⬇️ My Thoughts ⬇️

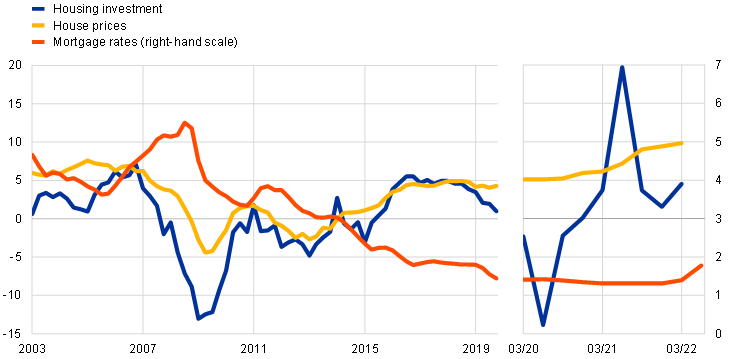

in the US, there's been a real estate bubble in the building since 1990's (pun intended). it was about to burst/de-leverage several times, but it was refueled via QE and government guarantees among others, thus delaying it

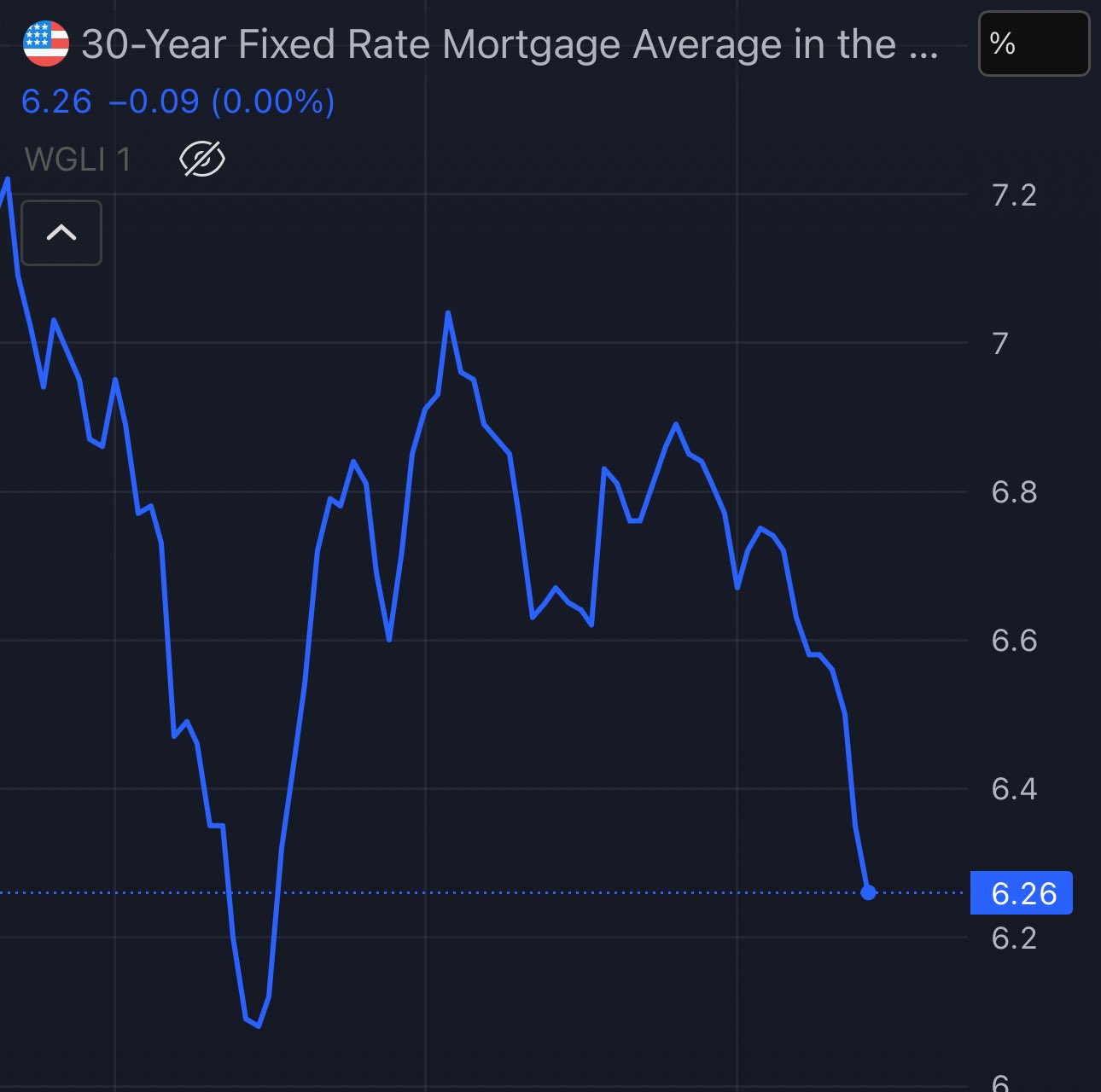

in the longer-term mortgage rates in the US will likely increase, but not because of interest rate cuts

in the longer-term mortgage rates in the US will likely increase, but not because of interest rate cuts

in fact, mortgage rates in the US have been on a downtrend for a while - way before the rate cut

