US dollar, DXY & FX market insights

High-frequency views on DXY, dollar funding, cross-currency basis and how USD trends shape global assets.

Grok summarized US tariffs effect very well

As well as what will happen to the US economy, and by extension, US Dollar - the most important currency in the world

🚨68-82 is the next range for USD/RUB

A lot of liquidity in that area & expect selling pressure. But there is also selling pressure on the USD

RUB is already up 30% YTD, so expect some pullbacks in the white box region

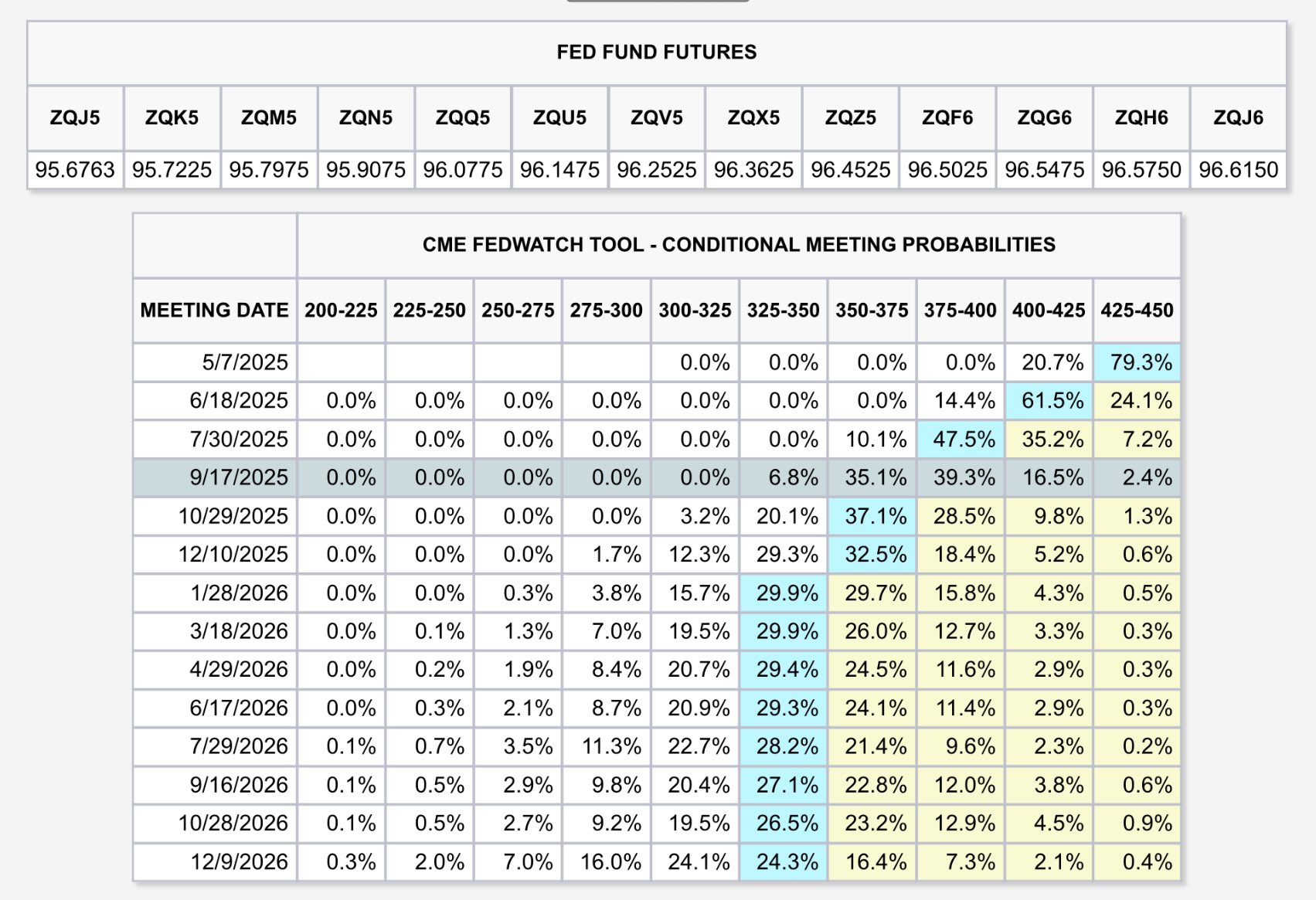

2Y US Bond is a good factor/signal of FED funds rate, but there's an even better one!

