⬇️ My Thoughts ⬇️

IMF's guidelines mandate for the data to be either reported in Excel spreadsheet or SDMX

IMF pls update the specs to require publishing in HTML - i will happily provide you with XML to HTML scripts 😄

and yes, to get this data i had to download an excel file from Russian Central Bank's website. that's a norm in banks's international balance sheet reporting

HTML hasn't been discovered there yet 😄

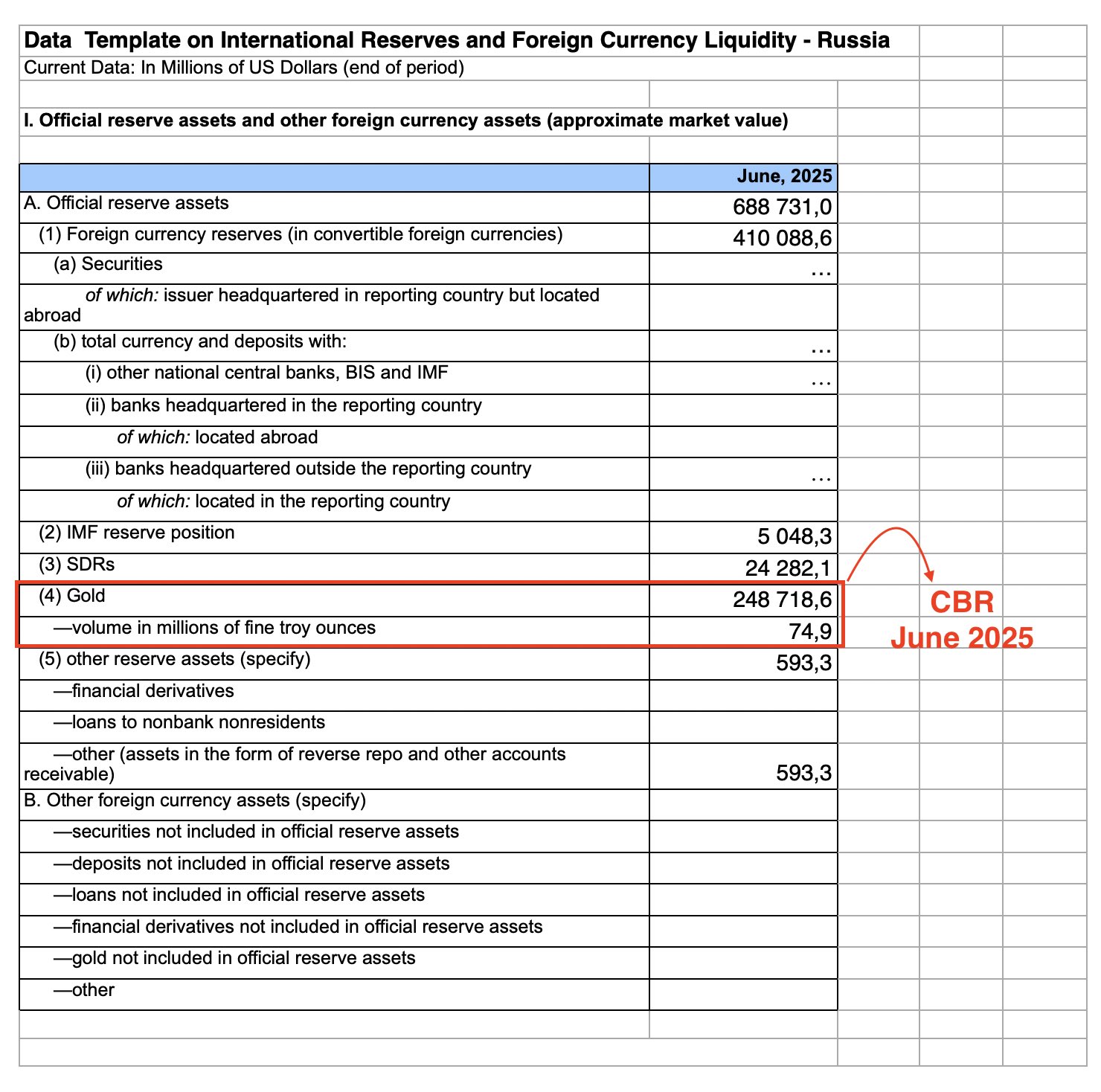

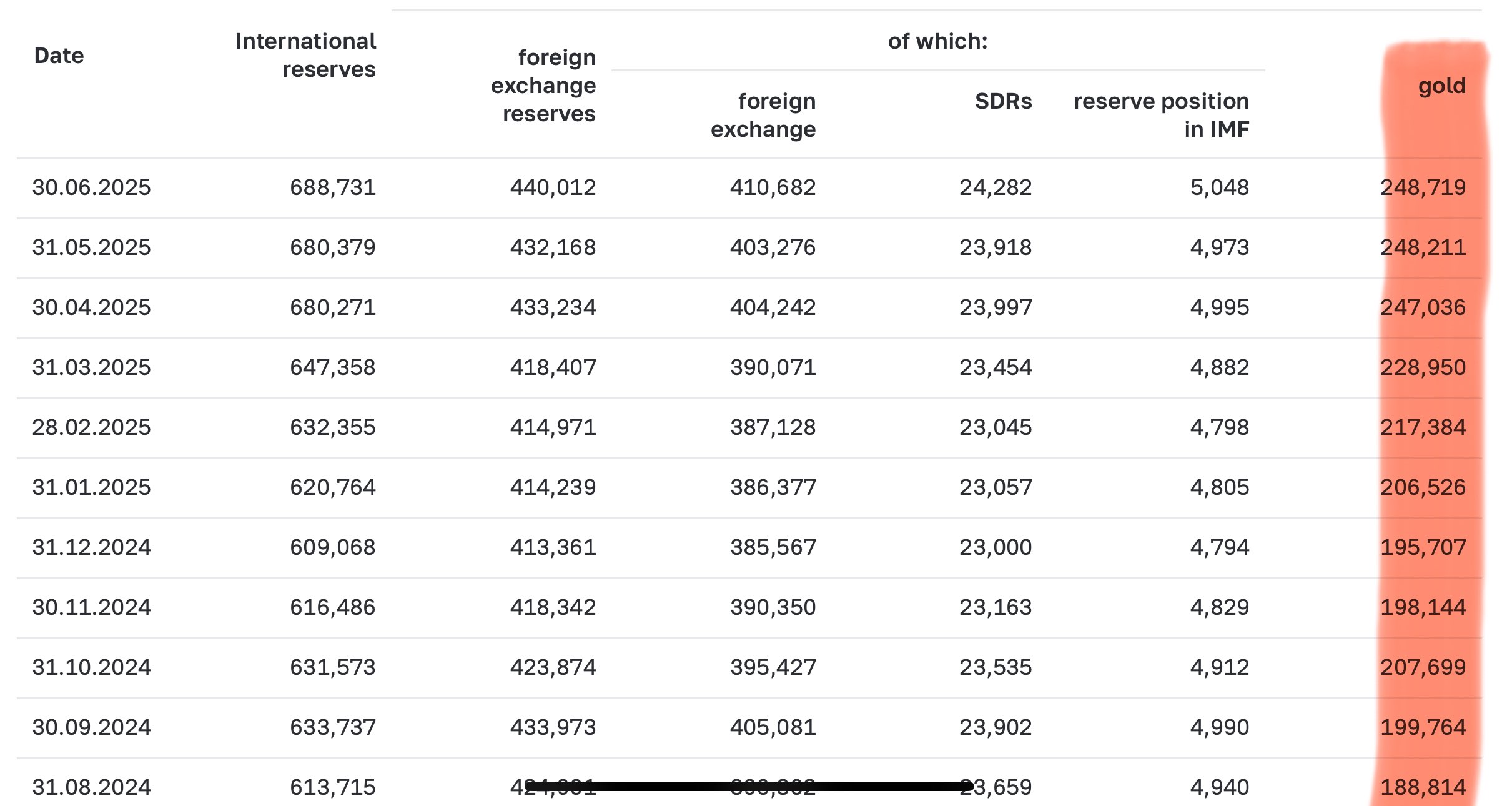

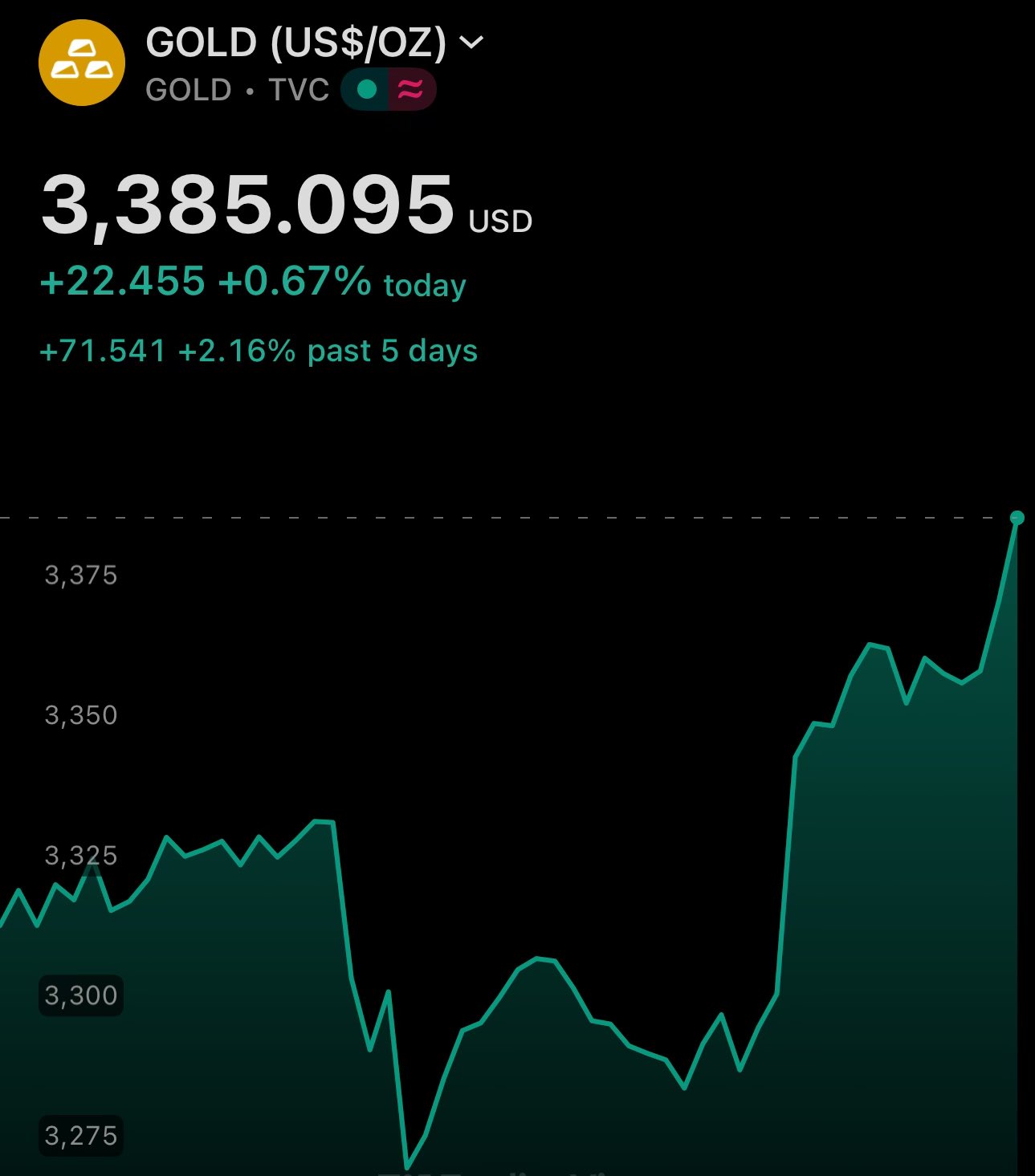

a clarification: the table is CBR's gold holdings in USD - so the value goes up if price of gold goes up and gold stock remains at least unchanged

troy ounce holdings are released in an IMF-templated PDF report, but with a lag

CBR's latest data is 79.4 M troy ounces of gold

China will win the AI race, but not because they're releasing better & more efficient models and are ahead of other sovereigns in terms of practical AI infrastructure and systems. These are side-effects

AI/ML is about maths - and Asia dominates in that regard

regarding the IPO/privatization of Fannie Mae & Freddie Mac i wrote a thread explaining the role, function and use during QE of those GSE

also their history and how they were used to lower mortgage rates after the 2008 GFC

you can read it it here ⬇️

https://illya.sh/threads/@1754148538-1.html

stablecoin issuers would get this new credit, purchase treasury bonds and increase the supply of their stablecoin

a new direct line from newly issued credit into treasuries 😄

stablecoin issuers could intermediate the issuance process, so you don't need to get all credit institutions on-chain from the start

non-algorithmic stablecoin issuance already happens off-chain and presumes trust in a third party

this would just be faster. more liquidity

stablecoin issuers could intermediate the issuance process, so you don't need to get all credit institutions on-chain from the start

non-algorithmic stablecoin issuance already happens off-chain and presumes trust in a third party

this would just be faster. more liquidity

now imagine when credit institutions can tokenize new credit and allow automated stablecoin issuance backed by that credit

