⬇️ My Thoughts ⬇️

banks are also subject to regulations when issuing loans

and no - it's not the fractional reserve system

in many sovereigns, like the USA the reserve requirements sit at 0%

there are other regulatory requirements limiting loan issuance

the bank has the legal right to increase the money supply AKA 'print money'

so to give you a $100 loan the bank can just create those $100 and give give them to you

pretty neat arrangement, huh? 😁

the bank has the legal right to increase the money supply AKA 'print money'

so to give you a $100 loan the bank can just create those $100 and give give them to you

pretty neat arrangement, huh? 😁

banks are credit institutions which means they can create broad money

while a non-credit institution or a regular business can issue loans - they must fund it (e.g. raise money, use excess profits)

they can't just create those $100, thus expanding the monetary supply

banks are credit institutions which means they can create broad money

while a non-credit institution or a regular business can issue loans - they must fund it (e.g. raise money, use excess profits)

they can't just create those $100, thus expanding the monetary supply

so the bank funds the loan by creating $100 and crediting them to your account

those $100 that they credited you did not exist before - the bank created that money on demand

those $100 are not physical cash - they're an entry in a digital ledger (i.e. in a computer system)

so the bank funds the loan by creating $100 and crediting them to your account

those $100 that they credited you did not exist before - the bank created that money on demand

those $100 are not physical cash - they're an entry in a digital ledger (i.e. in a computer system)

a loan for the bank ends up earning more than the lent amount

this is because the borrower repays the principal (loan amount) + interest

a loan for the bank ends up earning more than the lent amount

this is because the borrower repays the principal (loan amount) + interest

why is a loan an asset to the bank?

because the loan earns an interest over its lifetime. this the the fixed or variable interest rate associated with the loan

with time, that loan brings periodic cashflows repaying the principal and the interest

why is a loan an asset to the bank?

because the loan earns an interest over its lifetime. this the the fixed or variable interest rate associated with the loan

with time, that loan brings periodic cashflows repaying the principal and the interest

deposits are liabilities to the bank - as they are owed to depositors/customers

so the $100 cash loan that the bank issues to you becomes a deposit in that same bank, and thus a liability for the bank

you can move those $100 outside of the bank at any time/on short notice

deposits are liabilities to the bank - as they are owed to depositors/customers

so the $100 cash loan that the bank issues to you becomes a deposit in that same bank, and thus a liability for the bank

you can move those $100 outside of the bank at any time/on short notice

in the bank’s balance sheet:

⬆️ +$100 assets - the loan they just issued

⬆️ +$100 liabilities - the $100 your account was credited with

your loan is an asset to the bank - and your loan itself funds the $100 deposit that you get in your account

in the bank’s balance sheet:

⬆️ +$100 assets - the loan they just issued

⬆️ +$100 liabilities - the $100 your account was credited with

your loan is an asset to the bank - and your loan itself funds the $100 deposit that you get in your account

the bank needs a liability to fund an asset

when a bank gives you a loan it gains both an asset and a liability in the same amount

let's say you get a loan for $100

the bank needs a liability to fund an asset

when a bank gives you a loan it gains both an asset and a liability in the same amount

let's say you get a loan for $100

how banks work? bank's business model is very simple:

1️⃣ Take liability

2️⃣ Use liability to buy asset

3️⃣ Pocket the spread/carry

all of the bank's assets are financed by its liabilities

updated Illya's Threads url to https://illya.sh/threads/

now it gets it own subdirectory - so the URLs are shorter and it's more modular to manage the sitemaps this way

later I'll also add an RSS feed for threads, just like the one for thoughts at https://illya.sh/thoughts/feed.xml

