⬇️ My Thoughts ⬇️

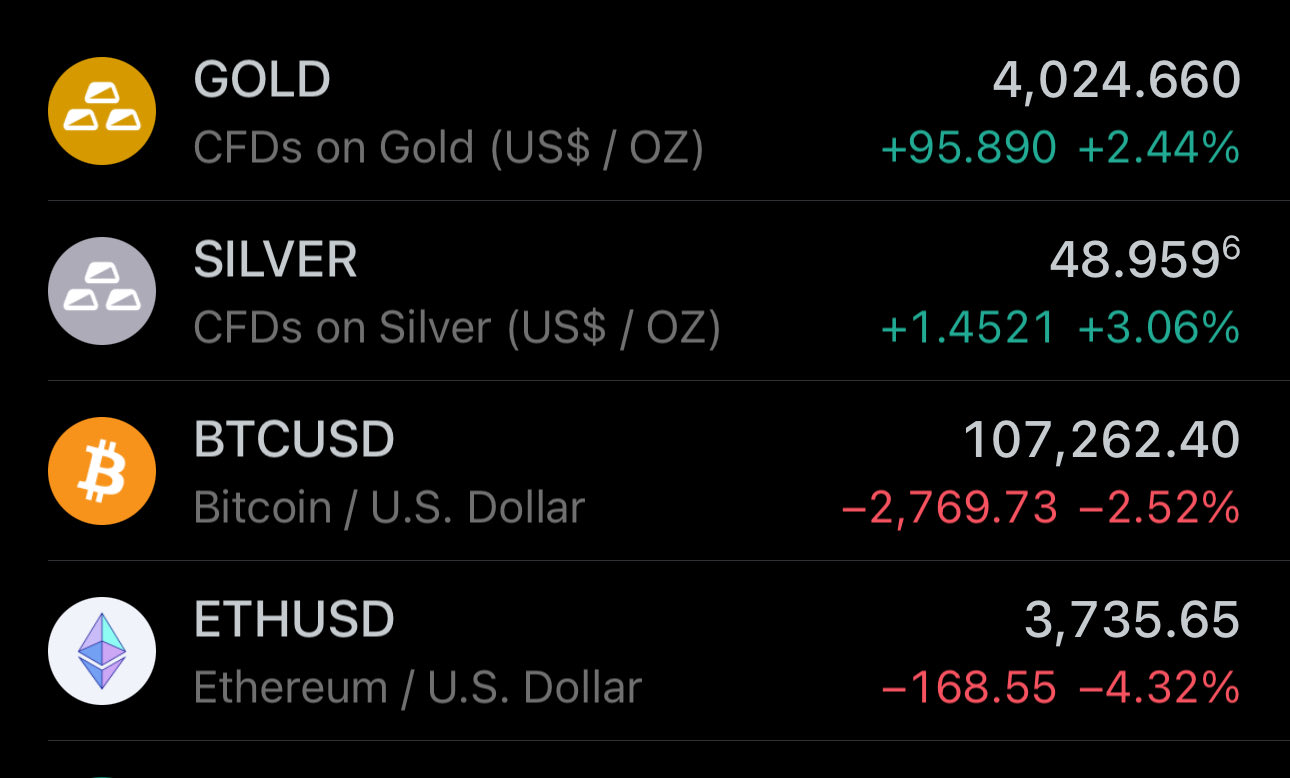

My prediction on Silver's bottom was correct: ≈$43-45 ✅

The uptrend goes on. The price will encounter more corrections along the way, but the bottoms I described previously remain valid.

Like for gold, I would re-analyze critically all sources that were claiming that the bullrun for silver is over.

silver could pullback to ≈$40 before continuing its uptrend

this represents a ≈27% correction from the top

this is the lowest possible bottom for this move - it probably won't go this low. if it does, the move will happen fast, so have your buy limit orders ready. next week is FOMC interest rate decision. the Fed will cut the rates by another 25bps, and other things equal - it's positive price pressure for silver

if the price breaks below $47, it will likely fall closer to $45. expect a stronger support in the $43-45 area

overall, any prices in the vicinity of September 15th 2025 prices is a GREAT buying opportunity

* keep in mind the total 75 bps interest rate cut by the Fed this year is already in progress of being priced in - the market doesn't wait for the official announcement. this is one of the reasons why you had so much upside price volatility in the last month

