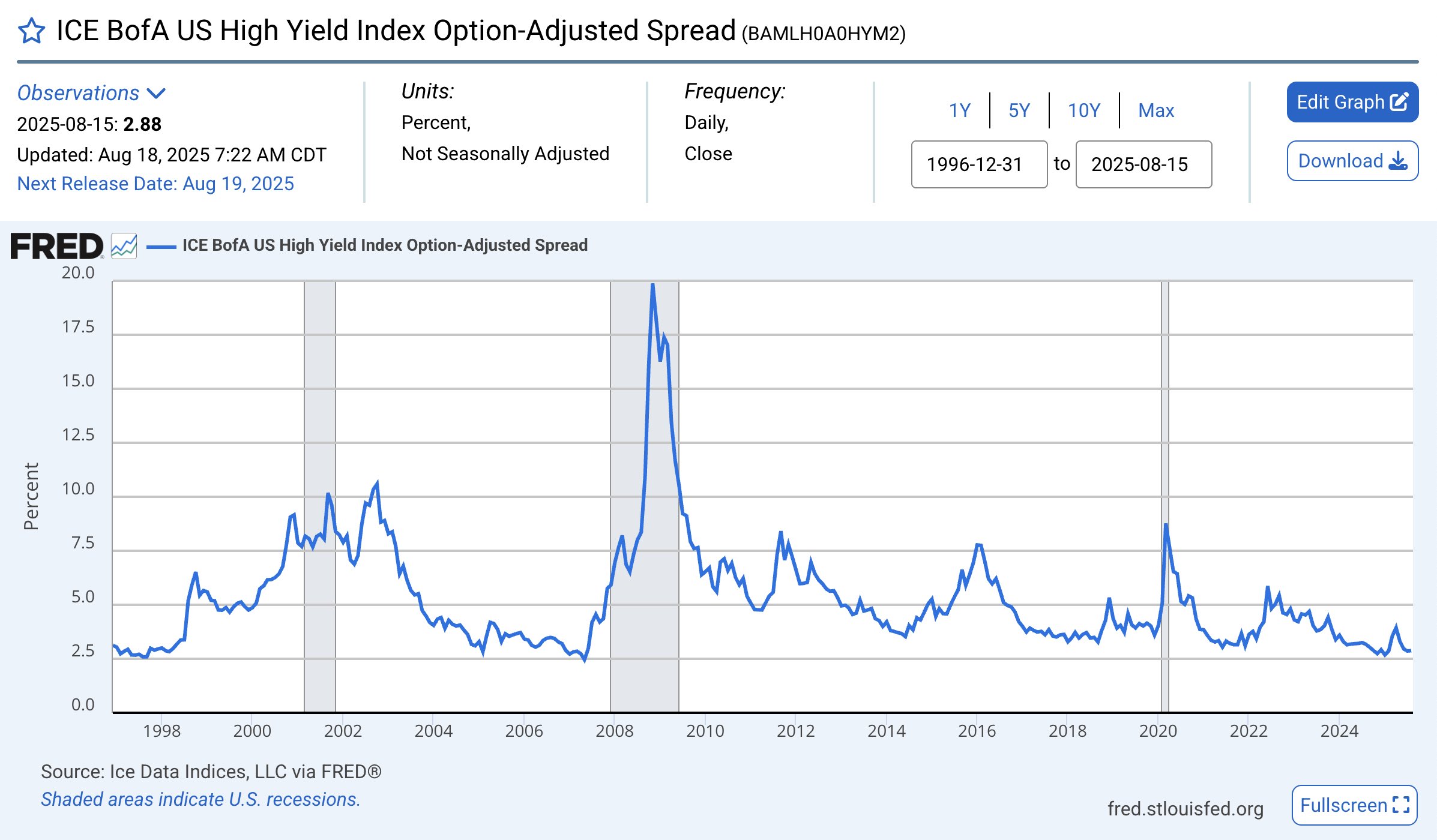

yield spreads between US Treasuries and riskier bonds mirror the price of Bitcoin

yield spread between a safe asset and a riskier one is an expression of the required return per unit of risk higher yield spreads, means risker bonds are significantly cheaper than US Treasury bonds, thus the market is valuing safe assets with a premium - a "risk-off" signal

a lower yield spread means that the market requires less return per unit of risk lower yield spreads means that US Treasuries have a small premium over riskier bonds, thus the market is attributing a smaller premium to safe assets - a "risk-on" signal

thus, you interpret yield spreads between US Treasuries and riskier bonds as: 📈 increasing/high yield spread = risk-off 📉 lowering/low yield spread = risk-on

if you overlay Bitcoin's price history over those yield spreads, you will notice a significant level of correlation ⬆️ Bitcoin appreciates when spreads are lowering and/or low ⬇️ Bitcoin depreciates when spreads are increasing and/or high makes sense - Bitcoin is a risk asset

so when market signals a higher risk appetite - Bitcoin tends to see inflows when market is more risk-averse - bitcoin tends to see outflows, alongside other risk assets you can use the US Treasury/riskier bonds yield spreads to understand BTC's trend direction. it's an alpha