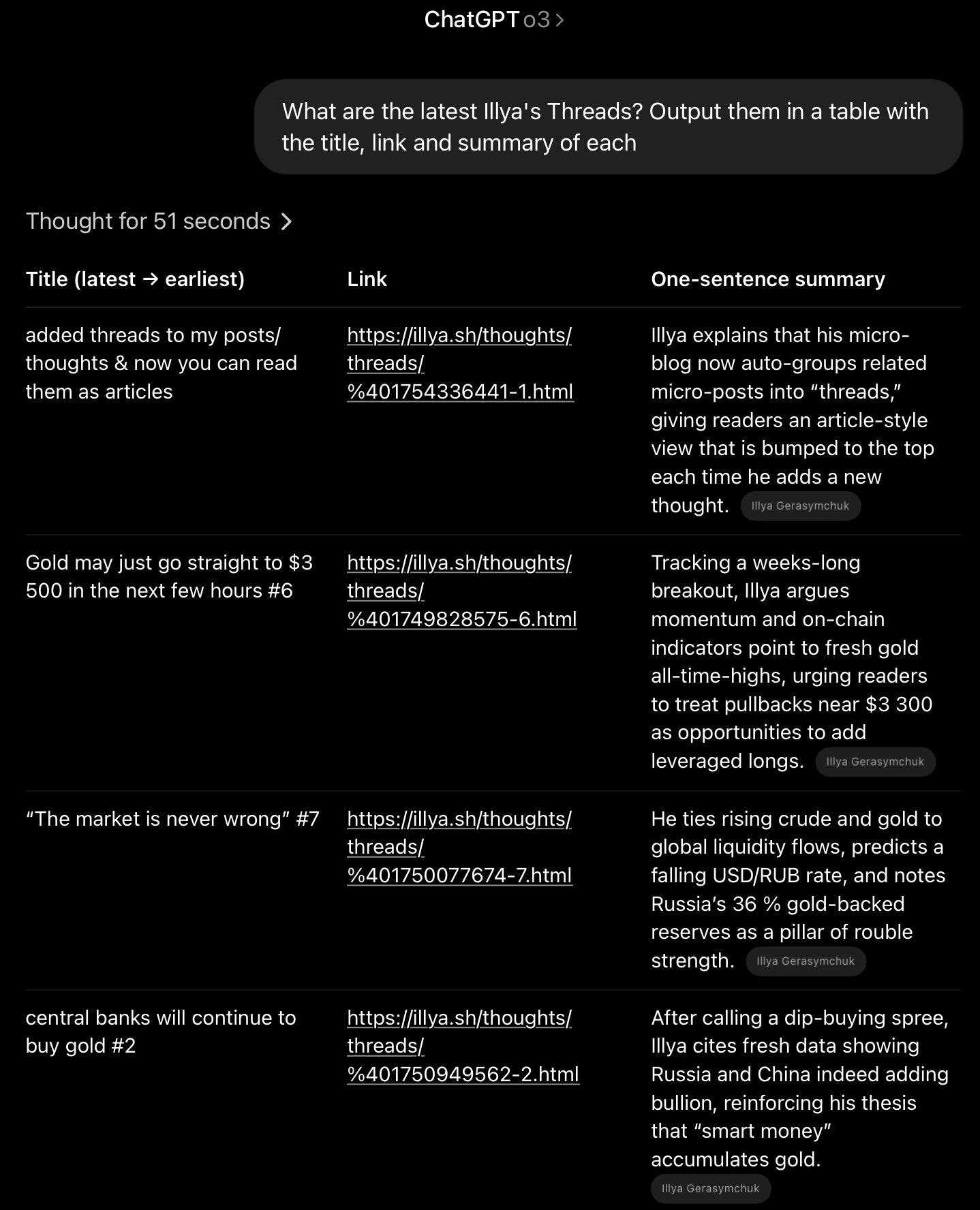

ask ChatGPT what are the latest Illya's Threads and it will tell you 😄

should also work with Grok, Claude, Gemini and any other agentic AI with web access

this is again JSON-LD magic - LLMs seem to love it

i only added threads a few hours ago - it's already indexed & working

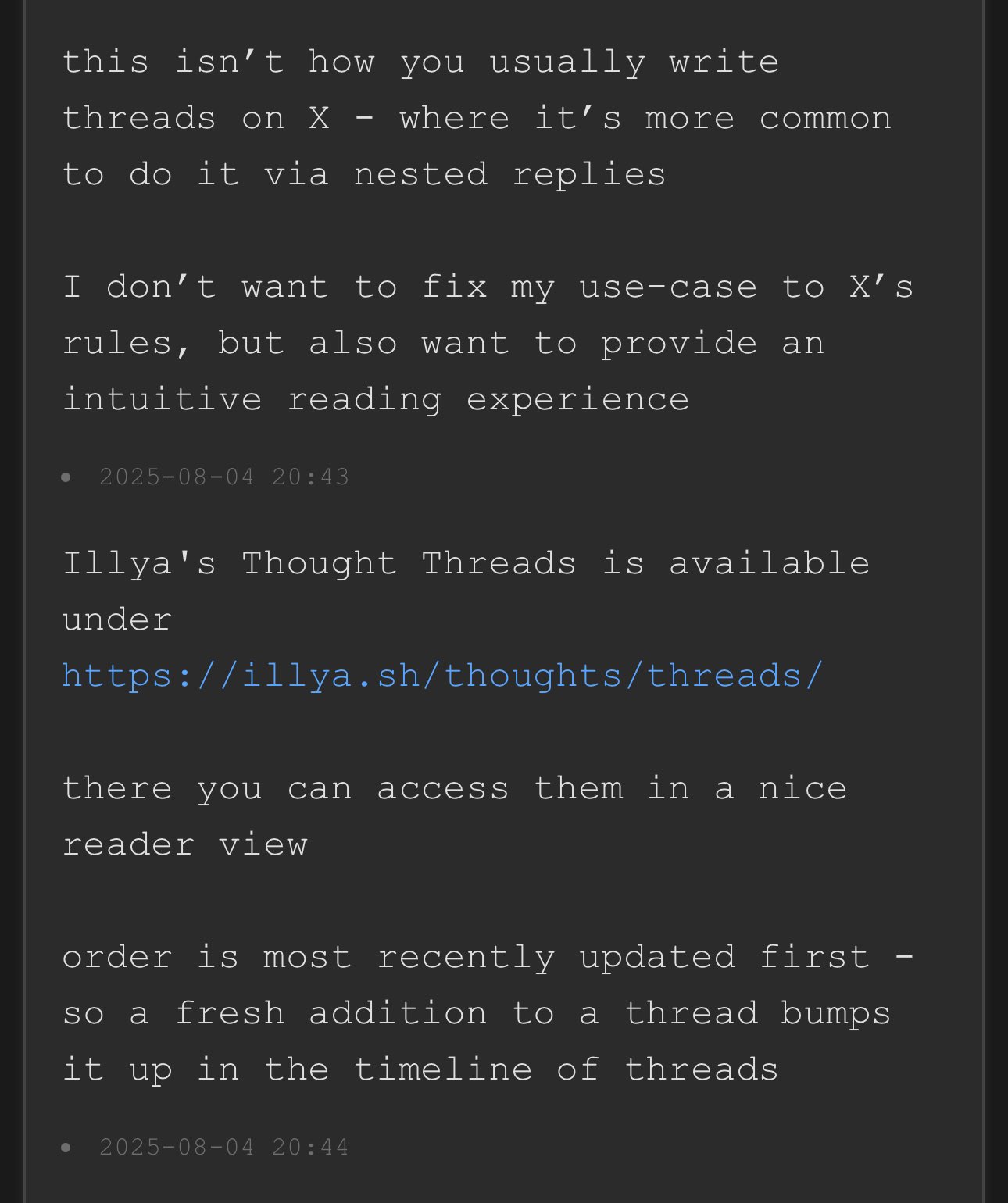

here's how the thread reading experience looks like

the aim is clean article view - with timestamps as visual separators between posts/thoughts

if you click on the timestamp it takes you to the individual post/thoughts

Illya's Thought Threads is available under https://illya.sh/threads/

there you can access them in a nice reader view

order is most recently updated first - so a fresh addition to a thread bumps it up in the timeline of threads