in practice it's code in smart contract that wraps one token with another

i created a similar project on an Ethereum hackathon ⬇️

https://github.com/iluxonchik/eth-lisbon-hackathon-23

now imagine when credit institutions can tokenize new credit and allow automated stablecoin issuance backed by that credit

in practice it's code in smart contract that wraps one token with another

i created a similar project on an Ethereum hackathon ⬇️

https://github.com/iluxonchik/eth-lisbon-hackathon-23

i wrote a thread about the rumored tariffs on gold and what that means for the gold price

also what's coming next

you can read the thread here ⬇️

https://illya.sh/threads/@1754662712-1.html

new all time high for gold is near 😄

this just adds further validity towards the consolidation before further upside for gold

i've shared these gold charts since the beginning, while incorporating new trends as they emerge

the price action has supported this throughout. notice the strong multi-trend support

gold tariffs put further upside pressure for gold towards a new all time high on spot

this is in addition to the global monetary, geopolitical and fiscal positive price pressures

a significant part of the markets will be closed for the weekend. there could be a gap on reopen

gold tariffs put further upside pressure for gold towards a new all time high on spot

this is in addition to the global monetary, geopolitical and fiscal positive price pressures

a significant part of the markets will be closed for the weekend. there could be a gap on reopen

🚀 gold futures NEW all time high above $3500

futures price is usually above spot. today's increase was caused by tariffs on gold used in COMEX & CME. i wrote a thread about that today

i will keep this thread active at least until the spot price reaches a new ATH 😄

gold tariffs are unlikely to stay for a long period of time

expect them to be removed and/or heavily reduced soon

just the fact that they happened adds longer-term upside pressure on its price

of course, the markets will be volatile 😄

the tariffs are not on all gold imports - just on a specific configuration - 100oz/1kg bars

this alone won't skyrocket the price of gold, but it adds to the existing breakout pressure

the tariffs are not on all gold imports - just on a specific configuration - 100oz/1kg bars

this alone won't skyrocket the price of gold, but it adds to the existing breakout pressure

tariffs on gold decentivize gold imports

higher import tax is a disincentive. not sure what' the benefit to having less gold come into US

there's plenty of buyers in Asia who will happily take it. soon you will see more central banks expanding their balance sheets with gold

tariffs on gold decentivize gold imports

higher import tax is a disincentive. not sure what' the benefit to having less gold come into US

there's plenty of buyers in Asia who will happily take it. soon you will see more central banks expanding their balance sheets with gold

when you see gold hitting a new all time high very soon - just remember that it wasn't caused by a single event

gold has a growing buying pressure for monetary, geopolitical and fiscal reasons

I've written about it in depth, so search through my post history if interested

when you see gold hitting a new all time high very soon - just remember that it wasn't caused by a single event

gold has a growing buying pressure for monetary, geopolitical and fiscal reasons

I've written about it in depth, so search through my post history if interested

it's not only futures of course - the broader physical supply chain of gold is also affected

the more imminent impact is on users of 1kg/100oz gold bars. in the future markets the effect is much more visible and quantifiable - so it will start the price movement from there

it's not only futures of course - the broader physical supply chain of gold is also affected

the more imminent impact is on users of 1kg/100oz gold bars. in the future markets the effect is much more visible and quantifiable - so it will start the price movement from there

the demand from 100oz/1kg gold bars will be shifted to its other forms - whose prices will increase

this will increase gold's spot premium in the US, putting upside pressure on the global spot price

the demand from 100oz/1kg gold bars will be shifted to its other forms - whose prices will increase

this will increase gold's spot premium in the US, putting upside pressure on the global spot price

it's mostly 100oz/1kg gold bullion markers that will be affected - so you're looking at futures

expect a larger basis trade (futures price higher than spot), which will eventually close down

with tariffs in place spot is being pushed up towards futures

it's mostly 100oz/1kg gold bullion markers that will be affected - so you're looking at futures

expect a larger basis trade (futures price higher than spot), which will eventually close down

with tariffs in place spot is being pushed up towards futures

gold tariffs means more upside price pressure

US tariffs don't apply to all gold imports - only to 100 oz and 1 kg bullion bars, which are mostly used for CME/COMEX futures

400 oz London Good Delivery bars are tariff-free - those are used by dealers, central banks and ETFs

gold back to $3400 - trend lines & channels on the chart

you can see where it's headed next 😄

further deprecation of USD against Ruble

now back to July 4th 2025 levels

8 month later after my initial post USD index is down ≈8%

Bad news for #USD 👎

The value of a currency is a direct reflection of the organic demand for it. Sanctions will decrease the demand for US Dollar, via disincentives