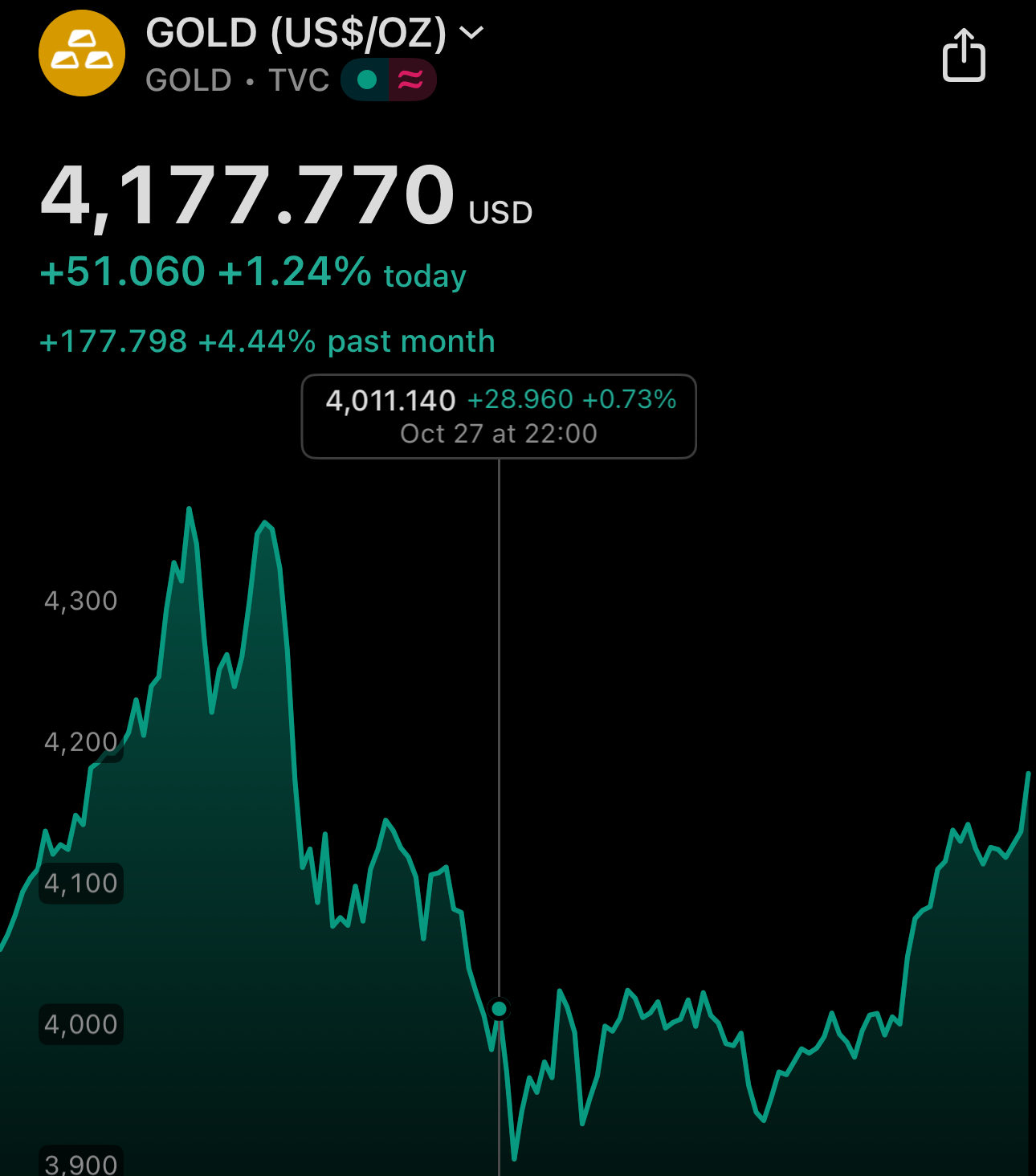

My prediction on gold's bottom was correct: ≈$3900 ✅

You can direct anyone who is saying that gold and silver have topped to my posts.

If you think that gold and silver have topped - I'm really curious to hear your thesis. I've laid mine out extensively in prior writings.

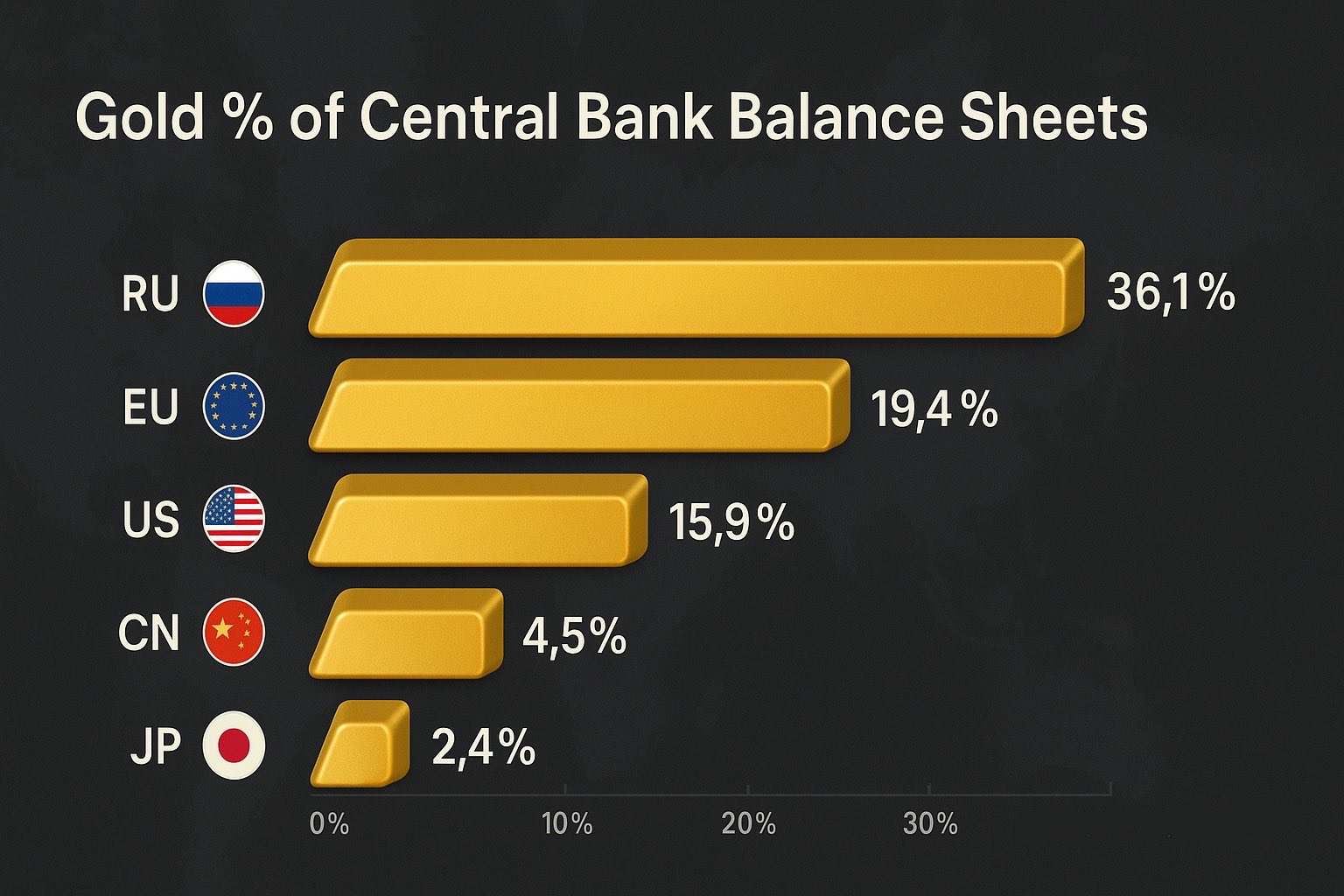

Gold as a percentage of balance sheet size in Central Banks (ranked):

