep dive into how they can be implemented on Mina Protocol blockchain without oracles or trusted intermediaries

Covering technical aspects, use cases, and innovations of this DeFi derivative over TradFi solutions

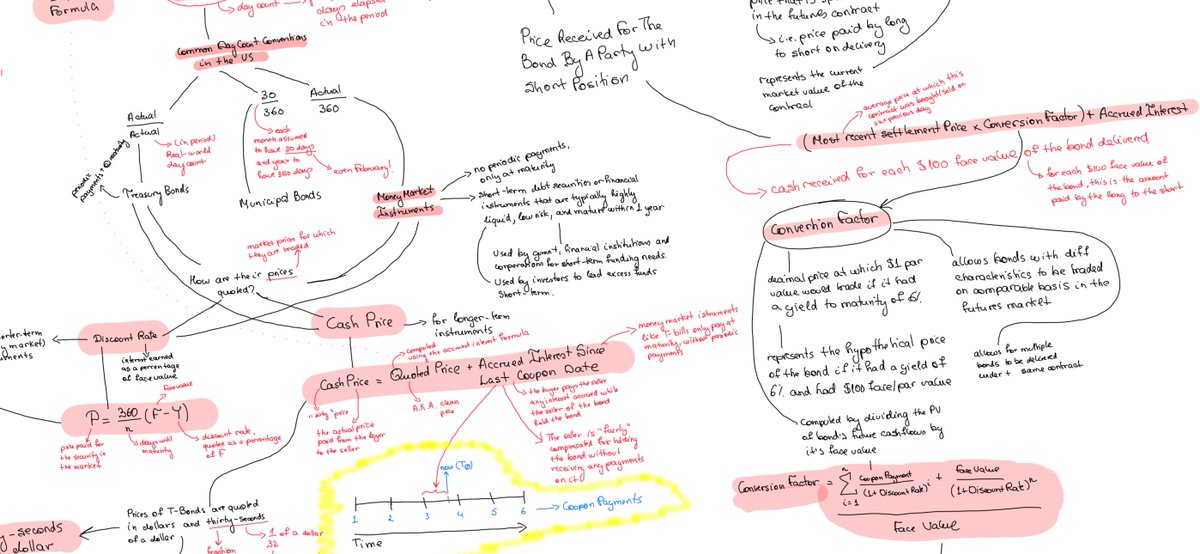

If you think you understand futures contracts, you must learn bond futures

Besides some differences, like dynamic settlement price, you will quickly realize how much #DeFi improves over #TradFi

The future of finance is on-chain

Simplicity, transparency & efficiency http

🔍 Let's explore how the BRICS currency can leverage these technologies:

✅ Dynamic supply mechanism via smart contracts

✅ Legal compliance on-chain using ZKPs

✅ Integration with DeFi and zkLocus for authenticated private geolocation

👉 A cryptocurrency for Web3

💡 While the original paper suggests the impossibility of realizing the BRICS currency as a cryptocurrency, we'll challenge it 🤔

A public blockchain with SmartContracts, combined with Zero-Knowledge Proofs (ZKP), provides a natural fit for the implementation 🧩

💡 While the original paper suggests the impossibility of realizing the BRICS currency as a cryptocurrency, we'll challenge it 🤔

A public blockchain with SmartContracts, combined with Zero-Knowledge Proofs (ZKP), provides a natural fit for the implementation 🧩

🌍 The BRICS digital currency aims to integrate with existing monetary systems, creating a unified economic area for member nations 🤝

Its value is algorithmically derived from various economic factors of the participating countries 📈

💡 When combined with the blockchain, zkSNARKs & zkSTARKs are disruptive:

🌍 zkLocus: geolocation RWA

🏥 zkSafeZones: Safeguarding civilians in warzones. Proposing to UN and ICRC

⚖️ Automated legal compliance on-chain

🕵️ Privacy-preserving AI systems

🛠️

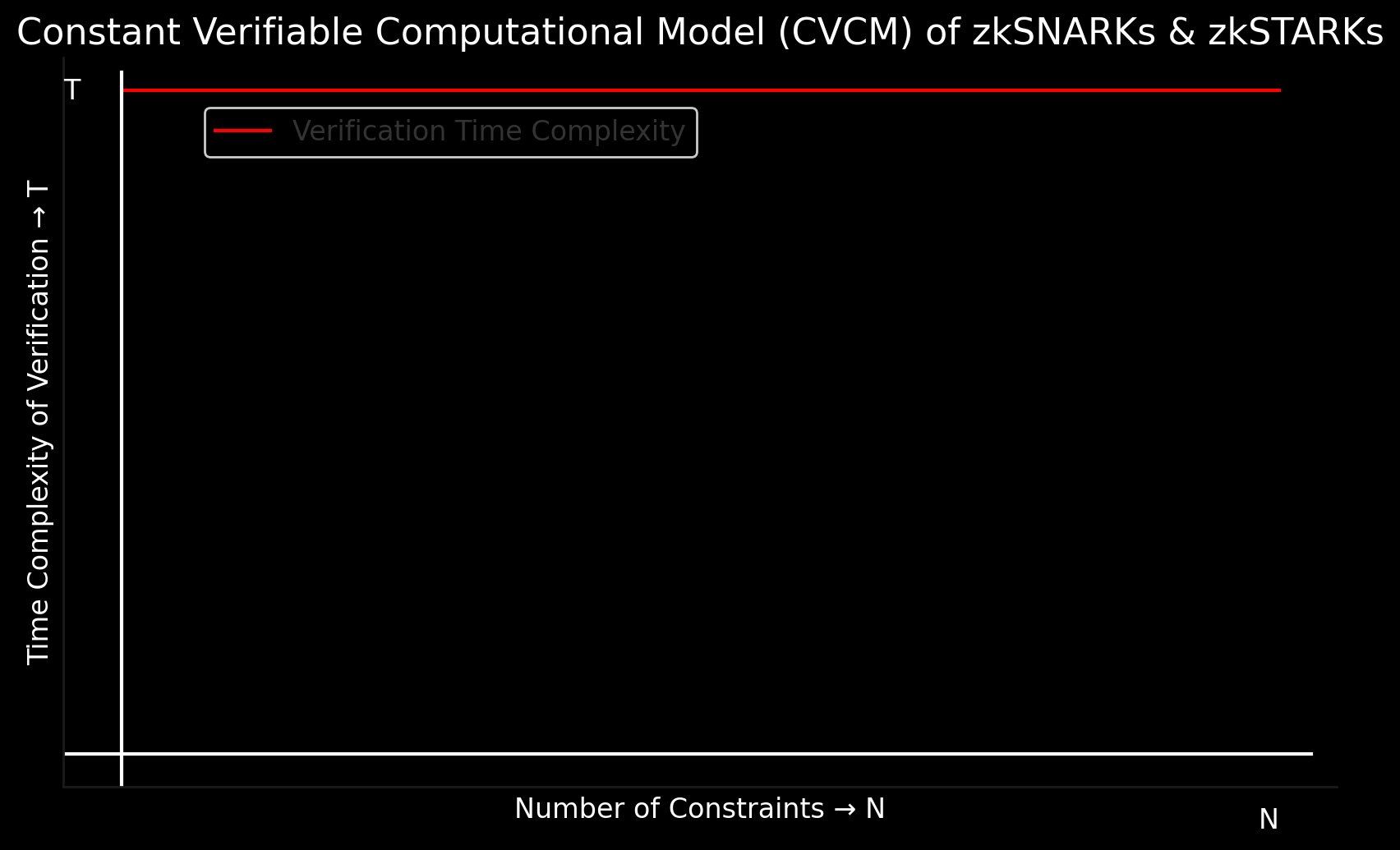

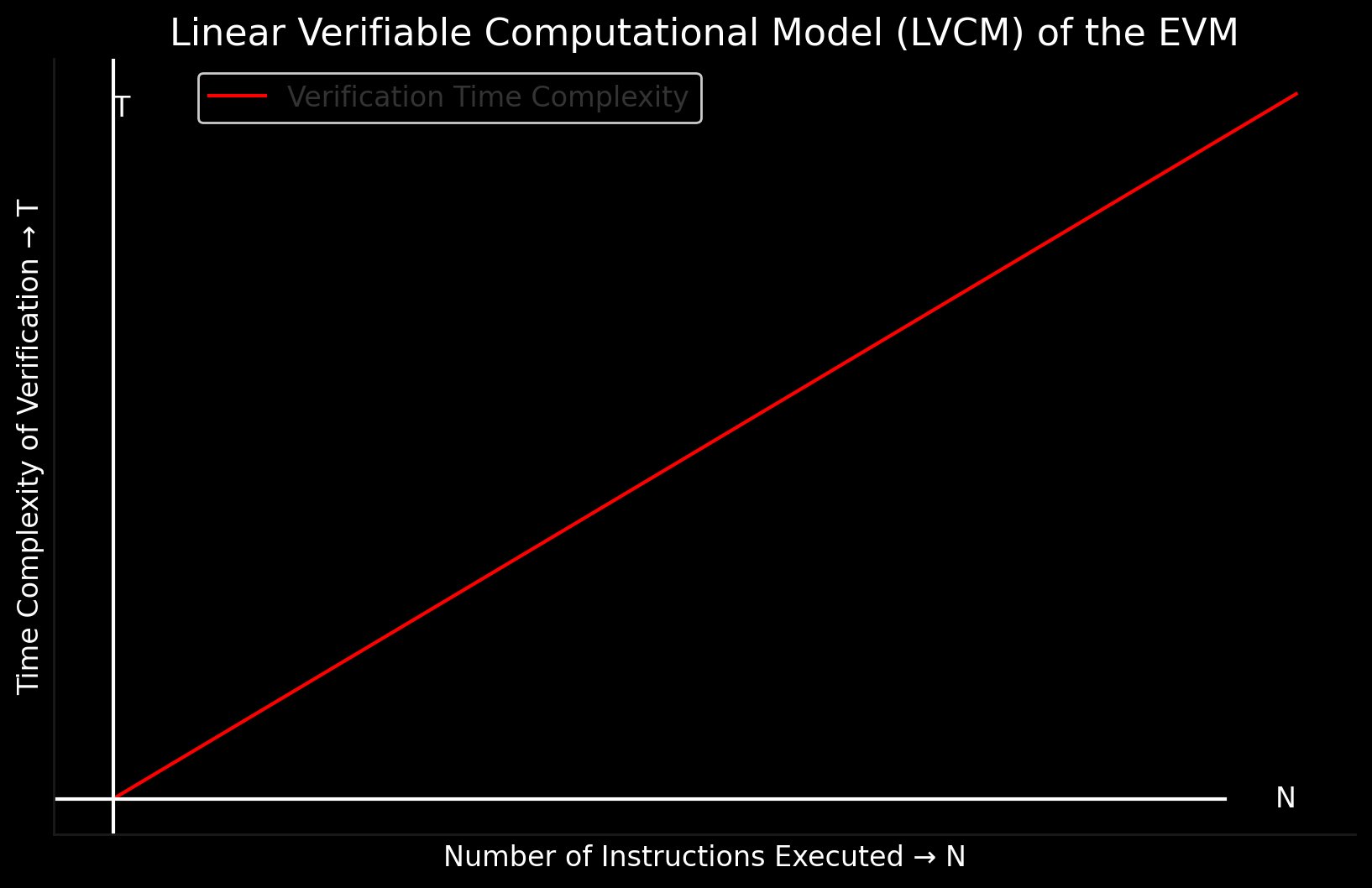

🕰️ Compared to the Ethereum EVM's Linear Verifiable Computational Model (LVCM), zkSNARKs & zkSTARKs offer a Constant one (CVCM)

⚡ Verification time: O(1) vs. O(n)

🌪️ Scalability: ♾️ vs. 📈

⛓️ Interoperability: 🌉 vs. 🚧

🌟 The implications of ZK are PROFOUND!

🔍 Let's examine how zkLocus leverages Mina's zkSNARK-based architecture

🌍 Geolocation data becomes a trustless, programmable Real World Asset (RWA)

🌉 zkLocus proofs can be used cross-chain or even off-chain

🎯 It's an "app-specific rollup" on Mina, focusing on its own logic

♾️ The recursive nature of zkSNARKs & zkSTARKs enables INFINITE SCALABILITY

🌿 Imagine compressing 1000s of computations into a SINGLE proof

⏰ Verification time remains ~CONSTANT

💰 Gas costs are DRASTICALLY reduced

🔥 This is the power of ZKP! 🔥

Mina Protocol blockchain aces it 💪

🤯 The implications are MASSIVE!

🧪 Mina Protocol blockchain and it's native token $MINA operate on this architecture

📍zkLocus leverages this technology to turn geolocation into a RWA, by enabling private, verifiable and programmable geolocation sharing

zkSNARKs & zkSTARKs: Disrupting Verifiable Computation

Explore how these #ZeroKnowledge protocols SURPASS the #EVM's model, opening a world of possibilities for #Web3 applications

Deep dive ARTICLE

Let's unravel the key insights

A small insight into the meticulous care that is necessary in designing #DeFi tokens with sound economic value principles ⬇️