⬇️ My Thoughts ⬇️

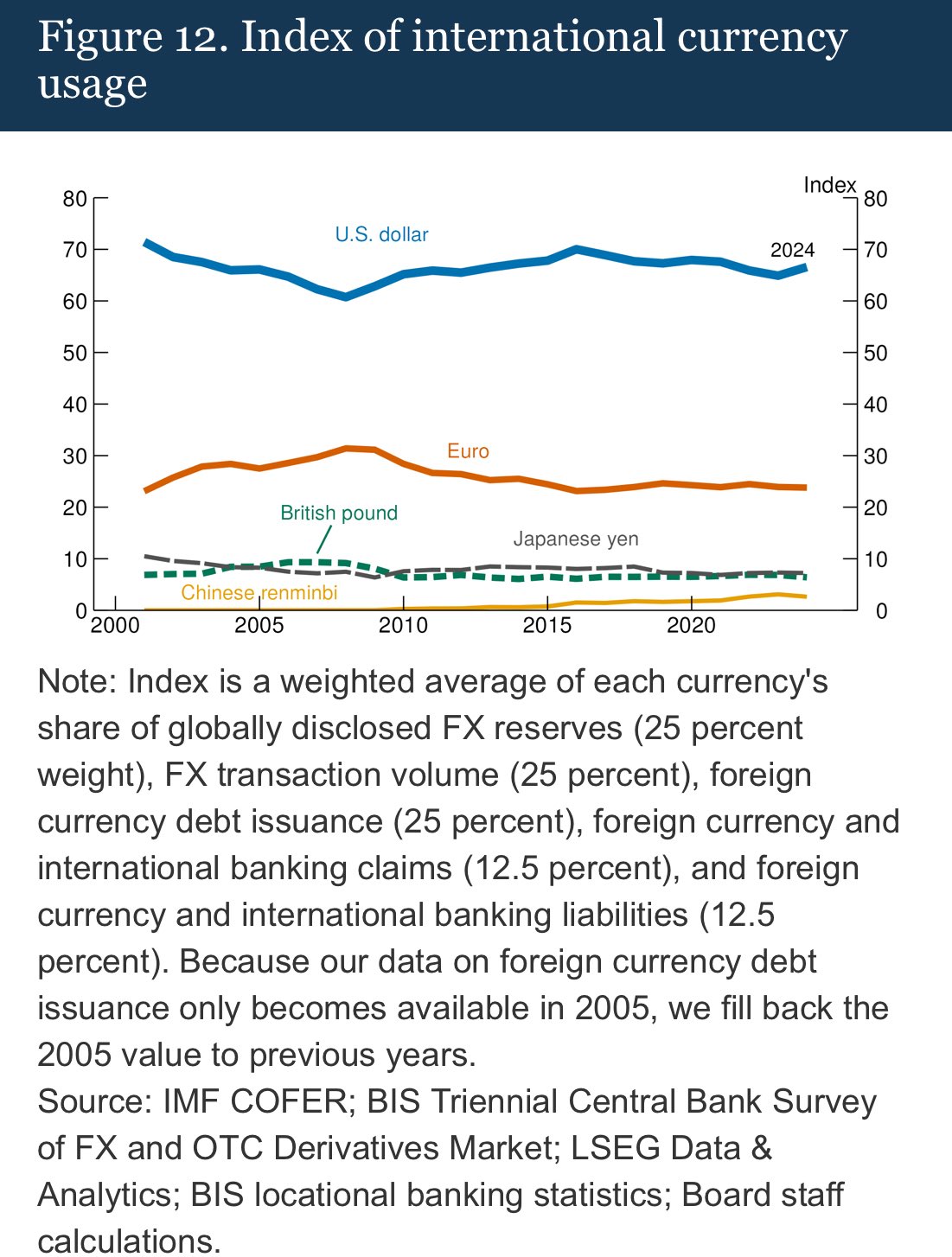

🇺🇸 USD dominance is alluring, accounting for ≈70% of currency usage worldwide

even countries that do relatively little trade with US have most of their transactions done in US dollars

ex: 🇮🇳 India invoices 86% of its exports in USD, while only 15% of its exports being to US