CME's 30-day FED Funds futures is a derivative for this exact purpose. The market prices them according to the expectations of upcoming FED Funds Rates

🔗

This is definitely good news short-term for the USD!

Today, short-term funding got 1.25% cheaper for the US government, and once the FED lowers the interest rates, the yields will fall more. Now ofc this will lead to inflation & devaluation of USD, but that's a a different story

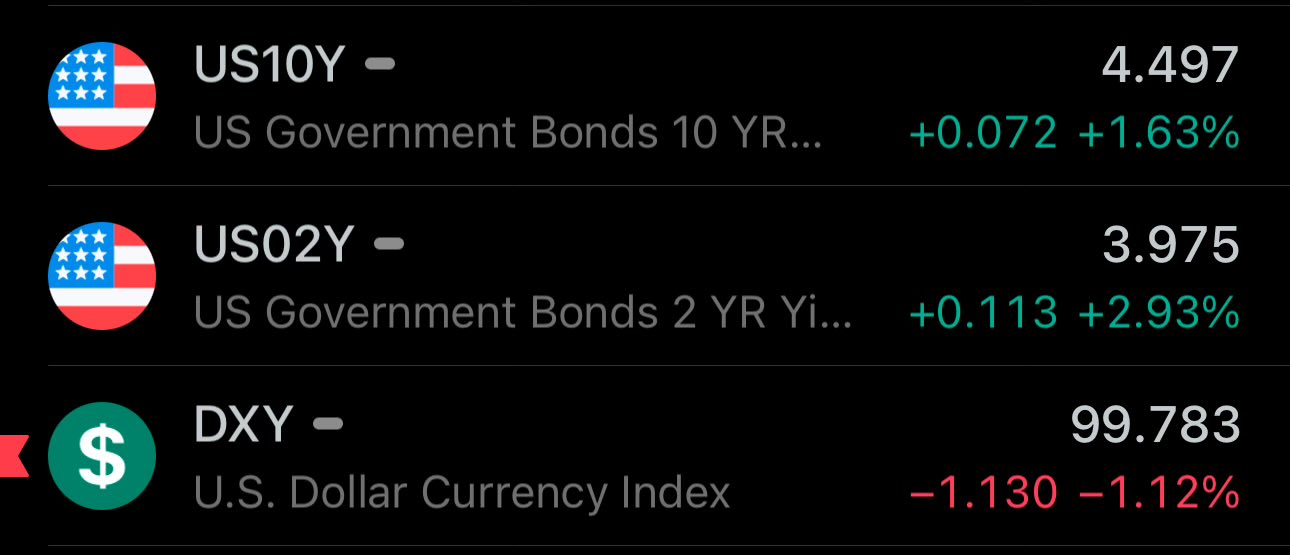

Look at that liquidity moving from short-term Chinese bonds(CN01Y), to short-term US bonds(US02Y) 👀

The market liked the removal of tariffs, however, you can't undo the massive volatility over the past 2 weeks

Moreover, US Dollar index is still below 100

🚨 Ruble is up 30% on USD 2025 YTD

82-68 is a strong support - including pre-Ukraine war liquidity

A small pullback is very likely to happen, but in the medium-long term it's heading towards the 68

Once sanctions are dropped by US & EU - RUB will skyrocket

🚨US 10 Year Bond yield spikes above 4.5% at open

I previously posted about the move of liquidity towards the Chinese bonds

The USD is facing an increased perceived risk, which in addition to the public debt puts questions on its role as the reserve currency

