⬇️ My Thoughts ⬇️

this will also further fuel the asset bubble & devaluate USD

so it doesn't mean that stock & crypto will go up perpetually - it's a cycle

of course, at some point the debt bubble will pop - but it's unlikely to happen tomorrow 😄

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

this means inflation & gold up

at least short-term: equities up, crypto up

central bank liquidity injection includes direct & indirect QE, interest rates & policies

end result is the same - more liquidity/cash in the system

this means inflation & gold up

at least short-term: equities up, crypto up

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

using FED's SRF for liquidity means cash/liqudity is scarce

there is a lot of short-term debt to be refinanced or default

default is not an option. thus, expect liquidity injections from the central bank

repo funding rates are predictors within this global, multi-factor liquidity context

you can use them to understand liquidity flows in the near future

this is also because repo markets are short-term debt instruments - so the signal is also more short-term

repo funding rates are predictors within this global, multi-factor liquidity context

you can use them to understand liquidity flows in the near future

this is also because repo markets are short-term debt instruments - so the signal is also more short-term

regarding liquidity flows - repo markets are just one of the sources

so it's more useful when you combine it with others, such as the central bank policies, how much short-term debt is maturing, and the overall leverage level

regarding liquidity flows - repo markets are just one of the sources

so it's more useful when you combine it with others, such as the central bank policies, how much short-term debt is maturing, and the overall leverage level

if regulatory ratios are breached, they must be restored

there is only so much a dealer/market maker can do

so you can deduce their next action with a high degree of certainty

then, deduce its implication on the liquidity flow & into which sector the funds are flowing

if regulatory ratios are breached, they must be restored

there is only so much a dealer/market maker can do

so you can deduce their next action with a high degree of certainty

then, deduce its implication on the liquidity flow & into which sector the funds are flowing

so the market operations of dealers/market-markers is quite predictable

you just have to look at their business & regulatory model - from there it's almost plain math under regulatory constraints

so the market operations of dealers/market-markers is quite predictable

you just have to look at their business & regulatory model - from there it's almost plain math under regulatory constraints

dealers/market makers are legally limited in their balance sheet

there are ratios that they must respect, or face legal consequences (e.g. fines)

check Basel III & Leverage Ratios for more info - I also wrote about it in my past posts

committee recommendations develop into law

in a monthly maturity/tenor timescale - the repo funding rate has very direct effects

this makes sense - if your bond is maturing in ≈1 month, every day is significant

so you see more immediate effects from federal reserve's SRF operations / repo funding fee increases

in a monthly maturity/tenor timescale - the repo funding rate has very direct effects

this makes sense - if your bond is maturing in ≈1 month, every day is significant

so you see more immediate effects from federal reserve's SRF operations / repo funding fee increases