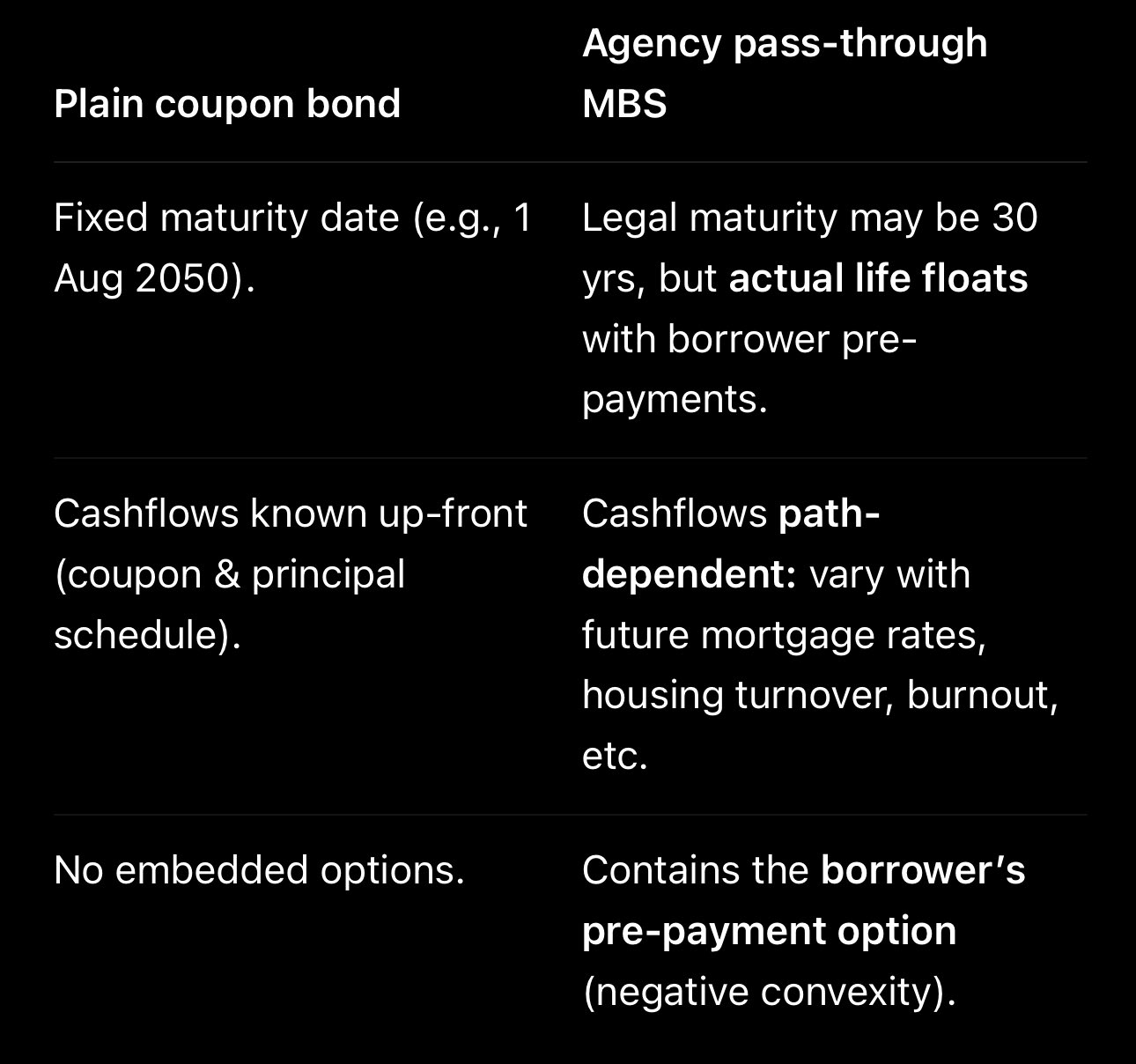

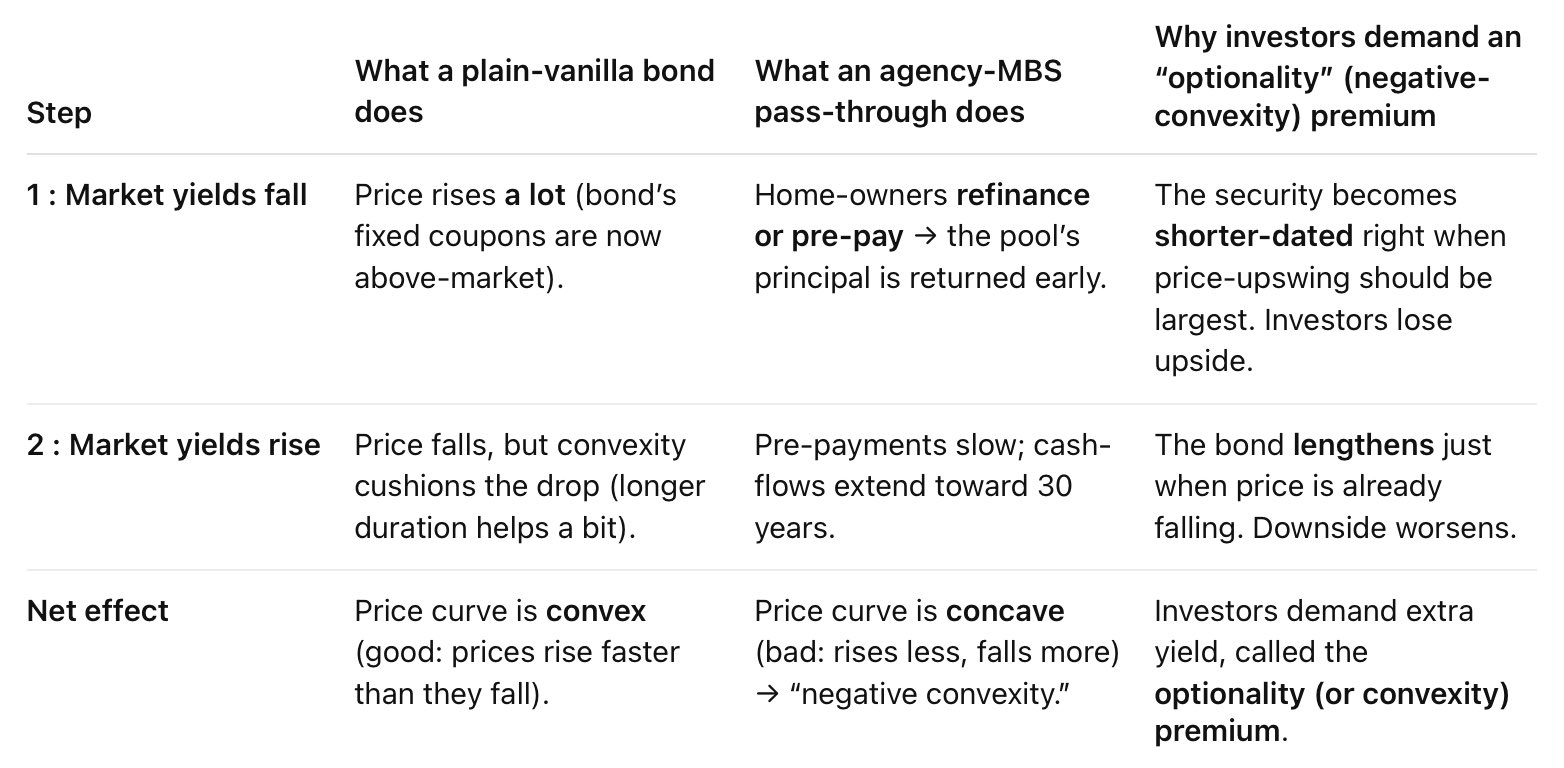

legally mortgage backed securities are bonds since they are tradable debt securities

but they're not a plain bond, due to the option of borrower's early repayment

Macaulay or modified duration used for Treasuries doesn't work - you need effective/option-adjusted duration

the duration formula for MBS assumes for some pre-payments

if those happen at a smaller rate - the duration increases

the duration formula for MBS assumes for some pre-payments

if those happen at a smaller rate - the duration increases

raising yields means lower incentives to re-finance mortgages which reduces the amount of pre-payments

thus, the duration increases when yields are raising - so even a higher price decrease

raising yields means lower incentives to re-finance mortgages which reduces the amount of pre-payments

thus, the duration increases when yields are raising - so even a higher price decrease

optionality/convexity premium in mortgage backed securities is interesting

when market yields fall the price should rise, but since borrowers take advantage of lower mortgage rates to make early payments - the price does not raise as much, due to lowered duration

