Gold: macro, inflation, miners and price

Ongoing updates on gold price action, central-bank demand, miners and macro drivers in the precious-metals market.

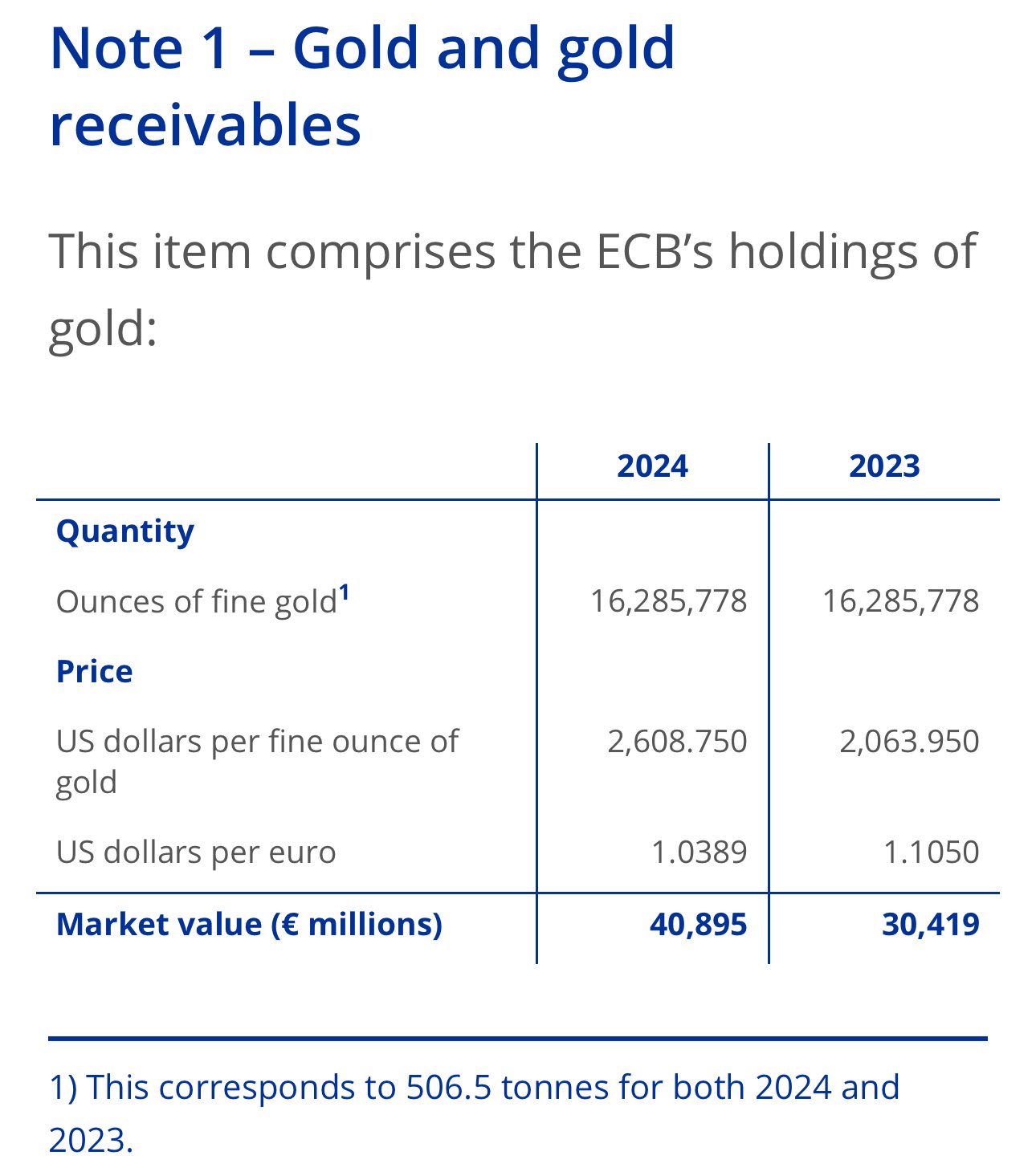

🇪🇺 ECB gained €10.5B on gold from 2023 to 2024

2025 YTD running gains add another net positive ≈€10B & likely to be higher by the year end's gold revaluation

that's an implied ≈8% yield on gold appreciation - much more than the ECB earned from other asset buckets