🇯🇵 Japan (MoF + BoJ): ≈2.4%

🇨🇳 China (PBoC): ≈4.5%

🇺🇸 U.S. (Fed gold certificates): ≈15.9%

🇪🇺 European Union (ECB + Eurosystem): ≈19.4%

🇷🇺 Russia (BoR): ≈36.1%

All of the above will expand their balance sheets, but it's mostly China & Russia actively buying more gold.

Conclusions you can take from here:

➖ China's gold holdings are relatively small when compared to their Central Bank's balance sheet size, and given their efforts to promote renminbi as the invoice currency worldwide, you can expect PBoC to continue their gold purchases for the medium-long term. The gold share must at least double to come close to the current reserve currency - the U.S. dollar. All reserve currencies started on a gold and/or silver standard - and the pressure towards this direction won't be different for renminbi/yuan. When the USD became the world reserve currency with the Bretton-Woods agreement - gold certificates accounted for ≈40% of the Fed's balance sheet.

➖ Russia has built up a massive balance sheet capacity for the future. Once the international trade markets with Russia re-open, there will be a plenty of reserves to back-up a massive wave of Ruble credit. Expect Russian capital markets to rally then.

➖ European Union has a healthy relative position. Given that the Euro is currently the closest alternative to the U.S. Dollar - it's a good idea to both, expand gold reserves and promote capital markets. The latter is an explicit goal via the Capital Markets Union (CMU). Given that EU will further expand the balance sheet, it's necessary to increase the gold reserves - repricing won't be enough. Gold will make Euro more attractive, and with it the FX holdings of Euro by sovereigns.

Bitcoin is not just for speculative gambling

Nation state-linked companies are already settling their transactions in Bitcoin. Sure, they're using Bitcoin only as an intermediary, not as the end settlement unit of account, but this takes Bitcoin's utility far beyond gambling.

Just because Bitcoin isn't replacing gold as money, doesn't mean that it's a failure. Just because Bitcoin bitcoin collapsed below 100K, doesn't mean it won't come back higher (liquidity cycles suggest it will).

Extremes are better for engagement, but reality is very inclusive.

