⬇️ My Thoughts ⬇️

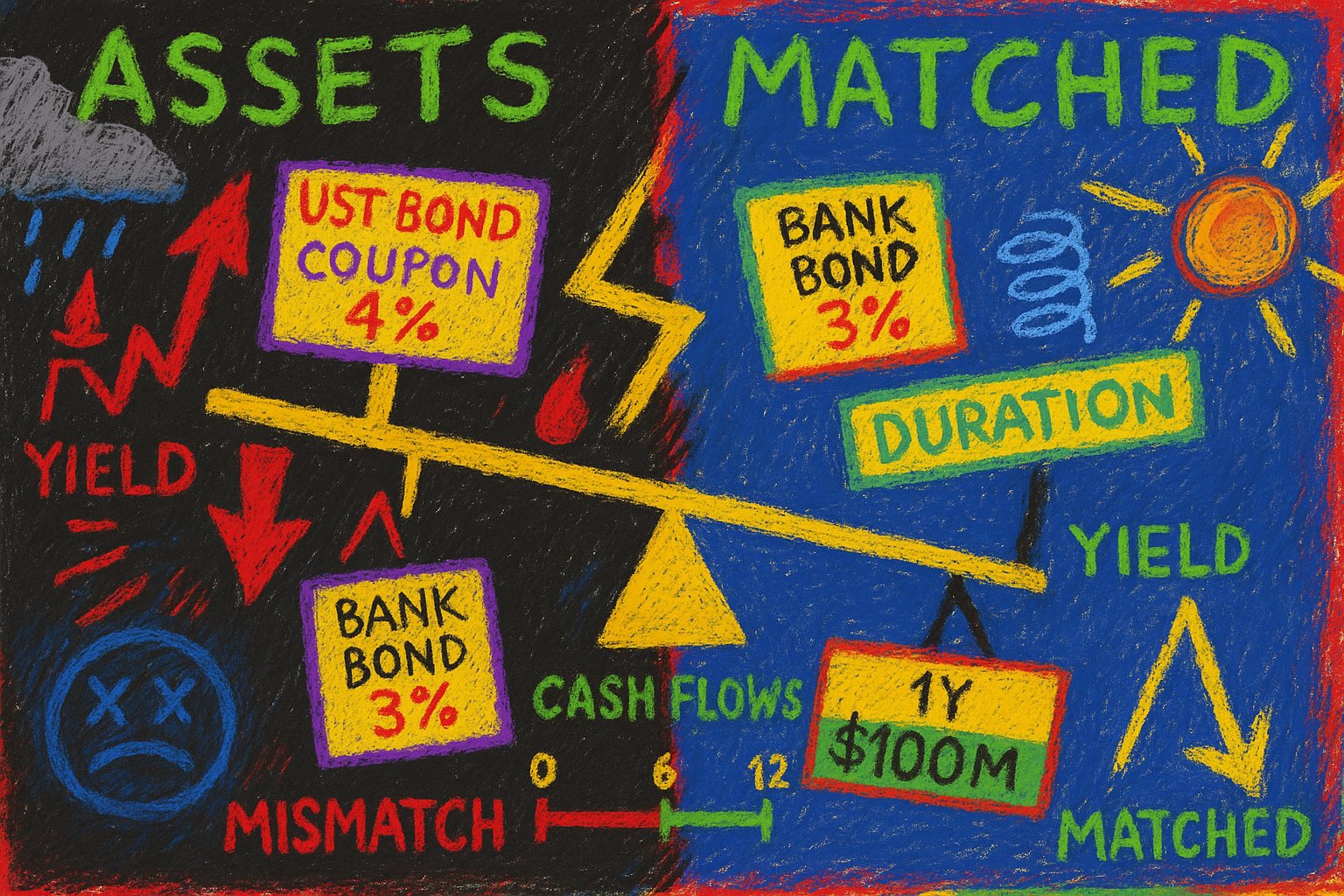

duration matching protects solvency and liquidity when yields shift

assets are financed by liabilities and equity. financial institutions like banks usually have small equity - so liabilities finance assets