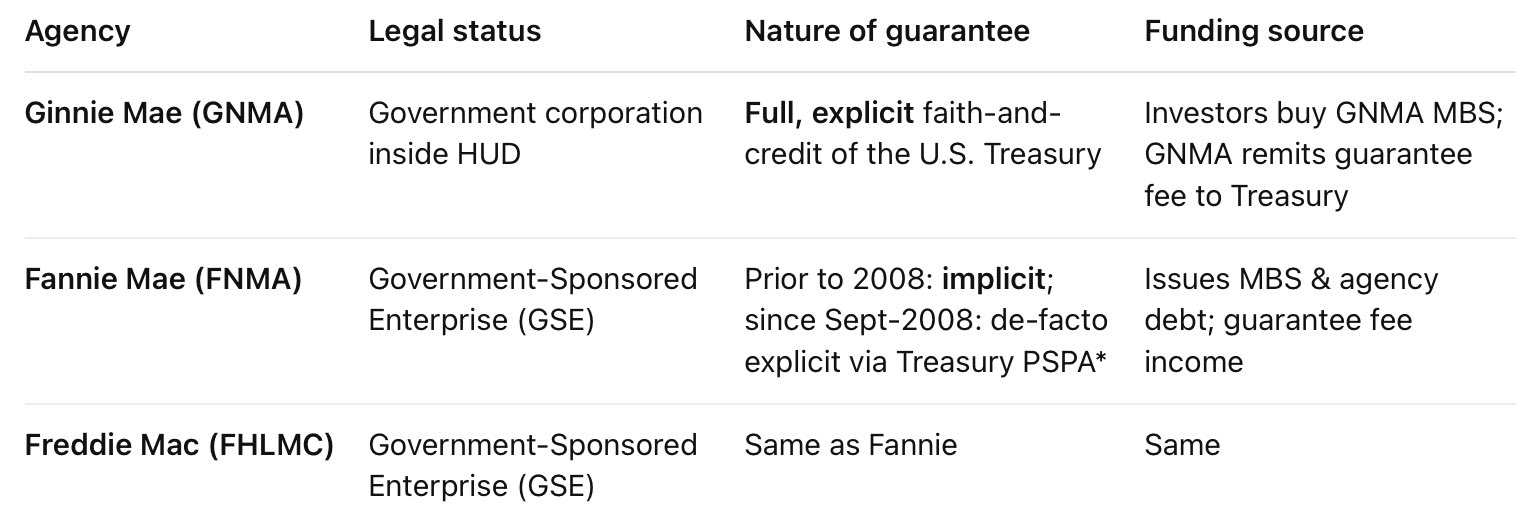

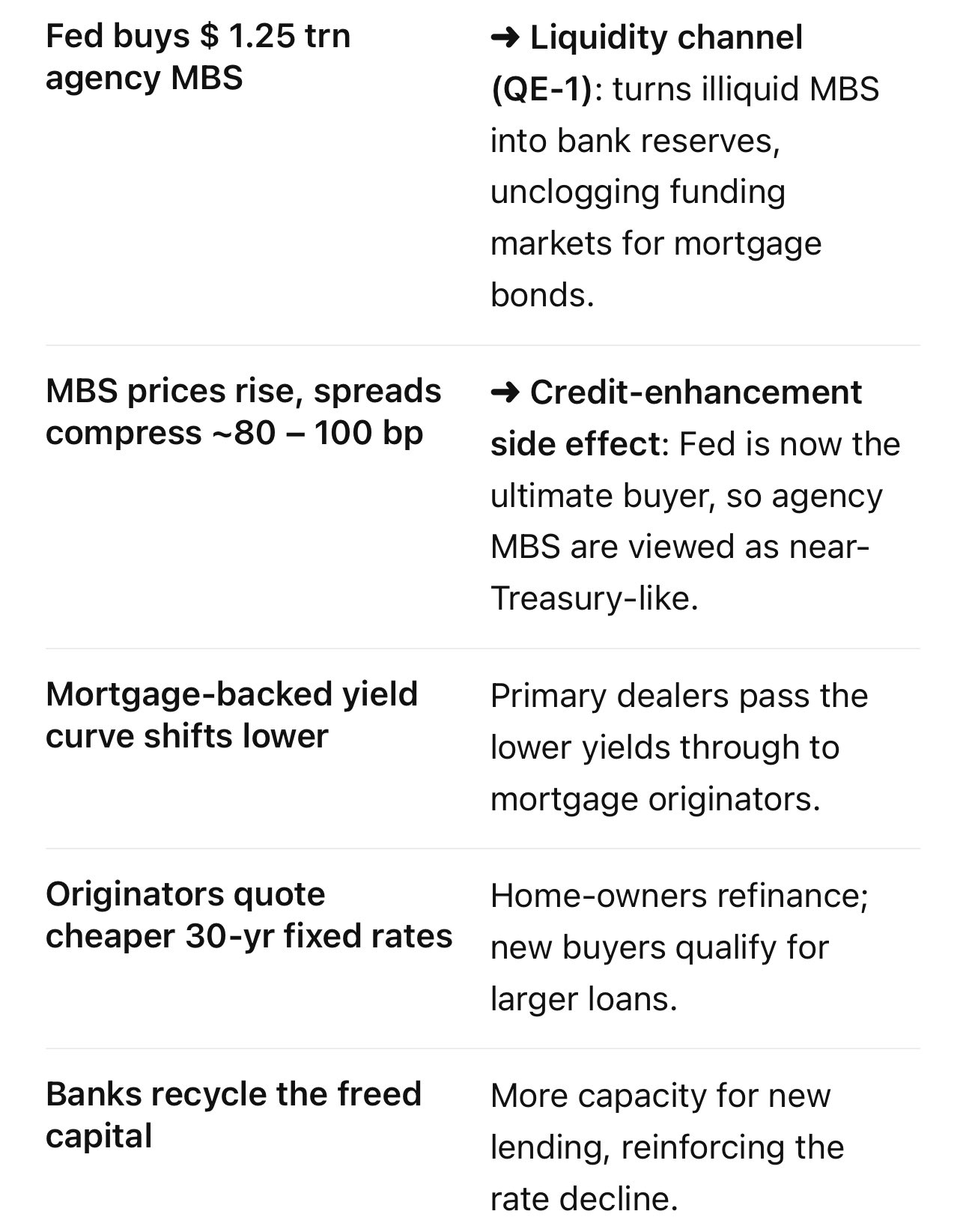

Fed's balance sheet expansion with agency MBS reduced risks in liquidity, market depth and optionality/convexity

this is a crucial point to understand - it wasn't just the Fed buying agency MBS, but the explicit government guarantee that accompanied it

thus, the yields fell

Fed's balance sheet expansion with agency MBS reduced risks in liquidity, market depth and optionality/convexity

this is a crucial point to understand - it wasn't just the Fed buying agency MBS, but the explicit government guarantee that accompanied it

thus, the yields fell

Ginnie & Fannie Mae conservatorship in Sept 2008 made agency MBS default risk free

essentially, the US Treasury covers all losses from GNMA and FNMA up to $200 billion each

from the total $400B budget ≈$170B are still available

once exhausted it will surely be increased

to lower the mortgage rates the Fed can purchase agency MBS - likely they did in QE 1 2008

buying mortgage backed securities raises their price and provides liquidity for dealers. this directly pushes down the yields