Illya's Thought Threads is available under https://illya.sh/threads/

there you can access them in a nice reader view

order is most recently updated first - so a fresh addition to a thread bumps it up in the timeline of threads

this isn’t how you usually write threads on X - where it’s more common to do it via nested replies

I don’t want to fix my use-case to X’s rules, but also want to provide an intuitive reading experience

this isn’t how you usually write threads on X - where it’s more common to do it via nested replies

I don’t want to fix my use-case to X’s rules, but also want to provide an intuitive reading experience

the way I do it is by quoting the logically connected post, thus forming a chain of related posts

if you build a DAG with temporal order & display posts from oldest to newest you get a thread of posts, forming a small article

the way I do it is by quoting the logically connected post, thus forming a chain of related posts

if you build a DAG with temporal order & display posts from oldest to newest you get a thread of posts, forming a small article

so everything that I post on other social media, like X/Twitter also gets posted to my microblog at https://illya.sh/thoughts/

frequently an idea evolves into a series of posts - a thread/small article

so everything that I post on other social media, like X/Twitter also gets posted to my microblog at https://illya.sh/thoughts/

frequently an idea evolves into a series of posts - a thread/small article

🚀 added threads to my posts/thoughts & now you can read them as articles

the static microblog now generates a series of quoted posts as threads, where posts are displayed from oldest to newest

Bitcoin is still in a weekly uptrend it must either go up or down to ≈$109500 - a strong weekly support

two factors in play here:

1️⃣ USD index - inverse correlation

2️⃣ Global liquidity- correlation

keep watching central bank's open market operations & balance sheets

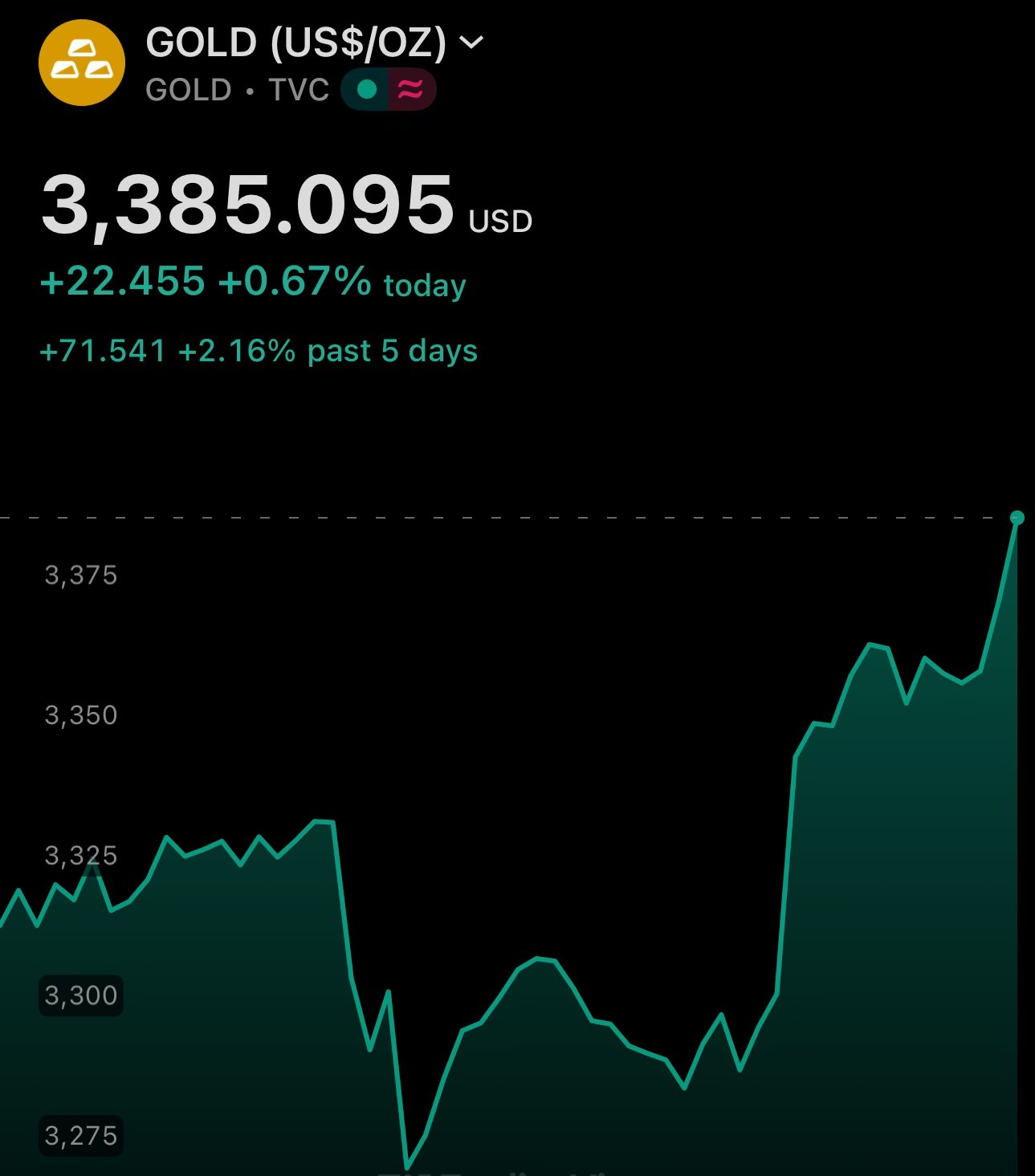

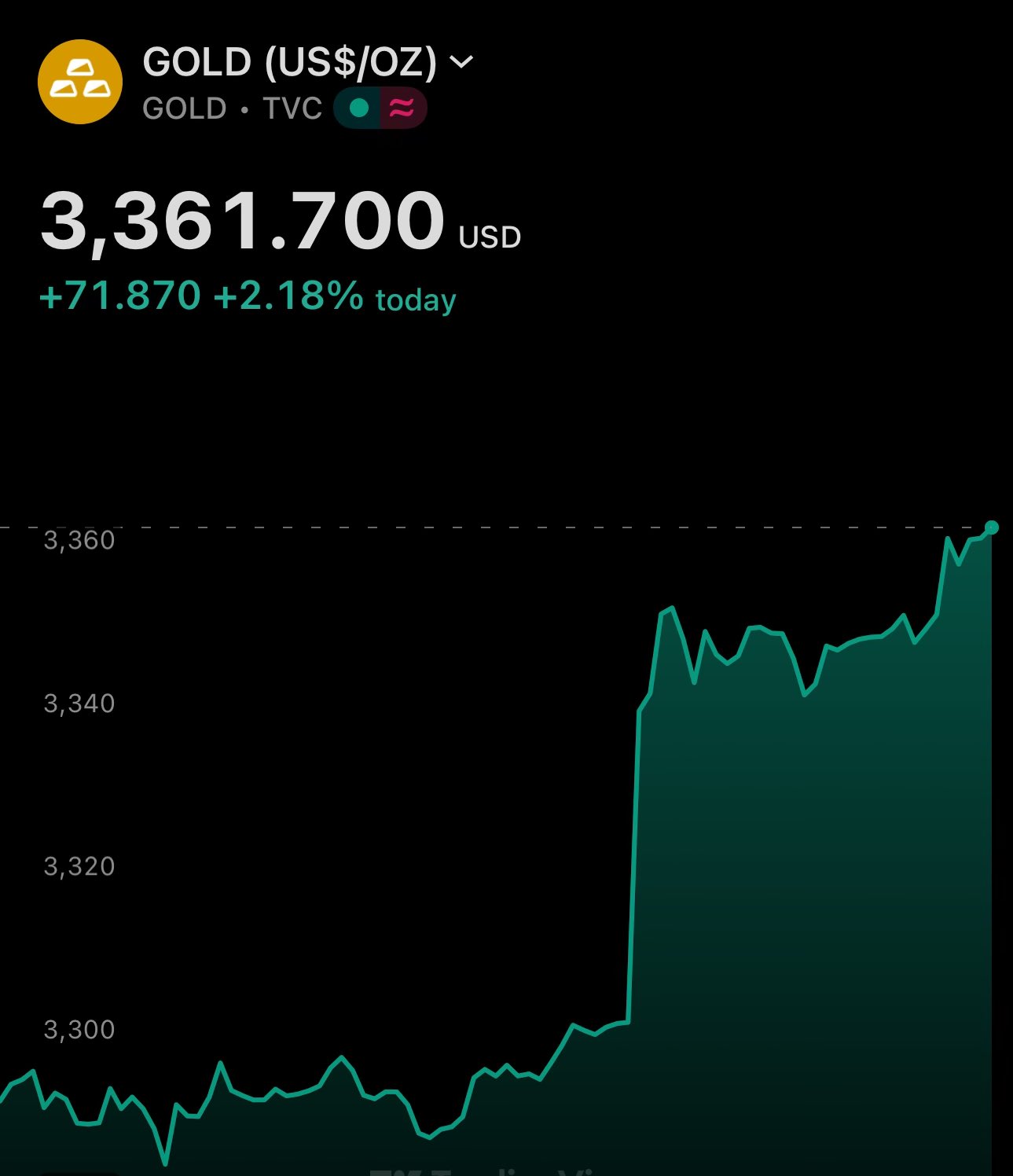