re-iterating on the 1.5 month old thread 😄

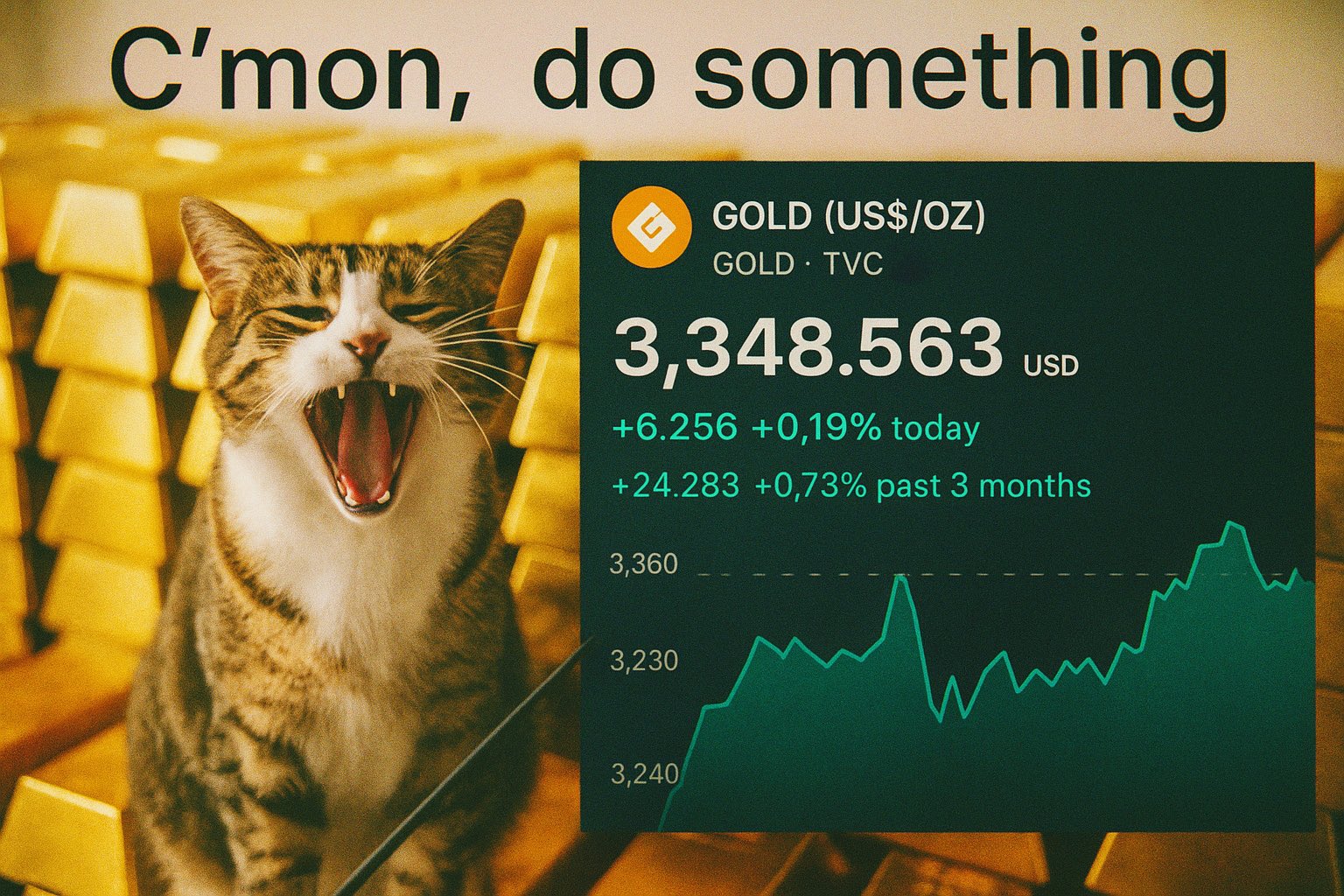

inflation is still here to stay and gold is still yet to do something - but it sure will

although gold already did a lot since this post - this is just the beginning ✨

persistent high inflation is here to stay

FIAT currencies will continue to devalue, specially with the massive government debit refinancing & further interest rate cuts