expect some MBS QE to come in the near future

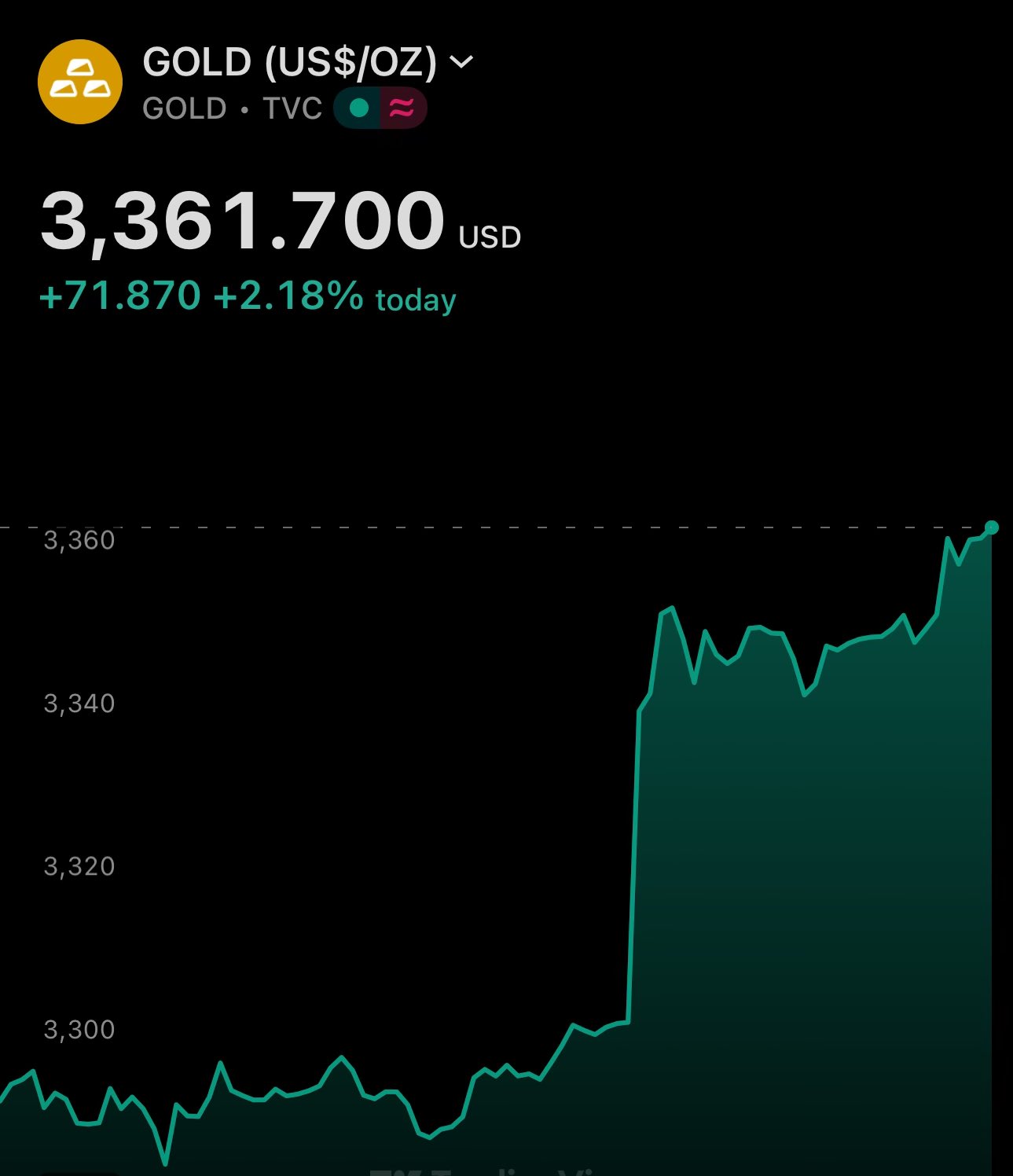

gold hasn't broken the weekly uptrend - note the higher highs

buying pressure today pushed the price up ≈2.5%

TA is an excellent tool to gauge the price action

gold price is back up to its price 2 weeks ago

so it indeed was a good idea to long it at the pullback

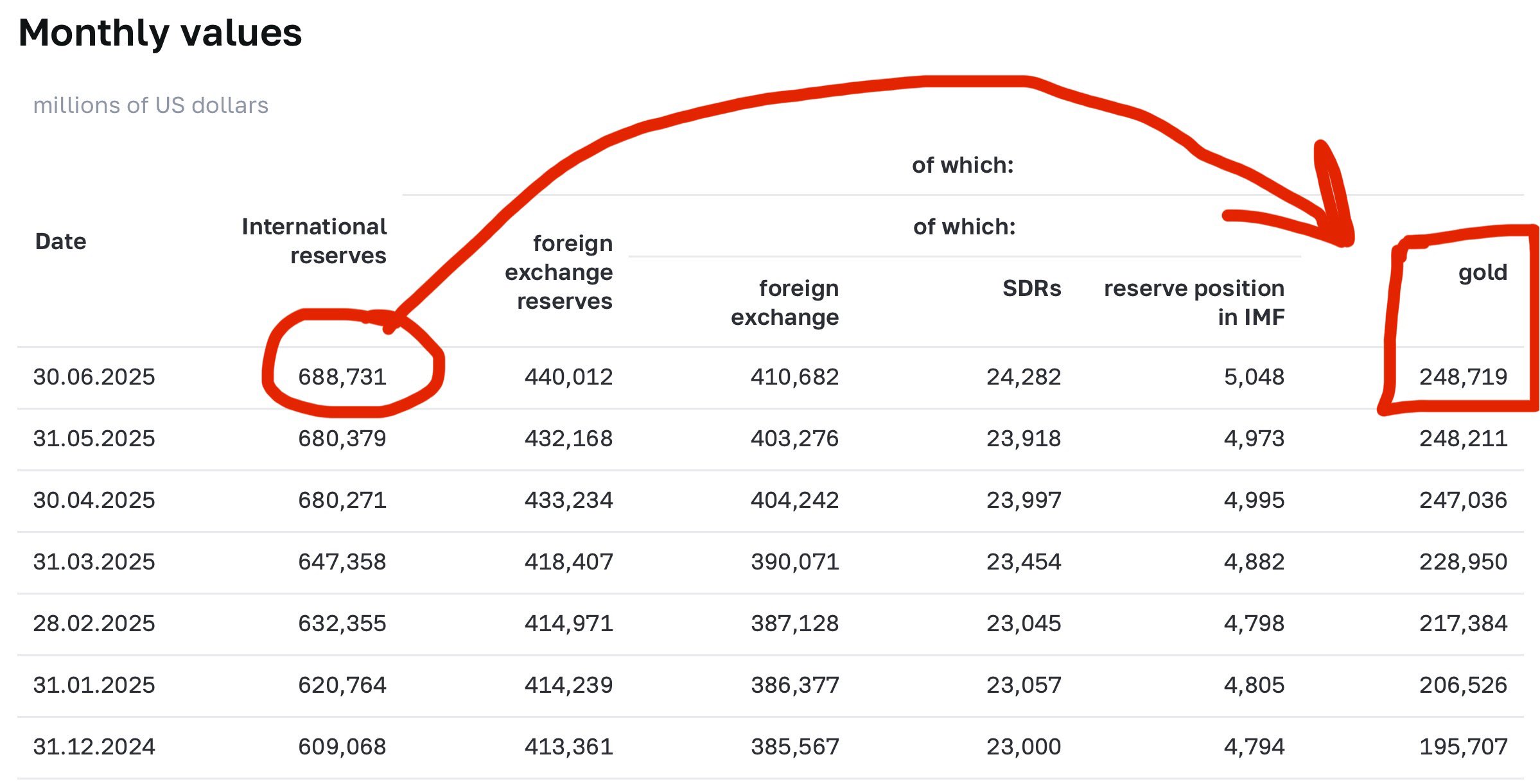

if you've read my previous posts you know that gold is ≈36% of Russia's international reserves

this is taken straight from the Bank of Russia's balance sheet statement

100% of it is stored in Russia, thus no counterparty risk

critical component of Ruble's strength

🇺🇸🇷🇺 USD/RUB rate already fell to July 24th close, below 80

although it's also important to note that there are several factors at play - USD index is also down today

despite oil down - gold is up. this is about the monetary policy of Russia and their balance sheet structure

and this is how the Federal Reserve steers the federal funds rate/interest rates in the market within the target range 🏦✨

follow the quoted posts to read the full thread/article

together, ON RRP, IORB, Discount Rate and SRF create a corridor for rates, which stay within the target 4.25%-4.50%

👉 by "firms" i mean select non-bank financial institutions - think dealers, market makers & other wholesale debt institutions

together, ON RRP, IORB, Discount Rate and SRF create a corridor for rates, which stay within the target 4.25%-4.50%

👉 by "firms" i mean select non-bank financial institutions - think dealers, market makers & other wholesale debt institutions

current rates set by FED:

1️⃣ ON RRP - 4.25% (floor) - firms won't lend below

2️⃣ IORB - 4.40% (supplementary floor) - banks won't lend below

3️⃣ Discount Rate - 4.50% (ceiling) - banks won't borrow above

4️⃣ SRF - 4.50% (supplementary ceiling) - banks & firms won't borrow above