in addition to being a store of value, gold is also acting as an investment

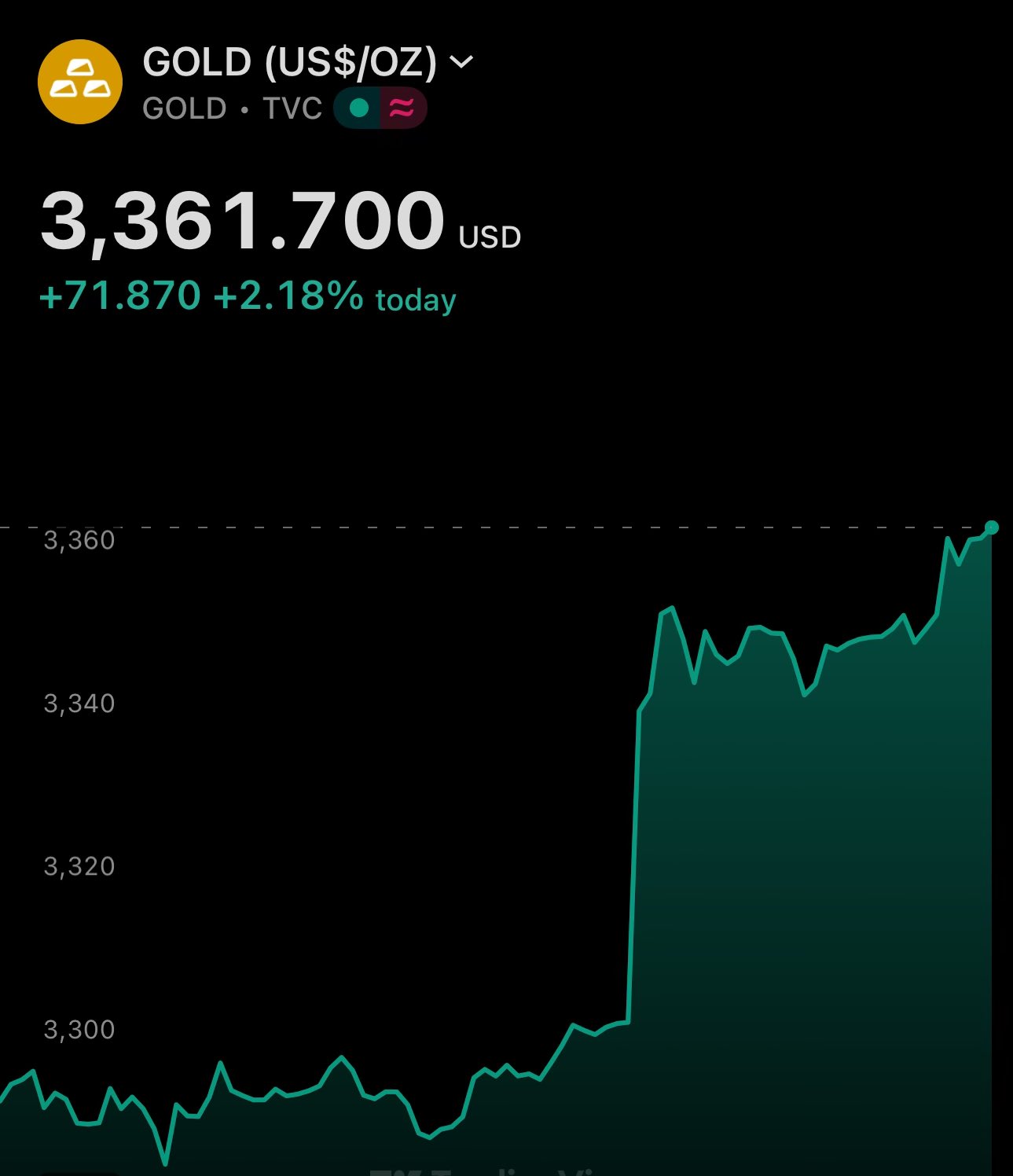

it's up ≈40% YTD

this is gold catching up to inflation and accumulated leverage

the financial system infrastructure, including monetary policies of the central banks are correlated

they're heavily exposed to the same set of assets - a lot of which are USD-denominated

this is of course extremely pro-cyclical

since i've written this, gold is up ≈16%

≈25% if you count from the tariffs announcements on April 7th

i will re-iterate that in order to protect the EUR the ECB should increase their onshore gold holdings

🇪🇺 The best countermeasure that EU can take is swapping US securities for Gold

Gold is inversely correlated with USD. Such a decision can be done today and it will:

1️⃣be a response to the US

2️⃣increase value of EUR

3️⃣minimize consumer impact

Anything else will hurt the economy

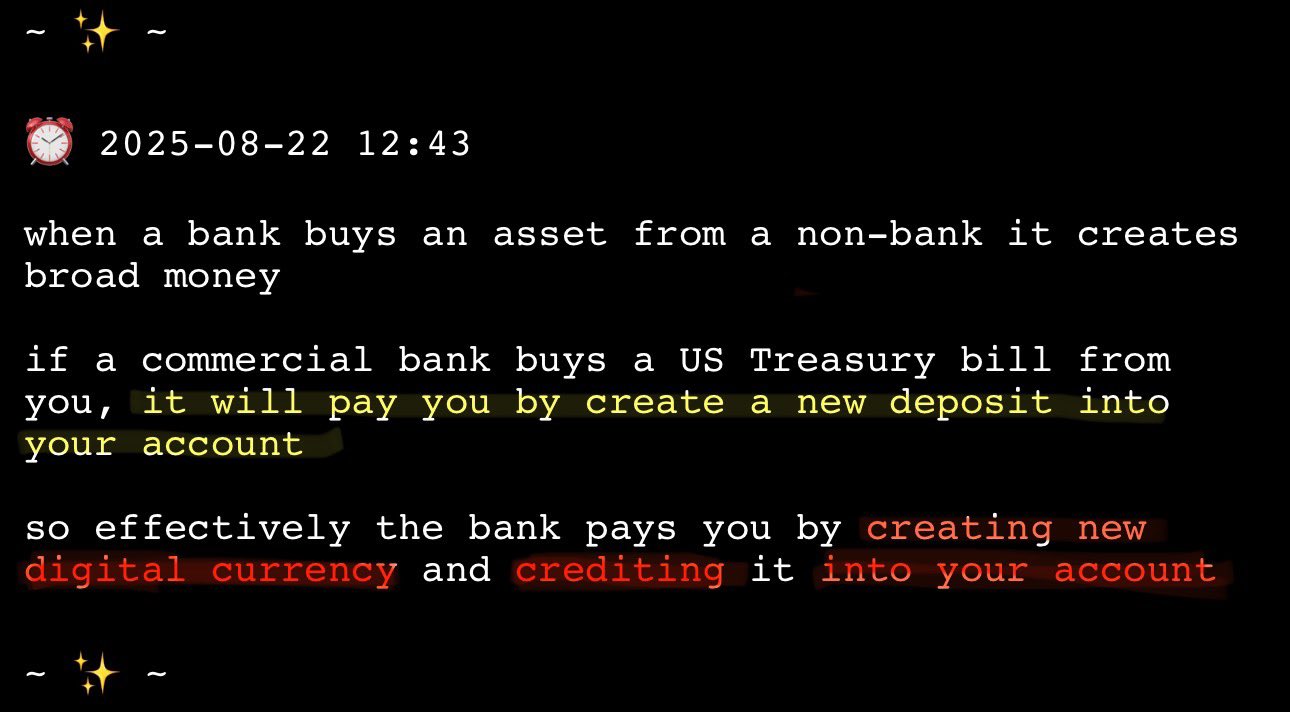

i wrote a thread explaining the business model of banks here: https://illya.sh/threads/@1755863018-1.html

the information in it is important to understand the balance sheet dynamics of gold reevaluation

in order to understand the mechanics of gold revaluation - it's important to understand the unique legal position of banks to issue broad money, and that their mode of operation differs greatly from non-credit issuance businesses

in order to understand the mechanics of gold revaluation - it's important to understand the unique legal position of banks to issue broad money, and that their mode of operation differs greatly from non-credit issuance businesses

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt

i'll add a link to it in this thread once it’s ready

soon i'll write a thread on how central banks/governments reevaluate gold and how the monetary gains can be used to cover central bank and/or government debt

i'll add a link to it in this thread once it’s ready

in practice, some level of sanitization (direct or indirect) will occur, and that Treasury debt/safe collateral would likely be reintroduced back via Treasury issuance and/or Fed facilities within a year

now everyone is talking about gold 😄

i've been writing about an imminent new all time high and uptrend continuation for 3 months now - you can check back up on this thread