shorter-term US bonds yields react IMMEDIATELY to repo funding rate

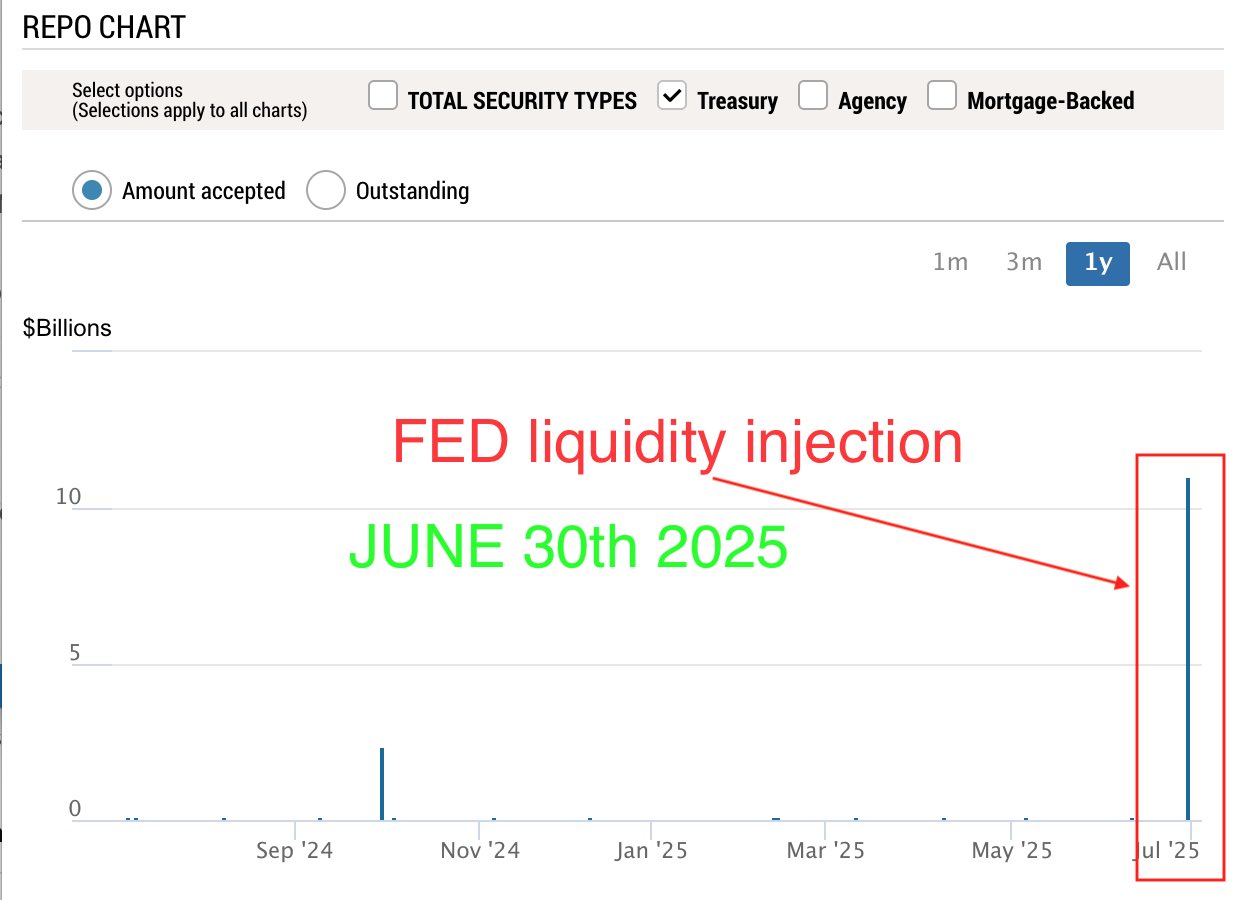

notice the huge green candle on June 30th - the same day of FED's SRF $11B volume

June 30th is when the FED SRF volume recorded ≈$11B

this is a 1 month treasury bill ⬇️

persistently high(er) funding repo rates will push the treasury yields up

eventually, the bonds would be sold for cash

again - think of the timescale: funding rates refer to much shorter periods

persistently high(er) funding repo rates will push the treasury yields up

eventually, the bonds would be sold for cash

again - think of the timescale: funding rates refer to much shorter periods

repo funding rates don't affect US treasury yields immediately due to time scale

treasury bond yield expectation is over 10 years, and repo rates are a short-term debt funding mechanism

so the rates shock would need to be prolonged/pronounced to affect treasury rates

repo funding rates don't affect US treasury yields immediately due to time scale

treasury bond yield expectation is over 10 years, and repo rates are a short-term debt funding mechanism

so the rates shock would need to be prolonged/pronounced to affect treasury rates

funding rates on repo markets & bond yields are not the same

different timescales:

1️⃣ repo - short-term / ≈day(s),week(s)

2️⃣ treasury bonds - ≈10 years

so even if a funding rate raises for a few days, the longer-term bond yields may not be affected

funding rates on repo markets & bond yields are not the same

different timescales:

1️⃣ repo - short-term / ≈day(s),week(s)

2️⃣ treasury bonds - ≈10 years

so even if a funding rate raises for a few days, the longer-term bond yields may not be affected

note that FED's SFR doesn't lower the treasury yields per se

it's more correct to say that it puts downward pressure on them, in the form of a $500B buffer

& note that treasuries probably wouldn't be the first in line for liquidation

note that FED's SFR doesn't lower the treasury yields per se

it's more correct to say that it puts downward pressure on them, in the form of a $500B buffer

& note that treasuries probably wouldn't be the first in line for liquidation

how does SRF lower UST bond yields?

if you have a US bond and you need cash, your options are:

1️⃣ borrow cash against bond in repo markets

2️⃣ sell the bond

this $500B liquidity pool for US bonds prevents their sell-off in the open market, which would raise their yields

how does SRF lower UST bond yields?

if you have a US bond and you need cash, your options are:

1️⃣ borrow cash against bond in repo markets

2️⃣ sell the bond

this $500B liquidity pool for US bonds prevents their sell-off in the open market, which would raise their yields

