how banks work? bank's business model is very simple:

the bank needs a liability to fund an asset

when a bank gives you a loan it gains both an asset and a liability in the same amount

let's say you get a loan for $100

in the bank’s balance sheet:

⬆️ +$100 assets - the loan they just issued

⬆️ +$100 liabilities - the $100 your account was credited with

your loan is an asset to the bank - and your loan itself funds the $100 deposit that you get in your account

deposits are liabilities to the bank - as they are owed to depositors/customers

so the $100 cash loan that the bank issues to you becomes a deposit in that same bank, and thus a liability for the bank

you can move those $100 outside of the bank at any time/on short notice

why is a loan an asset to the bank?

because the loan earns an interest over its lifetime. this the the fixed or variable interest rate associated with the loan

with time, that loan brings periodic cashflows repaying the principal and the interest

a loan for the bank ends up earning more than the lent amount

this is because the borrower repays the principal (loan amount) + interest

so the bank funds the loan by creating $100 and crediting them to your account

those $100 that they credited you did not exist before - the bank created that money on demand

those $100 are not physical cash - they're an entry in a digital ledger (i.e. in a computer system)

banks are credit institutions which means they can create broad money

while a non-credit institution or a regular business can issue loans - they must fund it (e.g. raise money, use excess profits)

they can't just create those $100, thus expanding the monetary supply

the bank has the legal right to increase the money supply AKA 'print money'

so to give you a $100 loan the bank can just create those $100 and give give them to you

pretty neat arrangement, huh? 😁

banks are also subject to regulations when issuing loans

and no - it's not the fractional reserve system

in many sovereigns, like the USA the reserve requirements sit at 0%

there are other regulatory requirements limiting loan issuance

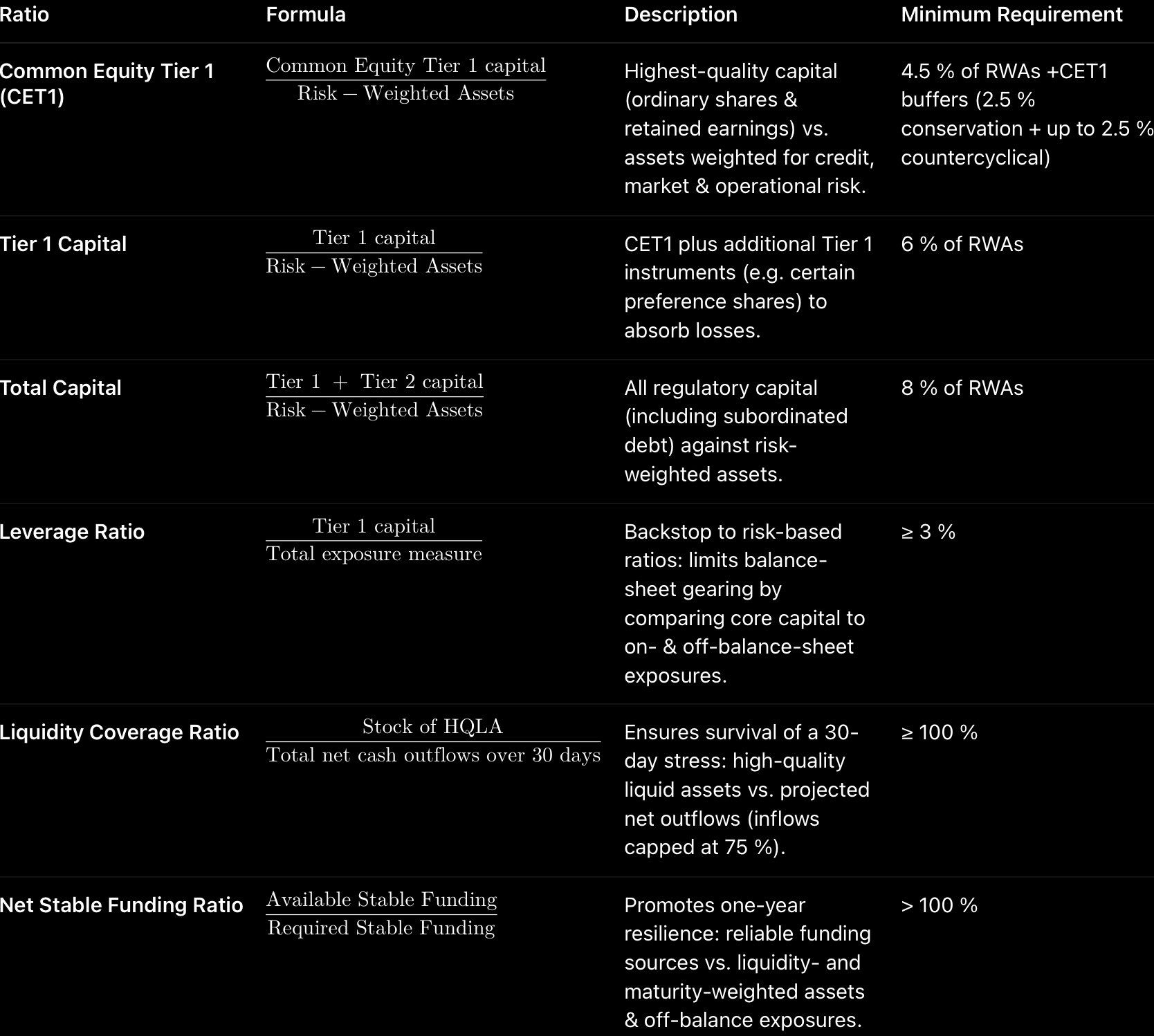

Basel III defines capital, leverage, liquidity and net stable funding ratios

they're in the form of formulas, and regulations require minimum thresholds to be met

I previously wrote about Basel III and its importance in financial markets here ⬇️

https://illya.sh/threads/@1753631798-1.html