every long call in this thread has been accurate

gold is a very special asset this cycle

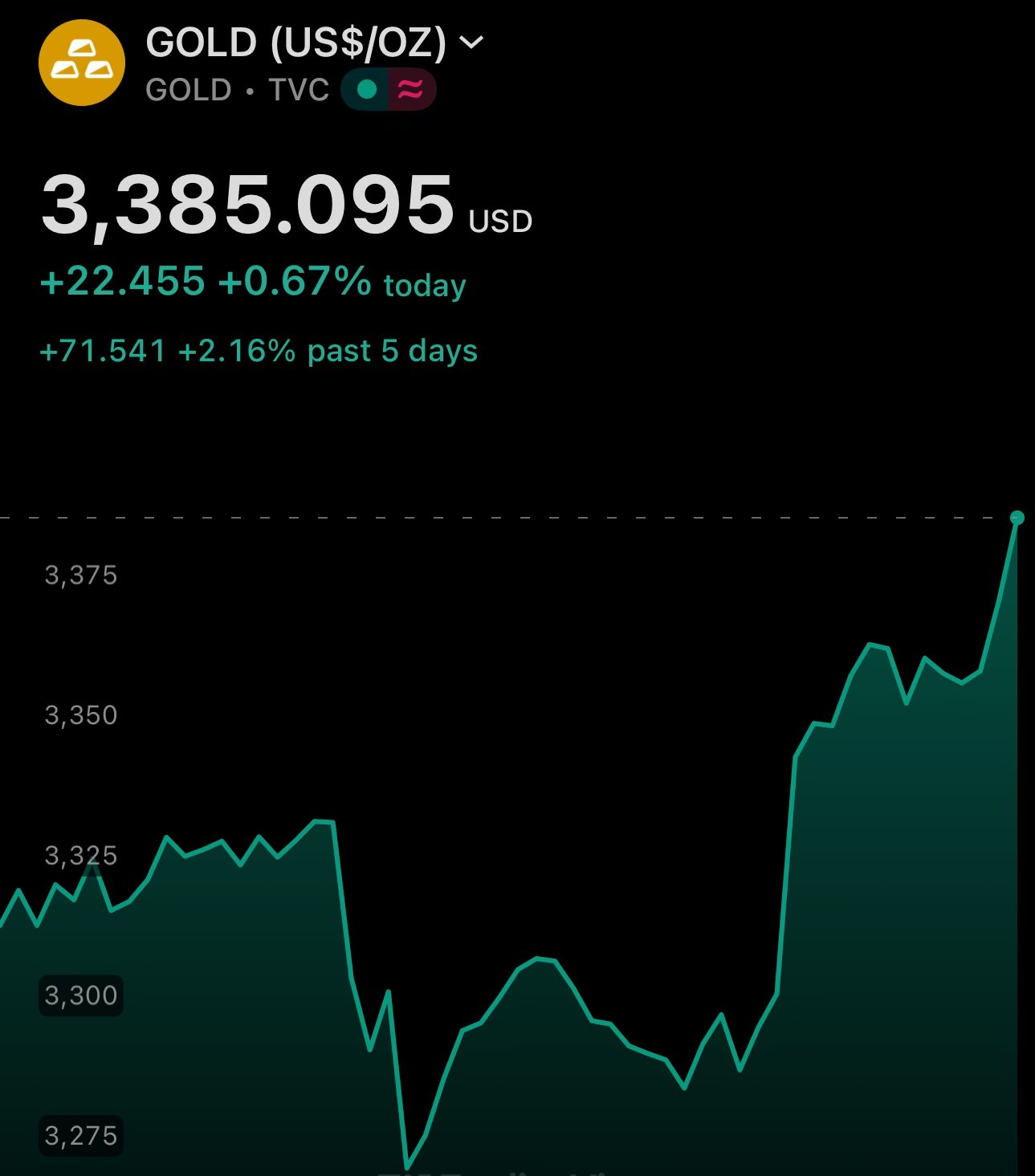

gold reached $3500 new all time high 🥳

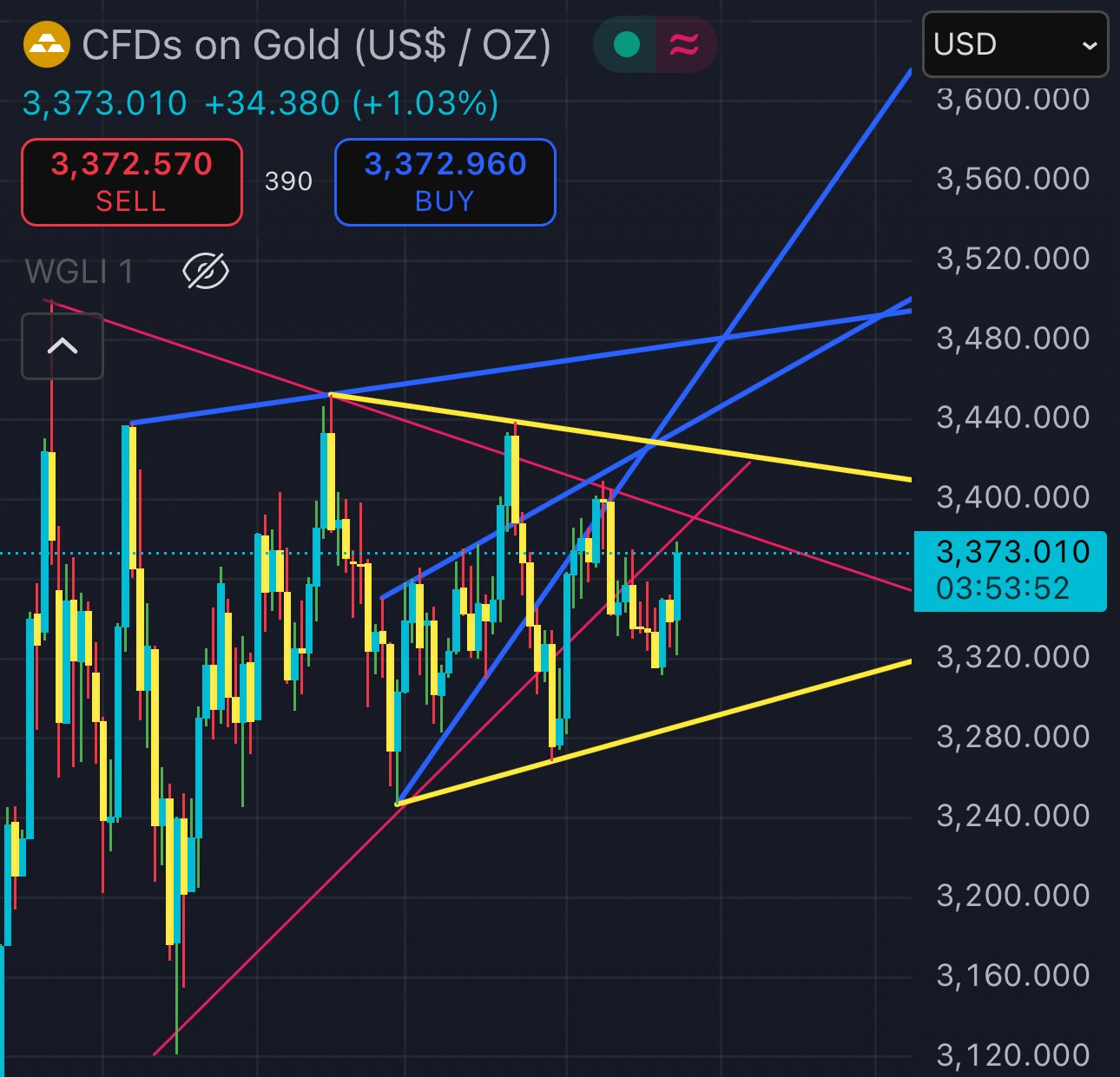

indeed once the yellow resistance trend line was broken - we saw a new all time high