1. It will NOT happen

2. What 😂

Imagine swapping a part of the peg of the US Dollar - the world reserve currency - from gold to a highly volatile asset

The US Bond market would crash at record numbers. Same for US Dollar index

Lower USD Index = USD Devaluation = Higher premium for USD loans = Lower bond prices = Higher bond yields

It's all connected

I think now you understand 😁

Gold hitting ATH after ATH 🎉

Very concerning for USD

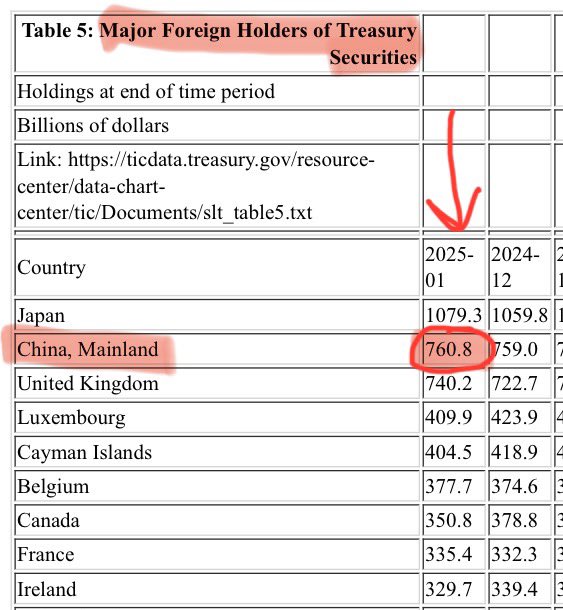

Of course, this also gives China leverage - if The People Bank's of China (China's Central Bank) dumps their US Securities in the market, it will skyrocket bond yields, by reducing their prices

Who will lend to the US then, and at what premium? And at 125% debt to GDP 😬

China is the 2nd largest holder of US Treasury bonds - a staggering 23% of their foreign exchange reserves

This makes China extremely exposed to US systemic risk. Which is why tariffs will hit them double hard - at exports and at renminbi/Yuan due to falling #DXY

Not saying they can't sustain it though

🇷🇺 #MOEX down 22% since Feb

Expect it to bounce back very soon - as capital is moved away from USA & USD into alt currencies, which includes Ruble

Once the sanctions against Russia are dropped - that's where Moscow Exchange Index will skyrocket 📈 http