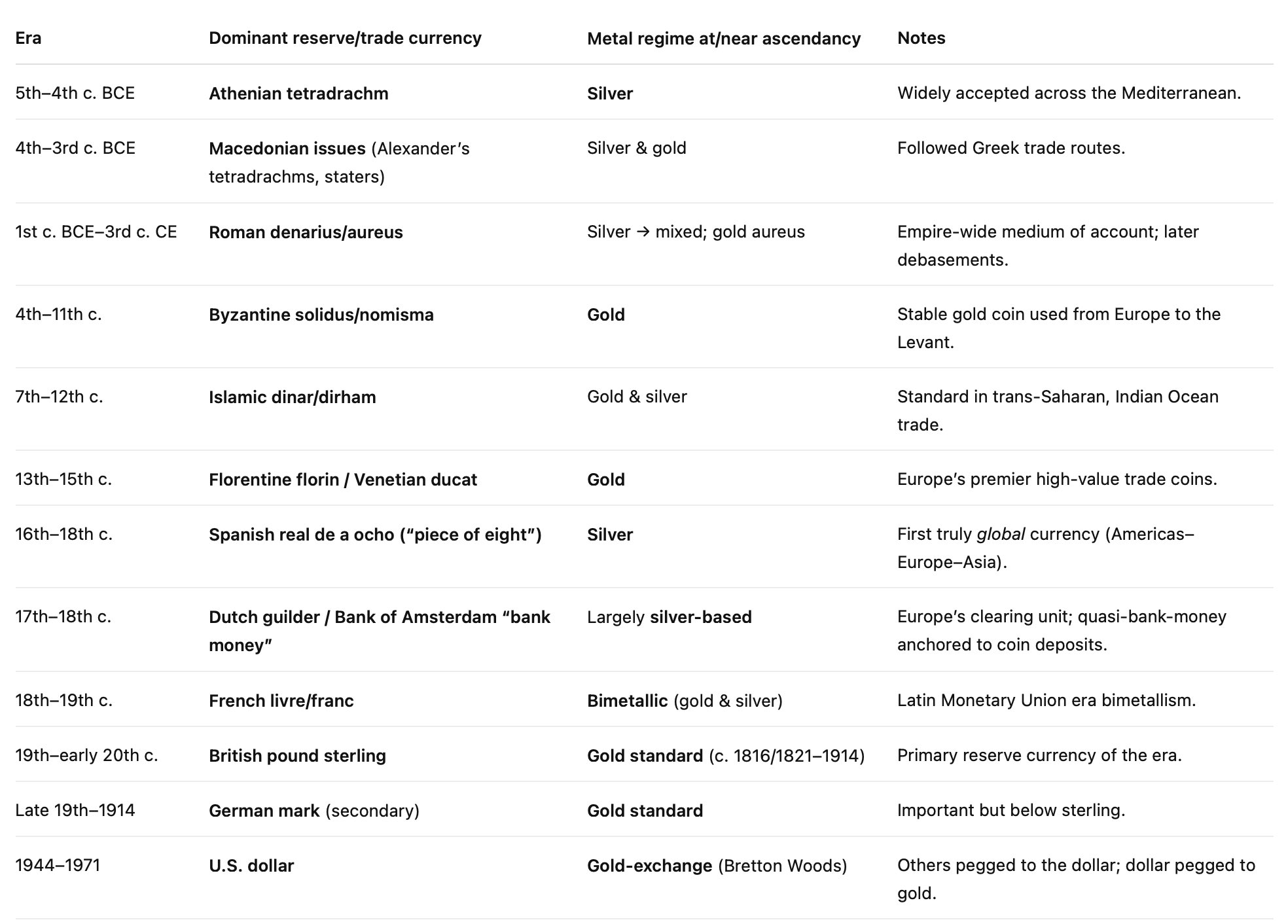

My article on how all reserve currencies started on a gold and/or silver standard: https://illya.sh/threads/all-reserve-currencies-achieved-reserve-status-under-gold-or

My article on Gold vs Bitcoin, and how Bitcoin needs Gold, but Gold doesn't need Bitcoin: https://illya.sh/threads/bitcoin-needs-gold-gold-doesnt-need-bitcoin.html

My article on Gold vs Bitcoin, and how Bitcoin needs Gold, but Gold doesn't need Bitcoin: https://illya.sh/threads/bitcoin-needs-gold-gold-doesnt-need-bitcoin.html

Gold is within the fabric of money, not just Central Banks

A lot of posts on X frame Central Banks as malevolent institutions, and by some form of conspiracy they hold gold in their reserve accounts. And apparently not holding gold is a step towards monetary freedom - even more if you forego an atomic element (Au) for a cryptographic computer algorithm (Bitcoin).

A more productive approach is asking why do Central Banks chose gold over all other commodities and assets. Every single world reserve currency, without exception, started on a gold and/or silver standard. Gold has been used as money for over 5000 years.

I've written several articles on what makes gold so special and how Bitcoin is not a replacement for gold. I'll leave them linked below

European Investment Funds Explained: UCITS, AIFs, AIFMD and the ELTIF Regime

As I’ve previously written, I am working on a framework for tokenizing European Long Term Investment Fund operation (ELTIF 2.0) on a public, smart-contract enabled blockchain like Ethereum. You can read more about it here: https://illya.sh/threads/tokenizing-european-long-term-investment-funds-eltif-2-0-on

This is financial markets legislation heavy topic, and it involves several regulations and directives, each one meticulously outlining rules and exceptions which together form a framework for operating various investment funds in the European Union.

I come across many negative commentaries regarding EU regulations in general, but not so many explaining those regulations. In general, there is not much information covering this topic on the internet, and if you ask ChatGPT to explain it - it will likely take you several iterations and back-and-forth to understand it.

Since this falls under my current area of work - I thought that it would be useful to share the knowledge, and provide a clear and concise starting point for anyone looking into investment funds legislation and practical application in the European Union.

So first of all let’s start with the definition of a “fund”. EU law doesn’t have a unanimous definition for what constitutes a fund. Instead, it defines rules for two collective investment schemes:

1️⃣ Undertakings for Collective Investment In Transferable Securities (UCITS) defined in Directive 2009/65/EC

2️⃣ Alternative Investment Funds (AIFs) defined in AIFMD Directive 2011/61/EU

UCITS is defined as an undertaking whose sole purpose is collective investment in transferable securities and other liquid financial assets, with the holders of UCITS units/shares being able to redeem/repurchase them on demand out of UCITS’s assets/holdings. The strict list of eligible assets is defined in Article 50 of Directive 2009/65/EC and it includes:

1️⃣ Transferable securities, which are securities that are negotiable/tradable on capital markets, such as shares/equities and bonds.

2️⃣ Money market instruments

3️⃣ Deposits with credit institutions

4️⃣ Certain financial derivatives

As per Article 5, a UCITS must be managed by “management company”, which is defined as a company whose regular business is to manage UCITS (Article 2(1)(b)), or set up as a self-managed investment company under Articles 29-31. As per Article 6(1) this management company must be authorized. Before a UCITS is authorized its’s management company must be authorized.

Alternative Investment Fund (AIF) is defined in Directive on Alternative Investment Fund Managers (AIFMD) to encompass all undertakings that raise capital from investors, invest according to a clearly defined investment policy for the benefit of the investors, and do not require UCITS authorization. In this sense, AIF is a functional classification, and it explicitly captures other collective investments that do not fall under the UCITS definition, as per Directive 2009/65/EC.

As a general rule, anything that’s a collective investment undertaking, but not a UCITS is an AIF. That definition comes directly from AIFMD Article 4.

An AIF must always be managed by an Alternative Investment Fund Manager (AIFM). Under Article 4(1)(b) of AIFMD, an AIFM is defined as “legal persons whose regular business is managing one or more AIFs”. Article 5 from AIFMD further reinforces this idea by requiring every AIF to have a single AIFM legally responsible for its compliance. This management entity can either be external (external AIFM) or the AIF may be managed internally with the AIF itself obtaining AIFM authorization. Article 6(1) mandates that no entity may manage an AIF, unless they are authorized as an AIFM (i.e. the managing entity must be authorized). The AIFM in an AIF is equivalent to the “management company” in UCITS.

European Long Term Investment Fund (ELTIF), defined in Regulation (EU) 2015/760, and later amended by Regulation (EU) 2023/606 , is a type of Alternative Investment Fund (AIF). All ELTIF are AIF, but in order for an AIF to be ELTIF, it must meet the requirements outlined in the regulation and is subject for authorization.

As such, under the EU law, ELTIF is not a distinct class of funds/collective investment schemes, but rather a legal label that an AIF can apply for. Since an ELTIF is an AIF, it is also managed by an AIFM.