the extended consolidation built up a strong future support

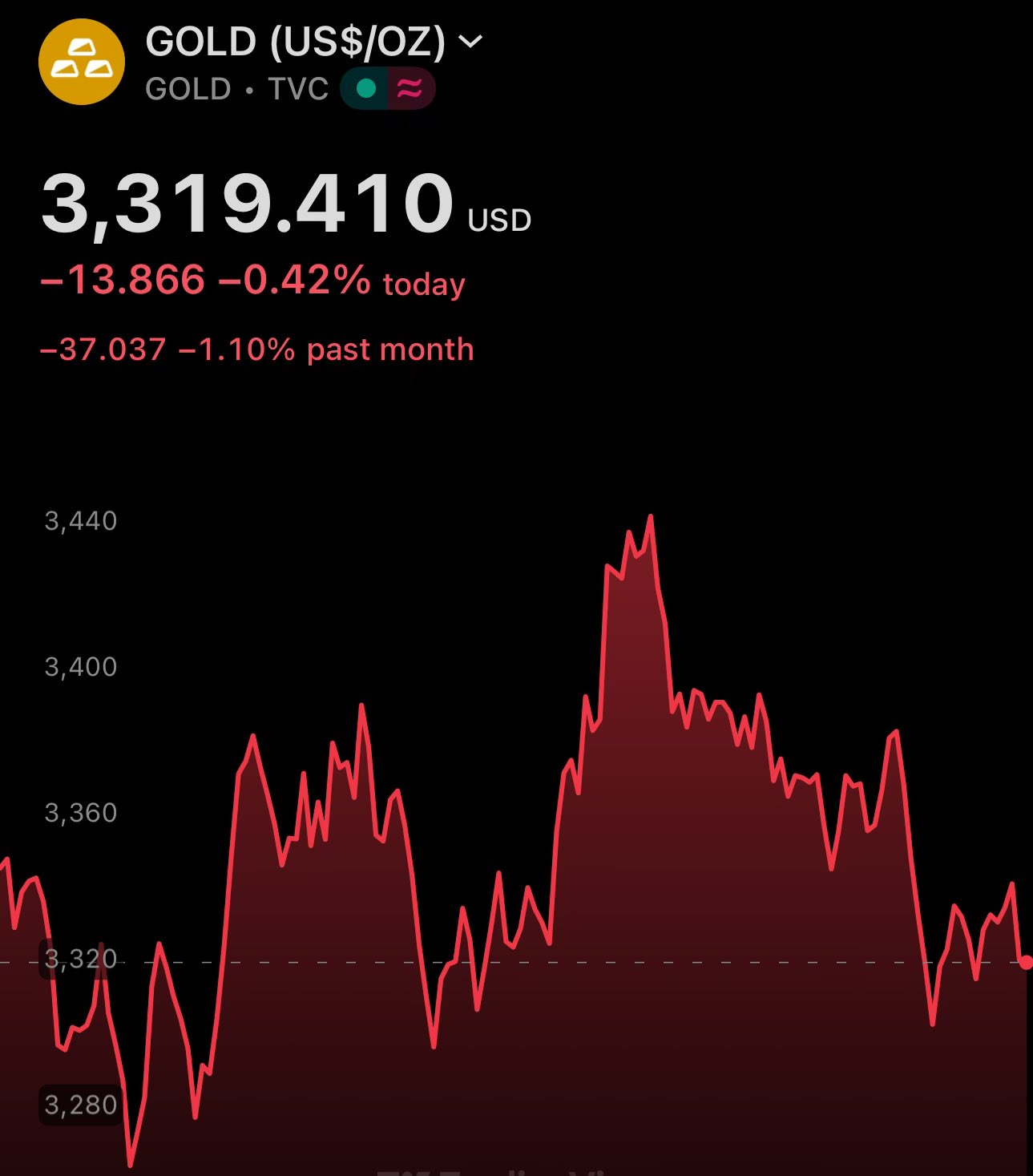

gold continues its uptrend towards the new $3500 all time high

i've previously written how gold's price action suggests a consolidation before the next ATH

the last main resistance is the upper yellow trend line. once it's claimed as support expect gold to shoot to new highs

gold is in the same price range as when the US dollar index was ≈97.7 on July 25th 2025

if DXY hits ≈97.1 - expect gold to retest ≈$3440. this time with a stronger support build up by price action