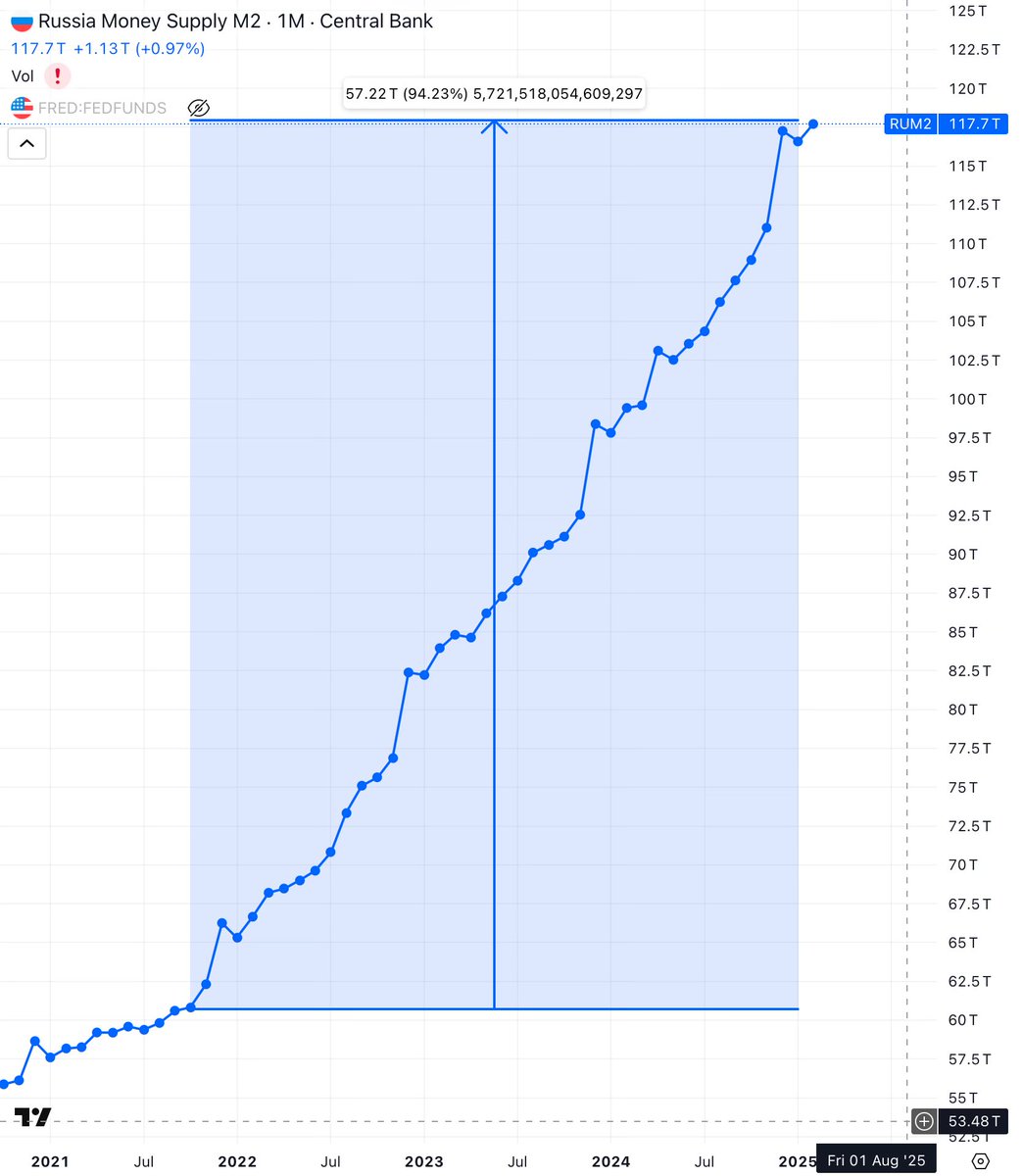

If you think 🇺🇸USD M2 is bad, look at 🇷🇺Russia's

In 3 years, Ruble DOUBLED in supply. Up by a 100%

How come despite this, Ruble maintained its value in FOREX?

The answer is GOLD, more specifically its expansion in the balance sheet of Central Bank of Russia

It works 🤷♀️

🤯 USD/EUR down 3 cents overnight

🇺🇸 An immediate response to Trump/USA import tariffs

This is Bitcoin-level volatility in FOREX

Volatility is a measure of risk. What does this mean for the US Dollar?

🚨 🇷🇺🇨🇳🇪🇺🇯🇵 reacting to US tariffs

The initial FOREX response to tariffs is a net outflow from #USD

US dollar fell against major currencies. The Euro fell against both the Chinese Yuan/renminbi & the Russian Ruble

Interesting, but expected having #RUB & #Yuan gain from this https://

🔴 $BTC, $DXY & $XAU during Trump's tariffs speech

Interesting to observe the negative correlation between Bitcoin & US Dollar Index

Gold wasn't clearly correlated with either. This makes sense - the tariffs lead to uncertainty regarding the reserve currency & central bank… https://t.co

Bad news for #USD 👎

The value of a currency is a direct reflection of the organic demand for it. Sanctions will decrease the demand for US Dollar, via disincentives

Plus, it's the US consumer that will be paying for the tariffs, not the BRICS countries 🤷♀️

Very interesting alternative USD market

Usual flow:

🇺🇸 buys oil from 🇸🇦, 🇸🇦 reinvest excess back into UST

New flow:

🇸🇦 reinvests excess into 🇨🇳-issued USD bonds

Result:

USD flows to 🇨🇳, instead of 🇺🇸, as the USD-denominated debt (bonds) are issued directly by 🇨🇳

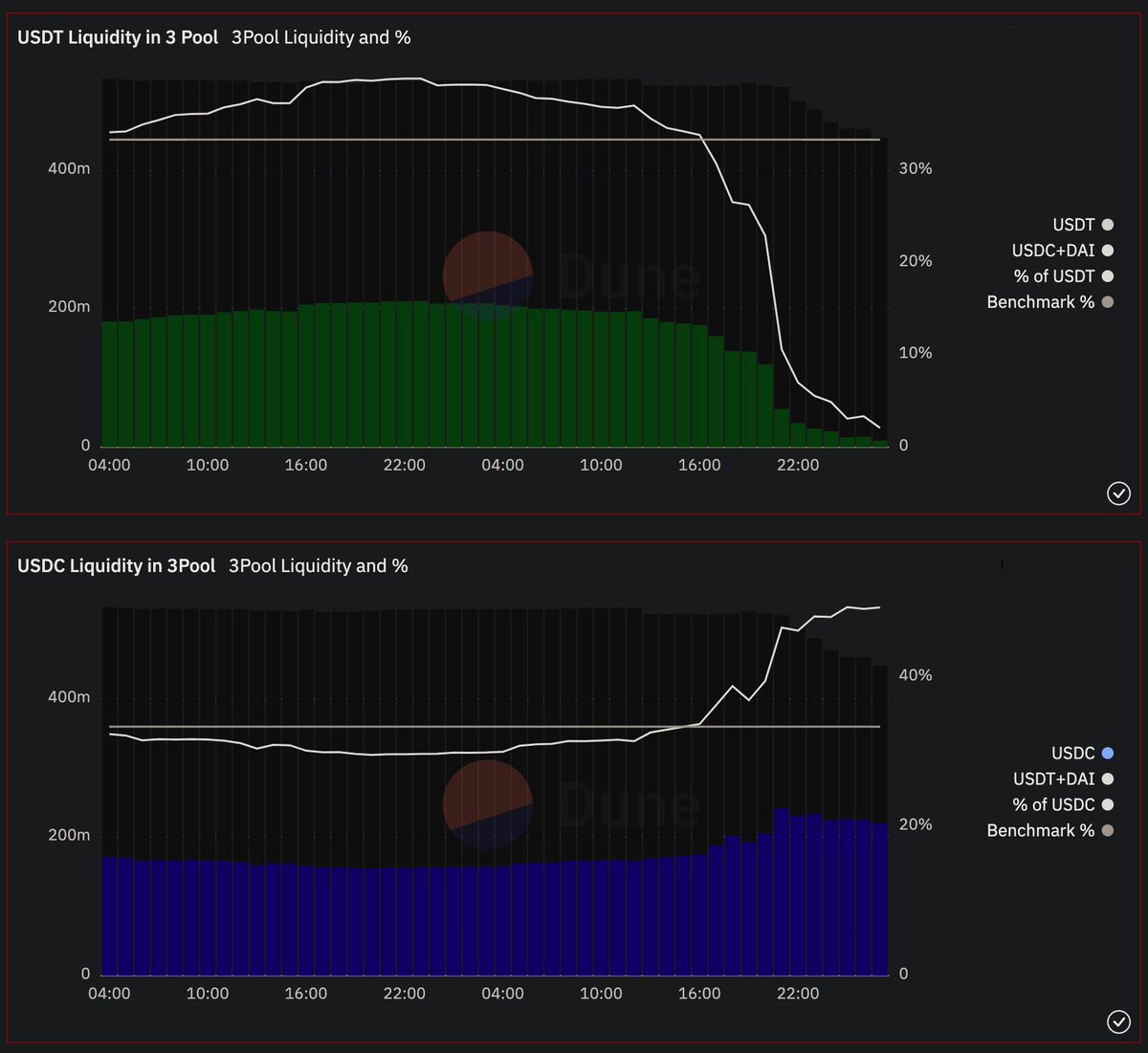

