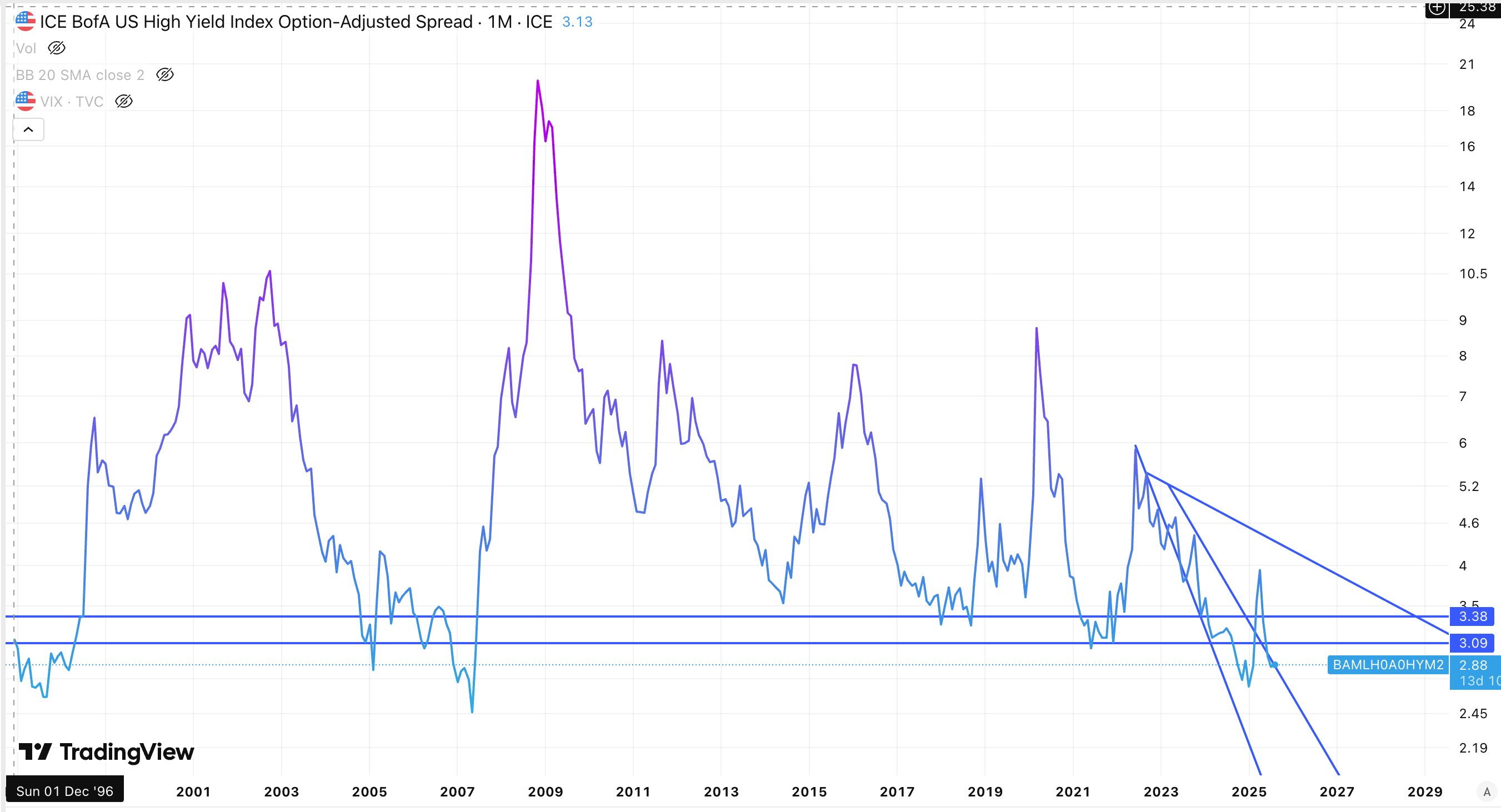

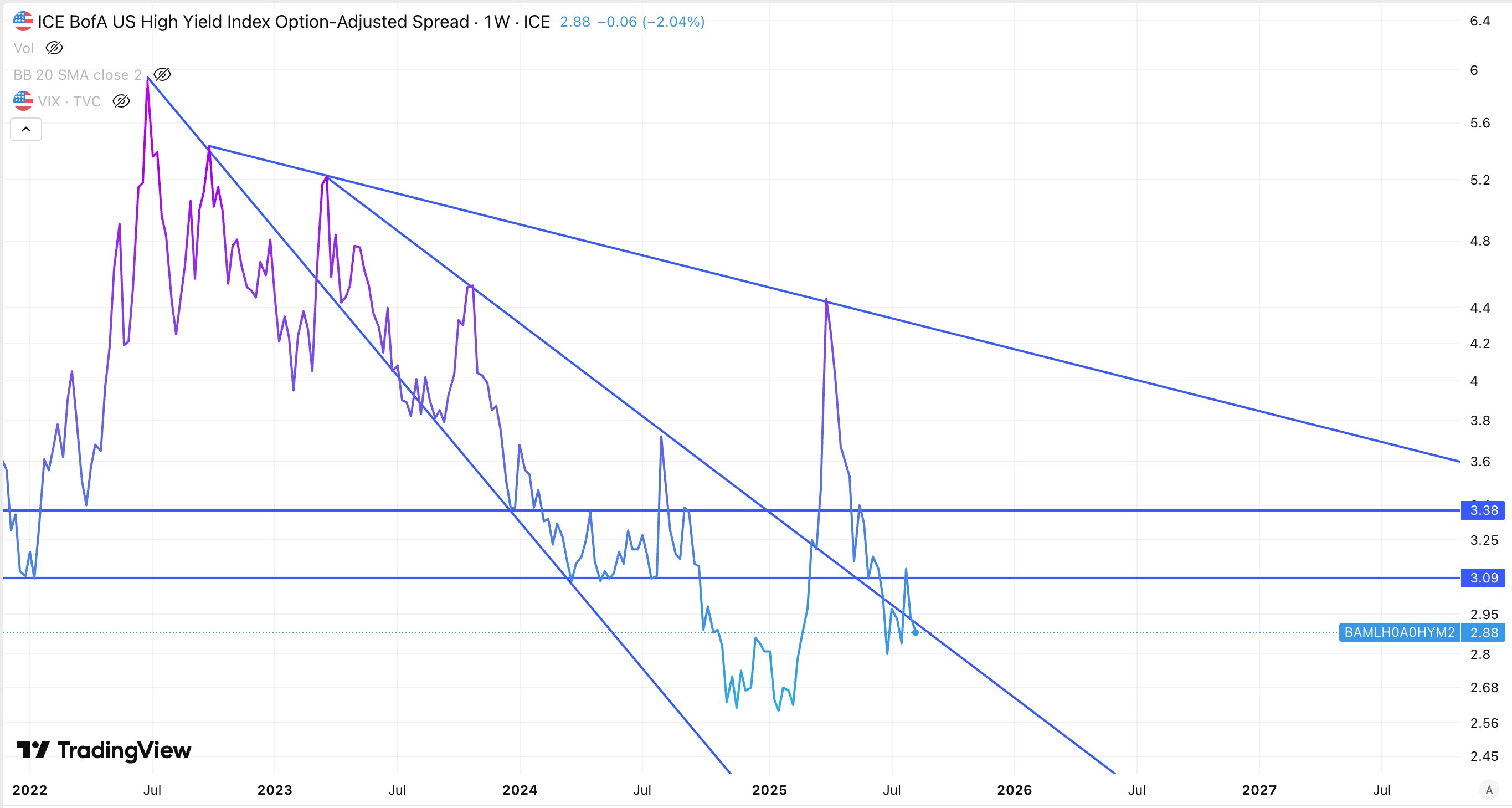

here's what yield spreads are saying about Bitcoin

the yield spreads may also start an almost vertical uptrend on a monthly timescale - this usually means a financial crisis to some degree that's probably not happening in the next 3 months though, as you can expect Federal Reserve to decrease interest rates and/or employ QE

in the short-term, lower rates and/or QE means easier funding conditions, so more positions will get to be refinanced

however, eventually yield spreads will raise with high velocity. this is the larger financial crisis part of the cycle. there you will also see lower rates and more QE

QE also removes safe collateral from the market, mainly US Treasury bills, notes and bonds. this safe collateral is the backbone of wholesale debt markets, where financial institutions, including commercial and central banks finance and re-finance their positions

the global financial system depends on the abundance of this collateral, otherwise - defaults, margin calls, etc i wrote a thread/article explaining how US Treasuries are the dominant collateral in short-term wholesale debt markets (e.g. repo). read here: https://illya.sh/threads/@1751726431-1.html

the US Treasury may also issue more debt to increase the supply of safe assets, thus offsetting the compression shock end result: more safe assets/prime collateral provided to markets. remember that the newly issued treasuries are likely to be rehypothecated several times

initially QE may only increase base money supply - as commercial banks reserve balances get credited by the Central Bank if the Central Bank purchases assets from non-bank financial institutions, then broad money increases directly as well, as deposits increase

even if it doesn't happen directly at the start - eventually QE also increases broad money, due to reduced balance sheet constraints and an increase in cash reserves, which needs to be invested ASAP. this leads to more lending and asset purchases

US Treasury debt is likely to be among the assets purchased by those same banks that received QE funds from the central bank. so central bank's QE injection may be used to purchase US Treasury debt at auctions, thus effectively monetizing the government debt 😁

eventually this carry trade unwinds, and yield spreads soar. balance sheet constrains, existing positions get too expensive too roll-over/re-finance that’s where you get the big(er) financial crisis and then you get more QE/lower rates to address that