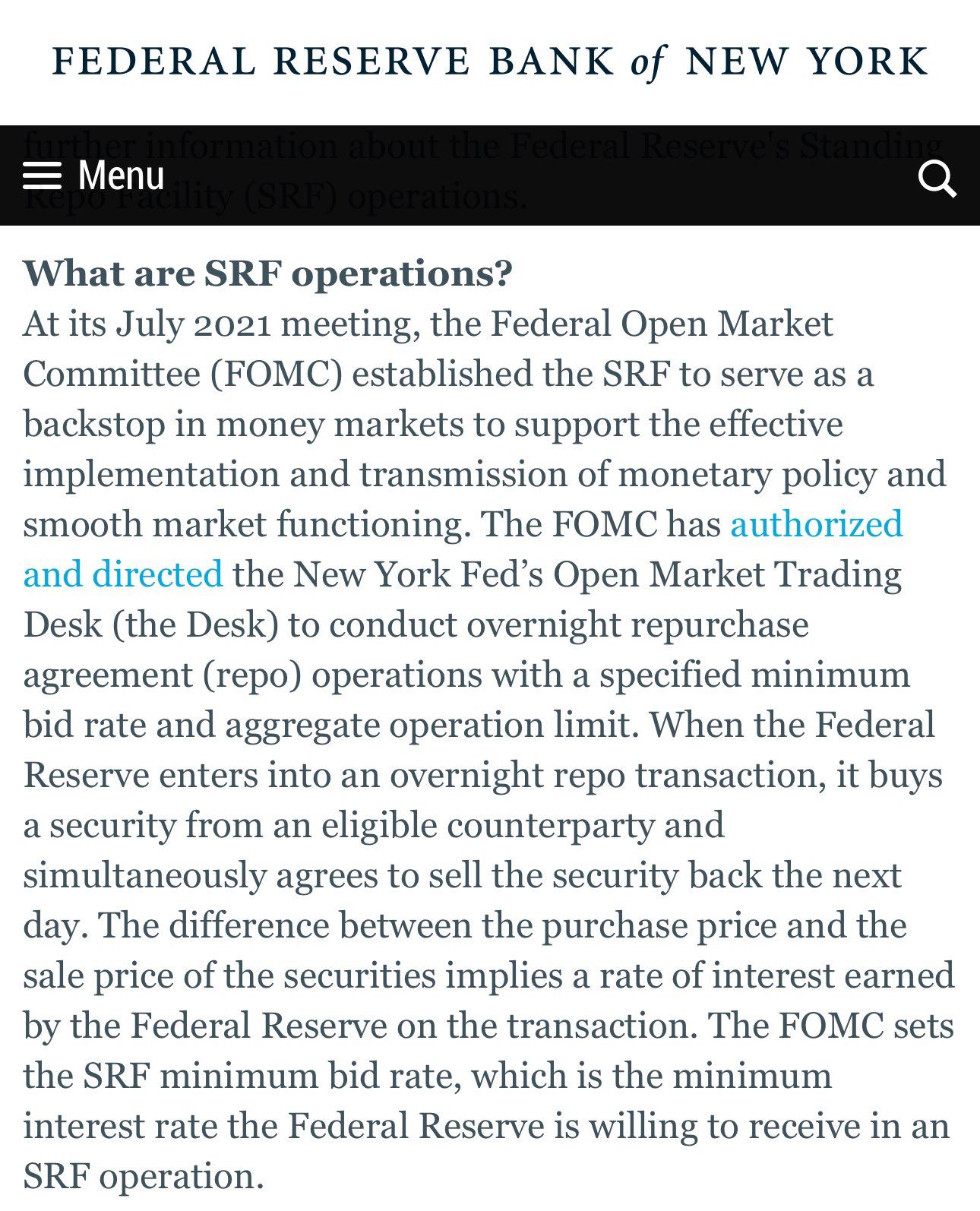

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs

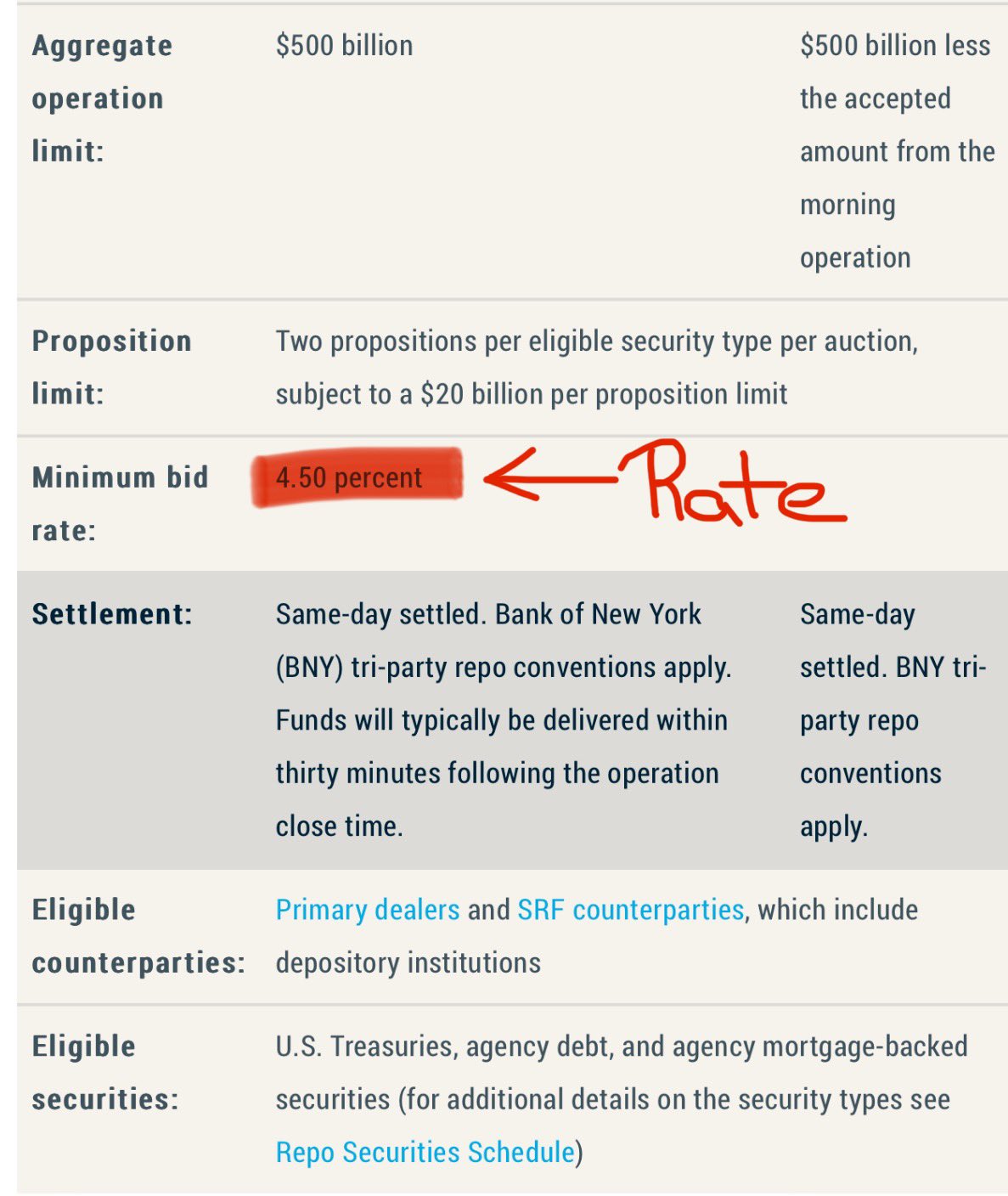

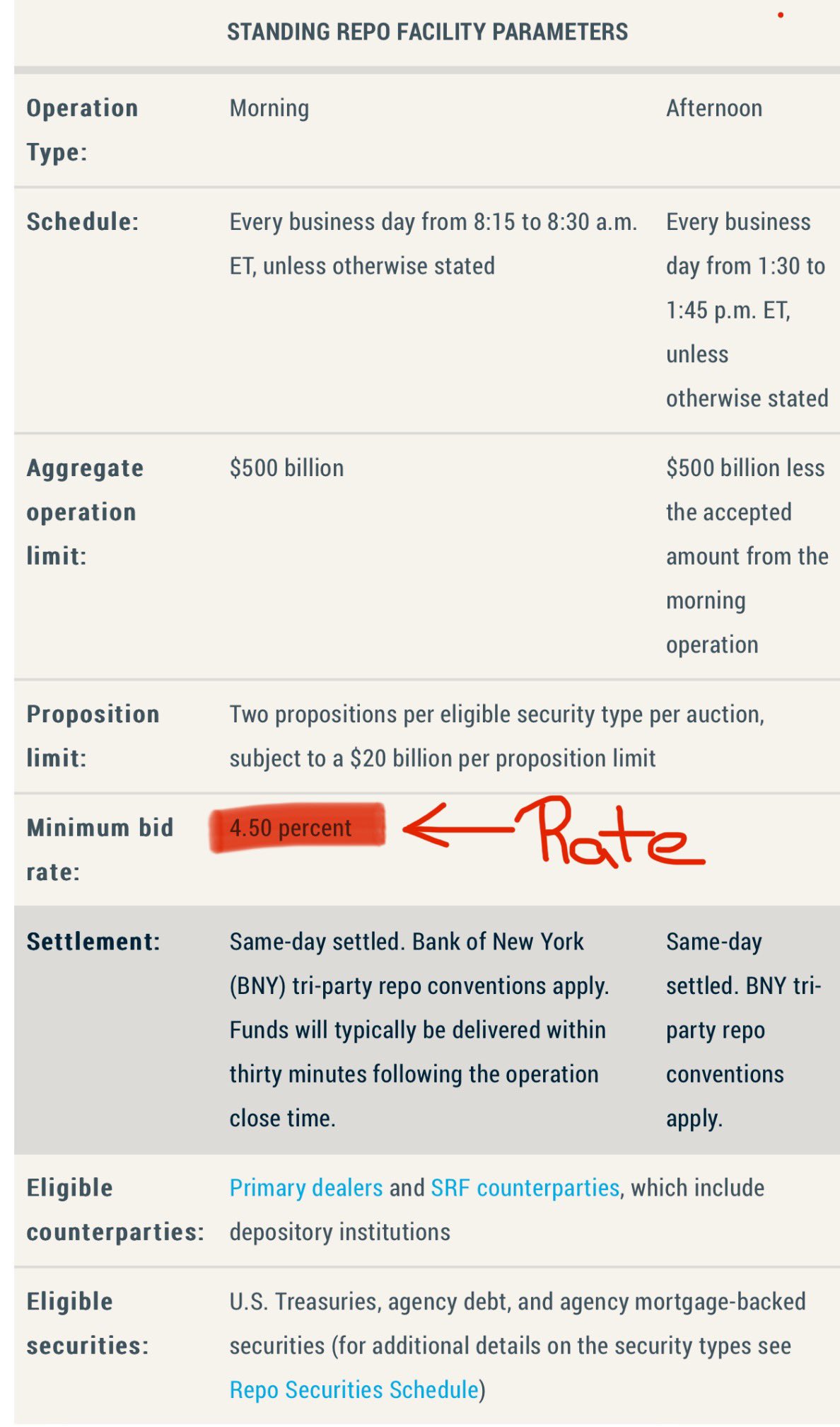

not only US treasuries are accepted as collateral for SRF

dealers/market makers can use:

1️⃣ US. Treasuries

2️⃣ agency debt

3️⃣ agency mortgage-backed securities

agency debt instruments aren't issued by US Treasury, but by government sponsored enterprises (GSE) & federal agencies

current SRF minimum bid rate is 4.5%

that's the annualized rate that the federal reserve sets requires dor overnight repo loans via Standing Repo Facility

dealers/market makers can borrow cash against US treasuries for 1 day at ≈4.5% annualized directly from the FED

in practice, FED's SRF is used when there is a scarcity of liquidity/cash

the market has US bonds & needs cash, so lenders increase rates

SRF sets a daily rate. if that rate is smaller than in the smaller repo market - the dealers instead borrow USD directly from the FED