So what distinguishes an ELTIF from a “regular” AIF? In short, it’s the type of assets that the collective investment undertaking holds. Among others, an ELTIF must invest ≥55% of its capital into eligible assets, which include real assets (e.g. real estate) and STS securitizations. Moreover, an ELTIF cannot invest into commodities, the use of financial derivatives is only allowed for hedging and there are limits on borrowing/leverage.

So why would one bother with the ELTIF label? Well, having the ELTIF label means your collective investment undertaking product is available to retail (i.e. to non-professional investors) EU-wide. An ELTIF allows you to offer illiquid investments to retail in the whole European Union

In conclusion - EU law defines a fund as a collective investment undertaking, and it can be of two types: UCITS or AIF. An ELTIF is a type of AIF, which comes with retail EU passport benefits.

This article doesn’t aim to be exhaustive, but rather to be used as the basis for forming a mental model on the legal structure of funds in the European Union, and how the ELTIF fits into the framework.

more mobile phones can also be produced - that doesn't mean that price of existing phones will go down

building new houses does not reduce the demand for highly desired areas - physical space is limited

moreover, those new houses will be built with the same credit/funding that will further drive real estate prices up. there is a reason banks eagerly finance at least 75% of the property value

Illya's Threads and Thoughts Now Uses Slugs In URLs

I've extended my static site with short (thoughts) and longer-form (threads) posts to have their URLs structured in the form of a slug.

Before, each individual thought’s and thread's HTML page name (and by extension, its URL) was based on the timestamp of the post. Now, it’s based on the first line of the post.

So now the URLs are nicer looking, more human readable, and much more SEO and LLM friendly.

For example https://illya.sh/threads/@1761122490-0 becomes https://illya.sh/threads/bitcoin-needs-gold-gold-doesnt-need-bitcoin

You will notice that the former URL still functions via a redirect to the new slug-based URL. This is because there were already thousands of pages indexed in search engines, and a smaller amount of third-party links (mostly other platforms, comments, direct shares and intra-links).

This was on the future TODO list since pretty much the start of the project, but it was purposefully delayed until the amount of content justified it. Also ChatGPT kept bugging me to update to slugs for a better SEO

From an architectural perspective everything is still fully static, automated and straightforward:

➖ The slug is constructed by getting the first line of the post, sanitizing it and adding dashes. It can have up to 60 characters in length

➖ The redirects are static. There is a Python list with hardcoded IDs for all previously generated threads and thoughts

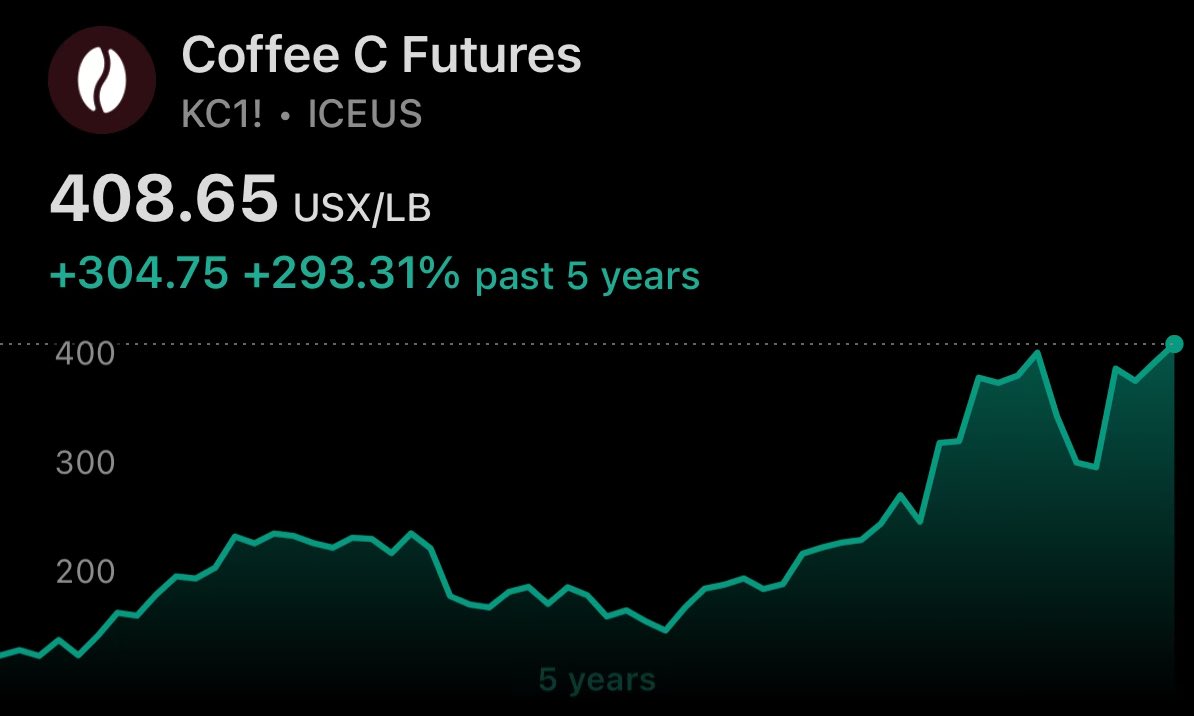

Coffee outperformed Gold in the last 5 years

Would it be sound to conclude that coffee beans are better money and investment than gold, and that Central Banks should hold coffee & its derivatives in reserve assets?

Bitcoin has less than 20 years of price action, and it started trading at a negligent price. Gold has been money for over 5000 years and its earliest recorded price per ounce is of ≈100 days of labor

A better question is whether Bitcoin will continue to consistently outperform gold over the next 20 years. *Consistency* is key - it must be at least a store of value, including shorter-term. If you get caught in the typical >50% price drops - you may pay a high opportunity cost.

It's not just whether Bitcoin will increase more in price than gold in the next 20 years, but also how severe and long-lasting Bitcoin's corrections are.

