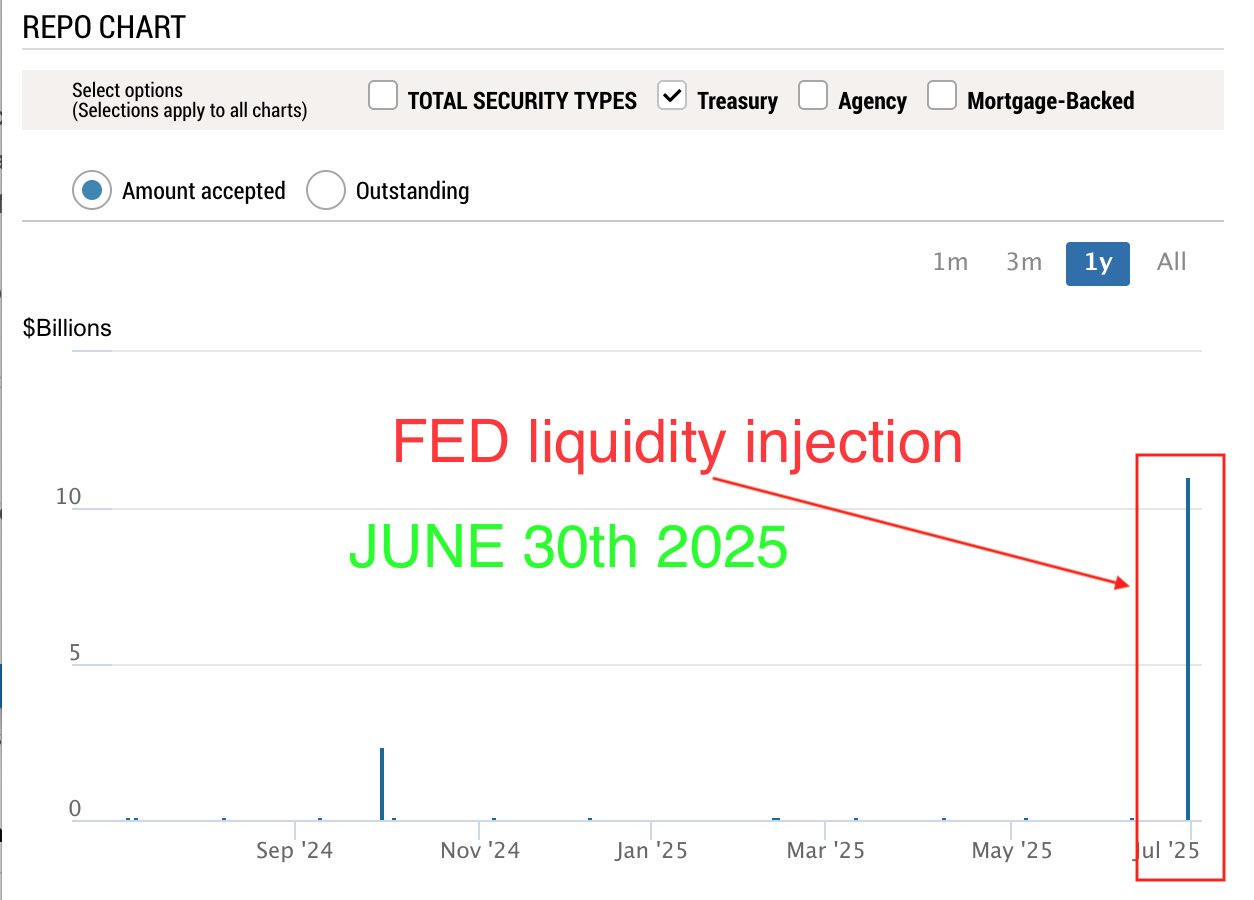

🚨FED just injected $11B of liquidity #2

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs

how does SRF lower UST bond yields?

if you have a US bond and you need cash, your options are:

1️⃣ borrow cash against bond in repo markets

2️⃣ sell the bond

this $500B liquidity pool for US bonds prevents their sell-off in the open market, which would raise their yields

note that FED's SFR doesn't lower the treasury yields per se

it's more correct to say that it puts downward pressure on them, in the form of a $500B buffer

& note that treasuries probably wouldn't be the first in line for liquidation

funding rates on repo markets & bond yields are not the same

different timescales:

1️⃣ repo - short-term / ≈day(s),week(s)

2️⃣ treasury bonds - ≈10 years

so even if a funding rate raises for a few days, the longer-term bond yields may not be affected

repo funding rates don't affect US treasury yields immediately due to time scale

treasury bond yield expectation is over 10 years, and repo rates are a short-term debt funding mechanism

so the rates shock would need to be prolonged/pronounced to affect treasury rates

persistently high(er) funding repo rates will push the treasury yields up

eventually, the bonds would be sold for cash

again - think of the timescale: funding rates refer to much shorter periods

in a monthly maturity/tenor timescale - the repo funding rate has very direct effects

this makes sense - if your bond is maturing in ≈1 month, every day is significant

so you see more immediate effects from federal reserve's SRF operations / repo funding fee increases

so the market operations of dealers/market-markers is quite predictable

you just have to look at their business & regulatory model - from there it's almost plain math under regulatory constraints

if regulatory ratios are breached, they must be restored

there is only so much a dealer/market maker can do

so you can deduce their next action with a high degree of certainty

then, deduce its implication on the liquidity flow & into which sector the funds are flowing

regarding liquidity flows - repo markets are just one of the sources

so it's more useful when you combine it with others, such as the central bank policies, how much short-term debt is maturing, and the overall leverage level

repo funding rates are predictors within this global, multi-factor liquidity context

you can use them to understand liquidity flows in the near future

this is also because repo markets are short-term debt instruments - so the signal is also more short-term

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

this means inflation & gold up

at least short-term: equities up, crypto up

this will also further fuel the asset bubble & devaluate USD

so it doesn't mean that stock & crypto will go up perpetually - it's a cycle

of course, at some point the debt bubble will pop - but it's unlikely to happen tomorrow 😄

when it pops - massive leverage unwinding will occur

here - equities & crypto will collapse in price, so will bonds. gold, silver & precious metals go up

worldwide systemic defaults will follow

the whole world is dependent on the US financial system, both public & private

while the bubble will pop - the side-effects can be minimized

historical behavior & current financial signals do not indicate that this will be the case

these boom & bust leverage/debt cycles have been the norm in modern financial markets:

1️⃣ each cycle gets refiled with more debt/leverage - boom

2️⃣ eventually, the debt cannot repaid - bust

3️⃣ go to boom

smaller busts precede larger busts

whichever is the ultimate resolution of the bubble - repricing will occur

for some assets this will be good, for others - not so much

even in the same asset class different assets perform differently (think manufacturing vs tech stock)

this is why funding repo rates are a very useful indicator

if you're just arriving here - read the previous posts 😄

you can also follow along the quoted posts from below. just click on it ⬇️