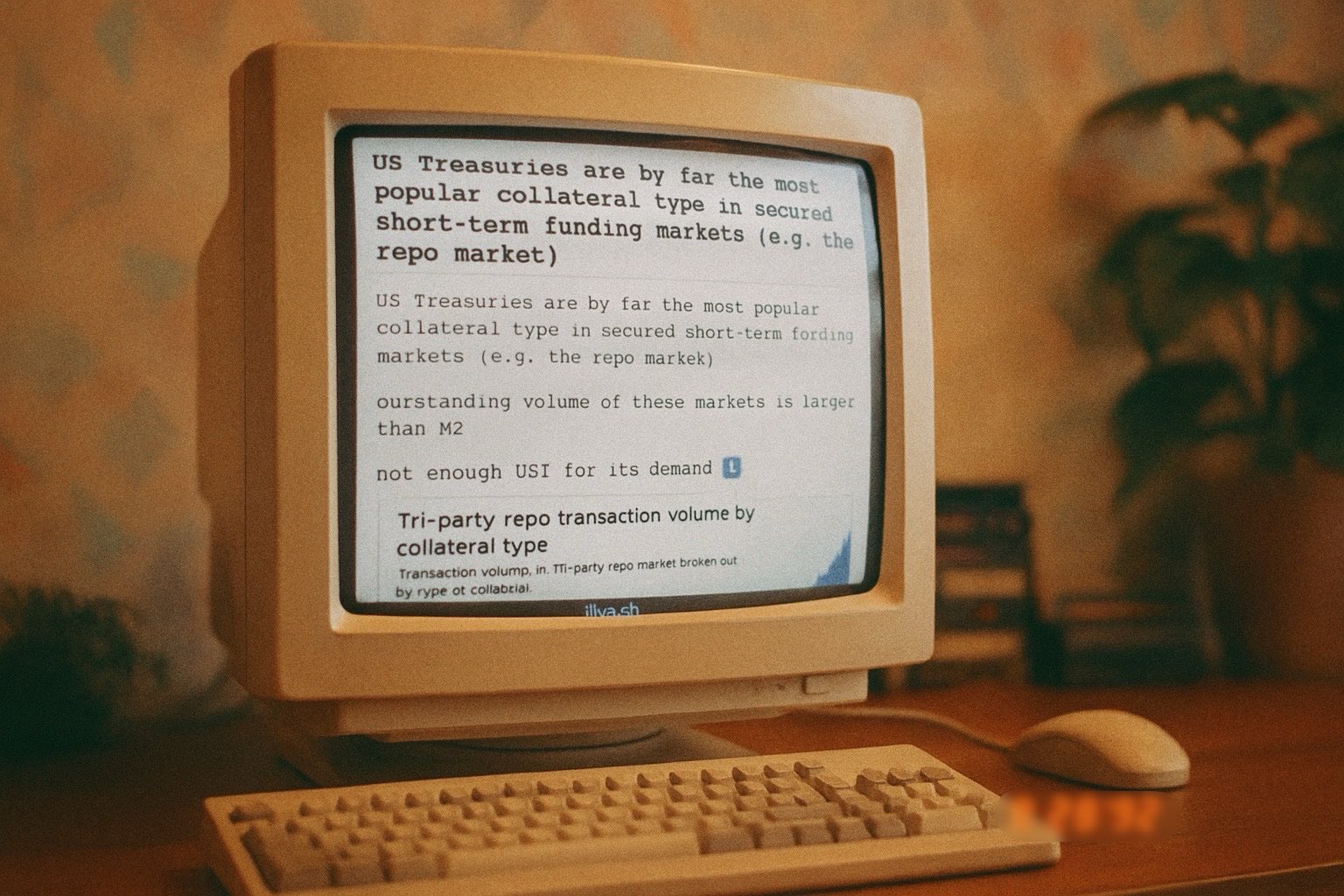

i also wrote a thread explaining the importance of USD-denominated government debt for short-term funding/credit markets

remember that most of credit is issued to refinance existing debt and not for new financing

you can read it here:

https://illya.sh/threads/@1751726431-1

i wrote about how reverse repurchase agreements work and their importance in the global financial system in this thread:

https://illya.sh/threads/@1751561045-2

bitcoin went up 6% from the weekly support line

until the end of this month, bitcoin will either see a new all time high or retest the ≈$0.1095M support

this is the daily timescale of the same chart - the blue and red lines are weekly, green is daily

just a quick check-up

on a weekly timeframe a stronger future support is developing for gold within the red box

it's a part of a multi-month uptrend

i wrote about how reverse repurchase agreements work and their importance in the global financial system in this thread:

https://illya.sh/threads/@1751561045-2

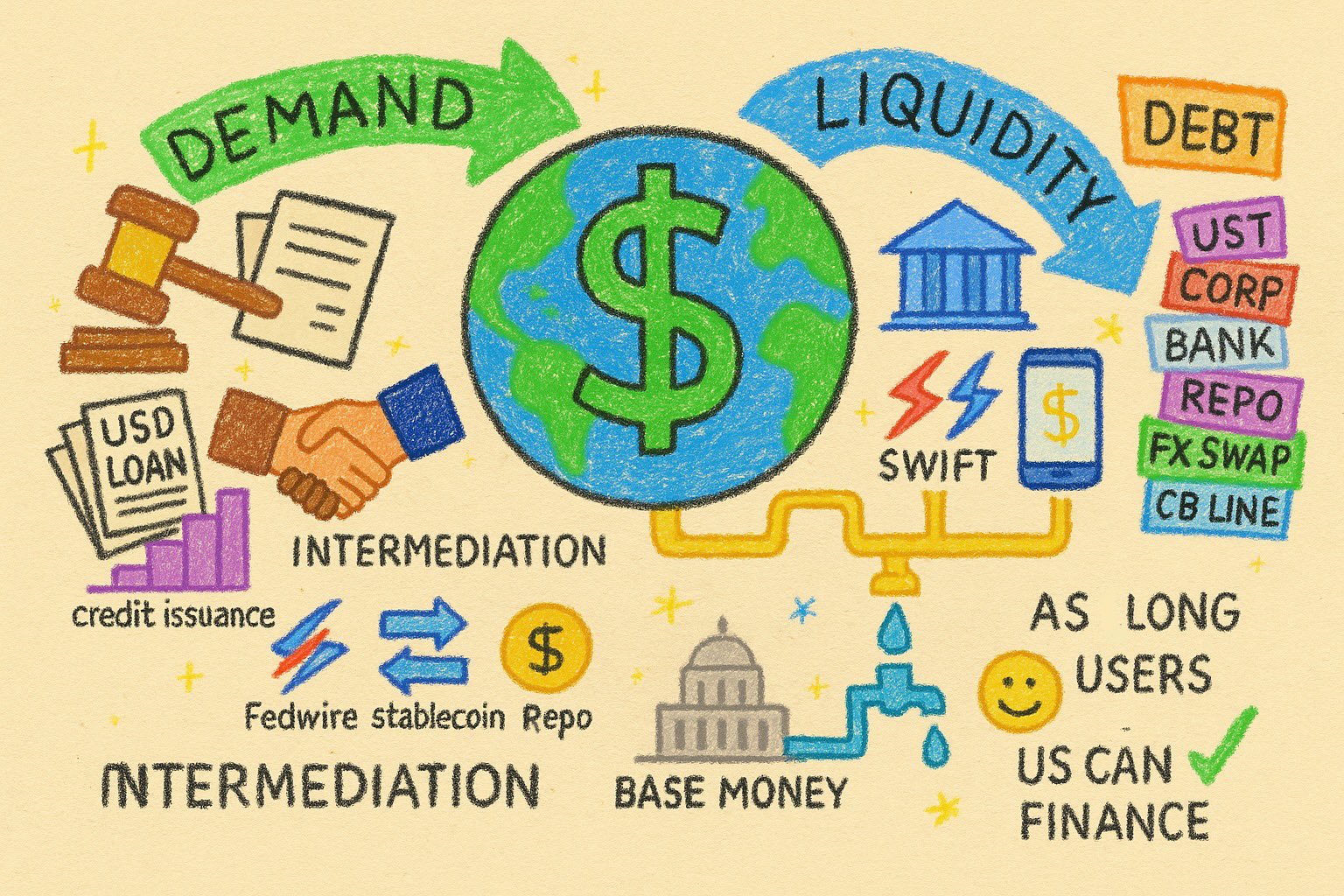

the US will be able to sustain their debt financing for as long as US government debt and US dollar dominate in demand

for as long as USD is the reserve currency - the US can finance its debt

in other words, as long as there's enough buyers and users - it's all good! 😁

the US will be able to sustain their debt financing for as long as US government debt and US dollar dominate in demand

for as long as USD is the reserve currency - the US can finance its debt

in other words, as long as there's enough buyers and users - it's all good! 😁

debt includes all form, tenor and issuers of USD-denominated debt are included, both public and private

examples: US Treasuries, corporate bonds, commercial bank credit, epos, FX swaps, central-bank lines

debt includes all form, tenor and issuers of USD-denominated debt are included, both public and private

examples: US Treasuries, corporate bonds, commercial bank credit, epos, FX swaps, central-bank lines

intermediation started with paper records, physical bank counters and now has mostly moved to technological - via computer systems

intermediation started with paper records, physical bank counters and now has mostly moved to technological - via computer systems

while hybrid intermediation systems don’t strictly need to be technological - in practice they vastly are as most of financial activity happens through computer and information systems

while hybrid intermediation systems don’t strictly need to be technological - in practice they vastly are as most of financial activity happens through computer and information systems

base money issuance and management is a responsibility of the US government - so it's always intermediated, even if by government-controlled systems

base money issuance and management is a responsibility of the US government - so it's always intermediated, even if by government-controlled systems

hybrid intermediation systems include all means of facilitating the issuance, servicing and transactions of USD and USD-denominated securities, including equities, bonds and derivatives

hybrid intermediation systems include all means of facilitating the issuance, servicing and transactions of USD and USD-denominated securities, including equities, bonds and derivatives

balance sheet capacity is heavily dependent on regulations (e.g. Basel III & local)

hybrid intermediation systems facilitate access to the payment and credit channels

SWIFT, FedWire and digital private USD claims like stablecoins & PayPal facilitate USD's movement and usage

balance sheet capacity is heavily dependent on regulations (e.g. Basel III & local)

hybrid intermediation systems facilitate access to the payment and credit channels

SWIFT, FedWire and digital private USD claims like stablecoins & PayPal facilitate USD's movement and usage

liquidity means availability, thus it comes down to being able to:

1️⃣ access USD credit

2️⃣ settle payments in USD

this means balance sheet capacity and hybrid technological intermediation systems in place

liquidity means availability, thus it comes down to being able to:

1️⃣ access USD credit

2️⃣ settle payments in USD

this means balance sheet capacity and hybrid technological intermediation systems in place

demand is created legal/regulatory environment and open market forces

legal/regulatory environment includes international bilateral agreements and national laws

open market forces influence the evaluation of USD against other currencies and assets

demand is created legal/regulatory environment and open market forces

legal/regulatory environment includes international bilateral agreements and national laws

open market forces influence the evaluation of USD against other currencies and assets

USD is the world's reserve currency, but what does that mean?

for USD to be a reserve currency it must dominate in:

1️⃣ USD-denominated credit issuance (demand)