Imagine you buy Bitcoin today and it goes into a bear market with a significant value loss in the next 4 years. In those 4 years - many investment opportunities may arise, such as in real estate, equities, commodities or bonds. If your capital is locked in Bitcoin throughout that period - that's an opportunity cost.

Gold doesn't come with those shortcomings. There is a reason why all world reserve currencies started on a gold and/or silver standards.

There is no free lunch in the markets. Higher return is almost unanimously correlated with higher risk. Quantitatively Bitcoin is high risk- it's not a matter of opinion.

This doesn't mean that Bitcoin is a bad idea, but it also doesn't mean that Bitcoin is a better idea than gold. It does, however mean, that Bitcoin isn't a replacement for gold.

And now you understand what makes gold so special. You don't have to believe me - believe centuries of price action and human history.

Anyone can buy 1 JPEG, but not everyone

2 JPEGs for 8 billion people (there are 2 fungible copies)

Everyone on earth is in this race to accumulate JPEGs, but 99% haven't realized it yet

A U.S. dollar note doesn't care who you are or where you're from - the laws of physics are fair for everyone

Neither does gold, nor a coffee bean or a rock. In fact, this is true for most inanimate objects.

There is nothing special about that property.

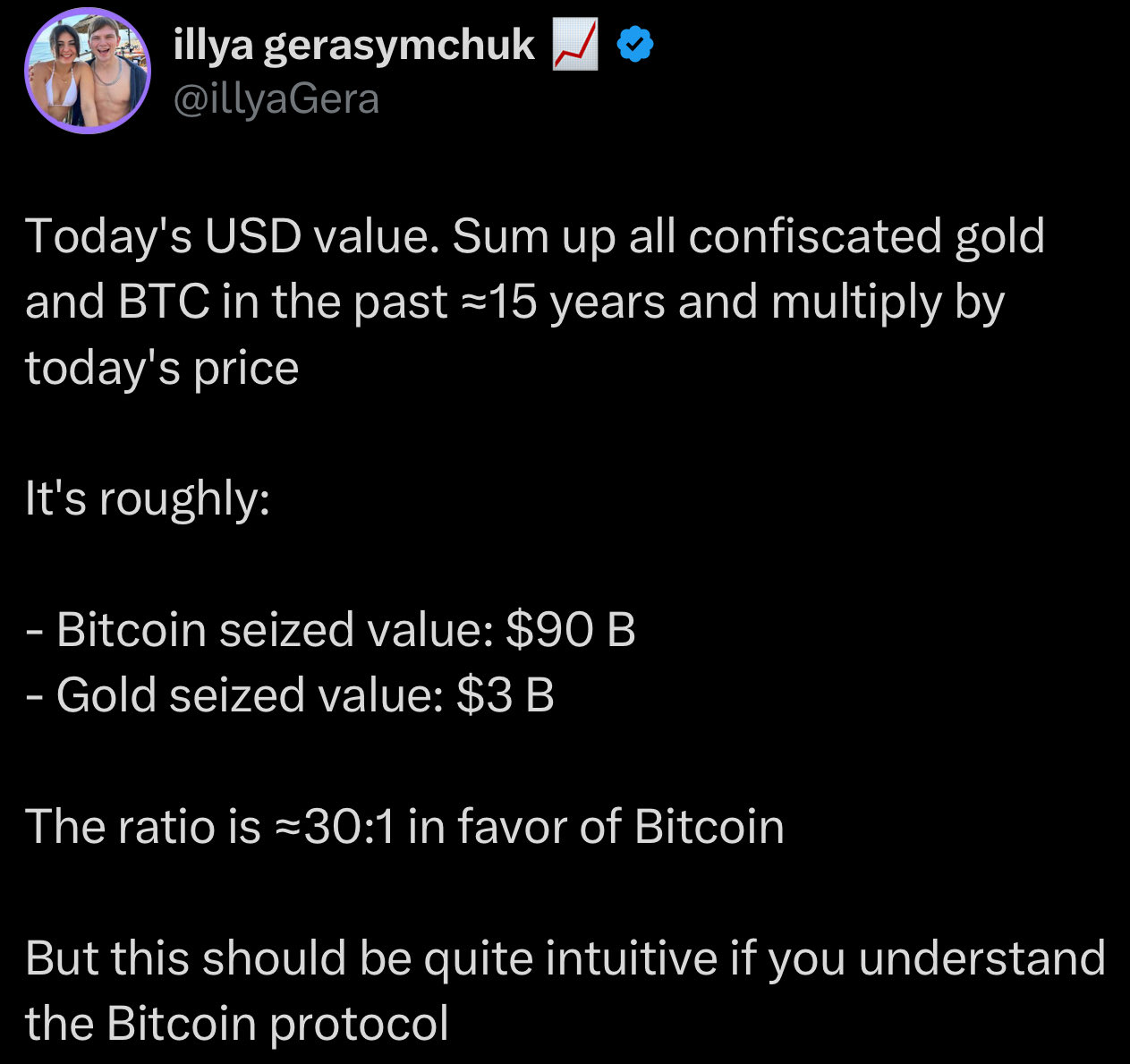

More Bitcoin has been seized than Gold

If you think that Bitcoin is harder to seize than gold, you are probably wrong. At least according to the data.

In the history of Bitcoin's existence, much much more Bitcoin has been seized than Gold. You don't need to compromise cryptographic primitives to seize Bitcoin.

Apparently this isn't a very well known fact in the Bitcoin Maxi world 😄

Gold is within the fabric of money, not just Central Banks

A lot of posts on X frame Central Banks as malevolent institutions, and by some form of conspiracy they hold gold in their reserve accounts. And apparently not holding gold is a step towards monetary freedom - even more if you forego an atomic element (Au) for a cryptographic computer algorithm (Bitcoin).