current rates set by FED:

1️⃣ ON RRP - 4.25% (floor) - firms won't lend below

2️⃣ IORB - 4.40% (supplementary floor) - banks won't lend below

3️⃣ Discount Rate - 4.50% (ceiling) - banks won't borrow above

4️⃣ SRF - 4.50% (supplementary ceiling) - banks & firms won't borrow above

so how does the FED currently targets an interest rate range between 4.25%-4.50%?

let's consolidate everything with an example using current, real-world data

so how does the FED currently targets an interest rate range between 4.25%-4.50%?

let's consolidate everything with an example using current, real-world data

SRF has been introduced in 2021, due to occasional spikes of short-term funding rates outside of the corridor

this is because banks avoid using the discount rate - as that is often seen as a sign of financial distress by the broader market

SRF has been introduced in 2021, due to occasional spikes of short-term funding rates outside of the corridor

this is because banks avoid using the discount rate - as that is often seen as a sign of financial distress by the broader market

thus, Standing Repo Facility (SRF) further reinforces the upper part of the target interest rate corridor

in other words, it strengthens the cap on short-term interest rates

thus, Standing Repo Facility (SRF) further reinforces the upper part of the target interest rate corridor

in other words, it strengthens the cap on short-term interest rates

Standing Repo Facility (SRF) allows banks & other financial institutions to do collateral-backed loans from the FED overnight

the institution provides high quality collateral (e.g. treasury bond) and gets a loan against it - at the set rate

Standing Repo Facility (SRF) allows banks & other financial institutions to do collateral-backed loans from the FED overnight

the institution provides high quality collateral (e.g. treasury bond) and gets a loan against it - at the set rate