2️⃣ USD use a means of settlement for payments (liquidity)

this dominance must be at least relative to alternatives

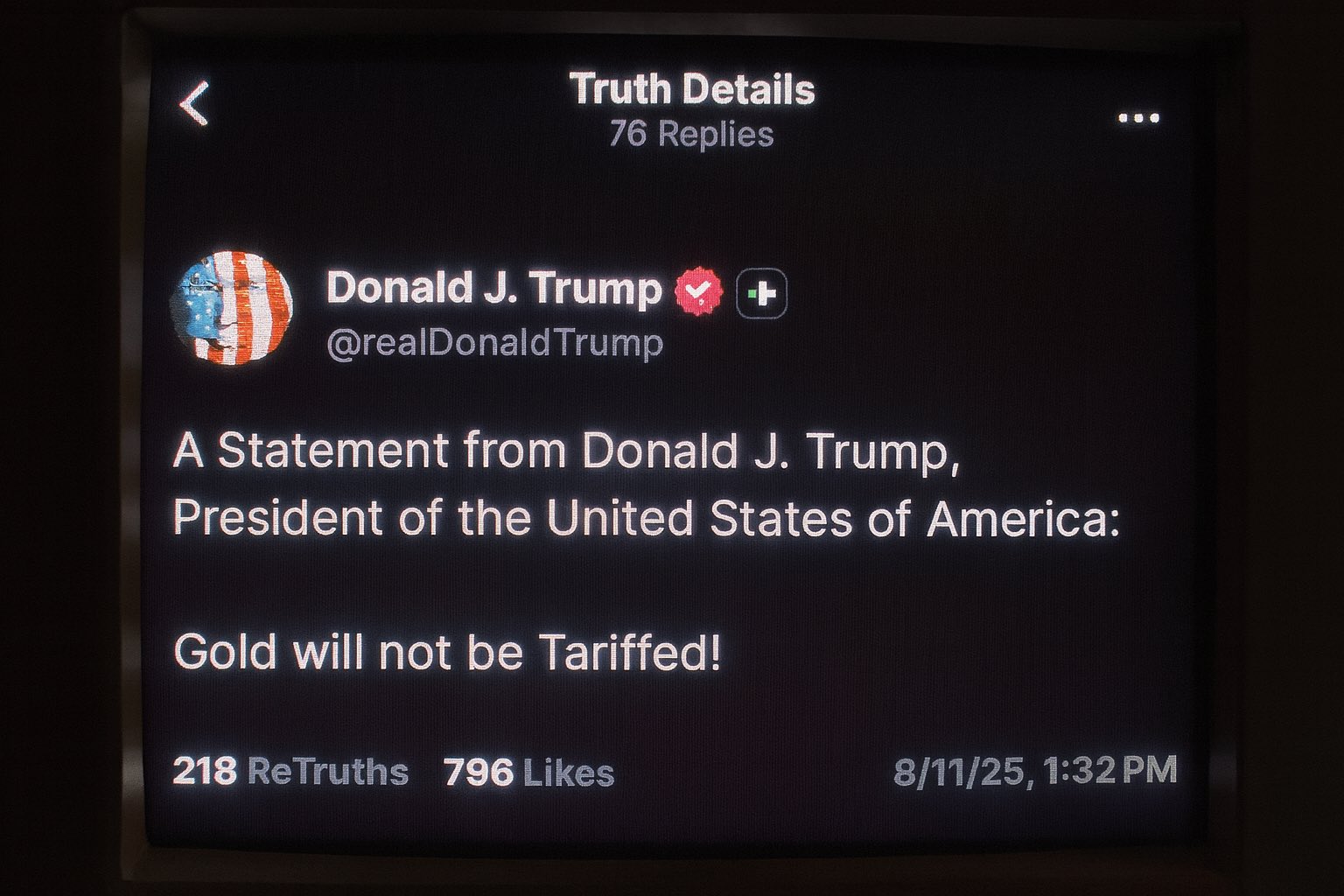

gold tariffs have been cancelled - just like I wrote in my thread on Friday (link below)

you can read about the gold tariffs, their impact on the market and why they were likely to get removed here

👇

https://illya.sh/threads/@1754662712-1.html

it's official: gold tariffs have been cancelled - just like I wrote last Friday 😄

in fact, rumors started less than 30 mins after i wrote the previous post in the thread - and the full removal of tariffs on gold has been confirmed just now

gold tariffs are unlikely to stay for a long period of time

expect them to be removed and/or heavily reduced soon

just the fact that they happened adds longer-term upside pressure on its price

of course, the markets will be volatile 😄

you can see how accurately gold price has been respecting the trend lines and channels you've seen in my graphs for months now 😄

gold tariffs ping-pong introduced volatility, but like i wrote in my other posts - its upside price pressure