A more productive approach is asking why do Central Banks chose gold over all other commodities and assets. Every single world reserve currency, without exception, started on a gold and/or silver standard. Gold has been used as money for over 5000 years.

I've written several articles on what makes gold so special and how Bitcoin is not a replacement for gold. I'll leave them linked below

Multiple governments have seized Bitcoin

In fact, more Bitcoin has been seized than gold in the U.S. It's really not hard to google this, but here are some examples:

- Silk Road takedown (2013–2015) - ≈175K BTC

- "Individual X" Silk Road stash (2020) - ≈75K BTC

- Bitfinex-hack recovery (2022) - >94K BTC

- Movie2K piracy case - ≈50K BTC

- Finland Customs seizures - ≈2K BTC

- Netherlands money-laundering case - ≈2.5K BTC

- China PlusToken crackdown ≈200K BTC

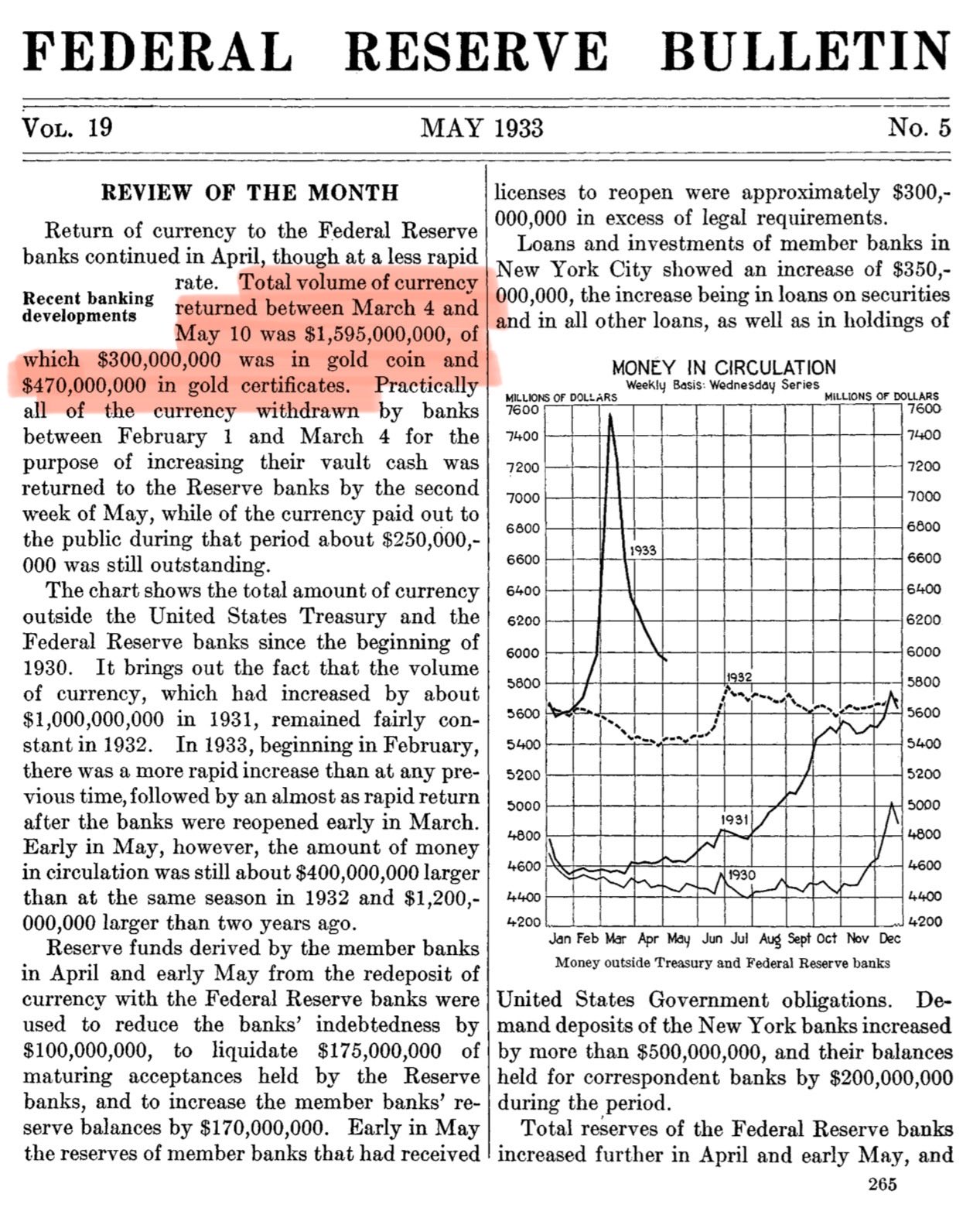

Regarding gold - yes, it was seized in the past in the US, but it was at a much smaller scale than you imagine.

The publicly documented, conservative floor for government-seized BTC is ≈700K BTC (≈$77B today), which is already above the $58–110B value range for U.S. public gold coin surrendered in 1933–34.

If your argument is that Bitcoin is better than gold, because it's more private/seizure resistant - you are wrong.

If you think that by holding Bitcoin you're immune to U.S. government policies you're also wrong, as more than 90% of all Bitcoin buying volume comes from USD or USD derivatives (including stablecoins).

Why would a Central Bank hold Bitcoin in reserves?

1. Even assuming that Bitcoin is an inflation hedge - it still doesn't mean that Central Banks should hold it. What would be the purpose of that? Central Banks are not commercial institutions - they hold assets for very specific reasons (e.g. FX rate stabilization).

2. You may have misunderstood me. I said that Bitcoin isn't money - but that by itself doesn't mean that Central Banks shouldn't hold it. FIAT currencies aren't money either. Neither are government bonds. BUT - those bonds or currencies generally don't crash >50% on cycle tops. So it's the fact that it's not money, combined with the other points I mentioned here and in the article that i linked

3. Kaspa isn't money. It certainly hasn't been long enough to be classified as money, nor it has enough intrinsic value. It carries the same set of technology risks as other cryptocurrencies- and even without looking at the chart - I can tell you that it's correlated to the rest of the crypto market.