this could definitely be what pushes gold to a new all time high

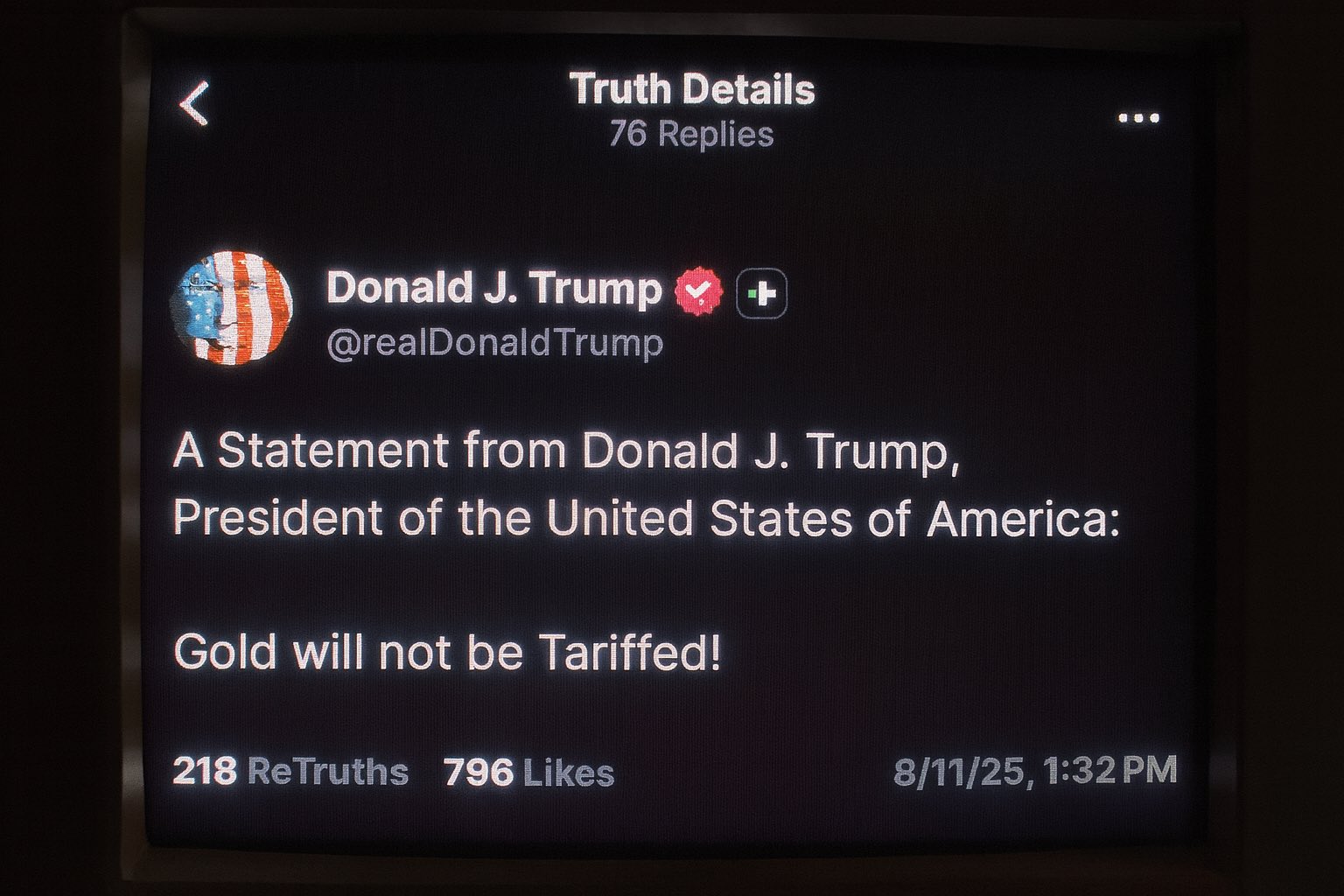

gold tariffs have been cancelled - just like I wrote in my thread on Friday (link below)

you can read about the gold tariffs, their impact on the market and why they were likely to get removed here

👇

https://illya.sh/threads/@1754662712-1.html

it's official: gold tariffs have been cancelled - just like I wrote last Friday 😄

in fact, rumors started less than 30 mins after i wrote the previous post in the thread - and the full removal of tariffs on gold has been confirmed just now

gold tariffs are unlikely to stay for a long period of time

expect them to be removed and/or heavily reduced soon

just the fact that they happened adds longer-term upside pressure on its price

of course, the markets will be volatile 😄

you can see how accurately gold price has been respecting the trend lines and channels you've seen in my graphs for months now 😄

gold tariffs ping-pong introduced volatility, but like i wrote in my other posts - its upside price pressure