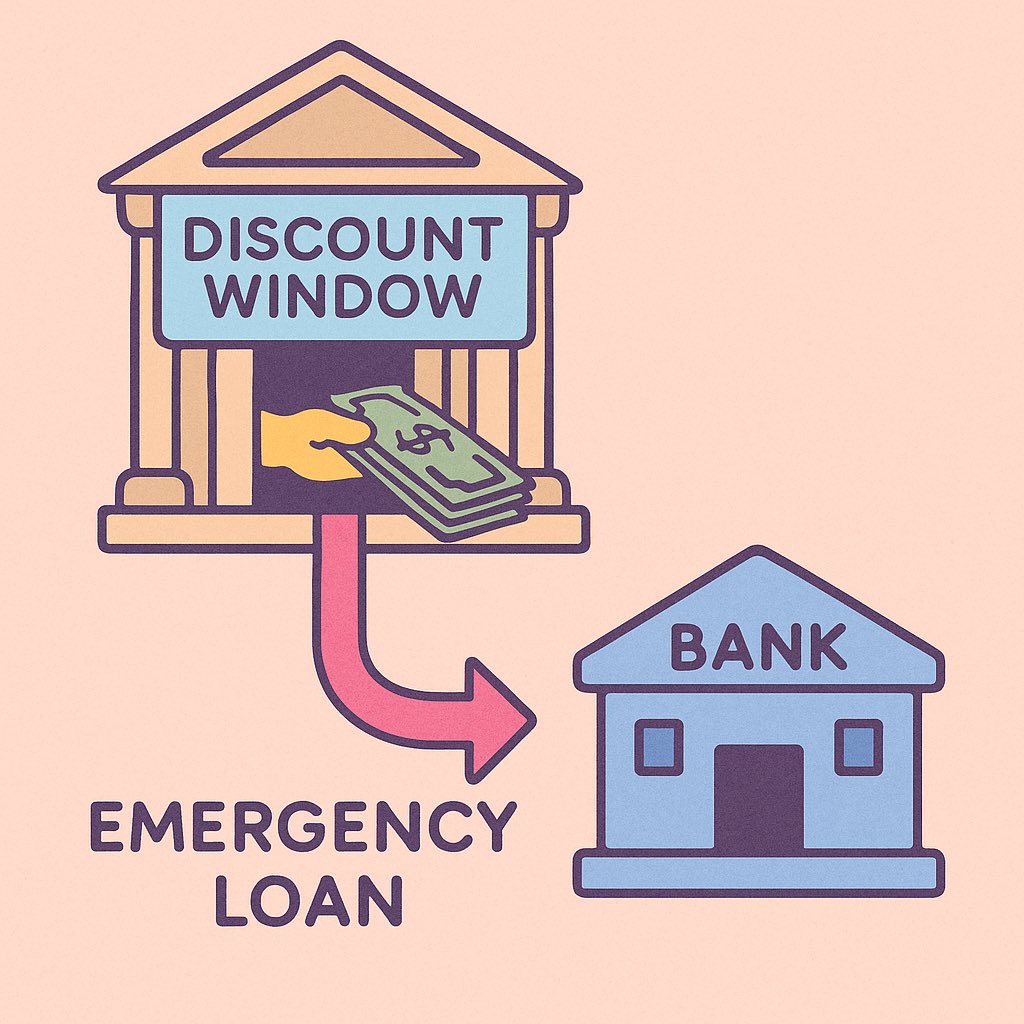

it't called discount window for historical reasons

discounting means buying treasuries at a slightly lower price - i.e. at a discount

window comes from the fact that these were sold at counter/teller windows at the bank

it't called discount window for historical reasons

discounting means buying treasuries at a slightly lower price - i.e. at a discount

window comes from the fact that these were sold at counter/teller windows at the bank

the discount rate is set higher or at the typical market rates to disincentivize its use

it's really meant to serve as an emergency lending source - only when other financing routes are exhausted: regular interbank markets, wholesale markets and SRF among others

the discount rate is set higher or at the typical market rates to disincentivize its use

it's really meant to serve as an emergency lending source - only when other financing routes are exhausted: regular interbank markets, wholesale markets and SRF among others

Discount Rate is the rate at which the FED lends directly to banks through its discount window

think of it as an emergency lending facility which the banks can use whenever they need funds

since banks can always get a loan at that rate - it caps the short-term interest rates

the majority of liquidity is actually created in wholesale short-term debt markets

ON RRP addresses exactly that sector, thus setting the lower bound of the target interest rate corridor for the broader financial sector

the majority of liquidity is actually created in wholesale short-term debt markets

ON RRP addresses exactly that sector, thus setting the lower bound of the target interest rate corridor for the broader financial sector

ON RRP further reinforces the the floor for the market-wide interest rates

since it's accessible to a broader set of financial institutions - not only banks. those now also have little incentive to lend below the ON RRP rate

ON RRP further reinforces the the floor for the market-wide interest rates

since it's accessible to a broader set of financial institutions - not only banks. those now also have little incentive to lend below the ON RRP rate

Overnight Reverse Repo Rate (ON RRP) defines the rate at financial institutions can lend money overnight to the FED

in return the FED provides treasury bonds as a collateral

ON RRP is accessible to both banks & non-banks (e.g. money market funds)

since banks can always deposit cash into their reserve account account at the FED and earn the IORB rate they have little incentive to lend at rates below IORB

effectively, this sets the floor (lower bound of the corridor) for interest rates for banks