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs

with SRF the FED sets an upper limit on repo market rates

most of the collateral is US Treasury bonds

this exerts downward pressure on bond yields - by preventing sell-offs

SRF provides daily $500B liquidity limit for overnight repo operations

a rate is published daily & dealers lend borrow against US bonds

dealers/market makers use SRF when the rate in the open repo market gets too high

SRF = Standing Repo Facility

🚨FED just injected $11B of liquidity

👉 TL;DR: interest rate cuts & QE incoming

$11B is insignificant - but it's an early sign: there is a lack of liquidity/cash

if undressed, will lead to systemic defaults. existing debt needs to be refinanced

the fix/what's next? see TL;DR

btw I'm not saying Ethereum won't reach 1 million USD per ETH, but rather pointing out that comparing Ethereum to the bond market and oil is a stretch

it's also more accurate to account for the whole crypto cap in this context

all of this very bullish for gold & other commodities

it's not just gold & silver - you may have seen the recent appreciation of platinum

those commodities have still have price to catch up on & that has been signaled by their volatility

gold up 40% on the year isn't normal

so today it may not be wise to assume that the FED will hike interest rates into double digits to lower the CPI/inflation

rather - the interest rates are headed down, bc of challenge in refinancing debt

that's what I meant by focusing on historical patterns from this century

so today it may not be wise to assume that the FED will hike interest rates into double digits to lower the CPI/inflation

rather - the interest rates are headed down, bc of challenge in refinancing debt

that's what I meant by focusing on historical patterns from this century

ex: in the 1980's US fought high inflation by raising interest rates towards ≈20%

if the FED did that today - the global financial markets, alongside the US would be destroyed. there wouldn't be enough liquidity to refinance the debt