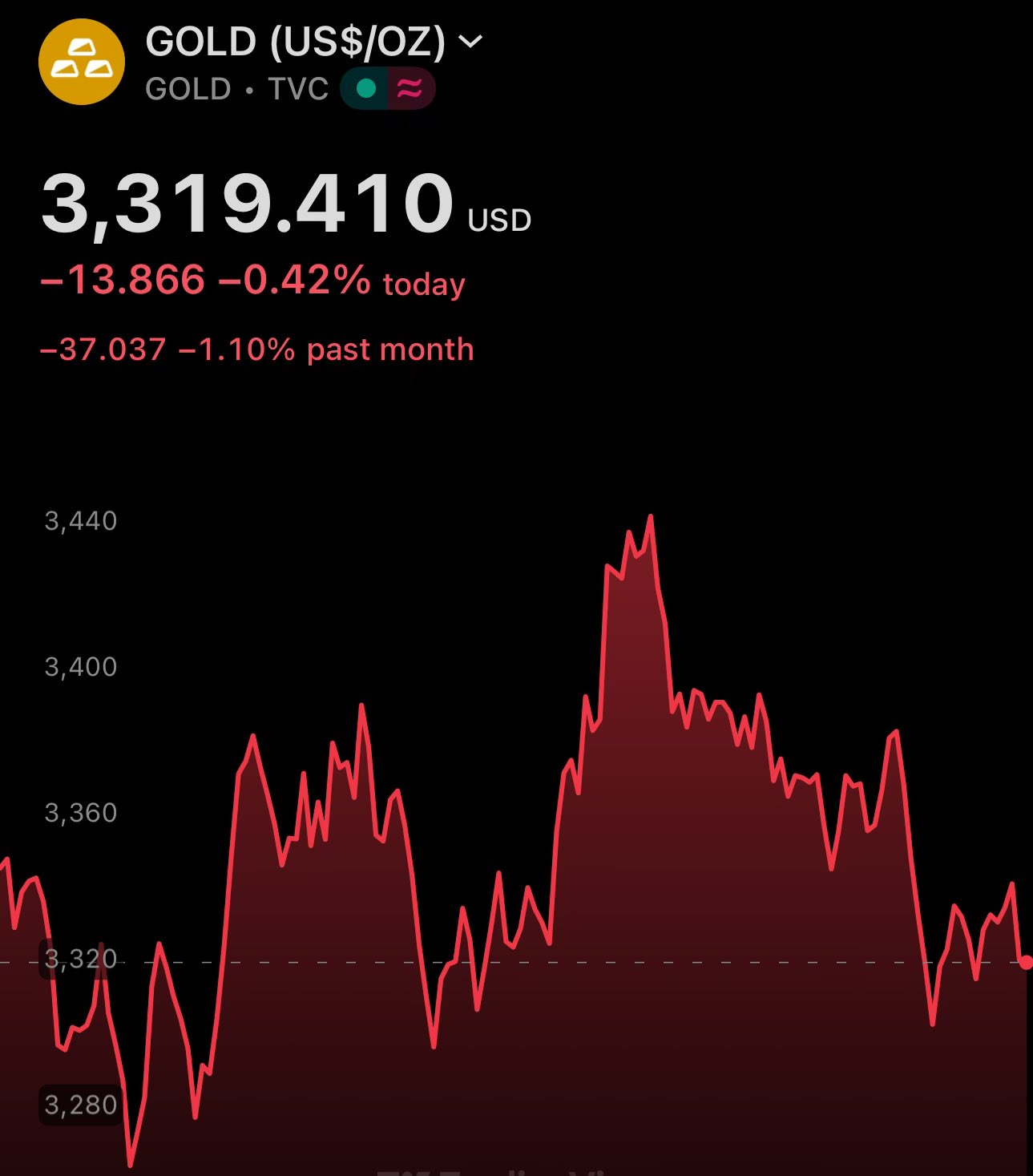

🚀 gold approaching $3400. $3300 was a good price for longs - like I wrote a week ago

currently gold is one of the only assets where leverage entails a much lesser risk