a new all time-high will arrive

new all time high for gold is near 😄

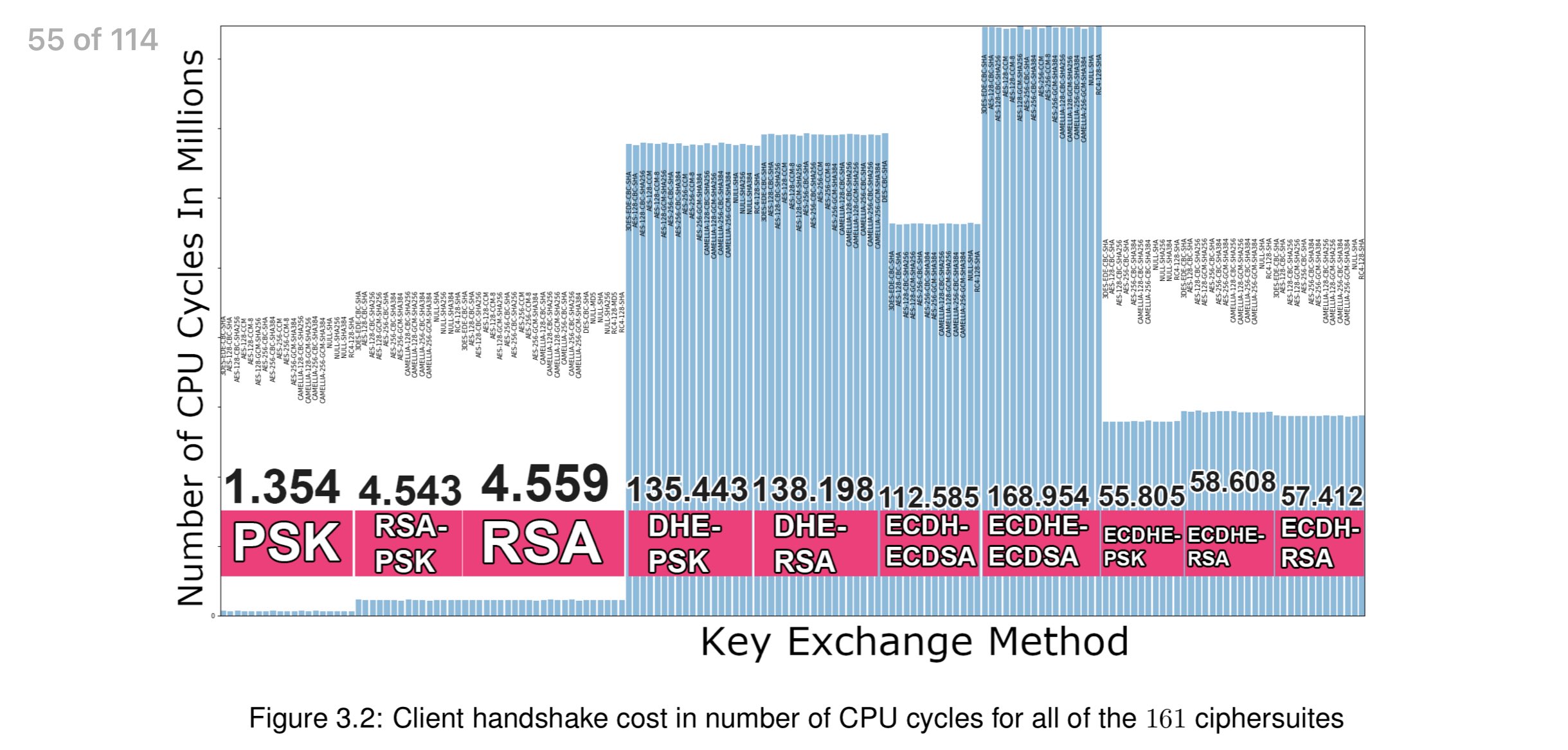

it took quite a bit of Python scripting and image editing to produce this cipher profiling graph 😄

161 TLS 1.2 ciphersuites were getting profiled by C code, which was then consumed by Python to produce the bars with algorithm names

all had to be aligned and readable

converting PDF to HTML is tricky due to formatting, but I managed to produce an acceptable HTML version

for highest fidelity use the PDF or Web PDF

an LLM/AI Agent visiting the page should also be able to access and read the full thesis content, including HTML version

added Transport Layer Security for Internet of Things/TLS for IoT master thesis page

i wrote this master thesis as a part of my engineering degree (MSc Software Engineering and Distributed Systems)

you can read it in HTML and PDF

here's the link

👇

https://illya.sh/tls-for-iot-msc-thesis/

added Transport Layer Security for Internet of Things/TLS for IoT master thesis page

i wrote this master thesis as a part of my engineering degree (MSc Software Engineering and Distributed Systems)