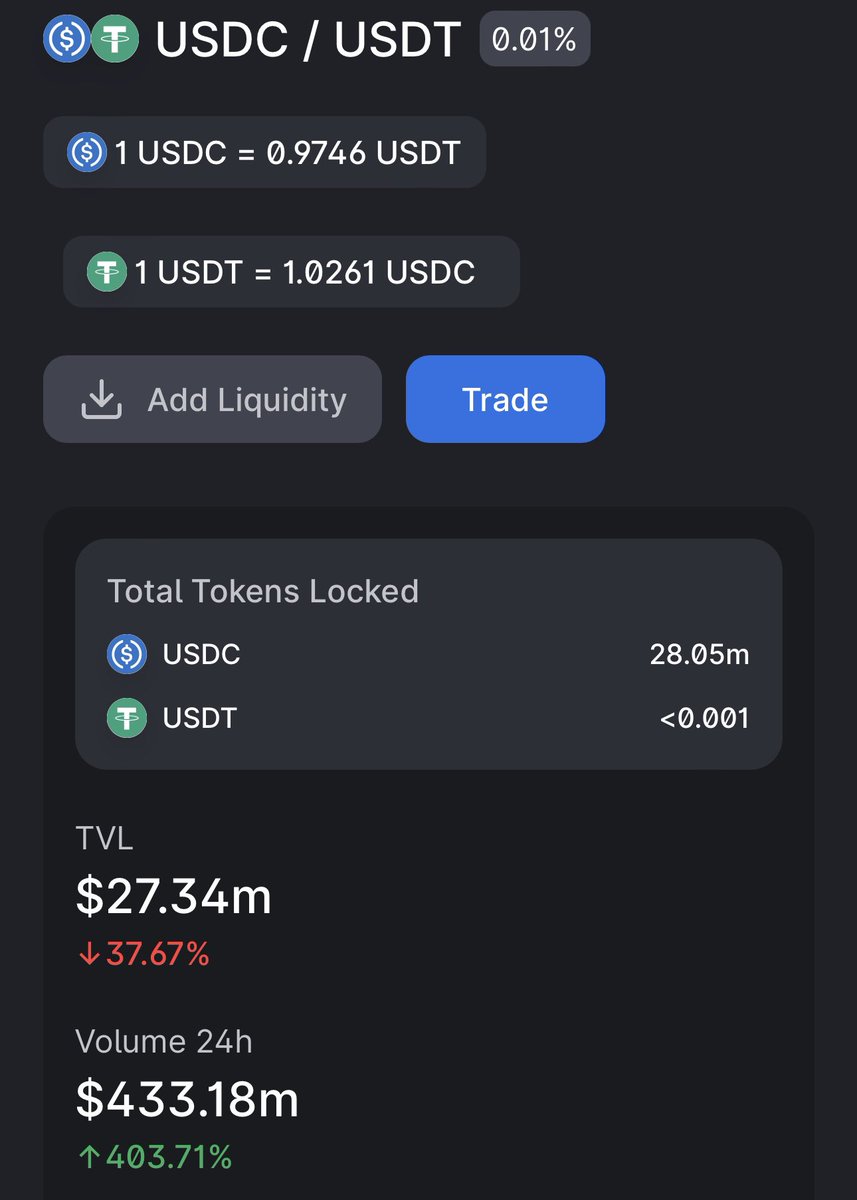

🚨📈 $USDT liquidity on #DEX pools decreased to almost ZERO, while $USDC liquidity almost doubled

