⬇️ My Thoughts ⬇️

Basel framework treats "capital" as a funding source that can absorb losses, rather than an owned asset

assets are funded by liabilities and equity, so assets are not a funding source

Tier 1 capital is the first-line of losses absorption for a bank

so gold can't be in "Tier"

🚨🏦 claims that gold is a Tier 1 asset under Basel III are FALSE:

1. gold is NOT a Tier capital under Basel - it's on the liability, not asset side

2. gold had 0% risk weight since Basel I (no haircut)

3. gold is still NOT considered a high quality liquid asset (HQLA)

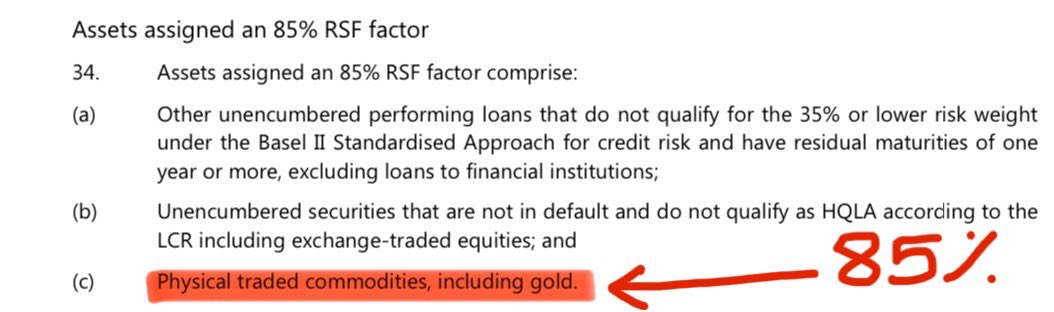

🏦 under Basel III gold is subject additional funding requirements

there's a 85% required stable funding (RSF) factor on gold under net stable funding ratio (NSFR)

so for every $1B of gold that a bank holds - $850M must be funded with longer term retail or wholesale funding

🚨🏦 claims that gold is a Tier 1 asset under Basel III are FALSE:

1. gold is NOT a Tier capital under Basel - it's on the liability, not asset side

2. gold had 0% risk weight since Basel I (no haircut)

3. gold is still NOT considered a high quality liquid asset (HQLA)

🚨🏦 claims that gold is a Tier 1 asset under Basel III are FALSE:

1. gold is NOT a Tier capital under Basel - it's on the liability, not asset side

2. gold had 0% risk weight since Basel I (no haircut)

3. gold is still NOT considered a high quality liquid asset (HQLA)

volatility is at best - a part of a the risk

an increase in volatility doesn't necessarily mean an increase in risk

e.g.:

shortages in global liquidity put mismatched liabilities at a loss. safe assets raise in price

the high risk already existed while there was low volatility

pre-market tesla is already down to a weekly support back from July 2023

the narrative that equities price is mainly linked with EBIDTA or other revenue/profit metrics is false

it's all about where the credit flows

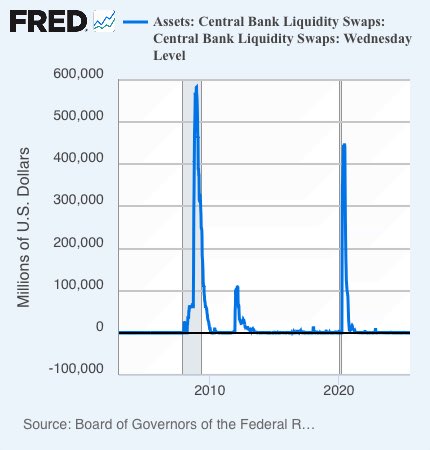

check the correlation between FED swap line volumes and Bitcoin price

large spikes in swap volume trigger an uptrend in Bitcoin

understanding these global liquidity flows helps to visualize them as a part of the larger system and understand where it's likely to move next

new currency in circulation is just one of the side-effects

and that transition is neither direct, nor instant

before these funds effectively become new currency, they flow into financial markets - that's why you see the stock market going up first

the same for risky assets

new currency in circulation is just one of the side-effects

and that transition is neither direct, nor instant

before these funds effectively become new currency, they flow into financial markets - that's why you see the stock market going up first

the same for risky assets

FED swap line operations reach ≈$600 bn

while the swaps are closed/repaid in less than a year, ≈80% of the repayment comes from newly issued wholesale debt

thus, ≈80% of the swap volume eventually becomes new currency in circulation

and then you wonder about inflation 😄

FED swap line operations reach ≈$600 bn

while the swaps are closed/repaid in less than a year, ≈80% of the repayment comes from newly issued wholesale debt

thus, ≈80% of the swap volume eventually becomes new currency in circulation

and then you wonder about inflation 😄

💧FED swap lines = infinite liquidity pool

👉 here's how:

1️⃣ central banks exchange their foreign currency for USD, 7-80 days later, they reverse the exchange at the same rate + fee

2️⃣ central banks then lend these new USD to commercial banks

thus, USD demand is met

💬 each comment is automatically saved

with a 7-day expiration - all locally in user storage

so essentially an automatic draft

try it yourself: go to one of my posts/thoughts, press/click comment emoji, write the comment, close the tab. the comment will be there on re-open

🚀 added stateless comments on posts

i wanted to add comments to my statically-generated thoughts site, but didn't want to depend on storage or server-side logic

solution: send comments via e-mail, X/twitter or telegram

demo in reply ⬇️

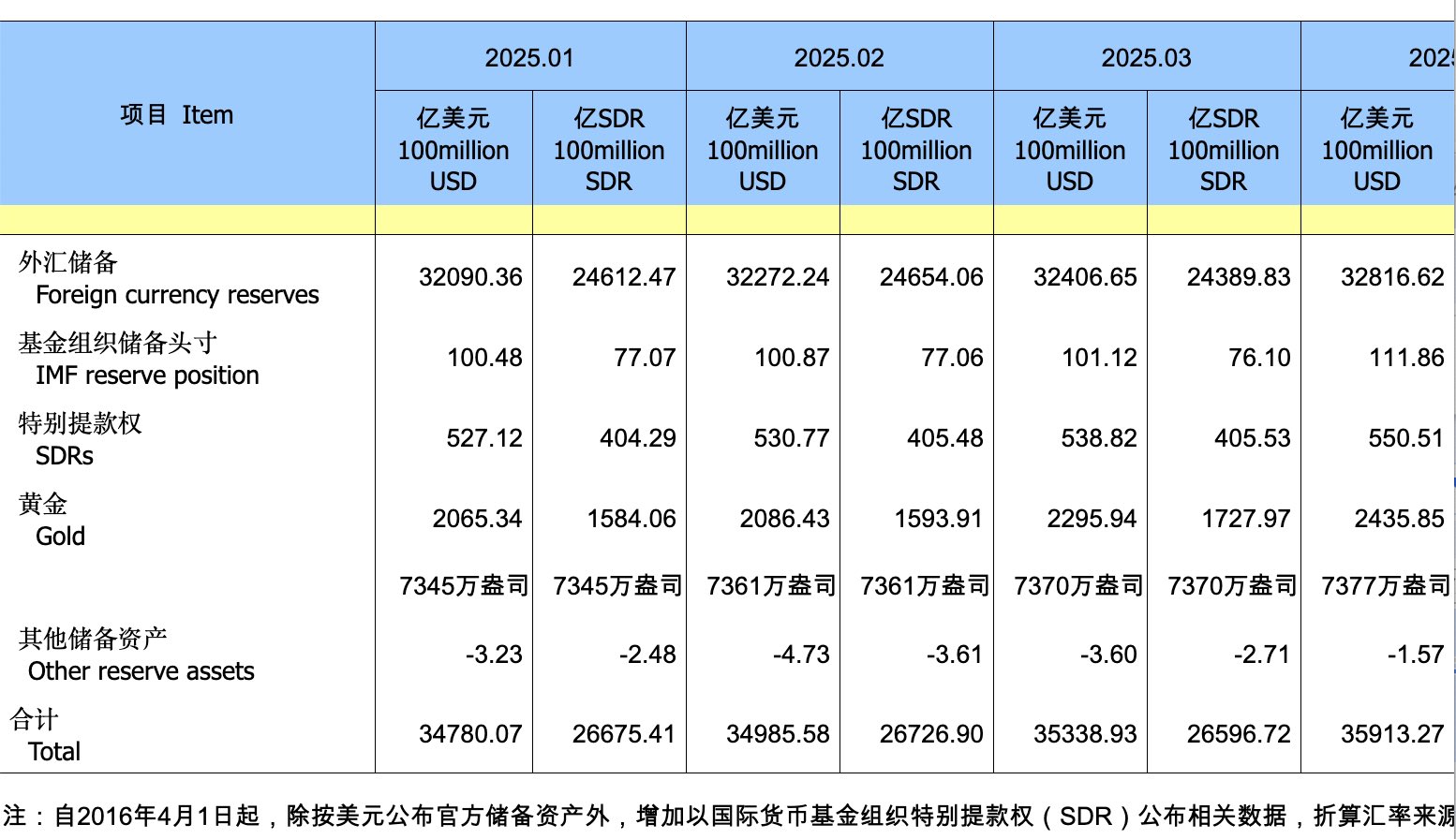

central bank balance sheets are an underrated resource for understanding the global liquidity moves