a new all time-high will arrive

new all time high for gold is near 😄

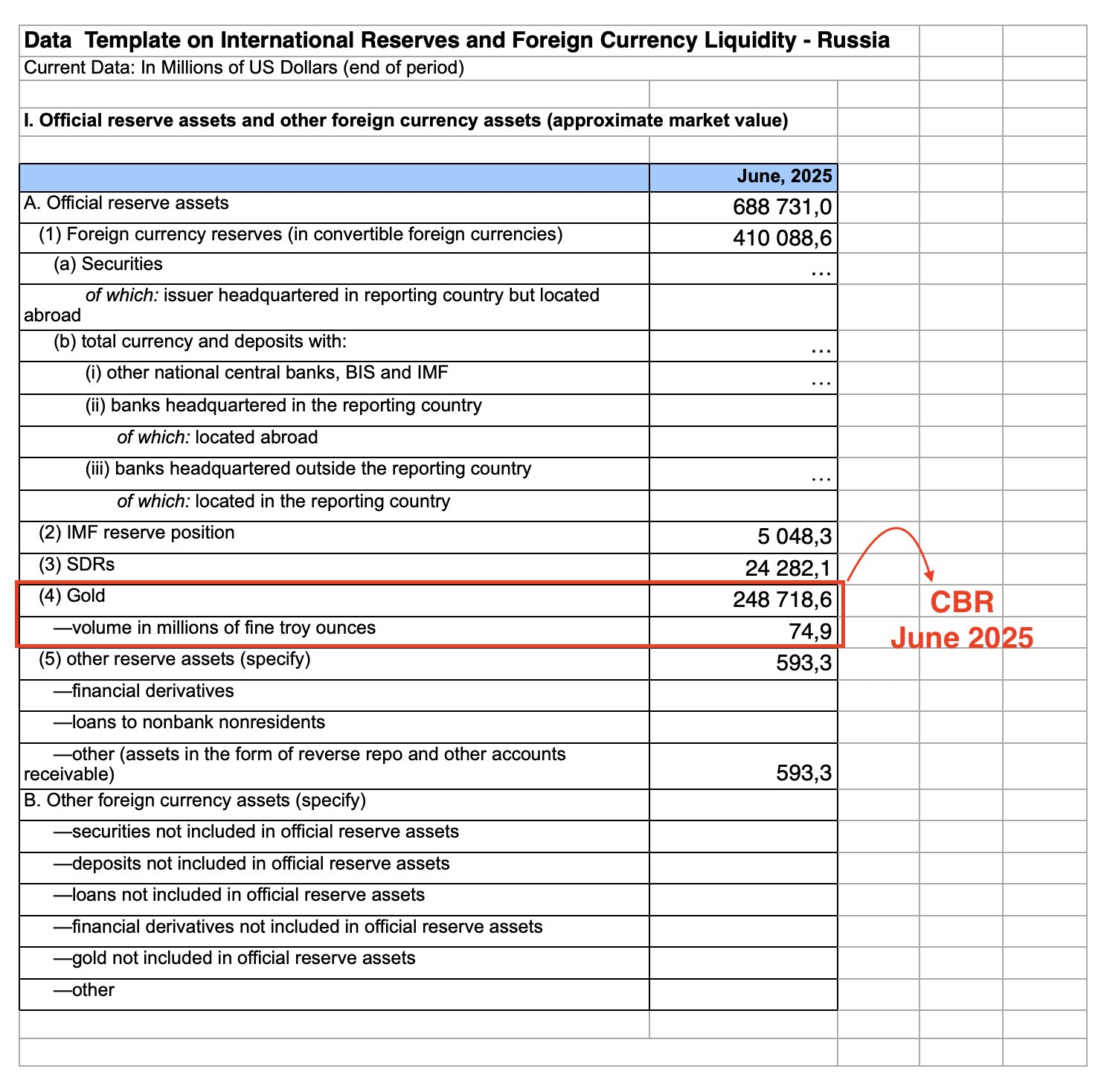

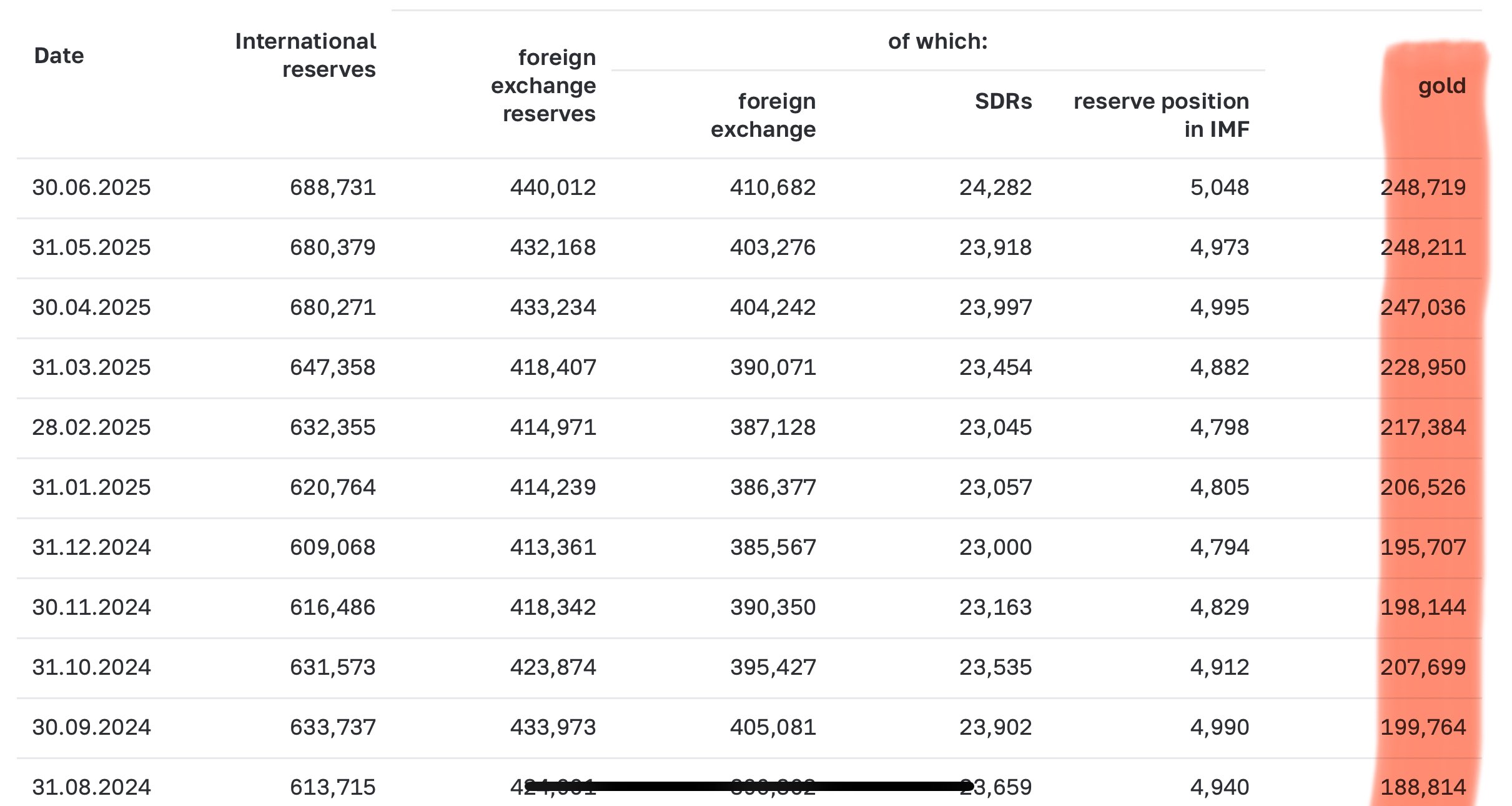

a clarification: the table is CBR's gold holdings in USD - so the value goes up if price of gold goes up and gold stock remains at least unchanged

troy ounce holdings are released in an IMF-templated PDF report, but with a lag

CBR's latest data is 79.4 M troy ounces of gold

new all time high for gold is near 😄

this just adds further validity towards the consolidation before further upside for gold

i've shared these gold charts since the beginning, while incorporating new trends as they emerge

the price action has supported this throughout. notice the strong multi-trend support

gold tariffs put further upside pressure for gold towards a new all time high on spot

this is in addition to the global monetary, geopolitical and fiscal positive price pressures

a significant part of the markets will be closed for the weekend. there could be a gap on reopen

gold tariffs put further upside pressure for gold towards a new all time high on spot

this is in addition to the global monetary, geopolitical and fiscal positive price pressures

a significant part of the markets will be closed for the weekend. there could be a gap on reopen