Plus, it's the US consumer that will be paying for the tariffs, not the BRICS countries 🤷♀️

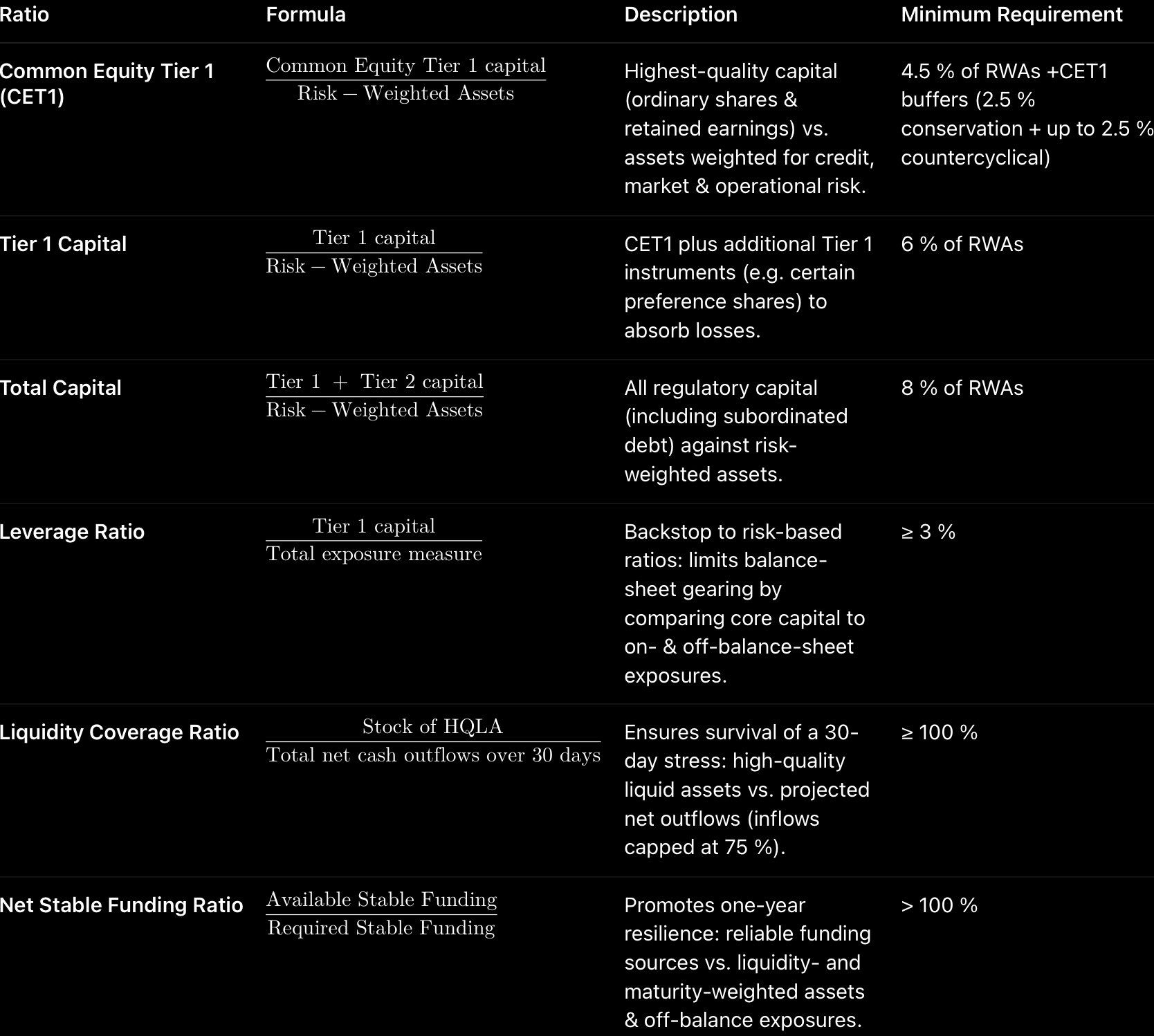

Basel III defines capital, leverage, liquidity and net stable funding ratios

they're in the form of formulas, and regulations require minimum thresholds to be met

I previously wrote about Basel III and its importance in financial markets here ⬇️

https://illya.sh/threads/@1753631798-1.html

banks are also subject to regulations when issuing loans

and no - it's not the fractional reserve system

in many sovereigns, like the USA the reserve requirements sit at 0%

there are other regulatory requirements limiting loan issuance