if you're following my posts - you already know that

rising US bond yields, ruble & gold

falling USD

i've been warning about it for months

90's style data = massive alpha 😂⬇️

beware that a lot of accounts with massive leverage trades are paid advertisements

wether it's by the exchange or larger parts of the industry. don't forget that smart money needs a counterparty 😉

a lot of them, specially the larger are definitely hedging behind the scenes

expected? yes ✅

normal? no ❌

gold shouldn't be up 50% in a year

and you shouldn't ignore what that means

i wrote this back in 2013. as the current highs are consolidated - it will move up further

maybe when you're reading this the above has already played out 😄

central banks will continue to buy gold

you'll be able to confirm that in their upcoming balance sheets reports. pay special attention to China & Russia

enjoy the dip, because smart money is!

USD decline prediction was spot-on ✅

2 months later and US dollar index just bounced off from 97

the past 6 months have been a downtrend for $DXY

🚀 added a share action to every post

so now you can press to open the share dialog

it only shares the url, but the preview image of the URL contains the post/thought text

definitely plan to open-source this at some point (the repo just needs some cleanup)

example in reply ⬇️

reverse repurchase agreement is just the other side (seller) side of a repurchase agreement (buyer)

repurchaser provides collateral and receives a loan

reverse repurchaser receives the collateral and issues a loan

at maturity the repurchaser repurchases the collateral

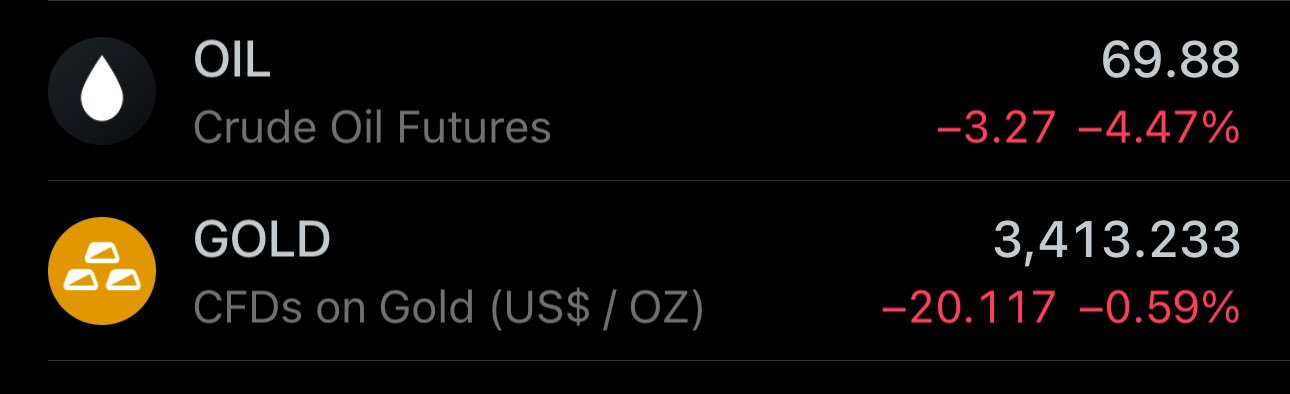

initial raise, now followed by a pullback

large geopolitical events do such moves, however don't you for a minute think that the thesis is now invalidated 😄

both of these commodities will continue their uptrend

and this is how the gold market opened

green candle straight to $3400 🚀

gold futures market opens in 2 mins!!

are you ready?

gold futures market opens in 2 mins!!

are you ready?