I am a big fan of crypto, but we need to keep it real 😄

Thousands of accounts on X with large following shill Bitcoin/Crypto non-stop, with little reasoning behind it. They either do it for pay, engagement or a mix of both.

You don't have to look far - usually just search for "gold" on their profile and you'll find something like this (see screenshot).

If you want to understand how Bitcoin is not gold, it will never be gold, and it will never replace gold - read this article: https://illya.sh/threads/bitcoin-needs-gold-gold-doesnt-need-bitcoin.html

Is the rotation from Gold to Bitcoin in the room with us? 😉

Over the past 2 weeks hundreds of X accounts with large following have been posting about an imminent rotation from gold to Bitcoin, once gold reaches a correction level.

Their main argument seemed to be based on Bitcoin's historic price correlation - essentially "here are some select occurrences from the past where this happened, so it will happen now". Many of them went as far as claiming that gold has topped in this cycle (it hasn't).

Local top for gold was reached, but rotation didn't happen. As I've been alluding to over this same timeframe - the reality in financial market is seldom this simplistic.

In general, you should be very wary of market thesis that are too abstract, or fail to consider the macro picture.

Tokenizing European Long-Term Investment Funds (ELTIF 2.0) on a Public Blockchain

Currently I'm working on a practical framework for tokenizing European Long Term Investment Fund (ELTIF) instruments on a smart contract-enabled public blockchain like Ethereum. While there have been some ELTIF tokenization initiatives by some funds in the EU - they all used non-public (e.g. in-house) distributed ledger technology (DLT) solutions, with scarce public information on the implementation details.

The idea of fully on-chain ELTIF is attractive for several reasons:

➖ It taps into trillions of USD of readily available on-chain liquidity

➖ It reduces processing, compliance, distribution and infrastructure costs

➖It's fully compliant with the existing EU legislation

In terms of DeFi, bridging the real world financial system on-chain enables investment vehicles, which are fully compliant with the legal systems in the EU, and by extension most jurisdictions. This increases the value of the whole DeFi ecosystem, by making it more attractive for institutional and retail investment.

To date, there isn't a clear and practical framework for operating an ELTIF fund on a public, permissionless DLT. Such a framework must encapsulate not only the legal aspects (those already exist - the relevant regulations themselves!), but also the technical details of operating the ELTIF fund via smart contracts, while remaining fully compliant with the EU legislation. This is the gap that I’m aiming to address.

I’ll be focusing on real-estate based ELTIFs - where the fund pools money from investors, invests it into real estate and collects yield from rents and appreciation, as it goes inline with my current area of work.

So the Fed will fully resume Treasury purchasing, as a part of their balance sheet expansion starting December 1st 2025

Not only all maturing Treasuries will be rolled over at auctions, but also all Mortgage Backed Securities (MBS) principal will be reinvested into Treasury bills (<1 year duration)

This will lower the duration of the assets on the Fed's balance sheet and contribute to debt monetization

But that's not a surprise. 3 months ago I explained why interest rate cuts and the end of QT/start of QE is imminent

How exactly does Bitcoin break U.S. dollar control, when >90% of Bitcoin's buying volume is USD-derived (including stablecoins)?

IMPORTANT message from finance cat:

"I hope you bought gold, silver and their miners. - October 2025"

All reserve currencies achieved reserve status under gold or silver standards

And some still think that Bitcoin will be the next reserve currency. Judging by the actions of the sovereigns positioning their local monetary units for reserve currency position that is highly unlikely 😁

More specifically, China & BRICS are heavily buying gold, and they have openly discussed partly gold-backed currencies several times. In the EU, the ECB is very clear on their stance against adding Bitcoin to their reserves.

Bitcoin doesn't exhibit the characteristics necessary for a reserve currency. If you believe that it does, then you need to start by explaining how it would integrate into the current financial system. Do not forget to consider Central Banks, wholesale debt markets and refinancing cycles. A potential role that Bitcoin may take is as collateral, for example in money markets. The problem is, that you will be inadvertently running into very large haircuts and low LTVs. So unless Bitcoin concisely keeps yielding higher highs, you'd be better off by using higher-quality collateral, such as government bonds or even equities.

Another point comes down to risk. The more Bitcoin is used the more risky it becomes. Sure, you can say that the network also growth with usage, but in case Central Banks start holding Bitcoin - it becomes a geopolitical liability. It will become a matter of time before disruptive attack and compromise of private keys. Also, >90% of the buy volume of Bitcoin is in USD or its derivatives, such as USD-pegged stablecoins. So it's USD that's mostly invested there, not euros, renminbi or others. This makes Bitcoin extremely exposed to USD currency risk.

Gold and silver have a much more modest exposure to the risks above. You don’t have to believe me - just look at the history. Since 500 BCE it's mostly been gold and/or silver - and Bitcoin doesn't change that.

Accounts on X that relentlessly promote the idea of Bitcoin being money, and better money than gold fail to address these points.

a kind reminder that higher oil prices benefit Russia and Ruble

U.S. puts sanctions on Russia --> Oil price increases --> Ruble price increases

This is driven by how Russia's National Wealth Fund (NWF) operates, plus the fact that both NWF and Russia's Central Bank have almost no exposure to USD

GOLD: look for rejection at ≈$4155

if gold's price get rejected at that price level again - you'll likely see the fall to ≈$3900 target I described in my previous post

it's a good idea to have the limit buy orders ready 😄

gold's lowest possible bottom for current correction is ≈$3900 (area)

the uptrend will resume soon. given the FOMC meeting next week - if that bottom arrives it should be very soon - within the next week

* this is trend analysis done in 5 mins, but likely a correct one 😄