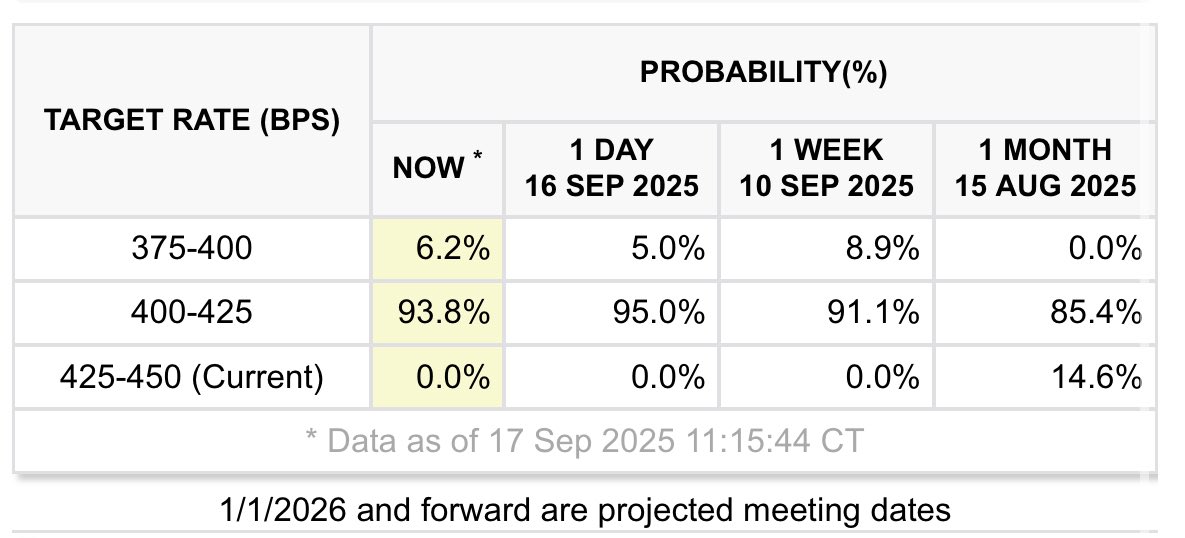

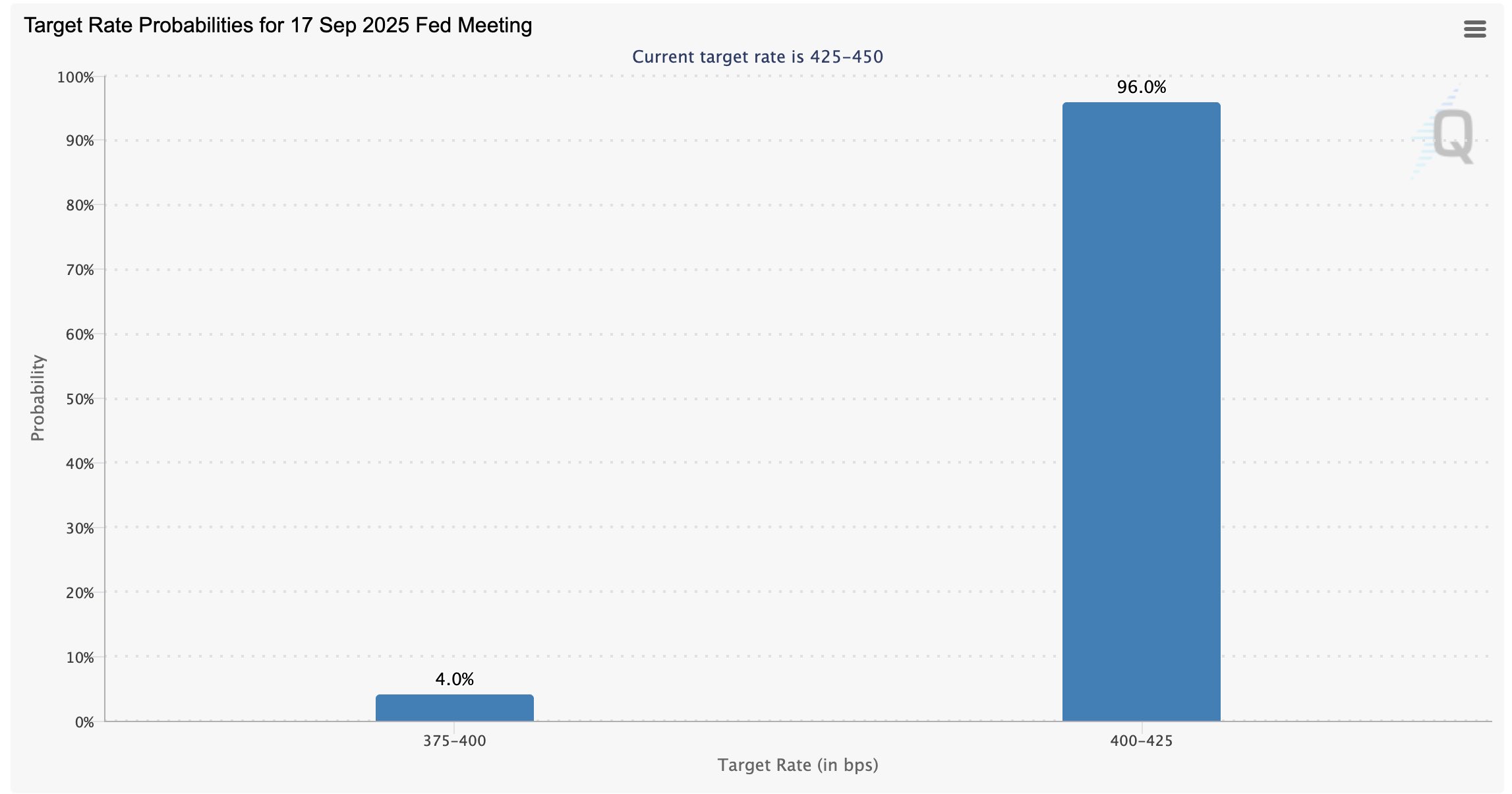

the markets have also gradually priced-in the September for a while, as you could observe in FedFunds futures

current area is also a monthly support, upwards pressure is expected

reducing the cost of capital by 25bps wouldn't affect mortgage that much - as it doesn't eliminate the existing risk in the market (i.e. existing mortgages)

to lower mortgage rates the Fed will likely do a mortgage-targeted QE, like with MBS in 2008 QE1

reducing the cost of capital by 25bps wouldn't affect mortgage that much - as it doesn't eliminate the existing risk in the market (i.e. existing mortgages)

to lower mortgage rates the Fed will likely do a mortgage-targeted QE, like with MBS in 2008 QE1