now it's official 😄

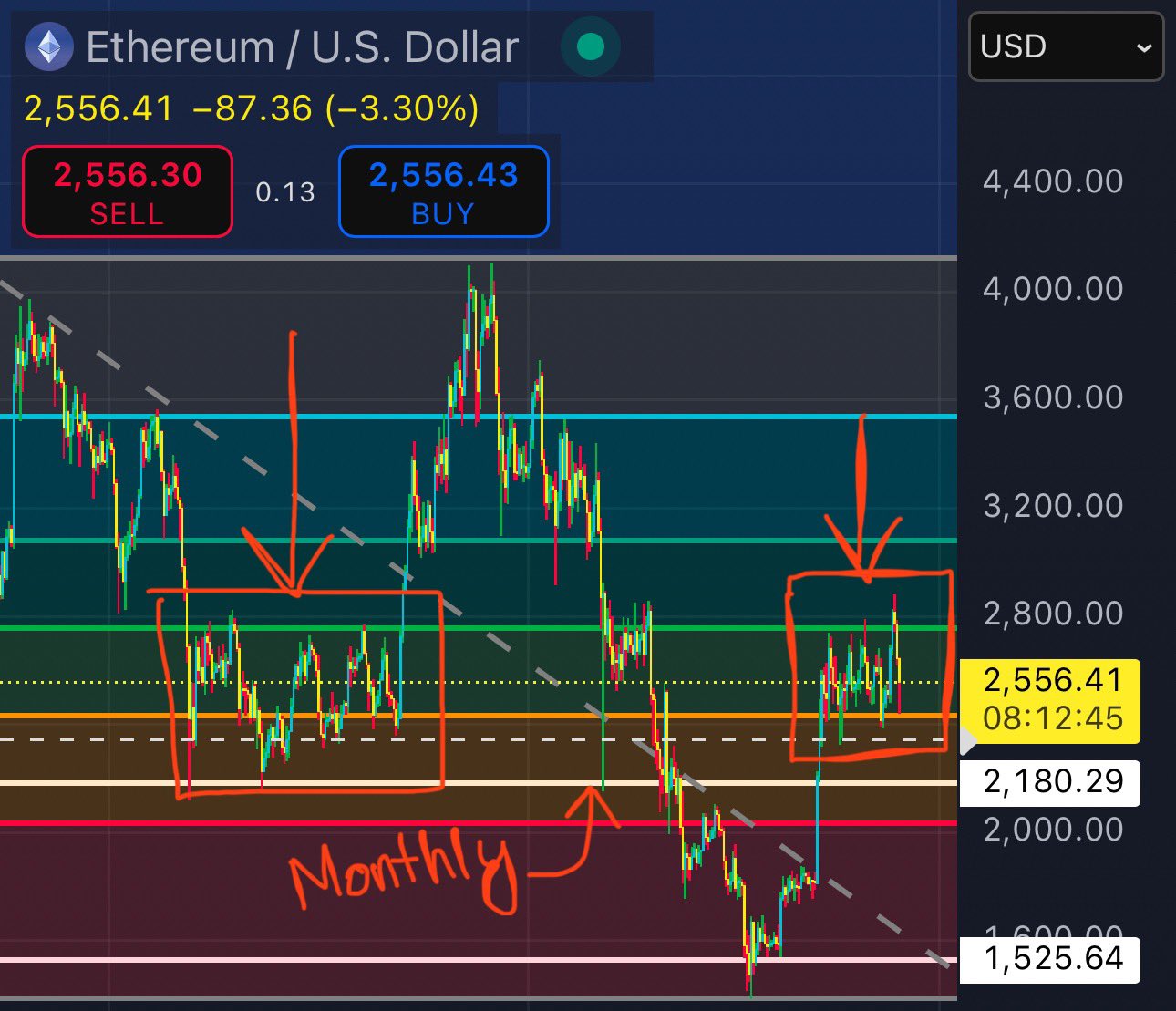

ethereum price fell to $2180 📉

interestingly, the majority sentiment of large following X accounts seemed to be bullish

please note, I wrote the original post more than a week ago - back then the market sentiment was extremely bullish

UN's Model Double Taxation Convention has a clear key benefit over OCED's

since UN's model gives more taxing rights for the source state - it's the one that makes sense for developing economies

imagine a developed nation benefiting from cheaper labor in the source state - who created the workforce in the first place, and having their tax base eroded in favor of resident state

so the resident state would get double benefit:

1️⃣ cheaper labor

2️⃣ higher tax income for the government

on the other hand you could argue for OCED's model favoring a higher volume of investment, thus effectively distributing more wages throughout the economy. this channels the funds more directly to the consumers, which would end up increasing their purchasing power more than if it had to go through the government first

but then again, you must remember the global market is NOT a free market economy. existing legislation overall favors more developed countries, so protective measures for developing countries in the international tax law may make a lot of sense

btw here I'm looking at PAXG (Paxos Gold) token

essentially, a 1:1 gold-backed ERC-20 token

there is also XAUT from Tether

whenever TradFi markets are closed - it's your go-to for alpha insights

can't believe that in 2025 there is still such a thing as market closure 🤯

gold's behavior during the current 'bullrun' has been consistently to flip previous week's resistance to new support

in the chart - the green vertical lines are weekly levels

gold's current price action suggests it's flipping another resistance for support

Road to $3500 🚀