you can read it in HTML and PDF

here's the link

👇

https://illya.sh/tls-for-iot-msc-thesis/

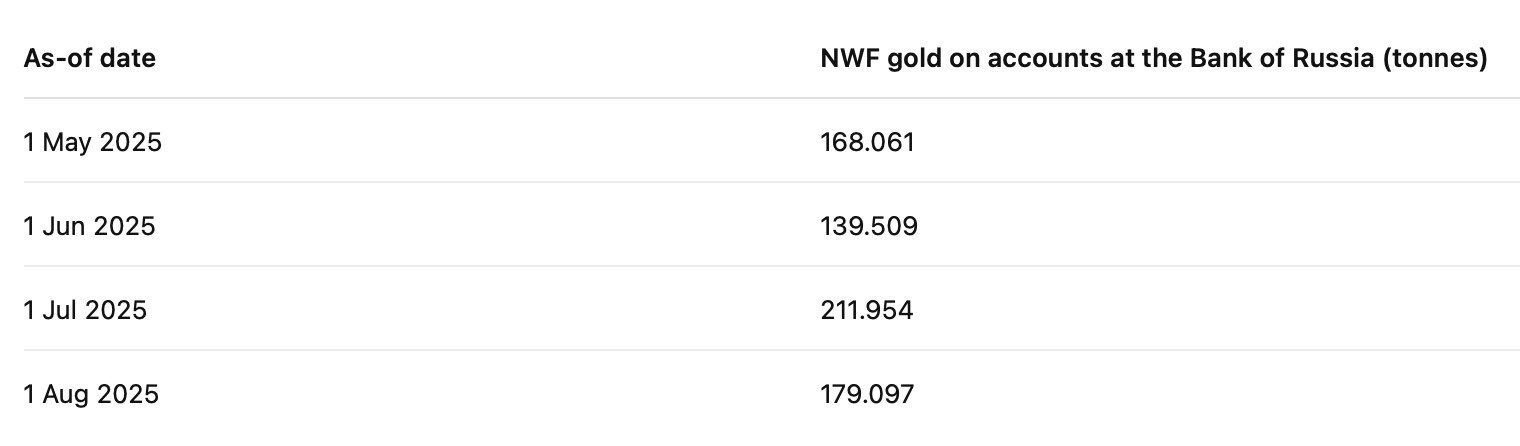

so did Russia really buy more gold?

yes! despite CBR's gold reserves remaining unchanged - Russia's NWF has increased its gold reserves

Russia's National Wealth Fund interoperates with the Russian Central Bank, government deficits and the broader economy