≈$39.6 is a great area to long silver during the pullback

similar to gold, there is also a strong support below, which will further fuel buying pressure

adapt the exact price to your ticker/derivative. chart below shows how to identify it (dashed line)

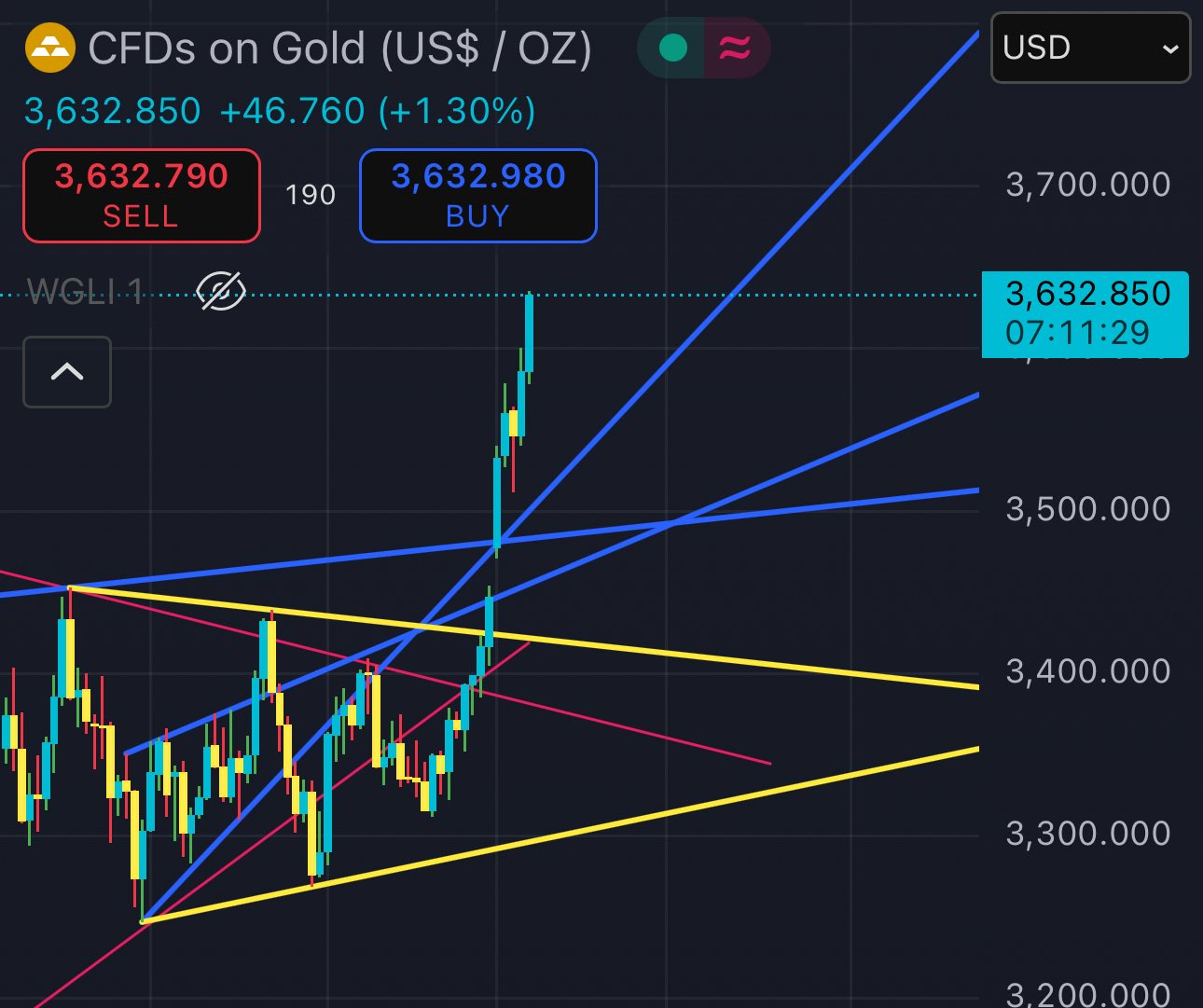

≈$3515 is a great price area to long gold during the pullback

you'll need to adjust the exact price to your ticker/derivative, but in the chart you can see how to find the relevant support (assuming your asset mirrors gold spot/futures)

and remember the strong support below

and there you go - the Fed cut the rates by 25 bps

there will NOT be a 50 bps rate cut

there is nothing to predict or speculate:

1. open FedWatch

2. observe

that's where institutions are hedging

30 day FedFunds futures implied target rate will NOT be wrong

you'll see in a bit 😉

what's up with the "urging" the Fed to cut by 50 bps today?

the rate cut is known NOW - and it will be no more & no less than 25 bps/0.25%. there is absolutely nothing to speculate about here

i assure you that your urges won't affect what the market already priced in 😄

these dynamics create an incentive for further upward price pressure:

➖ purchase prices raise due to low rates and ample financing

➖rent prices raise because purchase prices become too high

i've previously written an article about what makes real estate so special in terms of funding/re-funding capacity

banks finance ≈75% LTV on real estate purchases, and you can use existing properties as additional collateral

🧵read it here: https://illya.sh/threads/@1757632740-1.html

i've previously written an article about what makes real estate so special in terms of funding/re-funding capacity

banks finance ≈75% LTV on real estate purchases, and you can use existing properties as additional collateral

🧵read it here: https://illya.sh/threads/@1757632740-1.html

it's not just the Fed, the ECB is also lowering rates into higher inflation

this puts upwards pressure on both, real estate purchase and rent prices

so you can expect both - house prices and rents - to increase throughout the next 2 years

how will asset prices react to Fed's interest rate decision?

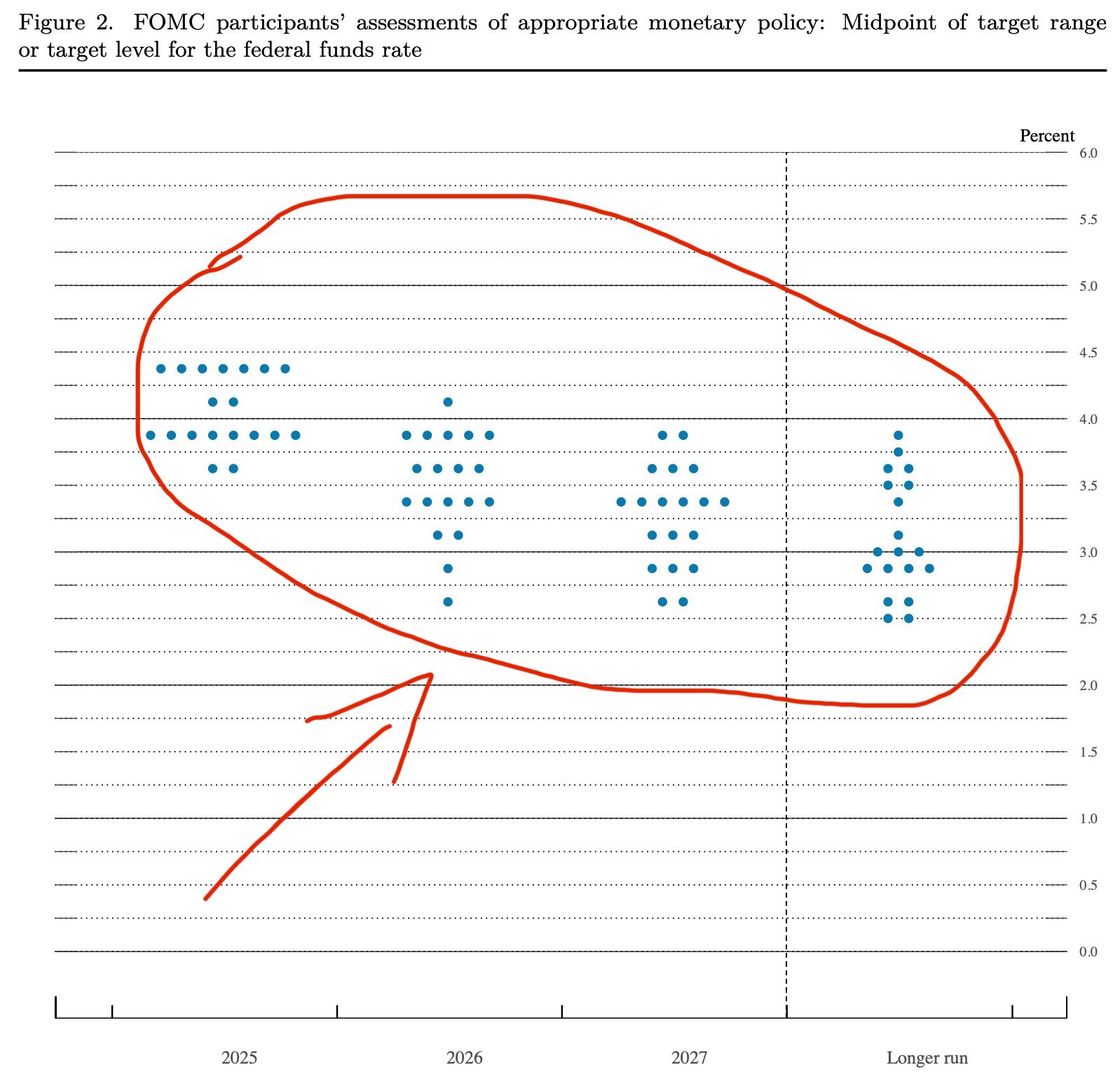

if the FOMC members suggest rates lower than in the June 2025 - expect an upwards rally in assets

if the FOMC members suggest higher or non-decreasing near future rates - expect a downward rally/profit taking in assets