This is a result of mass swapping of $USDC for $USDT

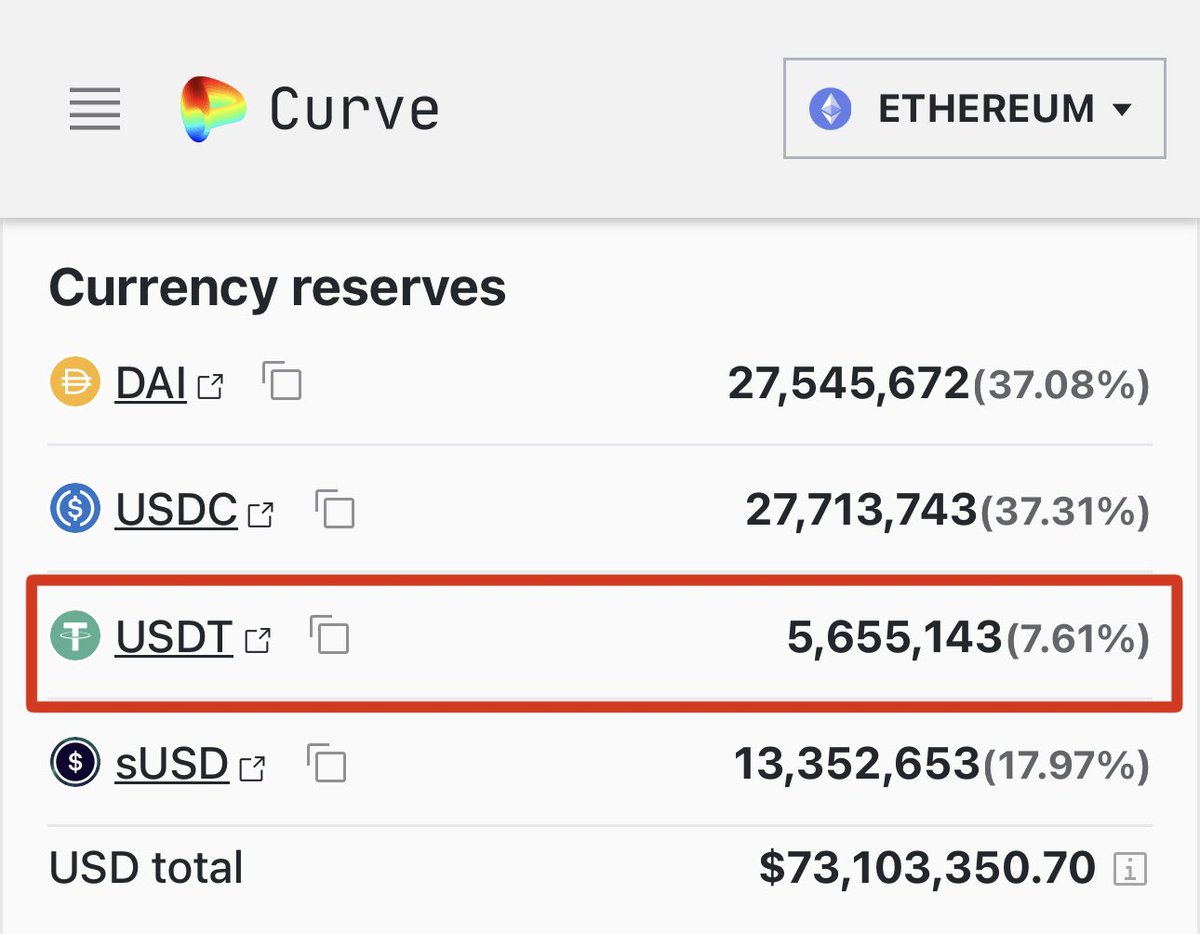

🚨📈 $USDT reserves are depleting across all #DEX pools that have $USDC.

It's not just the #3pool on #Curve, #SUSD pool is in the same situation.

This is a result of massive liquidation of $USDC, due to SVB's collapse.

The depegging seems to be more likely by the minute 😳

🚨📈 Mass $USDC to $USDT swapping has caused $BUSD to fall below $USDT by more than 1%

As $USDT reserves across #DEX are depleting, it's also affecting #CEX like #Binance

This is a result of the collapse of the Silicon Valley Bank, where $USDC has reserves

🚨 $USDC trading below $USD and $USDT above $USD

Looks like everyone is swapping $USDC for $USDT because of #SVB collapse