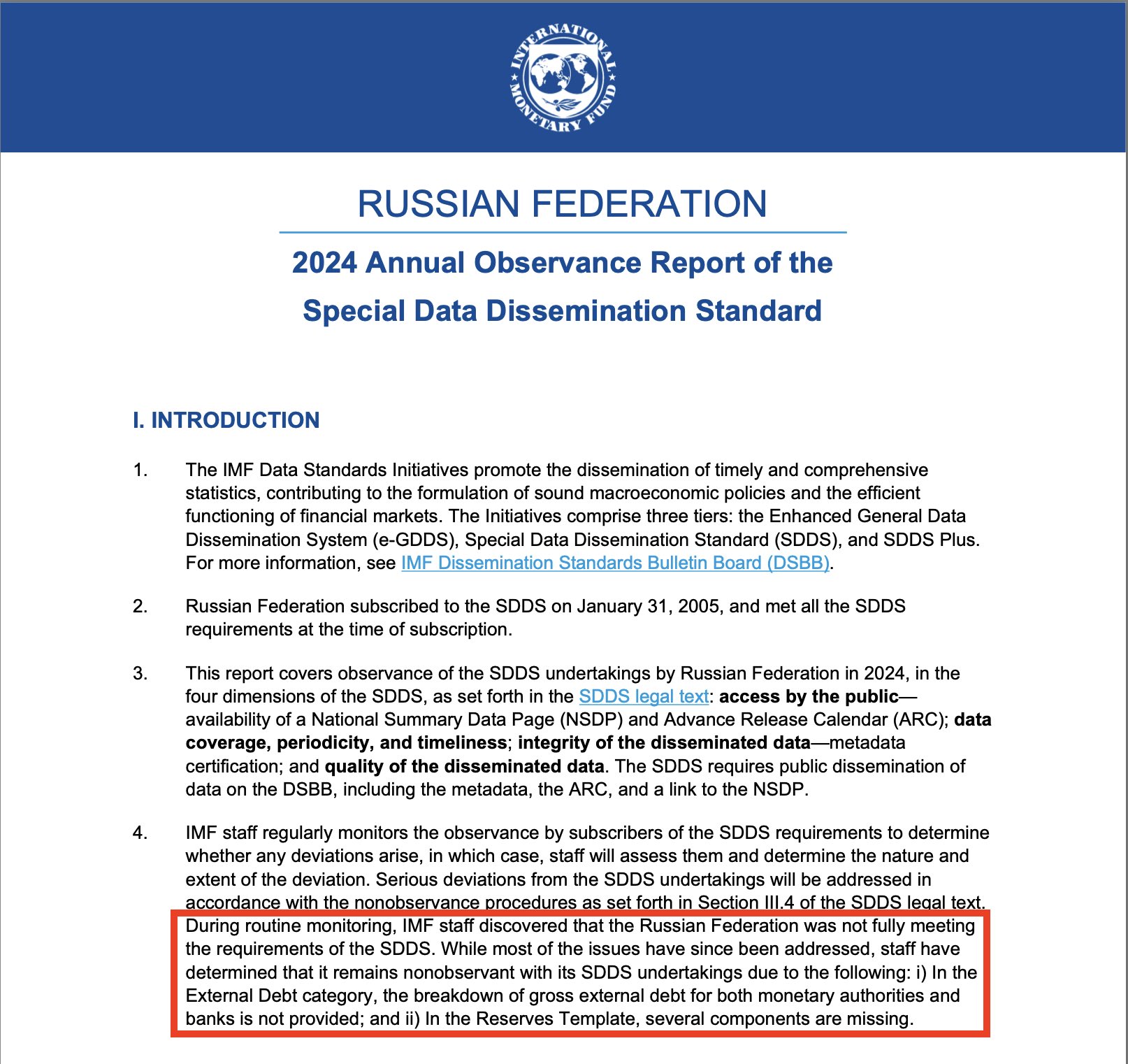

IMF's 2024 annual report on SDDS compliance pointed out that Russia hasn't been meeting its requirements to the full extent, since they didn't disclose all of the required macro-financial data

SDDS = Special Data Dissemination Standard

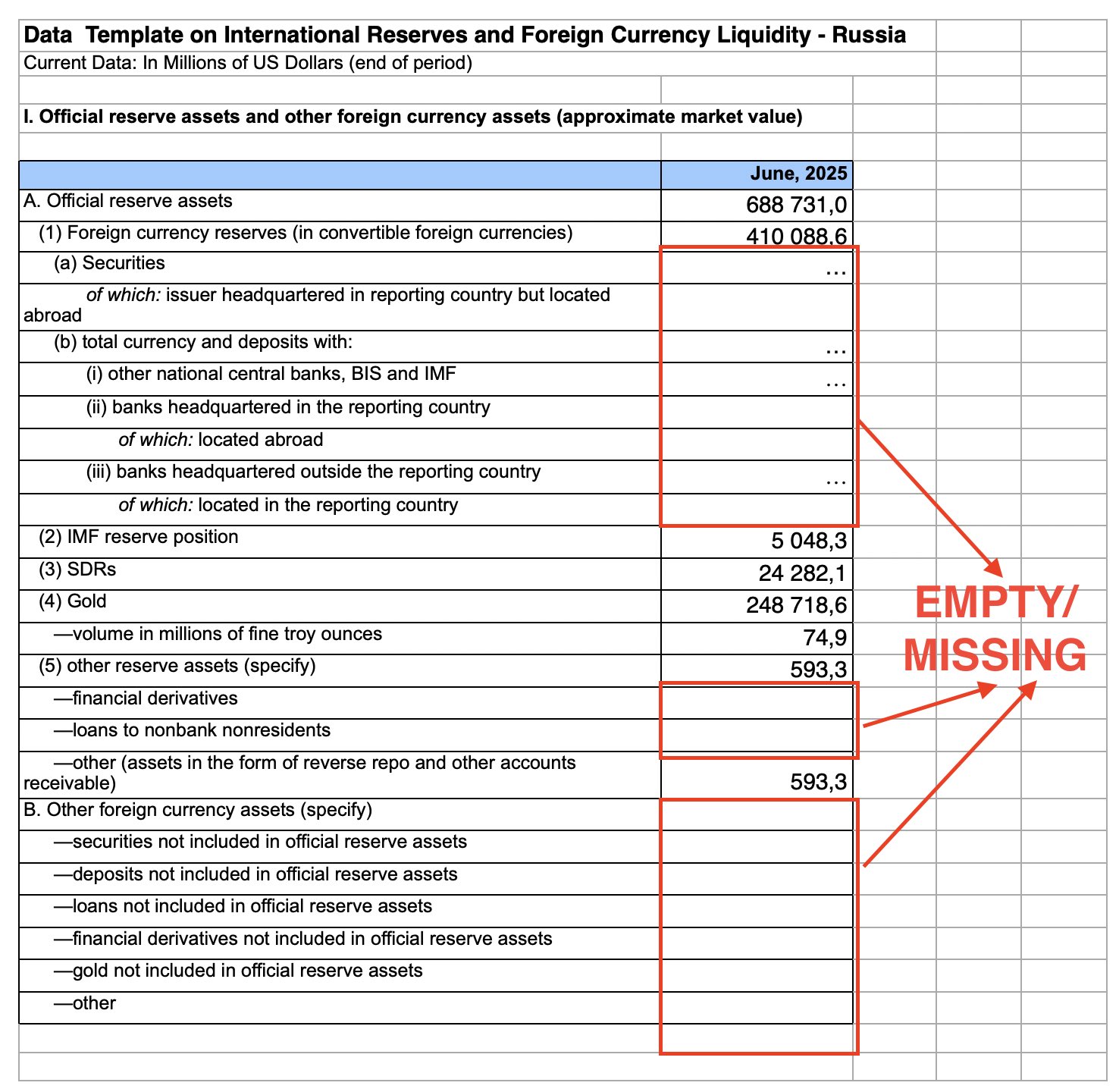

if you noticed - the IMF template reported by Russian Central Bank is missing entries

so they're actually supposed to report those values (or N/A - if it doesn't apply), but since the 2022 sanctions they have concealed some of the values