upside price pressure is coming from several points

5 days ago I wrote that USD/RUB rate will fall. 5 days later it's down ≈2%

despite oil being down - gold is up

Ruble has hedge from multiple sides

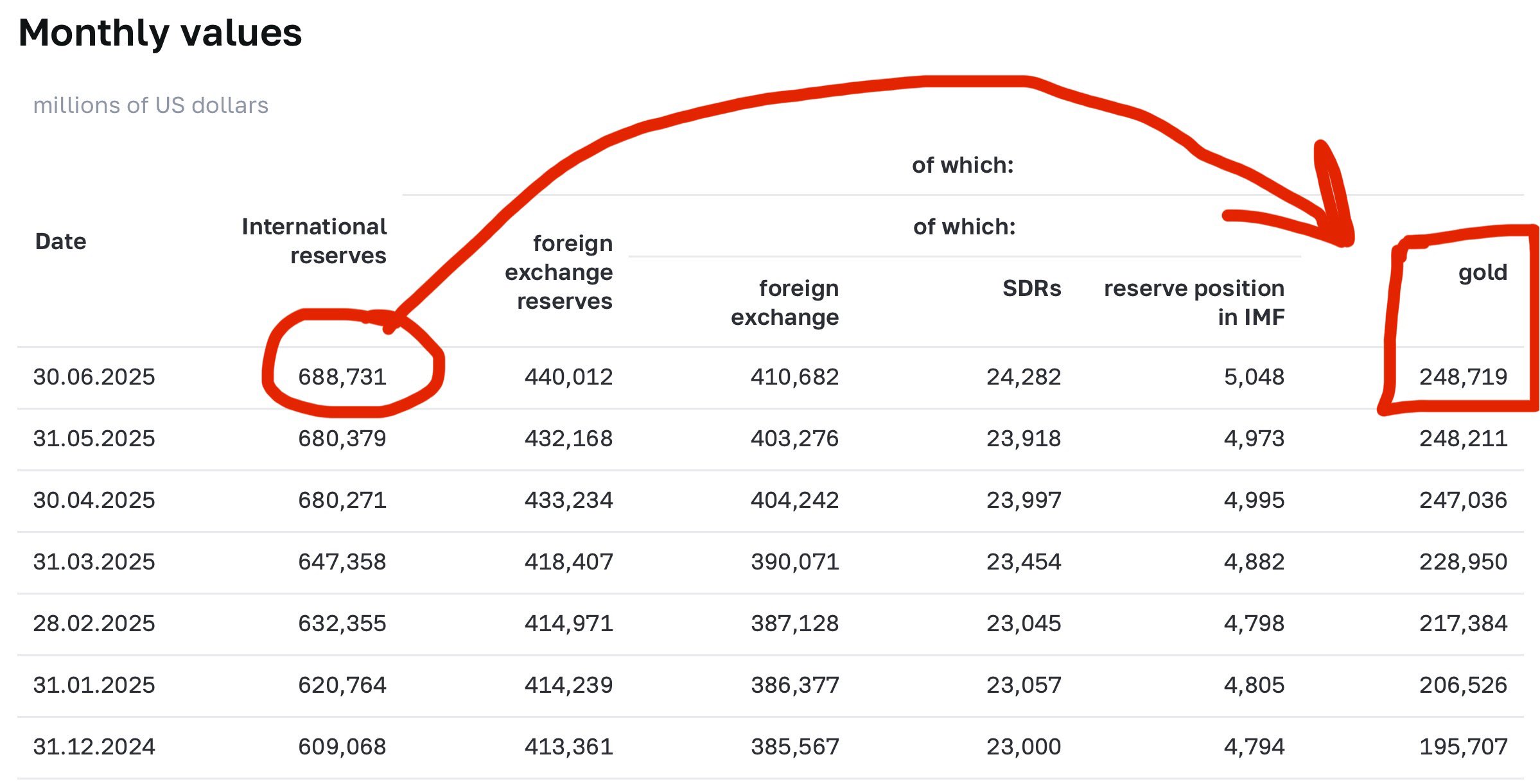

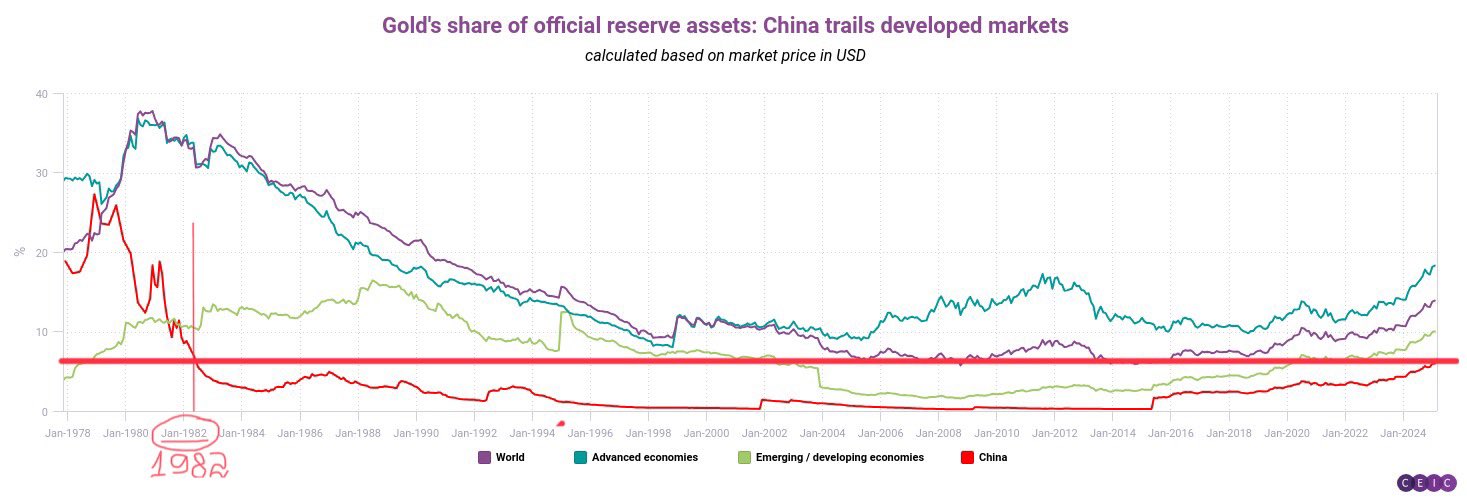

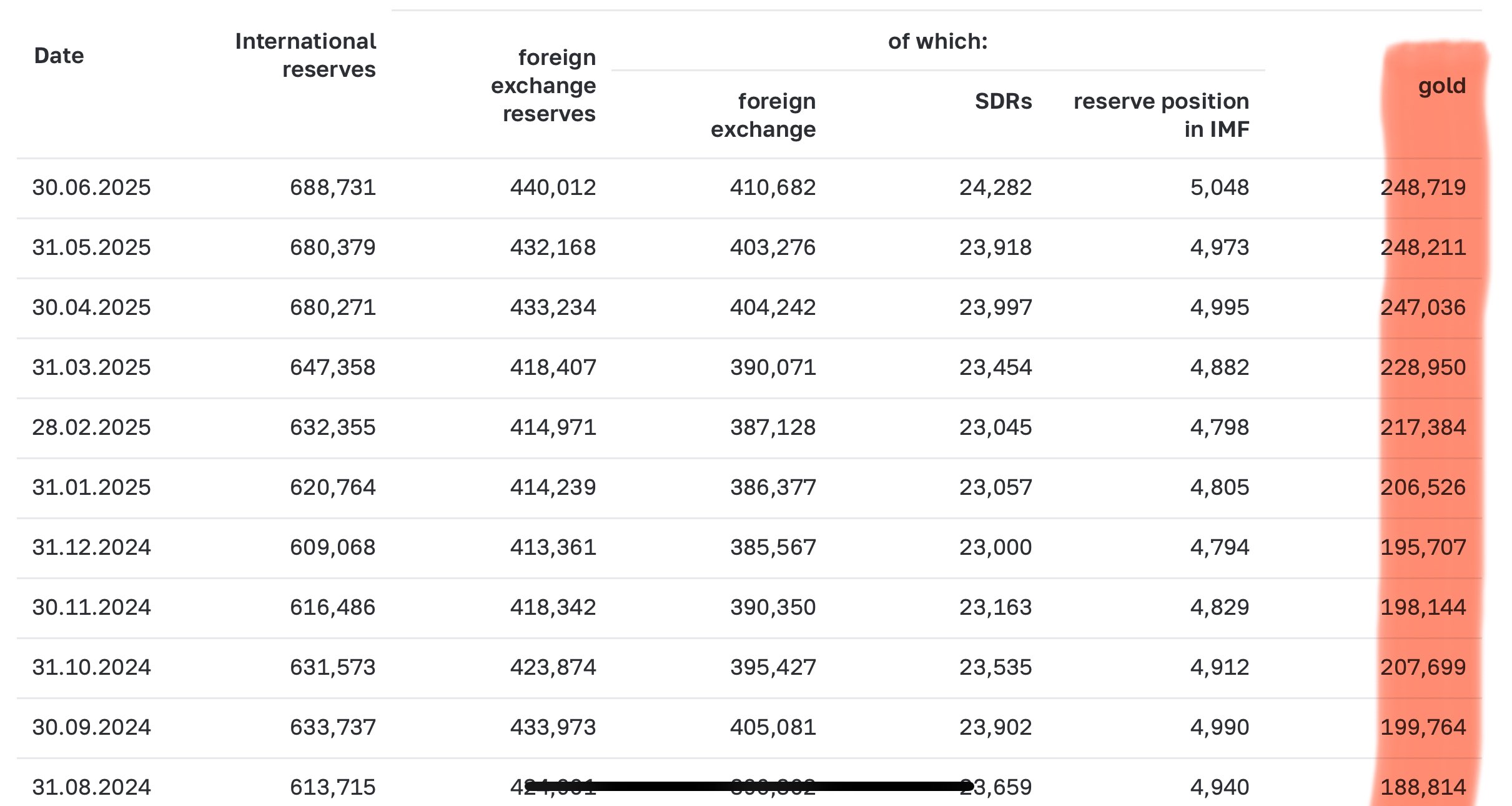

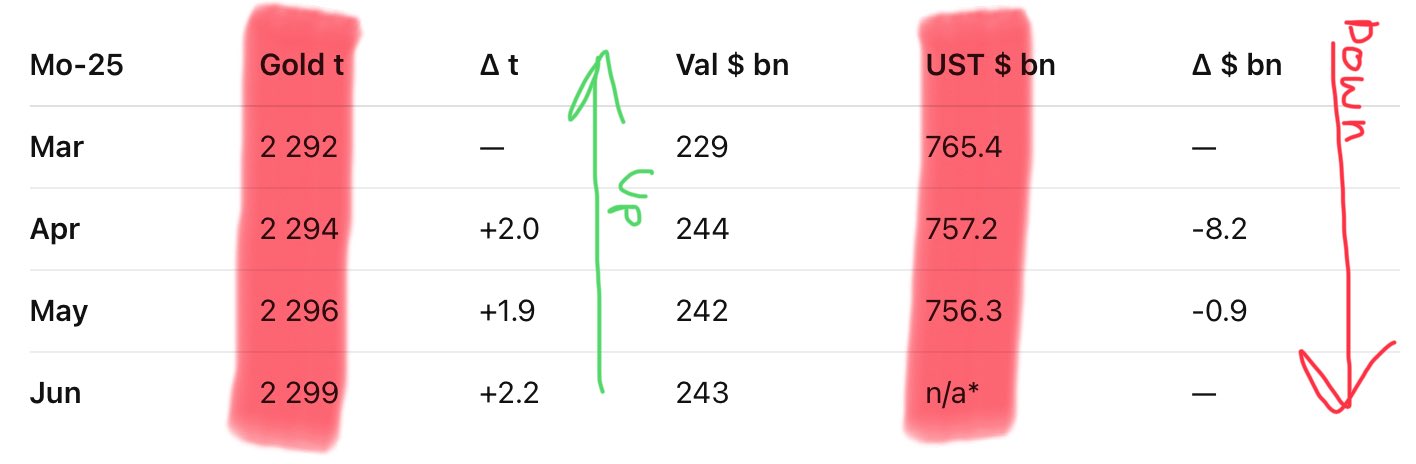

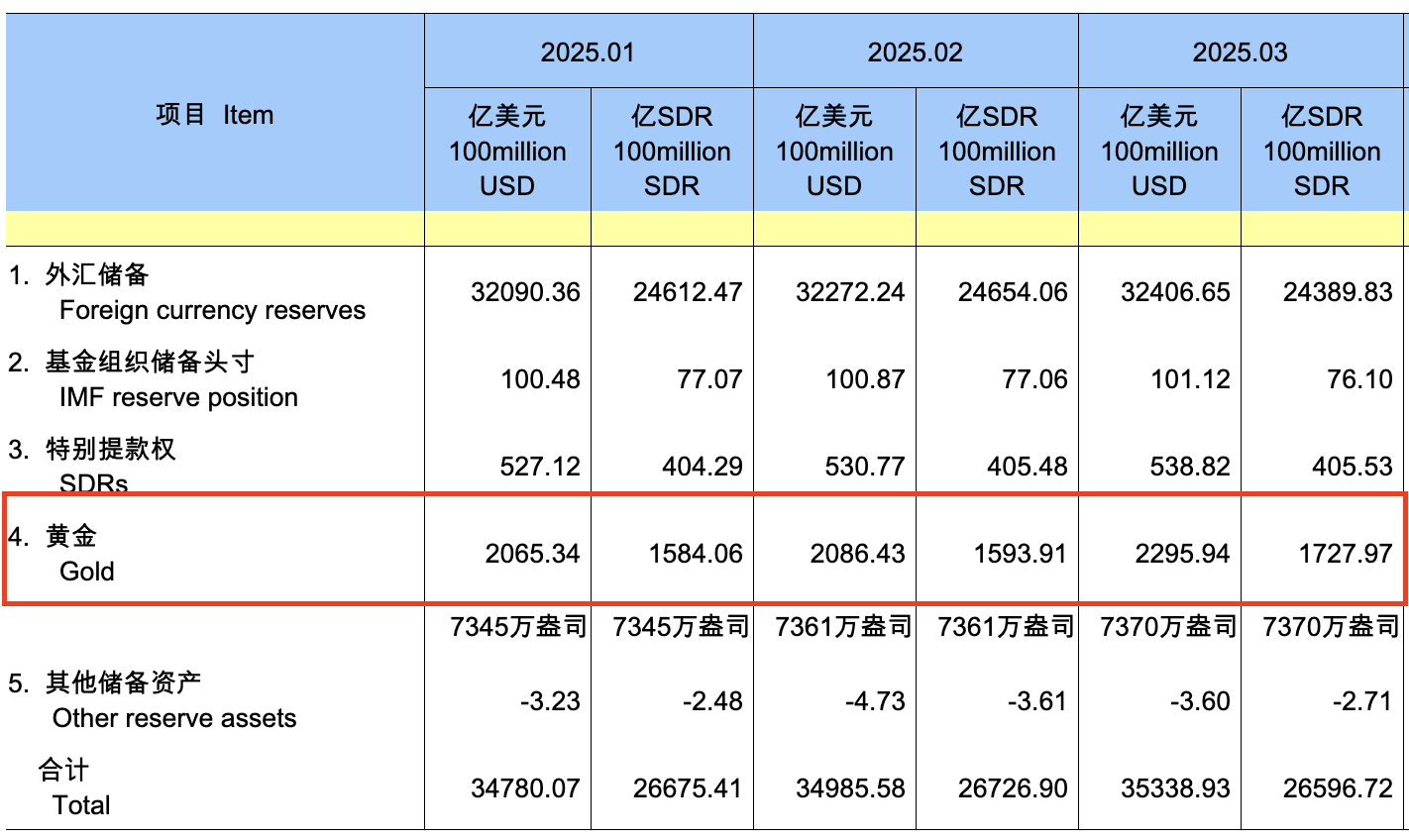

🇨🇳 China's gold holdings are at their highest level in 43 years