🚀 gold futures NEW all time high above $3500

futures price is usually above spot. today's increase was caused by tariffs on gold used in COMEX & CME. i wrote a thread about that today

i will keep this thread active at least until the spot price reaches a new ATH 😄

the tariffs are not on all gold imports - just on a specific configuration - 100oz/1kg bars

this alone won't skyrocket the price of gold, but it adds to the existing breakout pressure

tariffs on gold decentivize gold imports

higher import tax is a disincentive. not sure what' the benefit to having less gold come into US

there's plenty of buyers in Asia who will happily take it. soon you will see more central banks expanding their balance sheets with gold

tariffs on gold decentivize gold imports

higher import tax is a disincentive. not sure what' the benefit to having less gold come into US

there's plenty of buyers in Asia who will happily take it. soon you will see more central banks expanding their balance sheets with gold

when you see gold hitting a new all time high very soon - just remember that it wasn't caused by a single event

gold has a growing buying pressure for monetary, geopolitical and fiscal reasons

I've written about it in depth, so search through my post history if interested

when you see gold hitting a new all time high very soon - just remember that it wasn't caused by a single event

gold has a growing buying pressure for monetary, geopolitical and fiscal reasons

I've written about it in depth, so search through my post history if interested

it's not only futures of course - the broader physical supply chain of gold is also affected

the more imminent impact is on users of 1kg/100oz gold bars. in the future markets the effect is much more visible and quantifiable - so it will start the price movement from there

gold tariffs means more upside price pressure

US tariffs don't apply to all gold imports - only to 100 oz and 1 kg bullion bars, which are mostly used for CME/COMEX futures

400 oz London Good Delivery bars are tariff-free - those are used by dealers, central banks and ETFs

🚀 gold approaching $3400. $3300 was a good price for longs - like I wrote a week ago

currently gold is one of the only assets where leverage entails a much lesser risk

upside price pressure is coming from several points

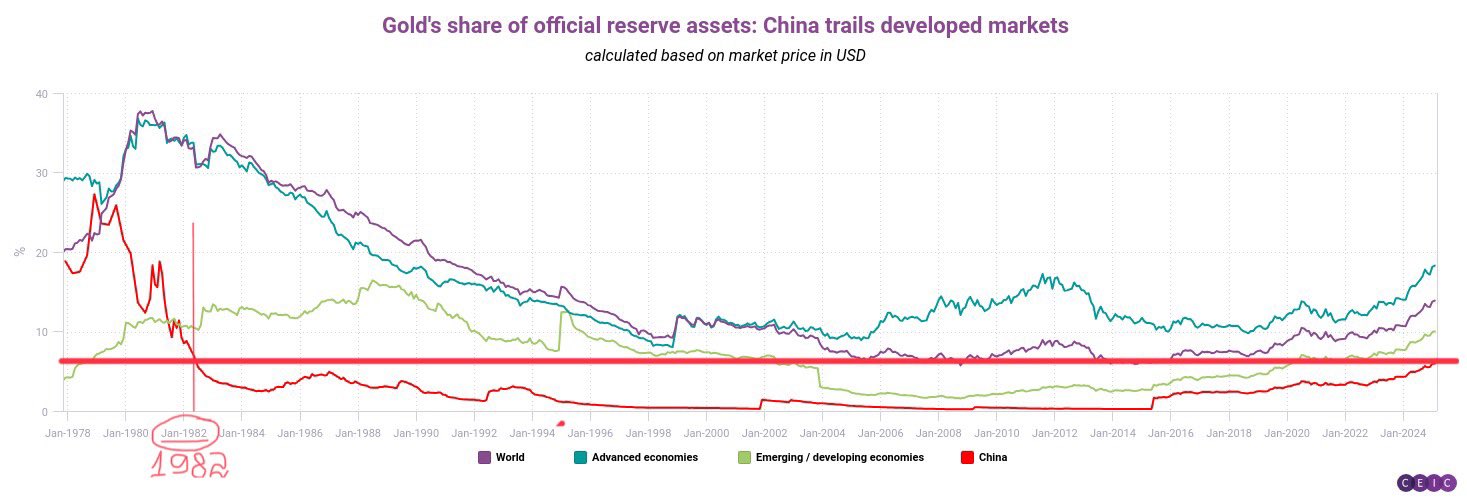

🇨🇳 China's gold holdings are at their highest level in 43 years

gold is now 6% of PBoC international reserves. but that's still below the world average of ≈14%. expect that gap to continue to shorten further

see my drawings on this nice chart spanning over 47 years i found

both Russia & China increased their gold holdings since I wrote this 😄

indeed - central banks are continuing to buy the gold dips