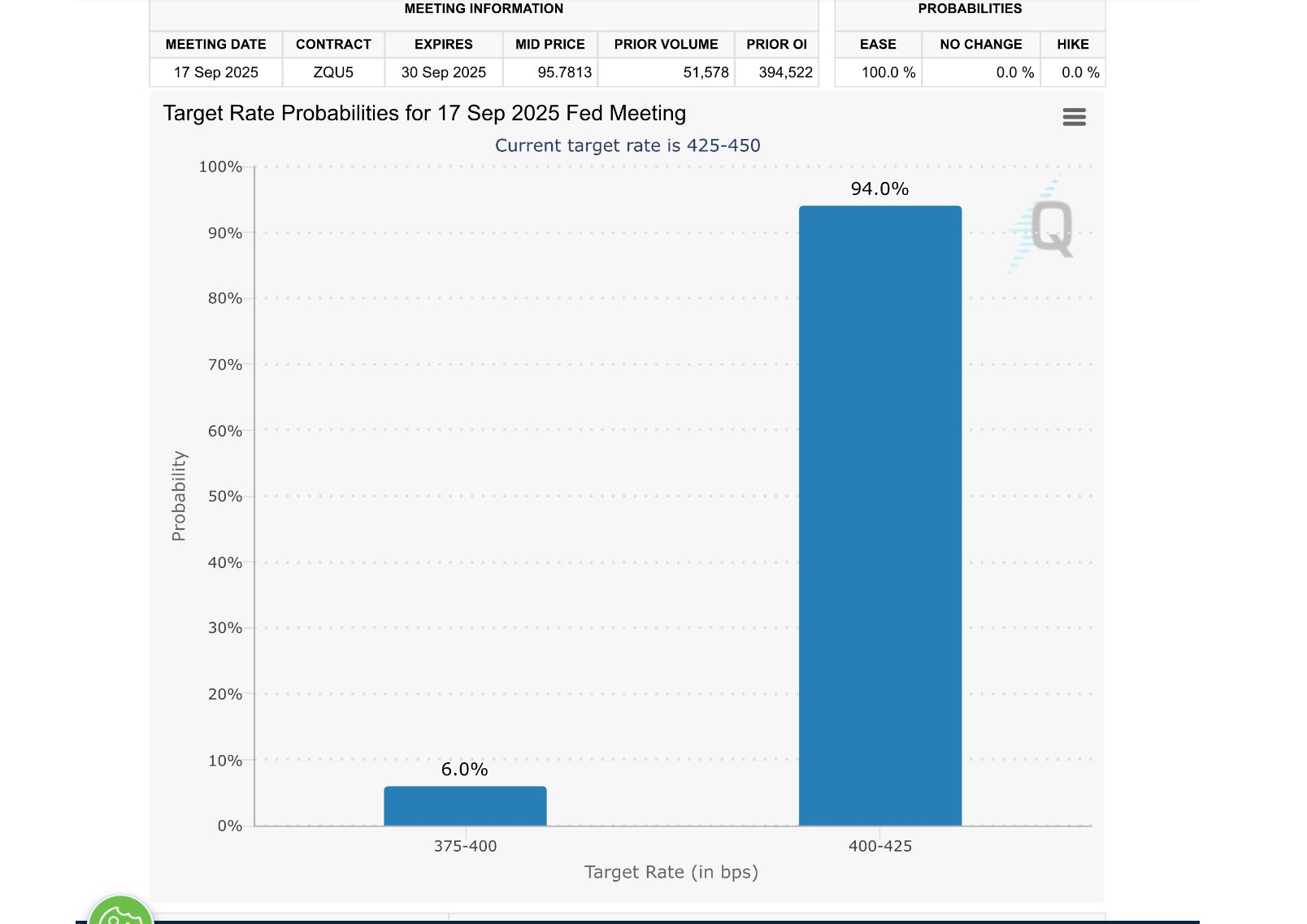

during the Sept 17th 2025 FOMC meeting, the Fed will publish a new dot plot with the suggested interest rates for 2025, 2026, 2027 and longer-term

during the Sept 17th 2025 FOMC meeting, the Fed will publish a new dot plot with the suggested interest rates for 2025, 2026, 2027 and longer-term

so the most likely outcome is a 25bp/0.25% rate cut on September 17th 2025, and then at least one more cut in 2025

so the most likely outcome is a 25bp/0.25% rate cut on September 17th 2025, and then at least one more cut in 2025

a cut larger than 25bp is highly unlikely, since the current CME's 30 Day Federal Funds Futures price strongly implies a 4.0%-4.25% target rate

this is 25bp/0.25% below the current target rate of 4.25%-4.5%

based on the current Fed policy guidance available since June 2025, by the end of 2025 the Fed Funds rate should be ≈3.9%

current one is 4.25%-4.50%, so we either get a larger than 25bp cut or several rate cuts this year

based on the current Fed policy guidance available since June 2025, by the end of 2025 the Fed Funds rate should be ≈3.9%

current one is 4.25%-4.50%, so we either get a larger than 25bp cut or several rate cuts this year

watch the Fed's projection dot plot, not the Fed Funds rate

the 25bp/0.25% cut on September 17th 2025 will happen, and it's mostly priced in

it's the future interest rate policy guidance that can amplify a market move either way