gold is now 6% of PBoC international reserves. but that's still below the world average of ≈14%. expect that gap to continue to shorten further

see my drawings on this nice chart spanning over 47 years i found

both Russia & China increased their gold holdings since I wrote this 😄

indeed - central banks are continuing to buy the gold dips

China sold US treasuries and bought gold - just like I wrote over 3 months ago

gold now accounts for ≈6% of PBoC international reserves, while US treasury holdings are ≈40% from their peak in 2013

off-ramp from USD debt to alternative assets continues its progress

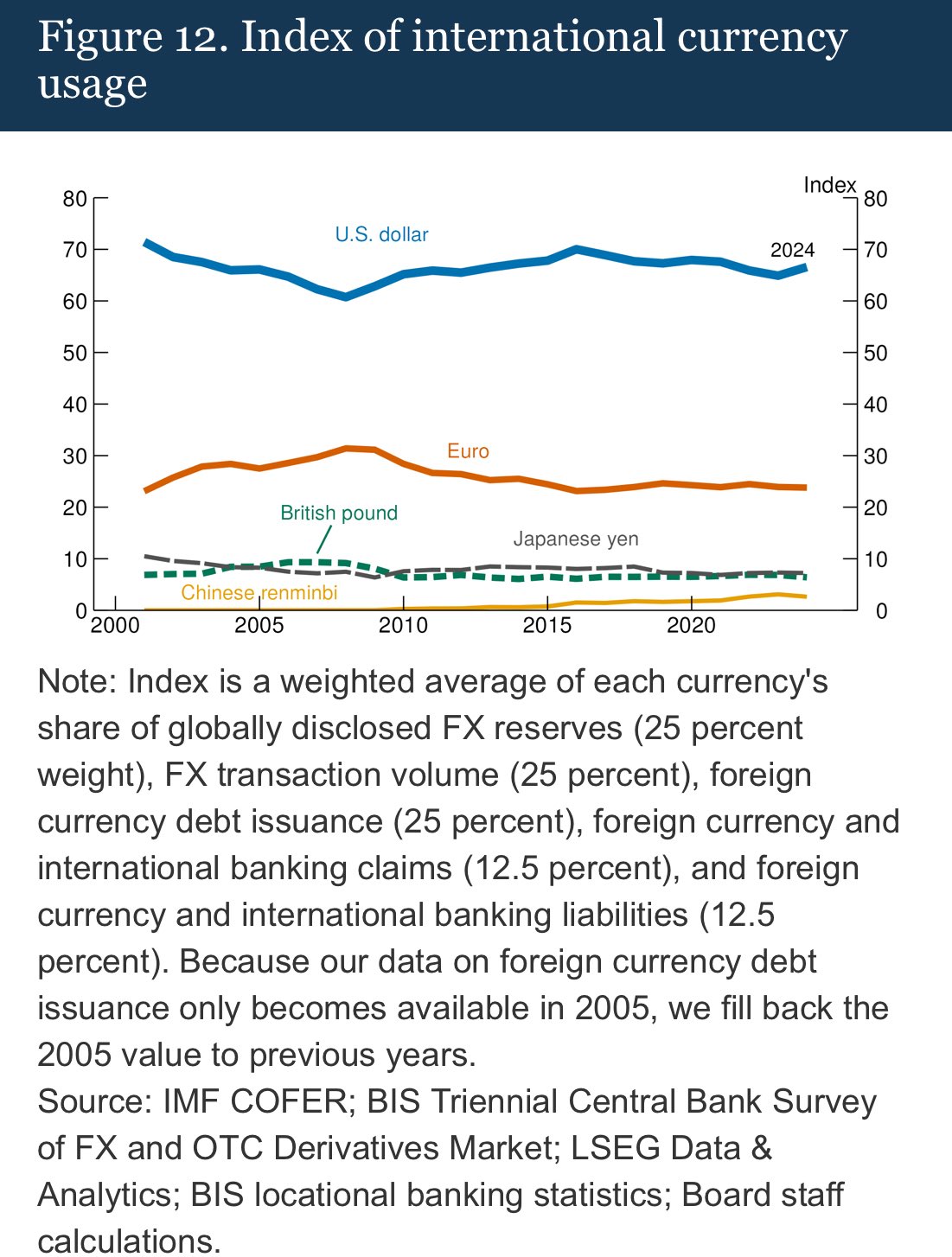

the 70% USD dominance here is as calculated by the Fed across the chosen 5 chosen buckets - with the end result being a weighted composite measure

so don't read this as a literal 70% of all cross-border transactions