👋 hello, $3700 gold

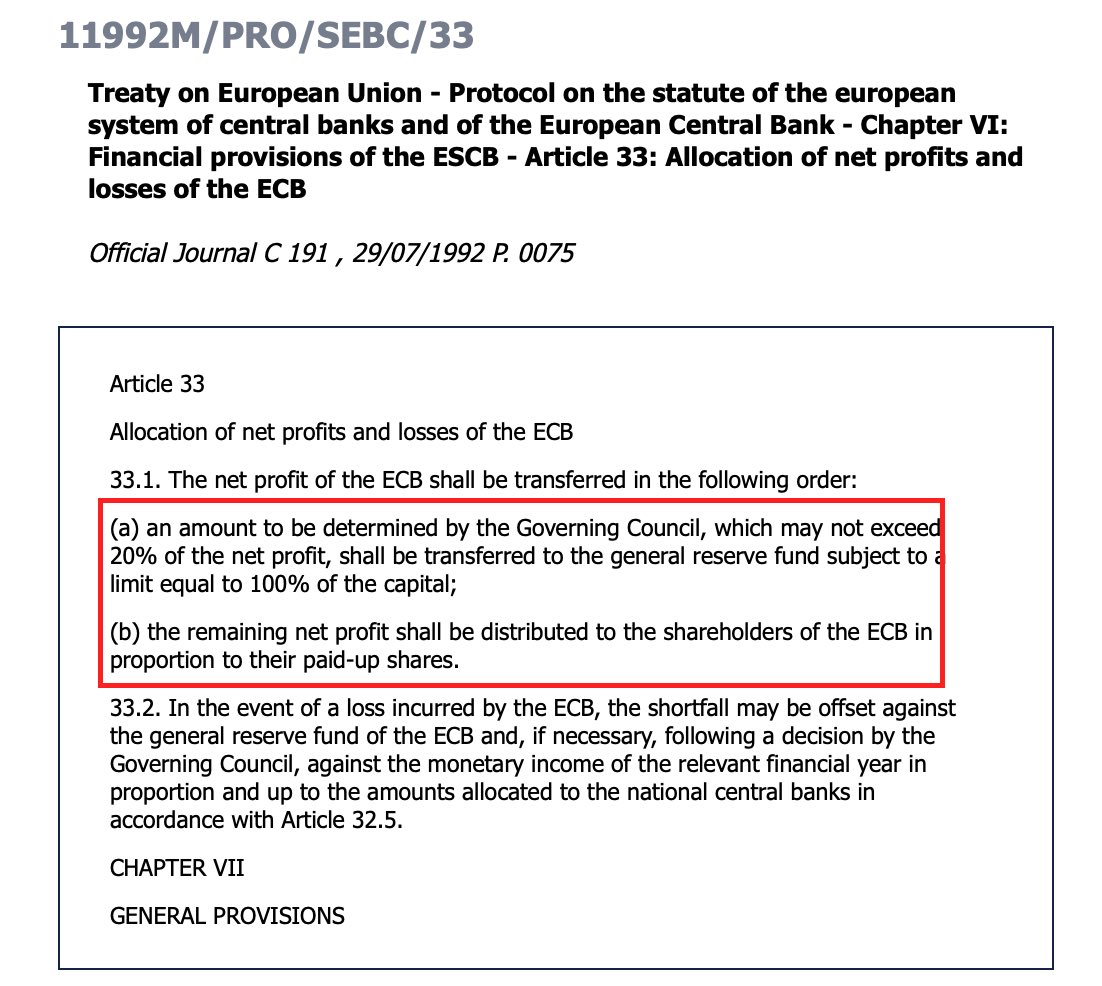

after ECB's realized gains are booked to PnL, the ECB splits up the net profit as:

➖ up to 20% to the general reserve fund, which can be used to offset future PnL losses

➖ the rest distributed to the NCB's, proportional to the National Central Bank's paid-up shares

thus, unrealized gold gains accumulate on the ECB's liability side, under the revaluation account, and the only way they can be debited (e.g. to cover expenses, or credit an NCB's reserve account) is:

1️⃣ when the ECB sells the gold, thus turning an unrealized gain into a realized one

2️⃣ offset future losses in the gold bucket

thus, unrealized gold gains accumulate on the ECB's liability side, under the revaluation account, and the only way they can be debited (e.g. to cover expenses, or credit an NCB's reserve account) is:

1️⃣ when the ECB sells the gold, thus turning an unrealized gain into a realized one

2️⃣ offset future losses in the gold bucket

this means the ECB can only use unrealized gold gains to cover/offset future unrealized losses on gold

these unrealized gains can neither offset an operational, nor a loss in another security bucket, such as FX

once a gain is realized, the corresponding proportion is debited to the revaluation account and credited to an income account/ booked to P&L

at the end of the year PnL is closed into equity by increasing equity reserves and/or NCB liabilities

this means the ECB can only use unrealized gold gains to cover/offset future unrealized losses on gold

these unrealized gains can neither offset an operational, nor a loss in another security bucket, such as FX

moreover, as per Eurosystem's accounting framework unrealized gains are non-distributable and may only offset future unrealized losses on the same item